During 2020 Q1, the Association of South-East Asian Nations (ASEAN) became China’s largest trading partner, surpassing both the EU and the US. Such rise in trade was partly due to lockdown measures adopted in the EU in an attempt to curb the spread of the pandemic, as well as part of a pre-existing trend to partially transfer the supply chain in ASEAN countries to reduce costs and shield from the effects of the US-China War.

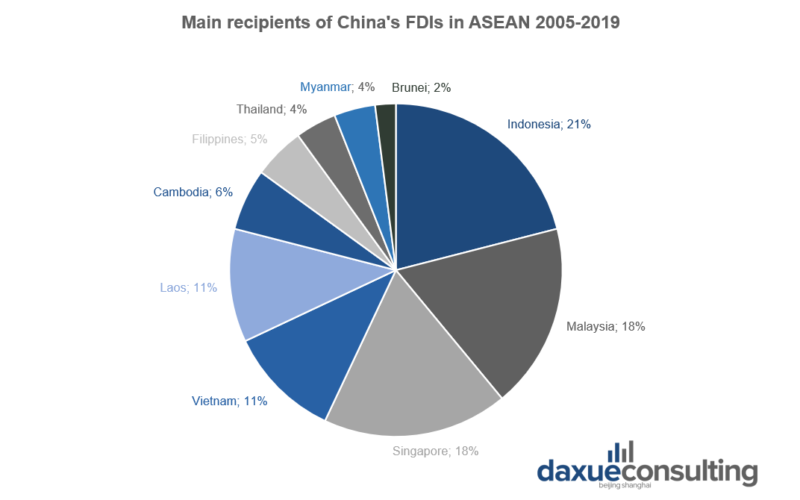

According to ASEAN Investment Report, Chinese Foreign Direct Investments (FDIs) in ASEAN countries rose about 65% in the last decade, hitting an annual average of 11.5 billion USD between 2016 and 2020. In 2020, China invested about 7.6 billion USD in Southeast Asia, mainly into manufacturing, real estate activities, and wholesale and retail trade. Between 2005 and 2019, Indonesia, Malaysia, and Singapore were the top three destinations of Chinese investments in ASEAN, together accounting for about 57% of total Chinese FDIs in the area. The bulk of such state-led investments concentrates on the financial, energy and infrastructural sector; however, more and more Chinese private companies are moving into ASEAN due to both political and economic reasons. In 2006, State-Owned Enterprises (SOEs) accounted for 81% of Chinese companies in ASEAN, while in 2019, the number of private enterprises investing in the area almost equaled that of SOEs.

Chinese companies look to ASEAN for their own “China+1” strategy

People tend to think that Chinese companies are outsourcing part of their production to Southeast Asia as a result of growing upward pressures on wages, especially in China’s Eastern provinces, and currency appreciation. Nevertheless, this phenomenon relates to the increasingly popular international business practice to accompany FDIs in China with investments in other Asian countries, usually in one of the ASEAN members. Such trend calls “China+1” strategy and its purpose is to cut overreliance on China and mitigate risk.

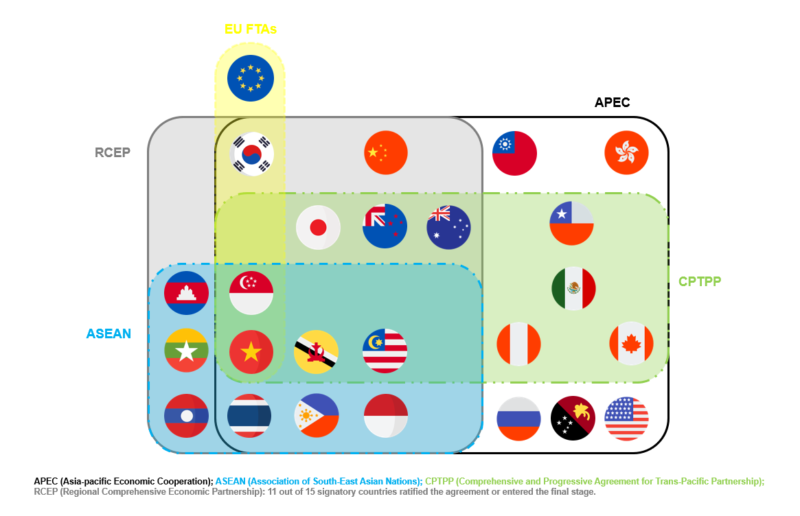

In order to deal with rising wages, Chinese companies could just relocate to lower tier cities instead of going abroad, therefore cheap labor cannot be the only explanation underpinning their decision to move into ASEAN. In fact, investments in ASEAN are principally a way to enter new markets and flee from the fierce competition in China’s mature sectors. Furthermore, Chinese companies in ASEAN can enjoy tax privileges as foreign-owned enterprises and benefit from the vast network of Free Trade Agreements (FTAs) involving ASEAN members. Last but not least, outsourcing production to ASEAN is an effective way for Chinese enterprises to bypass US sanctions and tariffs, thereby shielding themselves from the consequences of the ongoing trade war.

Chinese companies in ASEAN: Tencent vs. Alibaba

According to a report jointly released by Google, Temasek and Bain & Company, in 2020, Southeast Asia totaled approximately 400 million Internet users, while the local Internet economy hit 200 billion USD and is expected to surpass 300 billion USD by 2025. Thus, it is not surprising that Chinese tech behemoths, such as Tencent and Alibaba, want to get their piece of the cake.

Alibaba and Tencent compete in different sectors

Alibaba, ASEAN’s largest e-commerce platform, has invested heavily in the sector, with 83% of Lazada stocks acquired. Born as the Southeast Asian Amazon, under Alibaba’s guidance the company converted into a digital middleman – connecting merchants with customers and outsourcing delivery. Moreover, Alibaba succeeded in concluding a 1.1 billion USD funding round with Tokopedia, Indonesia’s largest e-commerce and Lazada’s main rival, leaving Tencent to hold the bag. Meanwhile, Tencent tapped into the entertainment and gaming industry by investing into Sea Group in 2010, and then encouraged the start-up to expand into the e-commerce and fintech market.

The latter is another ground of confrontation for the two Chinese tech giants. Indeed, Alibaba’s subsidiary Ant Group has shares in Vietnam’s digital wallet eMonkey, Myanmar’s mobile financial service provider Wave Money, and Indonesian e-wallet Dana, among others; while Tencent backs Sea Group subsidiary Shopee Pay, Vietnam’s digital wallet Zalo Pay and Thailand e-wallet Air Pay.

In addition, both companies directly operate in the region with AliPay and WeChat Pay. Alibaba and Tencent compete in the transportation field as well. In 2017, Tencent acquired the Indonesian ride-hailing start-up Go-Jek and encouraged it to become a multifunctional app akin to its WeChat. For its part, Alibaba is in talks to invest about 3 billion USD in Go-Jek’s nemesis, and the Singapore-based ride-hailing provider Grab. In Southeast Asia Tencent and Alibaba fight each other with no holds barred.

Chinese companies in ASEAN: bidding for hegemony in the regional automotive market

Japanese manufacturers have been dominating the automotive market in ASEAN for a long while, but now Chinese automakers want to give them a run for their money. Chinese car manufacturers entered the ASEAN market in the 90s, but they were not able to compete with the Japanese counterpart due to their low-quality components and after-sales services. Nevertheless, they seem to have learnt from past mistakes and are now bent on breaking Japanese carmakers monopoly in Southeast Asia. Thus, early this year, the Chinese automaker Great Wall Motor has made its official entry into Thailand, ASEAN’s largest car market, differentiating from competitors by focusing on electric vehicles (EVs).

This move is in line with Thai government’s plan to convert Thailand into the EV hub of ASEAN by 2030. Meanwhile, Wuling, Chery Automobile and Dongfeng Sokonindo are making inroads into Indonesian automotive industry, and Wuling’s sales have already surpassed those of Japanese brands such as Madza and Nissan. Instead, Hangzhou car manufacturer Geely acquired 49.9% of the loss-making Malaysian brand Proton and gradually brought it back to its former glory. Now, the Chinese automaker aims at expanding Proton’s business across Southeast Asia and beyond.

Takeaways from the growing presence of Chinese companies in ASEAN

- Both Chinese public and private enterprises developed a keen interest in the ASEAN market. Indeed, China’s FDIs in the region experienced a 65% rise in the last decade.

- Cheap labor and weak currency are not the only drivers underpinning Chinese companies’ commitment to the ASEAN market. In fact, increasing competition and growing saturation in the domestic market, tax privileges, non-tariff agreements as well as the attempt to avoid the consequences of US-China trade war were all influential factors in Chinese brands’ decision to move into ASEAN.

- China’s tech giants Tencent and Alibaba could not resist the siren call of ASEAN rising tech-savvy middle class either. Instead, they exported their competition to Southeast Asia and started backing rival tech unicorns, mostly operating in the e-commerce, fintech, and ride-hailing industry.

- After learning from past mistakes, Chinese automakers are back more combative than ever, and they are determined to give Japanese car manufacturers a run for their money. Geely, Wuling, Chery, and Great Wall Motor are just some of Chinese companies in ASEAN which are determined to conquer the regional automotive market.