The adornment of flowers is essential in Chinese festivals. During these festivals, copious amounts of flowers cover buildings and streets. Outside of these festivals, flowers are often given as gifts on special occasions. As symbols of love and happiness, flowers are welcomed by everyone. However, few people notice the Chinese flower market or flower suppliers behind the trucks of flowers used for big events and festivals. The flower market in China has a long history and is continuing expansion through online channels.

A large number of traditional flowers from a variety of regions in China have developed a rich culture of flowers. These include the peony in Luoyang, the plum blossom in the Yangtze River basin, the camellia in Jiangsu and Zhejiang as well as many others. During the Ming and Qing Dynasties, Hua Xiang, a region adjacent to Beijing, became the base for flower production made exclusively for the court. Farmers in Canton, at that time, began to produce ‘Nian Hua’, a flower sold on the streets. These two developments began the commercialization of local flower traditions in the country. After China reformed its import policies, foreign flowers have rushed into the Chinese flower market. This influx of foreign business helped shape the formal flower industry by infusing foreign business concepts and cultivation techniques into the industry.

The Current State of The Flower Market in China

A study conducted by the Chinese Ministry of Agriculture in 2016 shows that there were 79,512 flower companies in China, including 14,108 large and medium-sized companies with a planting area of at least 3 hectares or with an annual turnover of 5 million yuan. The study also reveals that there were 1,639,133 florists, 5,053,523 employees, and 247,616 technical experts in the Chinese flower industry. Although florists do not have the industrial and commercial registration that large companies possess, their production sales and output are not any lower.

Characterized by large-scale flower plantations, industrialized operations, and exports of numerous flower brands, Yunnan Province has transformed from a flower production base to a market-oriented base in China.

By the end of 2017, more than 12,000 households of over 400 florist cooperatives have registered with KIFA (the Kunming International Flora Auction Trading Center), with total flower farmland exceeding 2,600 hectares and an output value of about 450,000 yuan per hectare.

Trade volume of KIFA has maintained double-digit growth, selling 6.53 billion cut flowers worth 5.4 billion yuan in 2017.The Trend of Online Flower Business in China

The flower market in China has developed rapidly since the Chinese consumption upgrade. Multi-channel retailing has emerged in the Chinese flower market, driving the rapid growth of online flower sales. According to incomplete statistics from the China Flower Association, there were 2,980 flower vendors in China in 2017. The sales of fresh flowers reached 10 billion RMB, of which online sales exceeded 50%.

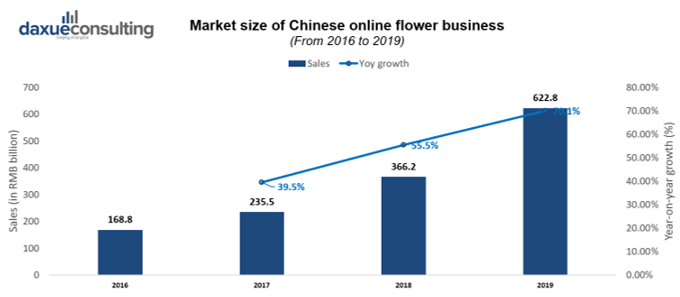

The scale of the online flower business in China

The market size of the Chinese online flower business in 2017 was about 23.5 billion RMB. In 2018, it reached 36.6 billion RMB, of which Taobao’s sales were nearly 15 billion RMB. The number of online merchants and products was about 400,000 and 25 million respectively.

[Data source: iiMedia, “Market size of Chinese flower business”]

With the expansion of consumption scenarios, the demand for flowers will further increase with more categories and service optimization.

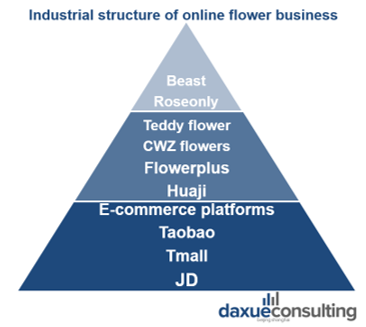

Industrial structure of Chinese online flower business

Chinese online flower suppliers have formed into three main echelons according to different target groups according to customer transaction and other variables. High-end brands include roseonly and Beast野兽派, whose per customer transaction is over 500 RMB. Mass brands include Teddy flowers, FlowerPlus, CWZ Flowers(春舞枝花卉), huaji(花集), whose per customer transaction is between 100 to 200 RMB. As for e-commerce platforms including Taobao, Tmall, and JD, their per customer transaction can be even lower.

[Source: daxue consulting, “Industrial structure of online flower business in China”]

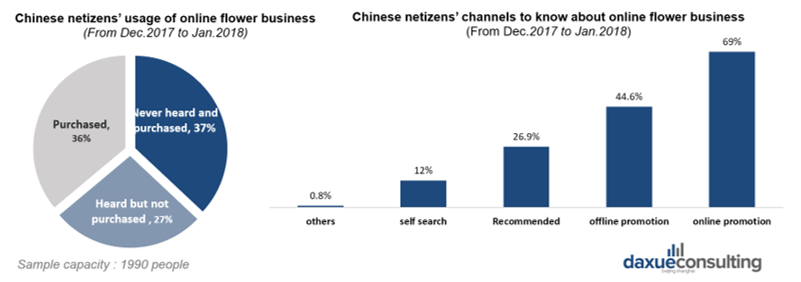

Customer willingness to adapt to the online flower business in China

Based on data from iiMedia, 63% of Chinese netizens have heard of the online flower business and 36.1% of them once purchased flowers through these platforms. The majority of them know about the Chinese online flower business through online and offline promotions, which include experiential and emotional marketing.

[Data source: iiMedia, “Distribution of netizens’ usage and knowing channels of online flower ]

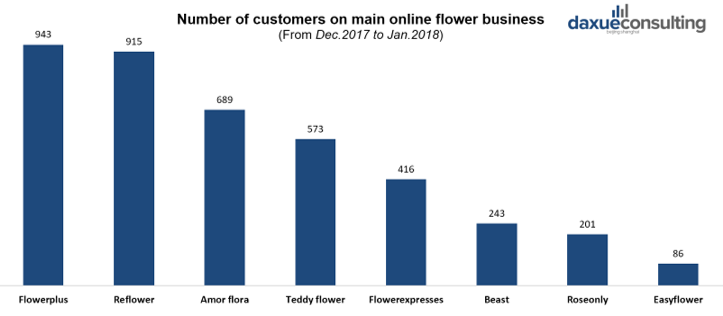

In terms of customers’ preference, B2C platforms such as FlowerPlus, Reflower(花点时间) and AmorFlora(爱尚鲜花) are used more frequently by netizens; while the customers of Flowerexpresses (鲜花说) has expanded since launching B2C business in 2016. Although the usage of high-end Chinese online flower business platforms such as Roseonly and Beast are relatively lower, their customers are all high net worth users with strong purchasing power.

[Data source: iiMedia, “Customers’ preference of online flower business in China”]

Case Study: How Chinese Flower Brand Beast Succeeded on the Chinese Online Flower Market

Beast is a homegrown brand, which is regarded as the pioneer of the Chinese O2O high-end brand by British Wallpaper Magazine. It has run an online flower business in China since 2011. Currently, it also provides high-frequency products including clothes, cosmetics, furniture, etc. The beast targets high- and mid-end consumers and aims to represent floral and artistic life. Though the Beast is a young brand, it has a good performance and strong competitiveness in the Chinese flower market. Let’s see how it explored an effective online flower business system in China.

How Beast Established its online flower business

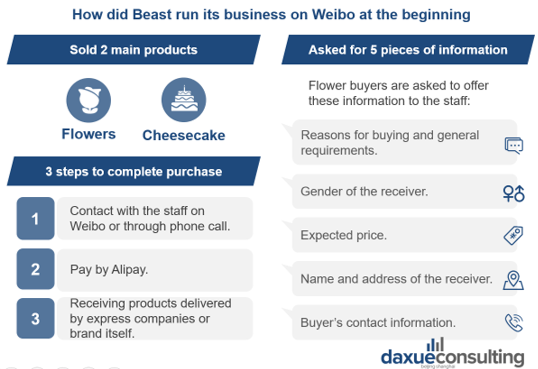

Beast started its online flower business in China from the Weibo store, which is an experimental studio and only serves consumers who live in Shanghai. This allowed Beast to successfully create an exclusive brand image by providing unique and customized service to a limited number of customers.

[Source: daxue consulting, “How Beast runs business on Weibo”]

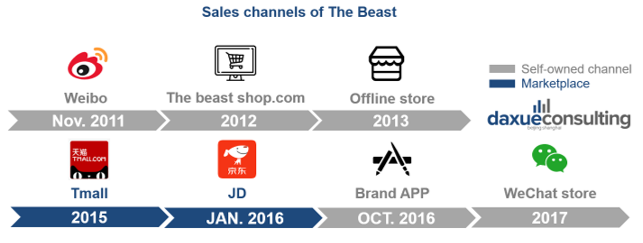

Beast expanded its online flower business by establishing a brand-owned official website in 2012. Three years later, Beast cooperated with the online marketing strategies of Tmall in various ways to stimulate sales. After Beast entering Tmall in 2015, the sales of the brand had seen a ten-fold increase in the period of three years. Tmall also supported the brand to further extend product segments and seek new opportunities.

[Source: daxue consulting, “Beast cooperated with marketplaces to expand business”]

Beast’s successful branding strategy helped the brand to realize dramatic growth in the marketplace and avoid brand dilution at the same time. And then, it continuously established self-owned channels, which include the brand app in 2016 and the WeChat store in 2017.

[Source: daxue consulting, “Sales channels of The Beast”]

The Beast began the business using brand-owned channels and entered the marketplace relatively late, which enabled it to leverage e-commerce platforms to drive public traffic into its private traffic pool to improve customers’ retention and repurchase rate. Based on accumulated users’ data and feedback, it can optimize services and products before establishing new sales channels.

Beast’s online marketing strategy in China

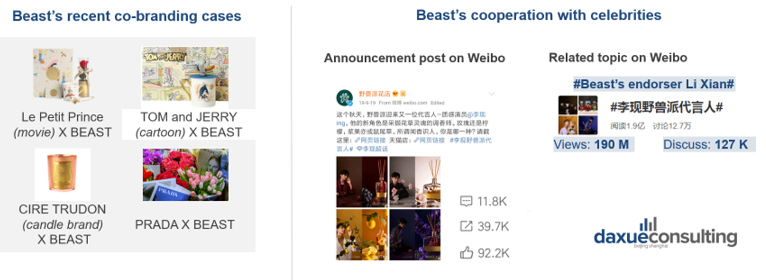

Leveraging the power of famous IP, successful brands and popular celebrities

[Source: daxue consulting, “Beast’s online marketing strategy in China”]

Beast leverages the power of famous IP, successful brands and popular celebrities to create a series of hot topics which can improve brand awareness in its extension segments like FMCG.

Beast announced its cooperation with Li Xian李现 (popular Chinese actor) in September 2019. The topics reached 190 million views and 127 thousand discussions, successfully raised the public’s attention and improved brand awareness.

Creating emotion connection with consumers through story marketing

[Source: daxue consulting, “Beast builds emotional connection with customers”]

Story marketing is another of Beast’s online marketing strategies in China. The brand shares buyers’ stories anonymously with flower’s photo on Weibo, which brings romance to their products. By telling the story, Beast identifies the voice and tone of the brand. Each story behind the order helps the brand build strong emotional connections with viewers, who would share their thoughts and personal experiences in the comments section. The emotional tie greatly improves brand acceptance and allows premium prices.

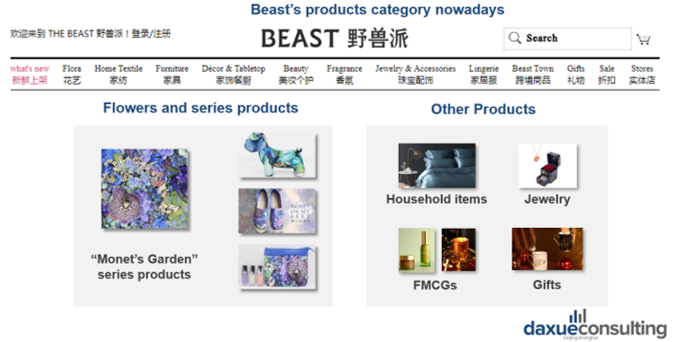

Realizing further growth by brand expansion

[Source: daxue consulting, “Beast’s current products category”]

Beast introduced more high-frequency products to improve brand awareness as well as brand loyalty. Thanks to Beast’s strong emotional connection with consumers and its powerful brand image, those related products and new categories can have high acceptance levels in the market.

Through product segments extension, Beast successfully transformed itself from a flower brand to a lifestyle brand.

Three obstacles in Chinese flower industry

However, the flower market in China is less competitive than other international markets such as that of Holland which is famous for flower production. This is due to three main reasons.

Lack of innovation in the development of new species

For flower production companies in most countries, it is important to cultivate new strands of species to differentiate their flowers and increase their sales. China has both the resources and ability to do this, but the lag of protection for new varieties has prevented companies from doing so.

Lack of large-scale production companies

The majority of the farmers in China only hold small production areas and usually the employees consist of family members. Most families of Chinese flower farmers consist of 2-3 people making an annual revenue only in the tens of thousands of RMB. The number of the farmers is only 20 times that of the number of firms. Furthermore, only 14,108 large and medium-sized companies exist among 79,512 firms, making up only 17.7% of the total. Unlike most large countries, no firm dominates the flower market in China; the production areas are small, and the revenues are even smaller.

Lack of emotional connection with customers

Information transmission channels have changed during the Internet era. The young generations have become the main purchasing power of flower market in China. In this context, utilizing social media to quickly disseminate products’ information and catering to the preferences of young consumers are important for establishing a brand that can meet the emotional needs of consumers.

Brand independence is how Beast captured the hearts of Chinese consumers

Beast is a good example of running an online flower business in China. It started with Brand independence and leverages e-commerce platforms to boost sales and reach new customers. It successfully builds an emotional connection with customers and drives them into its private traffic to improve customers’ retention and repurchase rate. Private traffic is also a strategy of Brand Independence, which is worth learning more about to imitate the Beast’s success. If you want to learn more about how your online business can work with private traffic, you can read our article, email our project team at dx@daxueconsulting.com to start your China market strategy project.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes