Despite growing global social and economic challenges, Chinese luxury market has developed rapidly in recent years. According to the Bain-Altagamma Luxury Goods Worldwide Market Study, the luxury goods market in China (excluding Hong Kong, Macao, and Taiwan) continued to enjoy double-digit growth in 2021, with some brands growing at over 70%. Due to frequent lockdowns and decreasing retails sales, Bain amended its previous forecast and Mainland China is now expected to become the world’s largest luxury goods market by 2030, thereby surpassing the regional share of the Americas and Europe.

Who are Chinese luxury consumers?

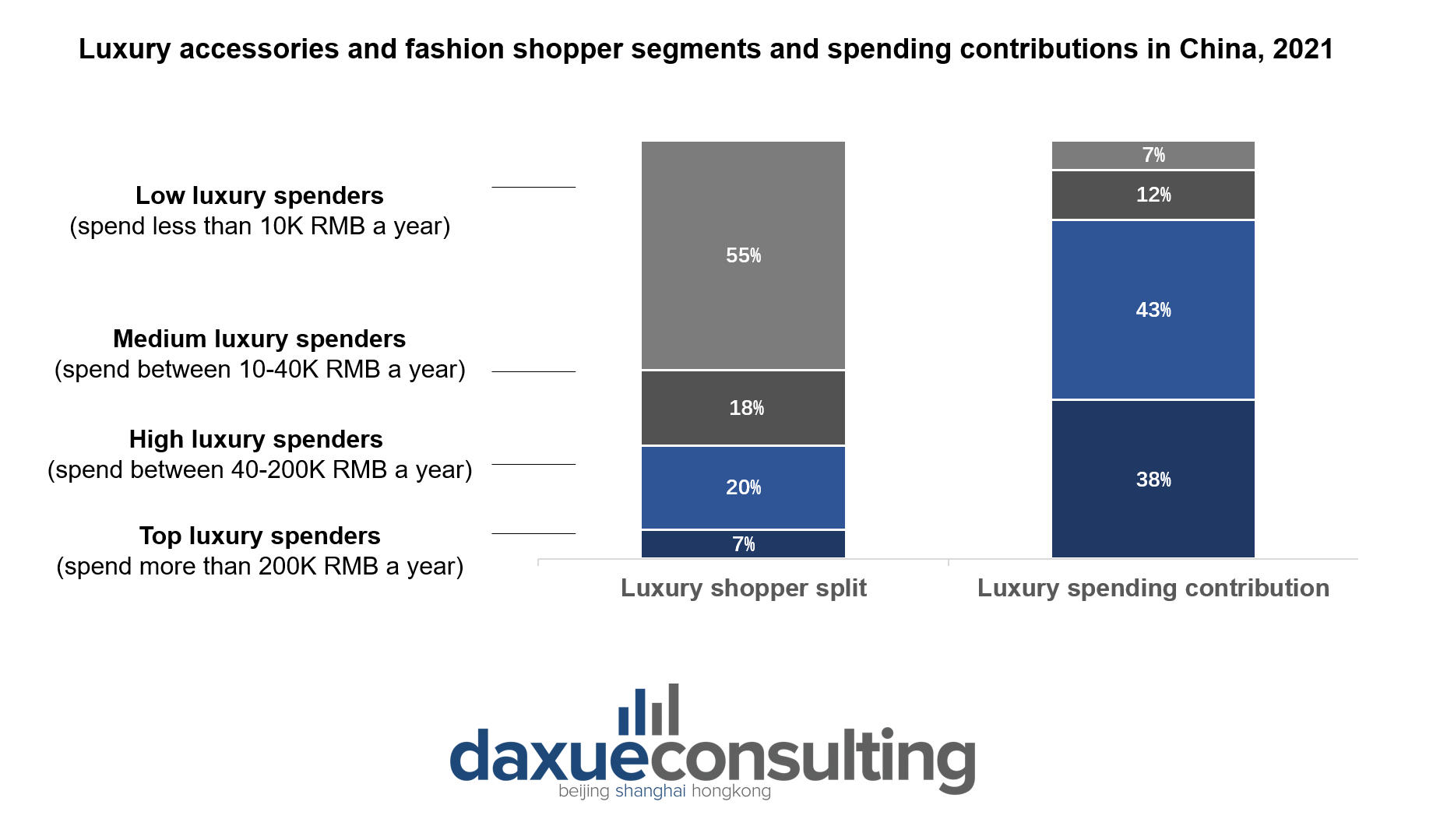

China is still a developing country, and the per capita disposable income of Chinese residents in the first three quarters of 2022 was 27,650 RMB. Therefore, Chinese luxury consumers mainly consists of low luxury spenders (spend less than 10K RMB a year). However, high spenders and top spenders still make up the main force of luxury consumption. Oliver Wyman estimates that there are 5.4 million local luxury shoppers, including 1.5 million who spend more than 40,000 RMB a year, contributing 81% of the total spending in 2021.

Millennials are the main force of the current Chinese luxury consumption

Millennials are the main engine of growth of Chinese luxury consumption, accounting for 50% of the Chinese luxury consumer base in 2021, and will continue to maintain a 25-30% consumption growth during the next few years. However, Generation Z is expected to replace them in the future. In fact, first-time luxury buyers are getting younger and younger: on average, Gen Z consumers made their first luxury purchase when they were less than 20, two to three years earlier than Millennials.

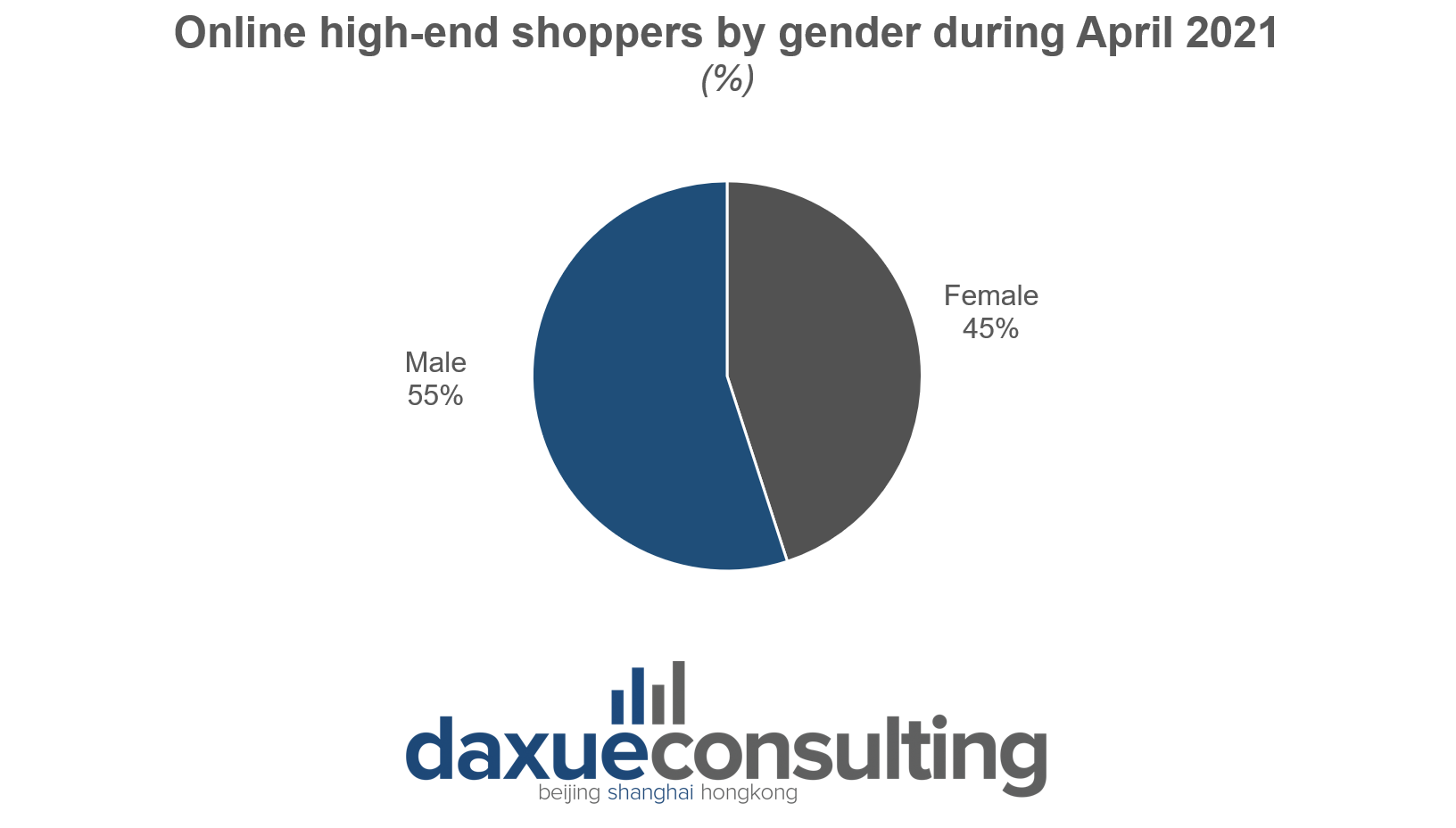

Growing male consumers purchase luxury goods

For what regards gender distribution, male users accounted for 55% of those who spent more than 1,000 RMB online monthly in 2021, which is higher than female users. Male consumers undoubtedly play a key role in China’s luxury market. According to QuestMobile data, the number of male online users with a spending power of more than 1,000 RMB has been expanding since 2019, reaching 122 million by April 2021. Chinese male users are becoming the backbone of the online high-end consumer base.

Chinese luxury shoppers are mainly concentrated in big cities

Chinese luxury shoppers are mainly concentrated in first-tier cities such as Beijing and Shanghai, as well as in new first-tier and second-tier cities such as Chongqing, Tianjin, Chengdu, and Shenzhen. Among them, luxury consumers in Beijing and Shanghai account for 9.7% and 8.4% of domestic luxury consumers respectively, both far higher than other cities, with a cumulative proportion of 17.1%.

However, Chinese luxury shoppers in lower-tier cities also vaunt strong purchasing power. The annual luxury spending in third-tier and lower-tier cities was about 393,900 RMB in 2020. Therefore, the sinking market is a world full of opportunities for luxury brands in China.

Key features of Chinese luxury shoppers

High-end consumers in China tend to buy luxury products offline

So far, brick-and-mortar stores are still the main purchasing channel for Chinese luxury consumers. According to China Luxury Consumption Behavior Report 2022, 24.4% of consumers chose to buy luxury goods online while 75.6 % offline. However, the frequency of online purchases continues to increase, becoming an important channel for Chinese luxury shoppers. Among online channels, consumers’ purchase brands’ official websites and brands’ WeChat mini programs are expected to increase the highest.

Today’s luxury shoppers care about sustainability

As the luxury market continues to mature, consumers are becoming increasingly aware of the importance of sustainable development. According to China Luxury Forecast 2021, 84 % of mainland respondents and 63 % of Hong Kong respondents agreed on the importance of sustainable development. Moreover, 85 % of mainland respondents and 62 % of Hong Kong respondents believe luxury brands should play an important role in encouraging it.

Low-pollution or zero- emission production processes and ethically sourced raw materials emerged as the most concerned sustainability propositions among respondents in both places. Therefore, luxury brands in China should pay attention to Chinese consumers’ environmental concerns, avoiding hypocritical green-washing techniques and embracing, instead, a genuine sustainability strategy.

The Guochao trend arouses Chinese luxury consumers’ interest

Guochao (国潮), literally “national trend,” refers to the increased consumer favoritism towards Chinese brands, designs, and culture. Stemming from a growing sentiment of nationalism and cultural confidence in consumption, Guochao played a major role in changing Chinese consumers’ perception of luxury brands, making them pay more attention to Chinese traditional culture, traditional aesthetics, and intangible cultural heritage crafts than before. Nearly 20% of luxury brands at the 2021 Shanghai Fashion Week were related to Chinese intangible cultural heritage. “Fashion + Chinese intangible heritage” is becoming a new trend in local luxury industry. Products with Chinese elements are likely to become more popular among Chinese luxury shoppers in the future.

Collaborating with KOLs and enhancing online presence can help brands capture Chinese luxury consumers

Increasing online exposure

Due to the comprehensive development and maturity of digital channels, the online shopping population in China has further expanded, reaching 84 % in mainland, with Millennials imposing themselves as the main consumer group. The China Luxury Industry Development Report predicts that in the next three to five years, about 2,000 high-end luxury brands will enter the Chinese market through various forms of e-commerce platforms, seizing the relative market share of traditional luxury brands. So as to provide consumers with better consumption experience and enhance the loyalty of consumers, luxury brands in China are gradually increasing their investment in online marketing and embracing a O2O strategy.

For instance, Dior was among the first luxury brands to set up an official account on Douyin. So far, the Douyin account of the French maison has posted 1,239 short videos, gaining more than 1,265 million likes and a total of 7,483 million followers. Through its efforts, Dior has become one of the most popular luxury brands in China in the last two years.

Collaborating with KOLs

Based on the rise of various media platforms in China, KOLs are ideal partners for luxury brands. There are two main ways of luxury brands and KOLs cooperation. The first one consists in utilizing KOLs to distribute brand-related news and information to increase brand exposure. Another way is promoting specific products through celeb endorsements and fashion bloggers’ recommendations. Indeed, celebrities have a stronger impact on purchase decisions of local luxury consumers in China than fashion week and exhibition activities.

Key takeaways from the Chinese luxury consumers

- Local luxury consumers are concentrated in big cities, mainly composed of low luxury spenders. Millennials are the main drivers of the current Chinese luxury consumption.

- More and more male consumers purchase luxury goods online in China.

- Chinese luxury shoppers tend to buy products offline, and they prefer products incorporating Chinese elements.

- Collaborating with KOLs and enhancing online exposure can help brands to capture Chinese luxury consumers’ attention.