As pandemic restrictions have come to an end, China’s affluent shoppers have started to return to traveling abroad and resume their luxury purchases. Domestically, Chinese shoppers are heading to Hainan for duty-free luxury shopping sessions. A report from Global Blue in 2023 revealed a strong sense of optimism among Chinese luxury travelers, with 90% of these shoppers wanting to restore or increase their pre-Covid shopping levels. However, Bloomberg analysts suggest that despite Chinese tourists’ willingness to resume their international travel, their overseas shopping volumes won’t be returning to previous peaks.

Download our China luxury market report

This shift is attributed to a significant rise in domestic consumption, propelled by improved shopping experiences within China and global price hikes. Sandalwood Advisors reported that in April, 62% of China’s luxury spending was domestic, an increase from 41% in April 2019. The trend toward domestic luxury purchases is anticipated to persist, potentially impacting international markets and brands that have historically relied on Chinese expenditure.

Hainan’s emergence as a domestic hub for high-end duty-free shopping

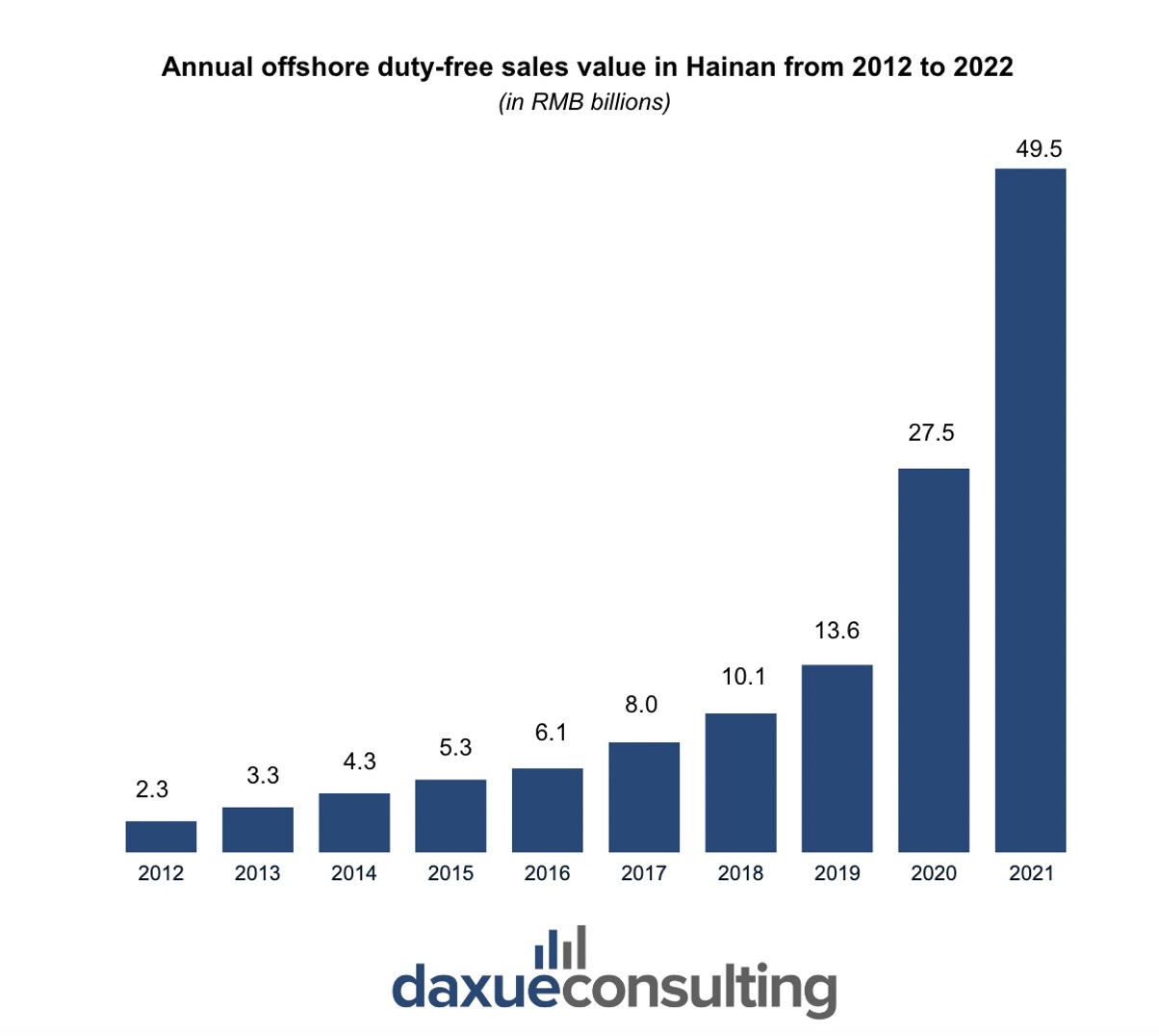

The decrease in Chinese luxury shopping abroad has been offset by Hainan’s emergence as a domestic center for high-end duty-free shopping, signaling what may become the future of Chinese luxury spending. While the first duty-free policies in Hainan were implemented in 2011, the island became a shopping haven during the early pandemic when travel restrictions limited Chinese consumers’ ability to shop abroad. Currently, 13% of China’s domestic luxury spending occurs on the island, a rise from 6% pre-pandemic.

Despite the lifting of pandemic restrictions, the discovery by many consumers of Hainan’s convenient duty-free policies has launched the value of the island’s duty-free sales towards a continuous growth spiral, unlikely to decelerate shortly. For instance, in April 2023, sales remained significantly above pre-pandemic levels, demonstrating a remarkable 203% increase from 2019. Additionally, a McKinsey survey found that over 62% of respondents who shopped in Hainan plan to return, even as international travel resumes.

Surging waves of commerce: Monitoring the growing attraction of Hainan among Chinese shoppers

Port of prosperity: The establishment of Hainan as a free trade haven

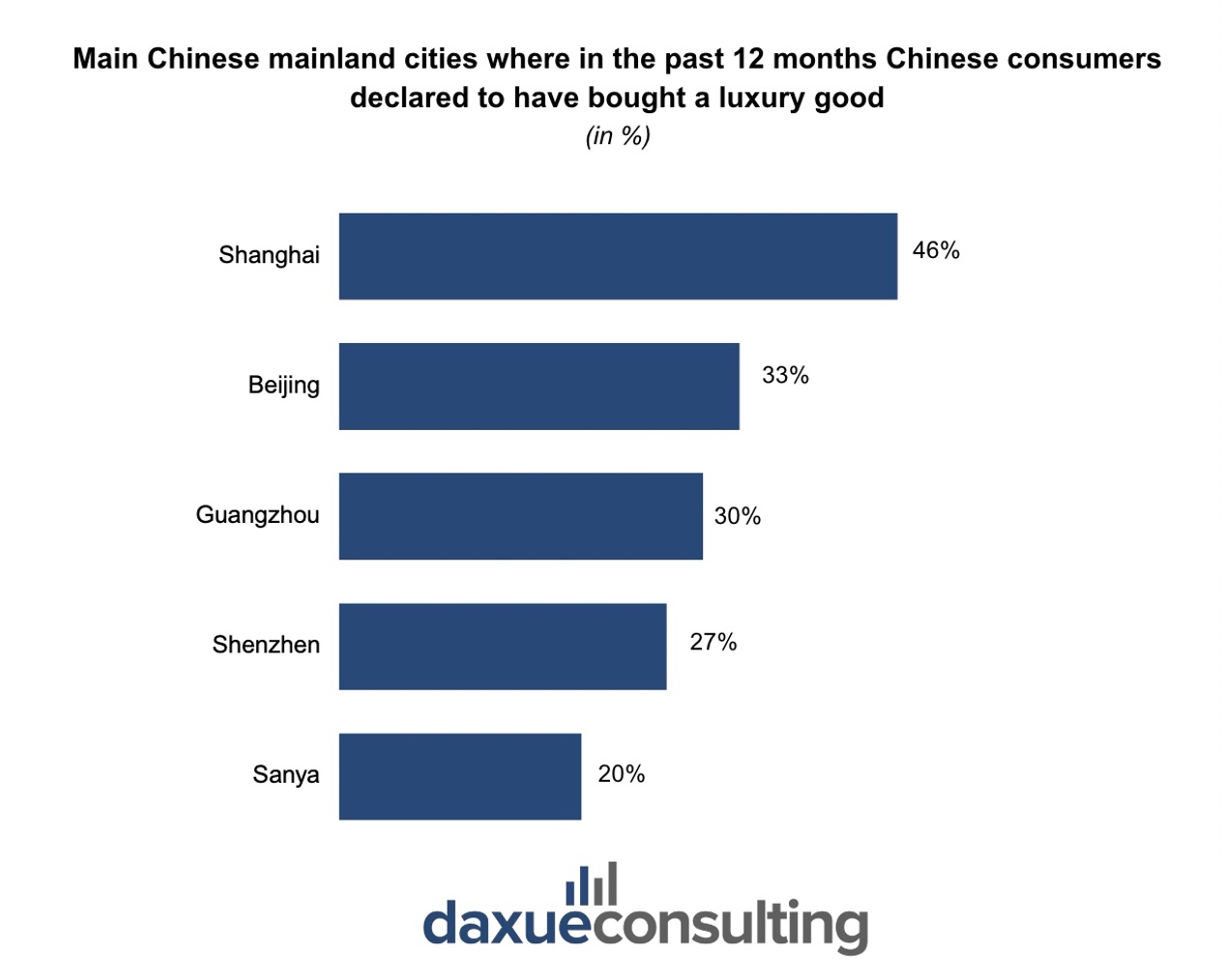

The Chinese government’s decade-long initiative to promote Hainan as a premier global shopping destination has seen recent uptrends in Chinese travelers choosing the island for shopping. Initiated in 2011 with Hainan’s free trade port status, this strategy significantly attracted visitors, especially during festive periods. The dual customs control system, distinguishing between restricted items and those eligible for tariff exemptions, facilitated this growth. By 2021, Sanya surpassed all second-tier and third-tier cities to become the fifth-largest luxury shopping city in Mainland China, underscoring the policy’s success.

Quota Impact: How duty-free changes shape shopping behaviors of Chinese shoppers in Hainan

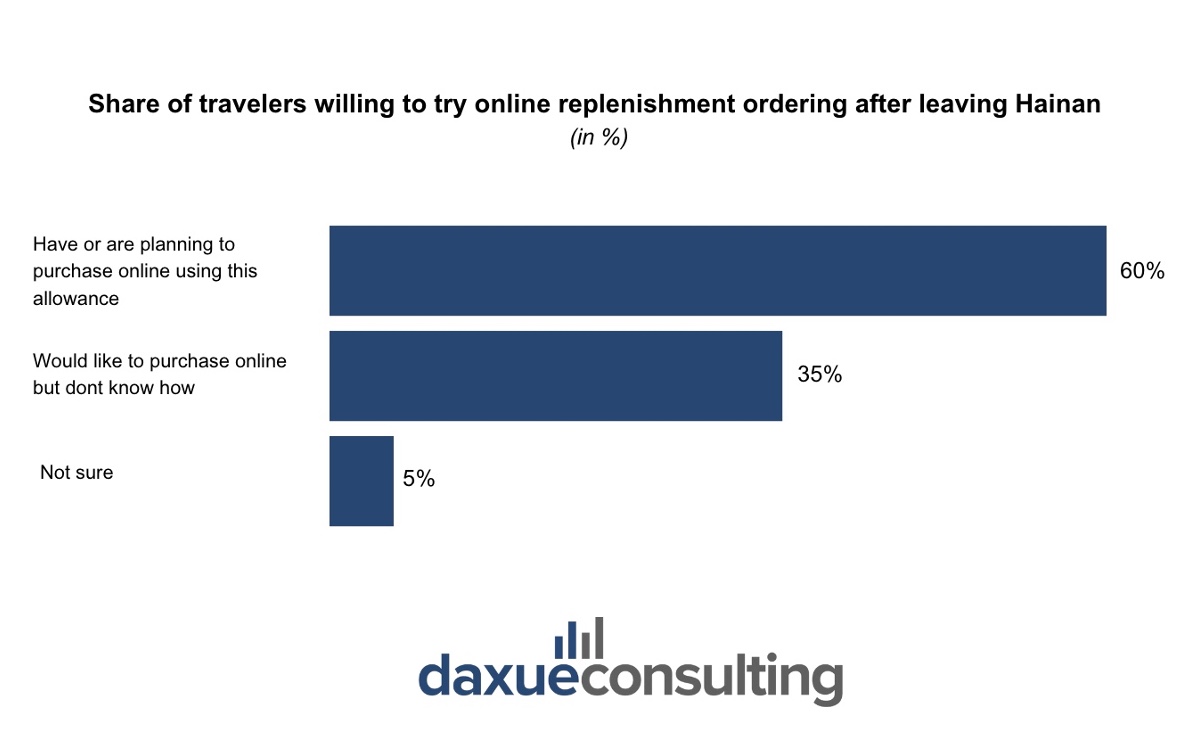

One of the most significant features of Hainan’s special customs-free zone has been the implementation of an exceptionally generous duty-free policy. Initially granting a RMB 30,000 allowance per traveler annually, was substantially increased to RMB 100,000 in July 2020. This allowance is among the most generous worldwide, putting Hainan ahead of other duty-free destinations like the UAE or Qatar. In addition, this policy also started to offer a unique advantage by supporting post-visit purchases through an online replenishment policy. This innovative approach allows visitors to utilize their unused annual duty-free quota to buy products online and have them shipped home within 180 days of their visit. It has garnered a lot of interest with over 60% of travelers willing to take advantage of the policy.

This strategic move significantly expanded shopping options for Chinese shoppers in Hainan, leading to a marked increase in both sales and foot traffic. For instance, between July 2020 and June 2021, Hainan’s offshore duty-free sales skyrocketed to RMB46.8 billion, representing a 226% growth year-on-year.

Navigating the lure: Understanding Chinese shopper’s journey to Hainan

Competitive shores: Hainan’s edge over mainland markets

Hainan’s duty-free shopping boom owes a key factor to the substantial savings achievable through the region’s competitive pricing policies. These policies, distinct to the province, enable travelers to enjoy considerable cost reductions on their purchases, with average savings ranging between 15% to 35% compared to prices found in other Chinese provinces. This makes Hainan’s duty-free regulations among the world’s most favorable, enhancing its appeal over other domestic and international destinations.

Luxury’s archipelago: Hainan’s expansive luxury brand landscape

Hainan’s extensive duty-free product range, which caters to the sophisticated tastes of international and discerning shoppers with a wide selection of premium brands, significantly enhances its appeal. The availability of luxury items, electronics, and more is supported by the growth of major retail centers across the island, such as the Sanya International Duty-Free Shopping Complex and Haikou Meilan Airport Duty-Free Shop. Consequently, today’s duty-free offerings have broadened to encompass an increasingly diverse array of categories, including wines, cosmetics, perfumes, handbags, eyewear, fine jewelry, luxury watches, spirits, and even electronics.

This diversity is poised to expand further, driven by increased investments from international brands and new operators, with the retail space for duty-free shopping expected to double in the next 4 years. Furthermore, the regulatory landscape is evolving to allow brands greater autonomy in operating their duty-free stores by 2025. This shift has prompted substantial investments in the duty-free sector as companies seek to leverage this model to stimulate market growth. Notably, major ecosystem players such as Alibaba and JD.com are intensifying their retail footprint on the island, signaling a robust commitment to expanding the already thriving duty-free retail landscape.

Homebound haven: A familiar embrace for Chinese shoppers in Hainan

Hainan’s geographical proximity to mainland China, compared to traditional luxury shopping epicenters like Paris and Milan, coupled with its familiar Chinese cultural ambiance, has markedly enhanced its attractiveness among Chinese consumers, who since the pandemic have increasingly valued the convenience of domestic travel versus international travel. A critical aspect influencing this consumer behavior has been the relatively low passport ownership rate among Chinese nationals. Reports from CGTN, a Chinese state-owned media, highlight that only approximately 10% of China’s 1.4 billion population possesses a passport, underscoring that a vast majority, over 90%, have their travel and duty-free shopping options limited to domestic locales.

While for affluent and experienced luxury shoppers, the allure of global fashion capitals will likely remain strong, the dynamic luxury retail environment of Hainan has become a legitimate alternative for a significant segment of middle-income consumers. The province’s deliberate development into a luxury shopping paradise, underscored by the economic benefits of domestic travel, aligns seamlessly with these consumers’ aspirations for high-quality products and exceptional value.

Voyager blueprint: The demographics of Hainan’s retail adventurers

The profile of Chinese travelers to Hainan differs from those traveling to Europe for luxury shopping. Hainan’s luxury scene appeals to a wider range of consumer profiles, ranging from families combining vacations with luxury shopping to lower middle-income families and first-time luxury purchasers. Drawn by duty-free shopping, this diverse group finds Hainan more accessible than the exclusive boutiques of Europe or North America. Conversely, Chinese luxury shoppers abroad tend to be wealthier, drawn by the latest fashion and exclusive items. For these consumers, Hainan is a secondary choice, often due to covid restrictions. Feedback suggests concerns over Hainan’s selection being less current and more limited than what’s available globally.

Regarding demographics, Ctrip.com, a Chinese online travel service site, shows that 67% of Hainan’s luxury shoppers are under 40. Generation Z consumers are the fastest-growing category, positioning them as the predominant demographic to the region’s consumer spending power.

Digital currents: The role of e-commerce in guiding shopping decisions

Digital platforms have profoundly influenced Chinese travelers’ decision-making, extending beyond shopping behaviors to include comprehensive travel planning. Before departure, a significant number of these Digital travelers use social media to research their preferred shopping destinations and items. Intelligence firm L2’s findings reveal that over 50 % of travelers engage in this activity, highlighting the critical role of digital tools in shaping travel and shopping itineraries.

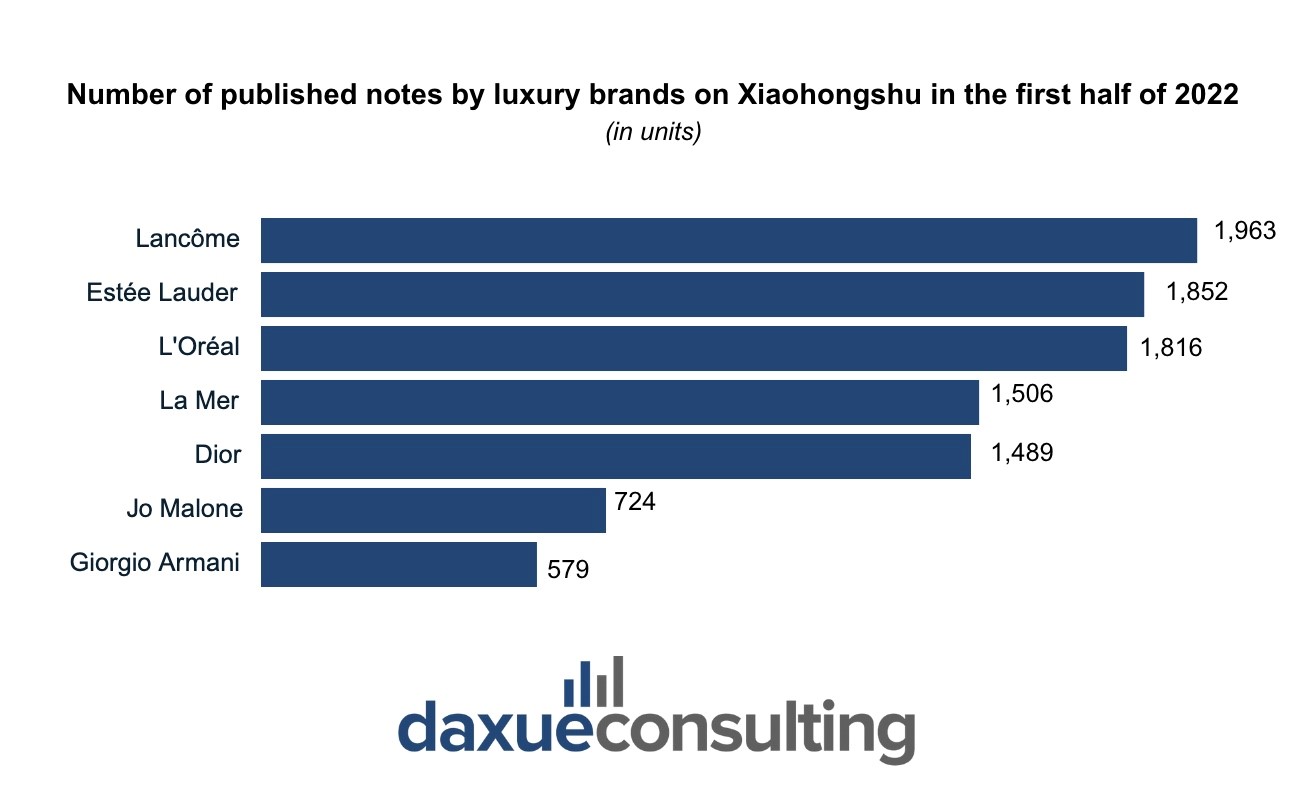

A standout in the digital arena is Xiaohongshu (Little Red Book), boasting over 200 million monthly users. It has become a central platform for travel and shopping enthusiasts, enabling users to explore products before international trips and share their purchase experiences. Recognizing the platform’s influence, luxury brands have actively pursued digital engagement strategies, with leaders like Lancôme, Estée Lauder, and L’Oréal amplifying their presence through substantial content contributions, marking a significant digital footprint in 2022.

Unpacking the most coveted desires in Chinese traveler’s trunks

The diversifying palate of Chinese shoppers in Hainan

In Hainan’s duty-free zone, Chinese consumers mainly buy luxury and beauty products, with beauty leading sales. Fashion is also rising in popularity, reflecting a broader interest in luxury beyond cosmetics. Chanel and Dior are the top-mentioned brands on Xiaohongshu, with 2.24 million and 2.14 million mentions respectively over the past year. Additionally, consumers are showing interest in other premium categories like watches, mobile phones, and computers, indicating a shift towards a more diverse range of luxury purchases. This trend highlights a more sophisticated consumer base expanding their focus from solely beauty products to include fashion, technology, and luxury accessories.

The shifting currents of Chinese consumer beliefs

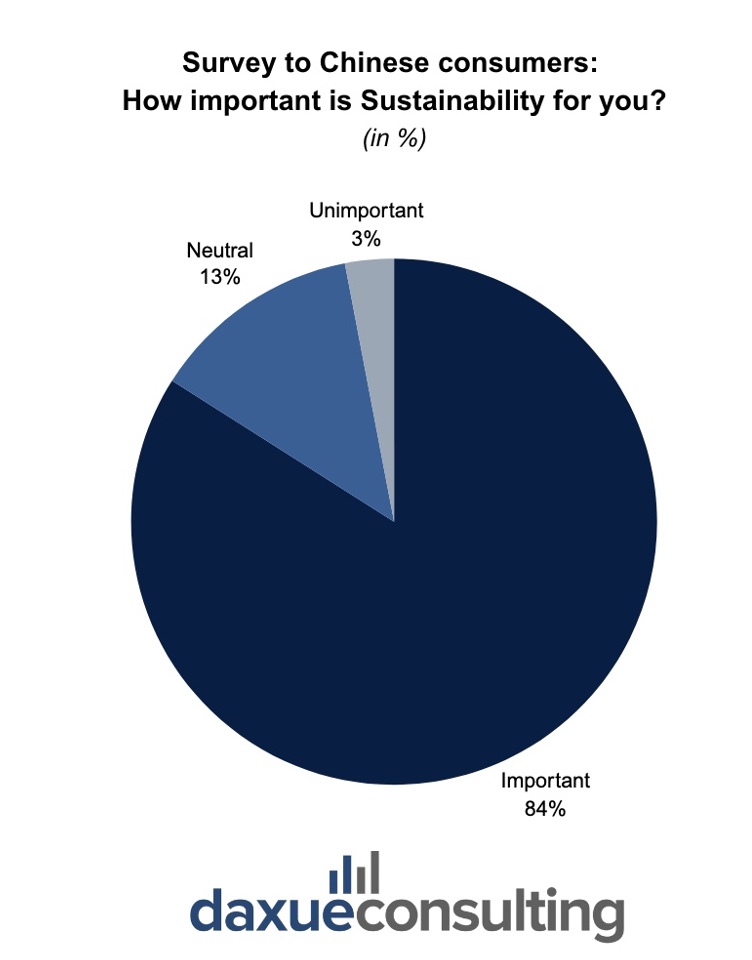

As luxury consumption behaviors in China evolve, Chinese consumers, particularly those from Generation Z, are starting to rely much less on the evaluation of brand logos and names as a way to explicitly display wealth and status. They have started to prioritize more values like authenticity and self-expression, which are embodied by brands that demonstrate a greater dedication to social and environmental responsibilities. This changing paradigm is supported by a report from the Ruder Finn and Consumer Search Group, which indicates that 84% of Chinese luxury consumers deem sustainability important, with a readiness to pay more for sustainable products.

Quest for Hainan’s unique retail experiences for Chinese shoppers

While duty-free pricing attracts shoppers to Hainan, they expect shopping experiences on par with international luxury standards. Consumers desire luxury, diversity, and up-to-date selections similar to global flagship stores. However, despite Hainan’s extensive high-end offerings, its reputation as a leading luxury destination isn’t fully recognized, especially among younger consumers. Research from luxury retail consultancy Rehub indicates that many consumers, particularly Gen Z shoppers, view Hainan as a family-friendly spot for affordable luxury rather than an exclusive shopping haven, underscoring a gap between expectation and perception.

Another significant trend is the burgeoning demand for immersive ‘phygital’ shopping experiences. This new retail paradigm, blending physical presence with digital innovation, resonates deeply with Generation Z shoppers who prioritize extensive customization and engagement in their purchasing journey. Luxury brands and duty-free malls are leading this shift by incorporating technologies like AI and AR, alongside extensive social media to create unique and memorable shopping experiences. These advancements allow for unprecedented personalization, with data analytics and the WeChat ecosystem enabling customized recommendations, shopping consultations, and tailored itineraries.

Chinese shoppers in Hainan in a nutshell

- Hainan stands out as a burgeoning hub for domestic luxury consumption in China, bolstered by strategic duty-free policies and convenient cultural and geographic proximity.

- Digital platforms, notably Xiaohongshu, play a pivotal role in shaping luxury shopping habits, offering a critical nexus for consumer engagement and pre-purchase research.

- Hainan’s luxury offerings are becoming increasingly diverse, moving towards a wider range of luxury goods, including fashion, technology, and other accessories.

- Gen Z’s luxury preferences are steering Hainan’s fashion industry towards a greater emphasis on sustainability and unique, technology-driven shopping experiences, marking a departure from traditional luxury shopping norms

We help brands better understand consumers from Hong Kong and Mainland China

Grasping the nuances of Chinese and Hong Kong consumers’ preferences, behaviors, and expectations is crucial for delivering tailored services and products. The diverse socio-economic landscape across regions, including the distinct characteristics between mainland China and Hong Kong markets, demands thorough and nuanced consumer analysis.

At Daxue Consulting, we specialize in employing advanced research techniques to not only gather consumer insights but also interpret them effectively, ensuring our clients make informed decisions to foster engagement and positive advocacy among their target audience. We offer:

- Extensive consumers research

- Focus groups analysis

- Tribes identification

- In-vivo research

Contact us at dx@daxueconsulting.com to get better results in Hong Kong and China with our help.