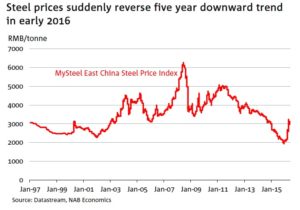

Chinese steel prices have been continually decreasing over the past five years. But the situation suddenly reversed at the beginning of 2016. The downward trend kept going during the first 3 quarters of last year. Consequences for China’s steel industry were immediate with the re-opening of some mills – which means job creation when the industry is seeing massive laid offs – even though China is still overproducing structural steel. The unexpected rise of Chinese steel prices is therefore presenting a new challenge to the government which has to arbitrate between the necessity of maintaining employment and boosting economic growth with the fight against an unsustainable overproduction of the steel industry for the long term.

Overproduction of Chinese steel, drop in prices, and the fight against increasing production capacities

Between 1978 and 2014, China saw its production evolve from 32 million tons to 823 million, thus easily becoming the world’s first steel producer. At the same time, China’s economic growth of the 1990’s and 2000’s – and in particular the massive investments in real estate and large infrastructure projects – swallowed a significant part of this production. China thus also became the world’s first steel consumer. But with the economic slowdown, this consumption stepped back in 2014 for the first time in thirty years.

The nearly continuous increase of steel production in China soon lead to a rising overproduction for China. The country found a partial and temporary solution in exports. However, the competitive loss of the Chinese steel industry resulted in a continuous price decline for more than five years.

Facing the extent of the overproduction – around 400 million additional tons – the Chinese government announced its ambition to decrease by 100 million tons, bringing the steel production’s capacity to 150 million tons between 2016 and 2020. For 2016 only, the planned reduction was 45 million tons and 21.26 million tons had already been withdrawn by the end of July.

The country’s first steel groups contributed to the reduction effort: in October of 2016, Baosteel group (宝钢) committed to decrease its production from 11 million tons in 2016 and 2017. Tanghsan (唐山) mill in Hebei region (河北) will have to reduce its own capacities by a third in 2017.

Sudden steel price rise in 2016

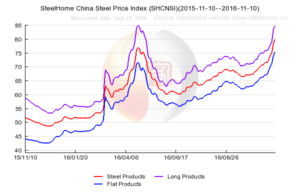

However, the unexpected flip of the market at the beginning of 2016 could deeply change the government’s plans. At the end of February, average prices of “rebar”, a product used in construction and made from steel, grew above 463 dollars per ton for the first time since 2014. The rise is more sensible in March, with a year to year growth of 2.9% for crude steel production, according to the China Steel and Iron Association.

Source: www.steelhome.cn

Source: www.steelhome.cn

The price rise was greeted with a message of support for growth from the Chinese government. Chinese steel mills re-opened right away: the private company Highsee Iron and Steel Group (海鑫钢铁集团), in Shanxi region (山西), went bankrupt in 2014, but opened its doors again in May 2016 with the support of its new owner the Jianlong group (建龙集团). The public company Baosteel (宝钢) also announced in September 2016 the takeover of its competitor Wuhan Iron and Steel (武汉钢铁集团) in order to form a new entity, the China Baowu Iron and Steel Group (宝武钢铁集团). The production capacity of this new group could reach 60 million tons per year. In total between February and April 2016, some 60 furnaces opened, causing a crude steel production rise of 2.16 million tons per day, according to custeel.com.

For 2016, production should thus lie around 1.2 billion tons, according to China Steel and Iron Association. Despite the reduction of the gap between the supply and the demand, the demand should not increase above 672 million tons for 2016, the BBC says.

The government’s challenge: find a balance between plant closures and the social issues that it creates

While the Chinese government is fighting to restore a sustainable steel production level on the long term, the re-opening of furnaces by several State companies may seem contradictory. But it can be partly explained by the central role historically played by the steel industry in China’s growth. Thousands of companies are working in this sector. Among the world’s first twenty producers, nine are Chinese. They largely contributed to the economic growth by massively providing steel to the construction sector for more than thirty years, thus enabling China’s urbanization.

Moreover, these companies employed thousands of workers. For the towns and villages built near mills and furnaces, closing plants only impoverished them more. In total, Human Resource and Social Security minister Yin Weimin estimated the number of workers put at risk to lose their jobs in the coming years was 500.000. For local governments, it is often difficult to close plants like Highsee Steel which represent a significant part of local taxes and provide employment to numerous people in the province. It is even more difficult since it is known that very few workers will actually receive a compensation for their redundancy. Social movements linked to mill closures are indeed more and more frequent in China, with an average eight demonstrations per day in 2015.

Daxue Consulting’s expertise

Daxue Consulting was contacted by a Finnish company specializing in the production of machines and software addressed to steel, aluminum, and paper factories. The group has already been present in China for almost ten years, but had difficulties to fully benefit from the market potential. The client asked our team to advise improvement opportunities regarding sales, distribution, and marketing strategy.

With this objective, Daxue Consulting realized a desk review collecting information on the market and its potential clients (steel, aluminum, and paper producers), benchmarking local and international competitors’ best marketing strategy on the Chinese market, and analyzing the client’s local retailers’ performance. Secondary data was then combined with a set of interviews realized during a qualitative survey. The results of the research and strategic advice from Daxue Consulting were used to make a detailed business plan.

To know more about Chinese Steel Market, please don’t hesitate to contact us.

Stay Up To Date! Sign up for our Newsletter to Receive the Last Updates.