The clean beauty market in China presents both opportunities and challenges for international beauty brands. Despite the potential challenges, certain brands such as Kiehl’s from the United States and La Roche-Posay from France have successfully established a strong presence in the Chinese clean beauty and personal care market. This indicates that there are avenues for foreign clean beauty brands to enter and thrive in these markets, although they may face certain obstacles along the way.

What is clean beauty?

Clean beauty (纯净美学 in Chinese) does not have an official definition, but it is commonly recognized as products that don’t include ingredients suspected to be harmful to the individual’s health or the environment. Parabens, artificial colors, and synthetic fragrance are a few of the harmful ingredients common in conventional beauty brands. While the term “clean beauty” may be unfamiliar to some consumers, related concepts like cruelty-free, natural, vegan, green, organic, and sustainable might sound more familiar. With regulations evolving, consumer demands changing, and competition increasing, there are promising opportunities for growth and success in China’s clean beauty market.

Download our report on Chinese beauty consumer pain points

Major challenges in the Chinese clean beauty market

Many international clean beauty brands have struggled to enter the clean beauty market in China mainly due to the required animal testing, the limited consumer demand for clean products, and the growing local competition.

Complicated animal testing requirements

China is one of the very few countries that have long required post-market animal testing. The required animal testing had limited the entry or even the growth of the clean beauty brands, whose ethical principles inhibit them from conducting animal tests. From 2023 on, general cosmetic brands can skip the tedious pre-testing and post-testing process. However, that does not apply to products like those considered “special-use” cosmetics like hair dyes, sunscreens, and whitening products.

Clean beauty is still niche in China

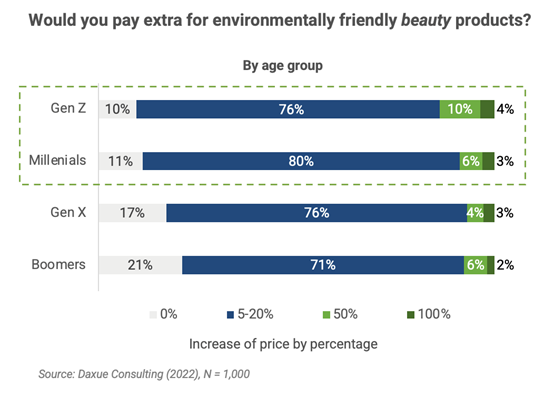

Another challenge is that clean beauty remains to be a niche market in China. Clean beauty brands typically differentiate themselves from other cosmetic brands by their minimum harm to the individual and the environment. According to our 2022 Green Guilt report, the majority of respondents stated that they would only pay a premium of 5%-20% for environmentally friendly beauty products. This suggests that environmental concerns are not the primary driving factor behind their purchasing decisions.

Pressure from local competitors

Although the clean market in China is relatively niche, international brands may face threats by local brands. Just because the local brands may not be actively encouraging clean beauty products, they should not be disregarded. One such brand, Floraris (花西子), stands out by incorporating Chinese recipes and ingredients in their products, embracing the Guochao (国潮) trend, may become one of the main competitors in clean beauty market.

By integrating flower essences and herbal extracts, Florasis offers “natural, healthy, and skin-nourishing” products that align with both the clean beauty principles and Chinese medicine philosophies. According to the data analytical firm Feigua, in February 2023, Floraris’s smooth sunscreen makeup primer’s sales ranked eighth among the top 15 Douyin beauty products, generating around 484.3 billion yuan.

What are the growth drivers of the clean beauty market in China?

The relaxation of animal testing regulations, coupled with the increasing consumer interest in health and the environment, creates a favorable environment for brands to strategically plan their entry and expansion in the Chinese market. By aligning with these evolving consumer preferences and leveraging the changing regulatory landscape, international clean beauty brands can position themselves for success in China.

Loosened animal testing for most clean beauty products

Recent changes in cosmetics animal testing have opened opportunities for clean beauty brands to enter China without violating their cruelty-free policies. From 2023 and onward, most of the cosmetics can be sold without animal testing. This means that brands are more likely to direct selling via their own website or online Chinese retail platforms like Tmall, Taobao, and JD. They can explore collaborations with various distribution channels to reach a wider customer base. For example, British Lush products can be found on Taobao but not in retail stores.

Growing demand for clean beauty products

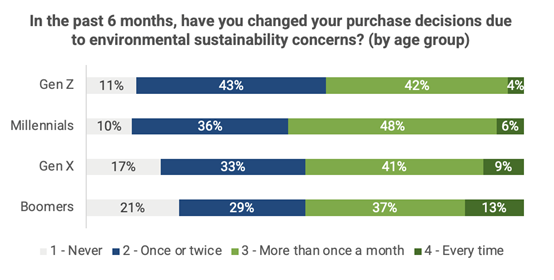

The interest in and willingness to purchase clean beauty products among consumers in China is on the rise. In fact, a significant number of customers across different age groups have expressed their inclination to modify their purchase decisions based on environmental sustainability concerns.

Source: Daxue Consulting, 89% of Gen Z and 90% of Millennials have altered their shopping decisions due to environmental sustainability concerns at least once over the past six months

When buying clean beauty products, what do Chinese customers look for?

Millennials

Millennials have high openness to international beauty standards and high sensitivity to organic ingredients and natural benefits. However, they have limited access to them. Based on an AlixPartners study on clean beauty products, 38% of the Chinese respondents agreed that “products are not readily available where [they] shop.” Thus, Chinese millennials care more about the availability and convenience in buying clean beauty products.

Trend catching Generation Z consumers

Generation Z are also important in the clean beauty market. Despite their young age, they have strong purchasing power. Also, they prefer natural ingredients, value eco-friendly products, and have strong intention to use natural skincare products, according to 2020 CBNData. However, their purchasing power on clean beauty products are limited by low-income level. For younger consumers, ‘price’ is thereby an important factor determining their spending on clean beauty products.

What are some successful international clean brands in China?

Brands such as Kiehl’s, L’Oréal, La Roche-Posay and Estee Lauder’s Origins are all key players in Chinese clean beauty skin care market. Based on their Weibo’s posts, most brands highlight the effectiveness rather than the “cleanliness” of their products. For example, in one of Kiehl’s posts as shown below, elements of nature such as calendula may be showcased in the background of their Herbal-extract toner, but the emphasis is placed on the product’s effectiveness.

Alongside Kiehl’s, La Roche-Posay engages in live broadcasts featuring medical experts who provide skincare advice to viewers. Origins, on the other hand, shares informative content along with photos of celebrities with clear skin. Interestingly, these brands do not place a specific emphasis on the cruelty-free or “cleanliness” aspect of their products. Instead, they prioritize effectiveness as the key factor in approaching their consumers.

Exploring the clean beauty phenomenon in China

- Clean beauty market in China presents opportunities and challenges for international brands.

- Challenges include animal testing regulations, limited consumer demand, and competition from local brands.

- Growth drivers include the relaxation of animal testing regulations and increasing consumer interest in health and the environment.

- Successful international clean beauty brands in China prioritize effectiveness over “cleanliness” in their marketing strategies.

- Consumer preferences in the clean beauty market in China are influenced by factors such as convenience and price, with millennials and Generation Z showing interest in natural ingredients and eco-friendly products despite limited purchasing power for younger consumers.

Author: So Ry Park

Updated by Linda

Download our white paper on China’s beauty industry