Haircare is becoming increasingly important in China, with consumers prioritizing holistic wellbeing and adopting haircare routines as sophisticated as their skincare routines. According to China Daily, 94% of urban Chinese consumers consider haircare as important as skincare.

Download our report on Chinese beauty consumer pain points

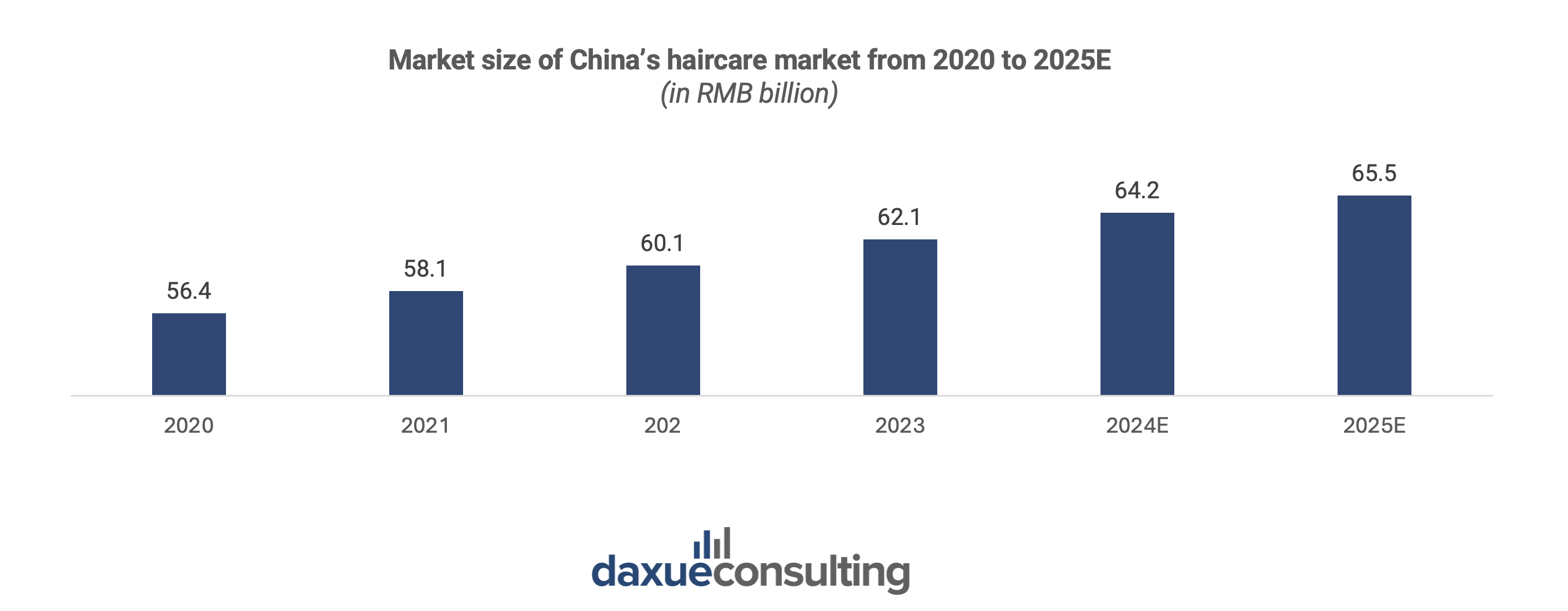

Over recent years, China’s haircare market, primarily segmented into shampoos, conditioners, styling products, and colorations, has consistently expanded. In 2022, it reached RMB 60 billion in 2022, with a year-on-year growth of 6.9%. By 2025, it is estimated to reach RMB 67 billion.

China’s haircare market surges towards premiumization

In China’s beauty market, as consumers seek healthy and silky hair and seek higher quality products, attention is increasingly drawn toward premium haircare.

While mass-market products still dominate the haircare market in China, there is growing demand for more premium products. Sales of mid-range and high-end products like hair growth serums, hair masks, and scalp health products are experiencing rapid growth, averaging a remarkable 20.1% increase in 2023.

With an increasing emphasis on quality and efficacy, Chinese consumers are gravitating towards higher-end haircare products enriched with premium ingredients. For example, in terms of ingredient distribution and growth rates in 2023, chamomile extracts witnessed the highest year-on-year growth at 113%. This was followed by caviar extracts at 98% and pomegranate extracts at 96%.

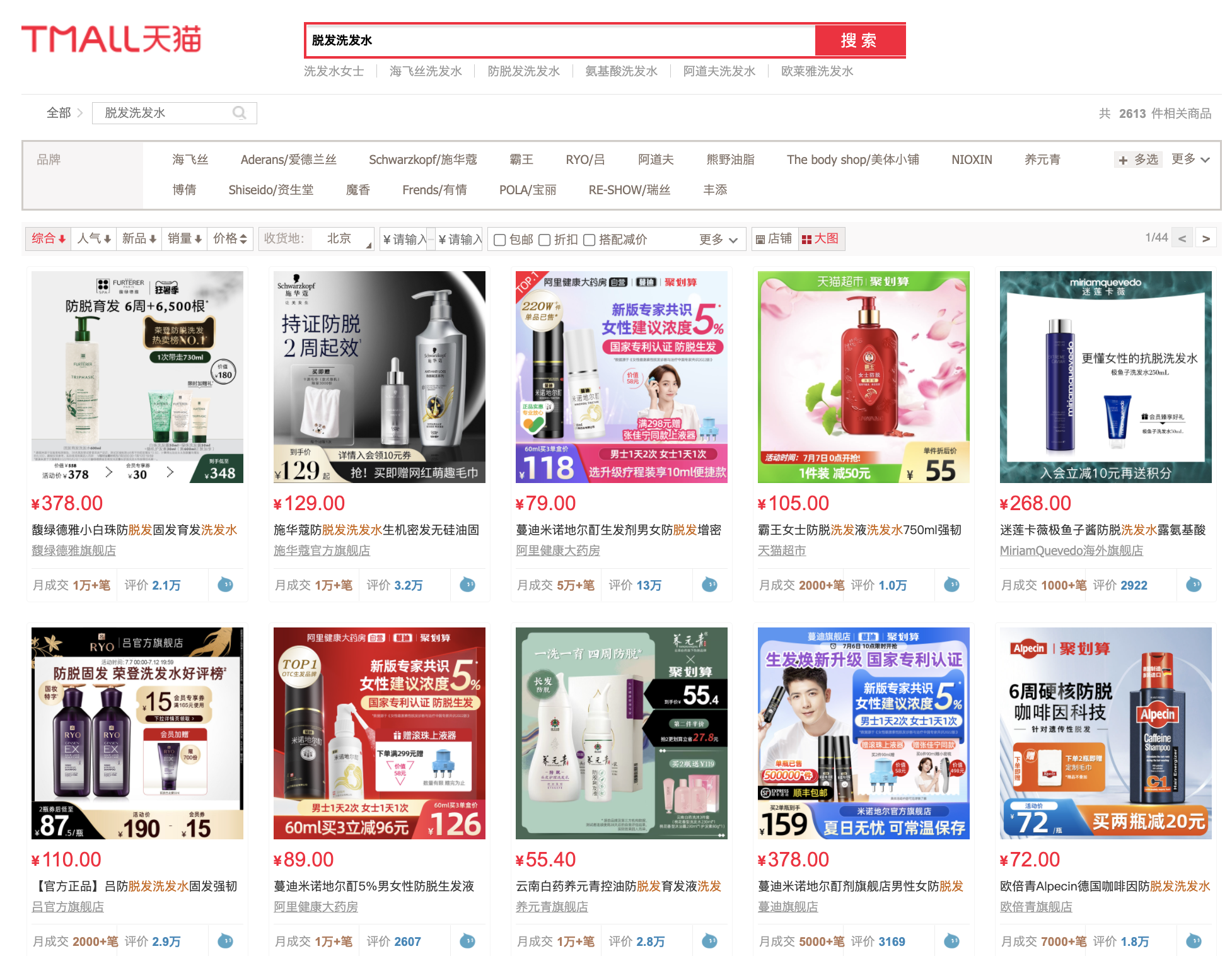

Hair growth products face a rising demand

In China’s demanding society, hair loss has becoming increasingly prevalent. According to CBNData, “hair loss and poor hair quality” ranks sixth (30.7%) on the list of consumer health concerns in 2022. The consumer demand for products promoting hair growth and reducing hair loss is steadily rising. In 2022, 81.0% of Chinese individuals experiencing hair loss purchased anti-hair loss products, with anti-hair loss shampoo (76.6%) being the most popular among them. This is not only affecting old people, but younger people too. In fact, young consumers are suffering from hair loss 20 years earlier than previous generations.

With this growing demand, the hair growth product market in China has witnessed significant growth. According to Qianzhan Research, the market size reached RMB 7.4 billion in 2021. It is projected it will continue to rise in the coming years, with an estimated market size of RMB 12 billion by 2027.

Haircare consumers are becoming younger, with Gen Z emerging

Consumer trends in China’s haircare market have seen notable shifts in recent years. One notable trend is the increasing dominance of Generation Z consumers, reflecting a younger demographic shaping purchasing behaviors. According to iResearch, from 2021 to 2022, 70% of buyers of haircare products on Taobao and Tmall were women, predominantly from second and third-tier cities, and aged between 18 and 34.

Generation Z consumers seek effective multifunctional products

According to data from iiMedia Research, in 2022, 50% of Generation Z consumers washed their hair every two days, while 25% washed it daily. This shows that hair washing frequency has increased, given that there are many people who believe that washing their hair daily is not healthy.

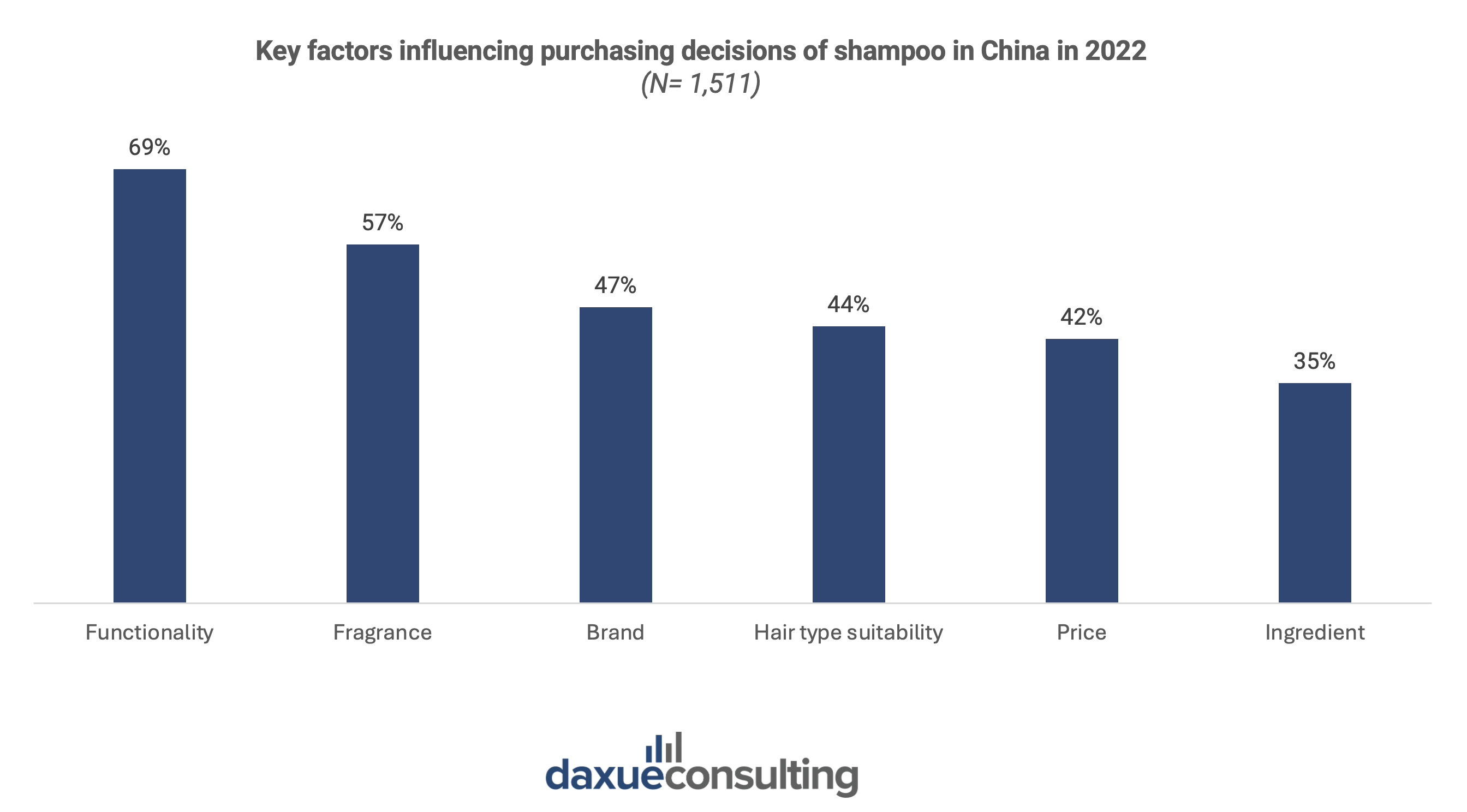

Additionally, functionality emerged as a top priority for this demographic. For instance, as for shampoo, 68.9% of consumers prioritize functionality in their purchasing decisions. Fragrance (56.9%), brand (47.1%), and price (41.5%) also played significant roles in their choices.

While consumers value functionality, there is still a need for development, especially in haircare products with multifunctional properties. According to social listening on pain points in China’s beauty market, consumers discuss the need for more effective multifunctional products. Most haircare products either address only one hair issue, while multifunctional ones often prioritize one and neglect others.

Leave-in haircare (免洗护发) fits with the developing “lazy economy”

The lazy economy refers to a new type of consumption, which by nature is time-saving, labor-saving, and convenient. The “lazy economy” has grown rapidly because it meets people’s diversified and ever-increasing consumer demands.

The leave-in haircare products emerging on the market correspond with the tendency of a “lazy economy”. According to the “Tmall Hair Care Industry Consumer Trend Insights” report jointly released by CBNData and Tmall, “lazy” haircare products like dry shampoo have gradually become the new favorites in the market.

“Skincare-style haircare” gives room for product subcategories

In recent years, as the pace of work and life has accelerated, young people have paid as much attention to hair as skin. The traditional “shampoo + conditioner” standard combination can no longer meet their needs.

The modern hair-care routine includes several steps. First, there is the pre-wash repair hair mask before shampooing, then vitamin infused shampoos and conditioners, and finally haircare essential oils and scalp moisturizing essences before spraying hair smoothing spray. For the most obsessed, there are also weekly scalp cleansing and advanced ampoule care or luxury hair coloring products. The level of sophistication of haircare routines has now become similar to that of skincare routines.

Behind the rise of “skincare-style haircare” (护肤式护发) is the surge in young people’s need for anti-hair loss and scalp care. The concept of “skincare-style haircare” has been used more frequently in the past two years. At the same time, more haircare brands have implemented this concept in their product lines, investing more in specialized products.

Gen Z prefers DIY hair dye to experiment with colors

Compared to professional hair salon services, the cost of homemade hair dye is relatively low, with prices ranging from tens of RMB to one or two hundred RMB. At the same time, dyeing hair at home is more convenient and time-saving, which appeals to the busy young Chinese generation.

Another notable trend is the preference for catchy hair colors. According to the report “Generation Z Beauty Consumption Trend report” jointly released by CBNData and Taobao Live ON MAP, in the past three years, the online consumption of coloration products by Generation Z has increased year by year in China. Although brown remains the most popular color, the proportion has gradually decreased and Chinese youth developed a preference for colors like blue, gray, and pink.

For Gen Z, DIYs give them a sense of accomplishment, a way to showcase personality, and how to dye a special hair color becomes an ice-breaking topic for socializing.

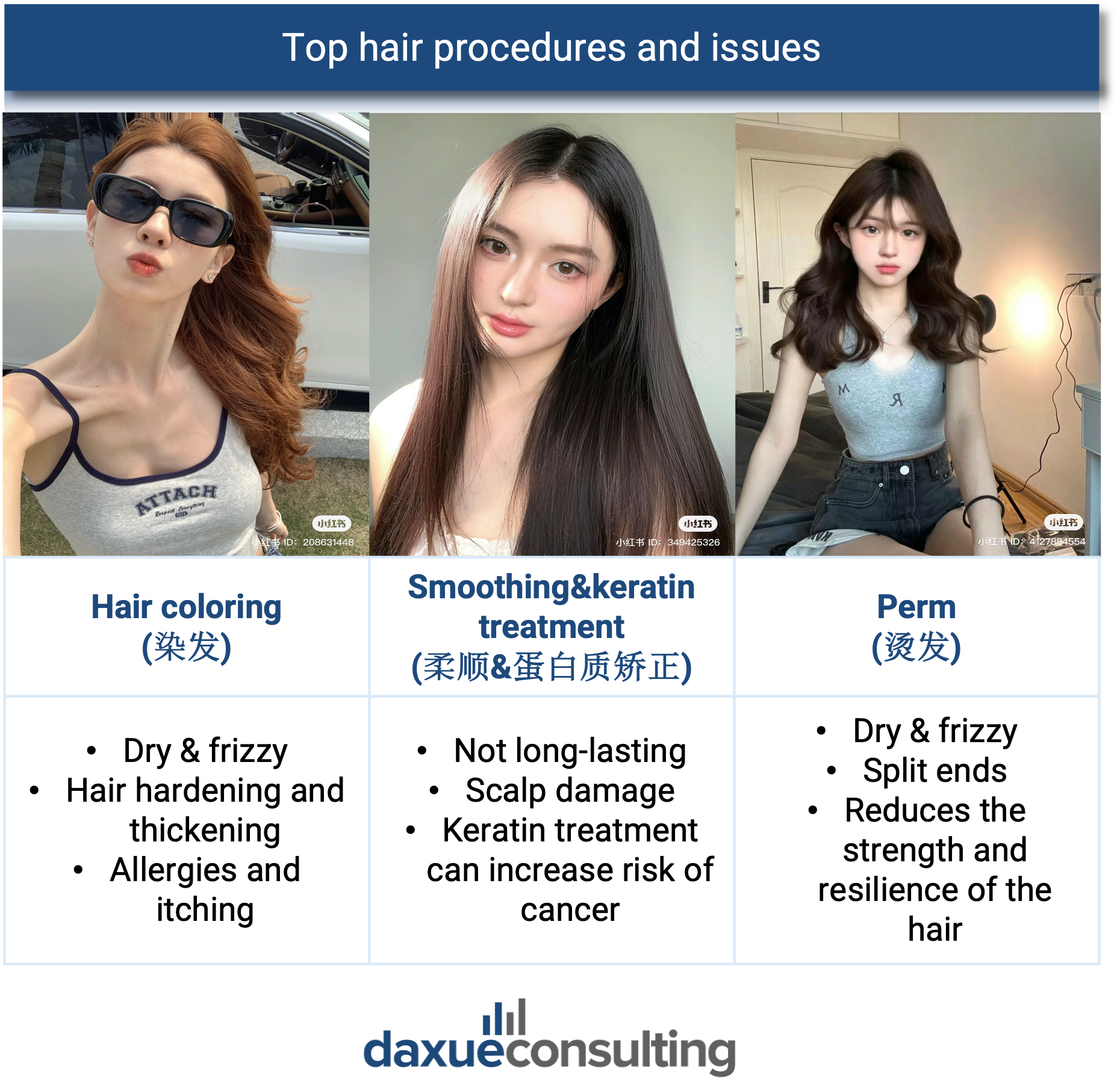

However, with more young people dyeing and styling their hair, there is a growing need for effective repair products. Social listening on pain points in China’s beauty market reveals that consumers discuss how existing products do improve hair that has undergone procedures, but they also diminish the results of those hair procedures.

Dynamics of the haircare industry in China: Foreign dominance and growing pressure from domestic brands

The haircare industry in China remains predominantly led by foreign investment, with industry giants such as P&G, Unilever, and Schwarzkopf asserting their dominance in the top tier. P&G and Schwarzkopf are positioned in the premium haircare segment, while Clear (清扬) and Rejoice (飘柔) by Unilever leverage robust brand recognition and extensive consumer loyalty to secure and bolster their market shares. In 2023, the luxury haircare brand P&G held the largest market share at 33.5%, followed by Unilever and Guangzhou Adolph (广州阿道夫) at 10.9% and 8.7% respectively.

However, intense competition in the Chinese haircare product market is causing leading brands to lose overall market share. Although P&G and Unilever and other foreign brands accounted for the biggest share of the market, the CR5 (the combined market share of the top 5 manufacturers) decreased from about 65.30% in 2012 to approximately 56.3% by 2021, indicating a trend of foreign leading market shares being eroded by emerging smaller brands.

Rise of domestic products: from substitutes to some consumers’ top choices

While foreign players in the haircare industry in China have been present for some time, domestic newcomers are increasingly making their mark after years of development.

With the influence of the Guochao trend, Chinese consumers’ willingness to purchase domestic brands is on the rise. According to CBNData in 2023, Chinese consumers buy haircare products with Chinese elements, which account for 61% of the total market share. Additionally, 86% of consumers express a desire to purchase domestic hair care products. Key reasons include domestic haircare brands having a better understanding of Chinese people’s scalp issues and the improvement of quality of domestic brands.

Furthermore, emerging players in the market, spearheaded by brands rooted in traditional Chinese medicine enterprises, are heightening competition. A number of these brands capitalize on their expertise in traditional pharmaceuticals to expand into hair care, setting them apart from other competitors.

For instance, Twelve Grasses (十二草集), a Chinese enterprise, emphasizes the inheritance of Chinese traditional herbal culture and invites the public both online and offline to witness the meticulous 168-hour process of crafting their botanical shampoo. According to Xianjing Data, in July 2023, Twelve Grasses ranked second on the list of top-selling shampoo brands on live-streaming platforms, surpassing brands like Head & Shoulders (海飞丝) and Clear, showcasing its growing influence.

It is foreseeable that in the coming years, domestic high-end hair care brands will continue to pose a significant challenge to international industry leaders.

What to know about China’s haircare market:

- The haircare market in China is steadily growing, witnessing a surge towards premiumization with increased emphasis on quality and efficacy.

- The Generation Z in China is reshaping the haircare market, with functionality, DIY hair dye, and color preferences driving trends.

- On social media, consumers express their pain points in China’s beauty market. Two notable ones are the need for more effective multifunctional haircare products and repair products.

- Foreign giants like P&G, Unilever, and Schwarzkopf dominate the haircare industry in China, while domestic haircare brands gain traction among Chinese consumers, driven by quality recognition and traditional herbal expertise, challenging international competitors.

We can guide you in navigating the haircare market landscape in China

At Daxue Consulting, we specialize in navigating the evolving landscape of the haircare market in China. Leveraging our deep understanding of this sector, we offer tailored solutions to optimize your haircare operations.

Whether you’re a global haircare brand expanding into the Chinese market or a local startup seeking to scale your operations, we have the expertise and resources to support your goals. Contact us today to initiate or review your haircare strategies and unlock growth potential in the dynamic Chinese market.

Download our China luxury market report