In the hyper-competitive Chinese coffee market, few stories are as gripping as that of Luckin Coffee (瑞幸咖啡). Once embroiled in a scandal that led to its expulsion from Wall Street in 2020, Luckin Coffee has not just clawed back to its former glory but has also eclipsed some of the industry giants.

As of early 2023, the Chinese coffee chain is staging a powerful comeback, rapidly expanding to nearly 10,000 coffee shops across China, which is now significantly more than Starbucks China’s 6,200. Luckin’s impressive growth is a blend of resilience, strategic reinvention, and technological prowess, marking a new chapter in the global coffee saga.

Download our report on Gen Z consumers

Sipping success: How Luckin democratized coffee culture in China

Founded in 2017 in Beijing, Luckin Coffee rapidly became one of China’s largest coffee chains, through a collection of variegated and multifaceted strategies.

The first major factor in Luckin’s success was its competitive pricing strategy. By offering coffee at lower prices compared to well-established competitors like Starbucks, Luckin effectively exploited an underserved niche and attracted a huge base of price-sensitive customers. A cornerstone approach of this cost leadership strategy relied on throwing money directly at its customers in the form of discount coupons. It was typical for new customers to receive the first cup of coffee for free, followed by coupons with discounts of up to 89%.

Luckin’s focus on rapid and aggressive expansion was also another cornerstone of its strategy, especially in the early stages of existence. The brand opened nearly 4,000 coffee shops in less than two years with the main goal of reaching a sufficient size for market dominance.

Technology also played a pivotal role in transforming Luckin into a convenient coffee alternative to Starbucks. Right from the start the brand actively emphasized the role of technology in every aspect of its business model. It notably used mobile apps to receive orders and payments from customers exclusively. Data analytics were also key factors in better-understanding customer preferences and tactically distributing digital loyalty programs.

Finally, Luckin Coffee’s success can largely be attributed to its joint venture business model. Unlike Starbucks which strictly based its business on direct ownership of its stores, Luckin opted to partner with well-established business entities like Centurium Capital and Joy Capital, two of the leading private equity investment firms in China, to open up a business in which both parties share costs and related profits.

Luckin’ subsequent strategy misfire and downfall

In the first years of operation, despite encountering a lot of popularity and success from consumers, Luckin Coffee wasn’t gaining any revenue. While Luckin’s business model was unique, its aggressive approach to acquiring customers through heavy discounts had backfired into unsustainable financial losses, as the majority of its clientele was drawn by affordability rather than the quality of the coffee. These losses eventually induced the company management to fabricate figures to give a better image of the company’s profitability.

But in 2020, Luckin Coffee was eventually forced to admit its fraud after a short-selling trading company called Muddywater allegedly reported a potential financial incoherence in Luckin’s income statement. Through an internal investigation, the company revealed that former Luckin’s COO, Jian Liu, had fabricated over RMB 2.2 billion (approximately USD 340 million) in additional sales for the company. This led to the company being delisted from Nasdaq and undergoing major management changes, starting from the dismissal of Founder and CEO Charles Liu, for its direct involvement in the fraud scheme.

Luckin’s successful redemption: A business model reimagined

A much-needed strategic cost reduction

After the scandal, a major part of Luckin’s strategy to regain trust among investors started with the optimization of the amount of resources it was spending to run its store operations. First of all, the company started slowing down its rapid expansion and began closing down underperforming stores. This resulted in a controlled decline of company-operated stores from around 4,500 to 3,900. Additionally, Luckin discontinued various side businesses that had never been profitable. This was the case with their retail vending machines initiative as well as their joint venture with the Louis Dreyfus Company (LDC) to commercialize fruit juice. These business strategies were seen as unproductive and only the result of unsubstantial business strategies used by previous management to aid with their exaggerated growth narrative.

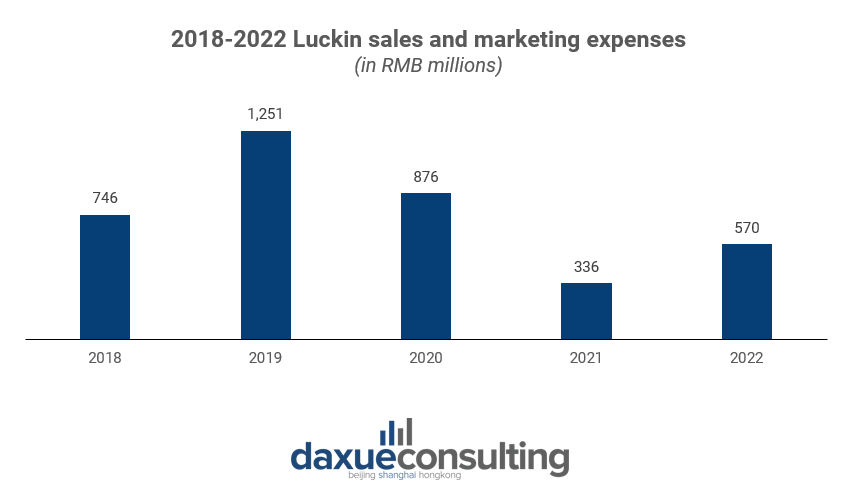

A significant reduction in marketing and advertising expenses was also a crucial step in reducing overall costs. Funds for advertisement campaigns were reduced by 70%, decreasing the overall budget from RMB 1,3 billion in 2019 to RMB 336 million in 2021.

Furthermore, Luckin adjusted its pricing strategy by raising prices, which was a critical move to make the business financially sustainable. This choice was especially felt with the company’s decision to terminate its free coffee promotions.

A renewed focus on revenue growth

On the revenue side, Luckin managed to recover its sales figures by innovating its product line. It did so by starting to introduce a variety of new coffee drinks that catered better to Chinese consumers’ palate, which is yet to be accustomed to the bitterness of traditional coffee.

These new offerings were not only unique but were also key in attracting a broader customer base. In 2019, they stumbled upon a game-changer: the Brown Sugar Boba Latte. This unique blend of coffee latte with boba tea ingredients resonated with young Chinese consumers’ preference for sweeter drinks. The success of this product led to a significant shift in Luckin’s R&D focus. They started blending coffee with unconventional ingredients like tea, juice, or fruit syrup. A notable example of this innovation strategy is the release in 2021 of the “Coconut Milk Latte,” which despite being priced higher than traditional lattes became a massive hit. This trend of creating unique, higher-priced drinks became a successful formula for Luckin, allowing them to raise prices while simultaneously increasing sales volume.

A successful rebranding strategy

Alongside product innovation, Luckin Coffee also revamped its marketing strategy to enhance its brand image and appeal. In 2021, the company shifted from relying heavily on performance ads to focusing on brand advertising, with the intent to target a younger demographic. Luckin advertised aggressively on platforms popular with a high proportion of young Chinese users, like WeChat, Douyin (the Chinese version of TikTok), and Xiaohongshu (Little Red Book), the Chinese social media app equivalent to Instagram.

A pivotal moment in their marketing success was securing an endorsement deal with Eileen Gu, an 18-year-old freestyle skier. At the time of the deal, Gu was relatively unknown in China, but her subsequent success at the 2022 Beijing Winter Olympics, where she won three medals, blasted her to national fame. Luckin leveraged her popularity to reinforce their brand image, leading Lucking to rise up in popularity among young consumers.

Luckin’s deep dive into global markets

In a significant stride towards global presence and market diversification, Luckin has finally commenced its international expansion outside of China. Since March 2023 the chain has opened stores for the first time abroad with Singapore being its first beachhead. By the end of the year, it had already opened its 30th store.

The company’s expansion strategy has been carefully orchestrated, with Southeast Asia identified as a fertile ground for its international expansion. After the first experimental steps in Singapore, bigger markets like Indonesia, Malaysia, and Thailand have been deemed as the next key markets to approach.

However, Luckin Coffee’s international journey is not without its hurdles. The brand has already stumbled upon legal challenges, such as a trademark lawsuit in Thailand, in which it recently lost an appeal against a local competitor who effectively stole its identity and distinctive trademark. The resemblance of the Thai competitor to Luckin is strikingly astonishing, almost provocative. Many of the aesthetic features making the Chinese brewer’s identity unique have been adopted like the famous blue background color.

Regardless of these obstacles, Lucking remains deeply committed to carrying out its international expansion. As such the company’s imminent launch in Malaysia, with stores currently being under construction, reflects its assertiveness in establishing a global footprint and solidifying its position in the international coffee market.

What brewing’s next for Luckin’s business strategy?

The Chinese coffee market is rapidly growing, particularly in second and third-tier cities where consumers are exploring coffee consumption. To sustain profitability and competitiveness, coffee chains must differentiate their value propositions as the market matures.

In this evolving coffee industry, Luckin Coffee faces a challenging scenario. Its cost leadership strategy is losing appeal due to increased competition and market saturation. New entrants like Cotti Coffee, founded by former Luckin executives, are rapidly gaining ground, targeting the same demographics. Cotti Coffee has expanded to over 6,000 outlets, with 5,000 opening in the last 10 months.

Nevertheless, shifting to a premium market segment poses risks for Luckin, known for affordable, convenient coffee. A sudden price hike could alienate its existing customer base, as seen in 2020 when it reduced free drink coupons.

To balance this dilemma, a plausible solution for Luckin is to gradually build its brand image, justifying a more premium price range without directly competing with high-end brands. Continuously innovating its product offerings, akin to the success of the Coconut Latte, allows Luckin to increase prices while monitoring customer reactions.

In the long term, this approach can open up a new niche that bridges the gap between on-the-go coffee and premium coffee experiences. As Chinese consumers’ tastes evolve and become more complex, this coffee consumption niche is expected to grow, providing a sustainable revenue stream for Luckin.

Luckin Coffee in a nutshell

- Luckin Coffee has rebounded in an unexpectedly successful way from its past scandals, now boasting positive returns and a presence of nearly 10,000 stores across China.

- Facing fierce competition, especially from Cotti Coffee, Luckin now confronts the challenge of gradually evolving from a cost leadership model to a more premium brand without losing its customer base.

- The company’s future hinges on balancing rebranding and product innovation efforts to justify higher prices.

- Luckin’s adaptability in this increasingly competitive coffee landscape while simultaneously expanding into new global markets, will be key to its sustained growth.