The sauce and condiment market in China has been steadily growing over the past few years, from RMB 301.6 billion in 2016 to RMB 592.3 billion in 2023. It is typically divided into two categories: single-flavor sauces and compound sauces. Single-flavor sauces use one ingredient, such as salt or pepper, while compound sauces blend multiple ingredients, as is common in many Western sauce brands. Though less common, compound sauces are gaining popularity in China. More restaurant chains, smaller household sizes, and younger generations with limited cooking skills and time, are driving this growth.

Download our China F&B White Paper

The compound sauce market in China is largely dominated by Chinese-style sauces and condiments, which make up over 70% of the market share. Despite strong preference for local flavors, consumers are becoming more knowledgeable and interested in western-style sauces. These sauces make up about 30% of the market. This notable figure highlights the growing applications of western sauces in diverse dining scenarios.

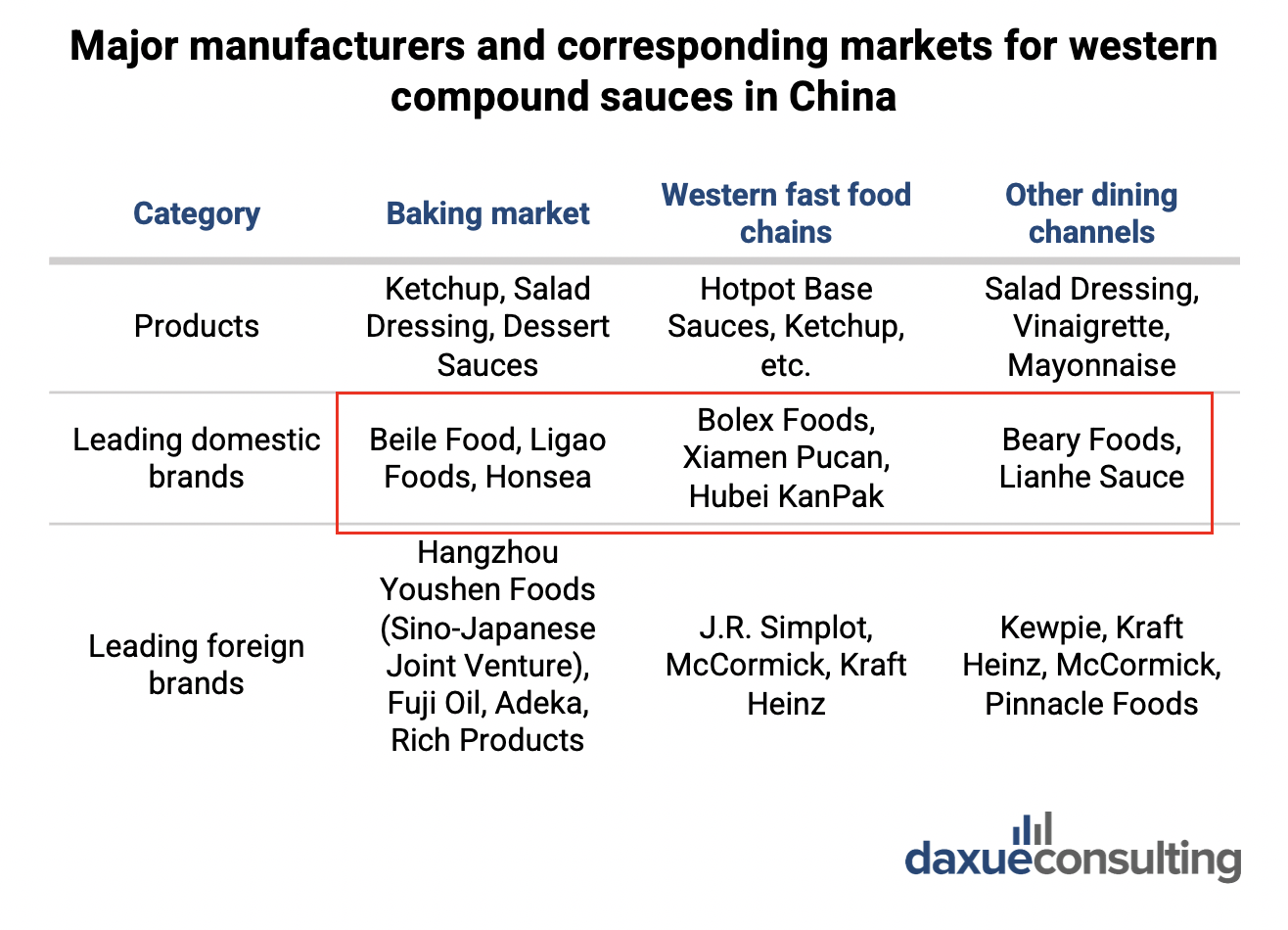

Chinese local companies are increasingly gaining edges in major distribution channels in the western sauce market

In the maturing western-style sauce market in China, these sauces can be found in increasingly diverse dining scenarios, ranging from traditional western fast-food giants like KFC and McDonald’s to more recently pre-prepared meals.

While foreign brands benefit from large-scale production when it comes to consumers who prioritize good value for money, this also makes it slower for them to respond to new trends and niche demands. This gives Chinese local brands an edge as they can adapt more quickly to consumer needs. Some good examples of local companies who have gained some competitive edges in the western sauce and condiment market in China include Bolex Foods and Beile Foods. As shown in the table below, local companies have emerged as leaders in the western sauce market in China.

Bolex and Beile Foods: Rising local manufacturers in the western sauce market

Bolex (Baoli) Foods (宝立食品) is a leading domestic supplier of western sauces and seasonings. It is a Tier 1 supplier for major B2B clients like KFC, Pizza Hut, and McDonald’s. Though well-established in B2B, Baoli remains lesser known in the consumer market. Notably, Bolex is working to build its C-end brand “Baoli Kezi” and has also expanded through acquisitions, such as the 75% stake in Airmeter Pasta (空客意面). Over the past two decades, it has accumulated extensive formula data, offering over a thousand unique products annually by collaborating with major clients. Its ability to develop customized products, flexible manufacturing, and systematic quality control allow Bolex to meet diverse client demands efficiently.

In terms of Beile Foods (倍乐食品), which is positioned in the mid-to-high-end market, specializes in western sauces for baking. Their products, such as their cheese sauce series, made with high-quality ingredients like imported real cheese, make them suitable for premium baking. Similar to Bolex, Beile is also capable of flexible manufacturing and provides one-stop solutions from sauces and fillings to finished products, owing to its advanced product line design.

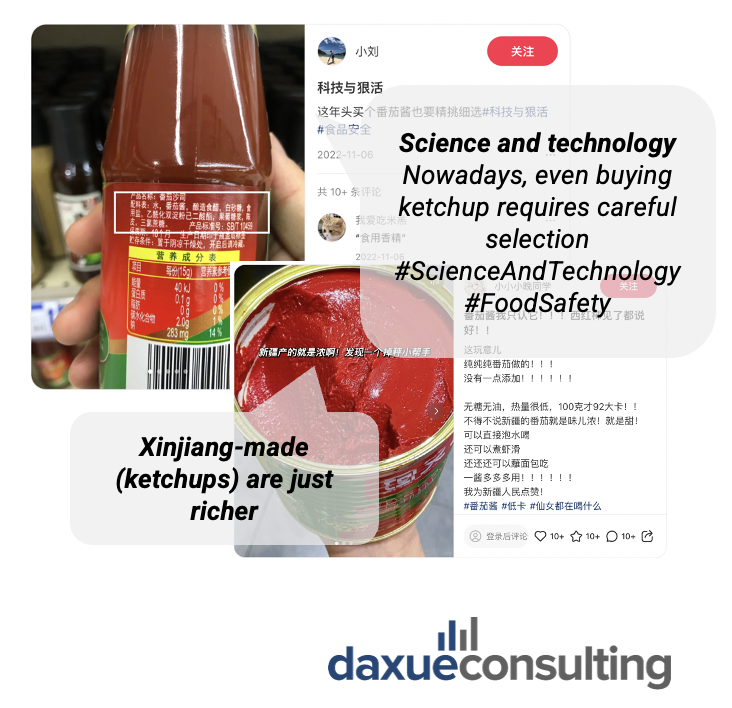

Chinese consumers hold conflicting views about Western sauces

In China, many consumers refer to foreign sauce brands, including those from Japan, Korea, and Southeast Asia, as “Western” (西式酱料). “Western” sauces are often labeled as unhealthy due to their trans fats and high calorie content. For example, there are many social media posts on how salad dressings can contribute significantly to weight gain and negative health and beauty effects, including uneven skin texture. In contrast, domestic sauces, like those from Xinjiang, are praised for being healthier, with a rising trend towards homemade sauce options.

The term “科技与狠活,” translated as “science and technology,” was popularized by vlogger Xin Jifei. A catchphrase on Chinese social media, it’s often used sarcastically to describe cheap, low-quality food made to appear fancy and uses excessive technology and additives. This implies the distaste toward overly processed foods that rely on artificial ingredients and technologies, rather than natural production methods.

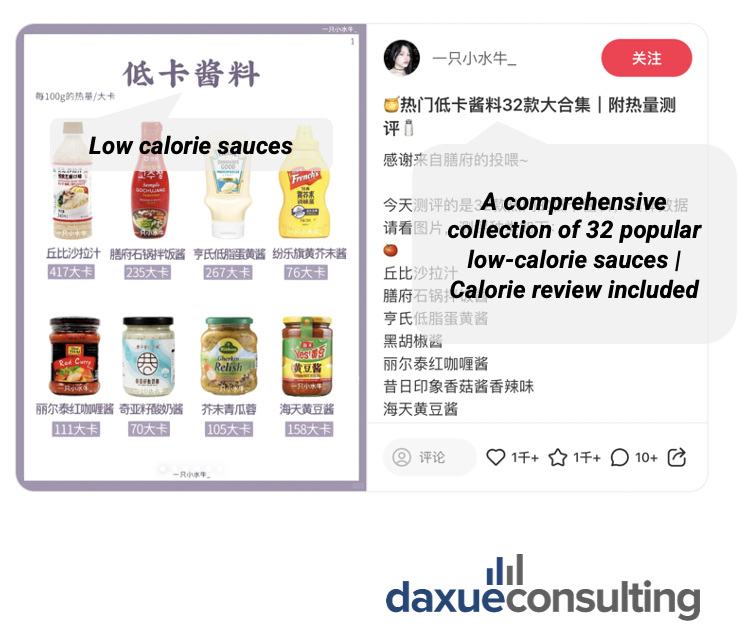

Despite various health-related concerns, sometimes western sauces are often associated with health-related trends among Chinese consumers. In our white paper on the food and beverage industry, we observed that western sauces are often associated with trends like “light eating (轻食),” weight loss, low-fat meals, “white people food (白人饭)”and sugar controlled diet.

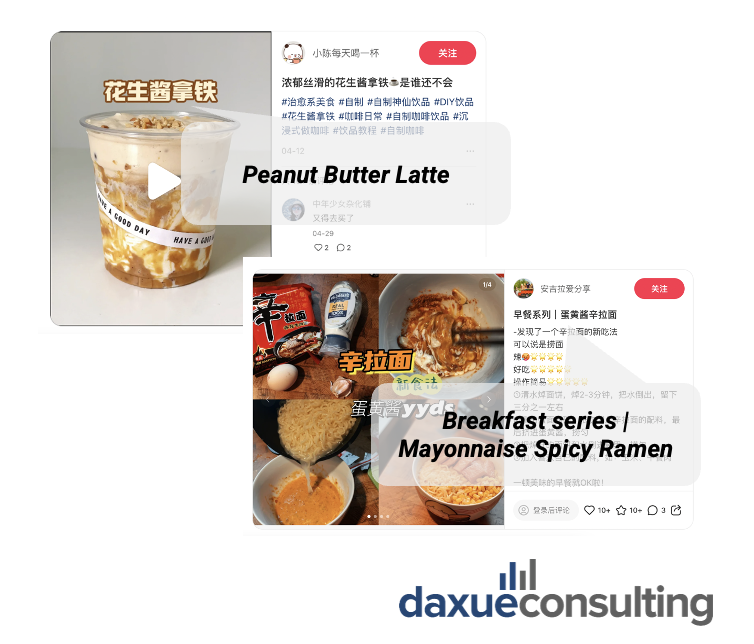

Chinese consumers love to experiment with Western sauces despite limited understanding

Innovative usage scenarios for Western sauces are becoming increasingly popular, especially among young Chinese consumers. Young people are eager to explore different ways of using Western sauces. Ketchup lattes, peanut butter lattes, mayonnaise with spicy noodles, and mayonnaise on rice, are some of these creative examples. This suggests a growing interest in integrating Western sauces into diverse culinary experiences and a need to further localize Western sauces in China.

Despite the growing demand for Western sauces in various dining scenarios, there is a knowledge gap of Western sauces. On Chinese social media, there are many posts on educating the public on Western sauces. There are numerous reviews of different brands, common recipes, and explanations of different sauces in different cultural contexts.

Key takeaways and growth opportunities for western sauce brands

- The condiment and sauce market in China has seen steady growth in the past few years. It grew from RMB 301.6 billion in 2016 to RMB 592.3 trillion in 2023. Chinese brands remain the dominant players in the market. They are often more agile and quick to adapt to ever-changing preferences of Chinese consumers.

- In China, consumers refer to non-foreign sauces as “Western sauces”, even those from Japan and Southeast Asia. This shows that Chinese consumers still need to be educated about foreign sauces and brand.

- Chinese consumers also have mixed opinions about Western sauces. They often label them as unhealthy, even though the sauces are associated with health-related trends on social media. This is important for the growing health-conscious Chinese consumers.

- At the same time, Chinese consumers show willingness to experiment with western-style sauces and brands. From ketchup lattes to mayonnaise on rice, they are showing interest in learning about the sauces and adding them to their diets.

We offer consulting services for China’s F&B industry

China’s restaurant market is a dynamic sector, influenced by shifting consumer preferences, technological advancements, and evolving dining habits. Daxue Consulting offers expert market research in China, providing in-depth insights into the trends and challenges shaping the restaurant industry.

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with local diners. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us to discover how our expertise can drive your restaurant business’s success in China.