Market research: Consumption of seafood in China

Per capita consumption of seafood in China was about 45 kilograms in 2013, higher than the world average. According to FAO, China’s consumption of oysters and mussels increase 20% each year, making China one of the leading markets of expensive molluscs. The price of oyster has been doubled in the past three years.

Per capita consumption of seafood in China was about 45 kilograms in 2013, higher than the world average. According to FAO, China’s consumption of oysters and mussels increase 20% each year, making China one of the leading markets of expensive molluscs. The price of oyster has been doubled in the past three years.

Chinese demand for seafood is booming since the increase of household income

Since seafood is generally expensive compared with other meat protein substitutes, family income is a key determinant of domestic demand for products in the industry. Increasing family income and purchasing power have led to growing demand for seafood in recent years. The current low consumption level of seafood in rural areas also implies strong potential demand in the future. Moreover, due to the high costs of transportation and preservation of marine products, consumption of seafood in China is mainly restricted to Eastern China.

Price of Seafood in China

In comparison with red meat prices, prices of seafood have been relatively stable in China in recent years, due to self-regulation and demand flexibility.

Substitutes to consumption of seafood in China

The substitutes of seafood are other protein sources, such as pork, beef, poultry meat, freshwater fish, and domestic harvested sea products. There has been a shift in consumption toward industry products as fish is perceived to be a healthier source of protein than red meat. Also, concerns over polluted inland freshwater have been deterring some customers from buying freshwater fish and increasing demand for farmed fish. Good quality seafood is generally quite expensive compared to red meat, which can impact the volume demanded. However, demand for some high-end products, such as abalone and lobster, is relatively unresponsive to price fluctuations.

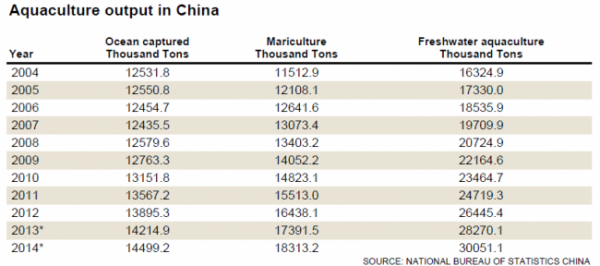

Production of seafood in China

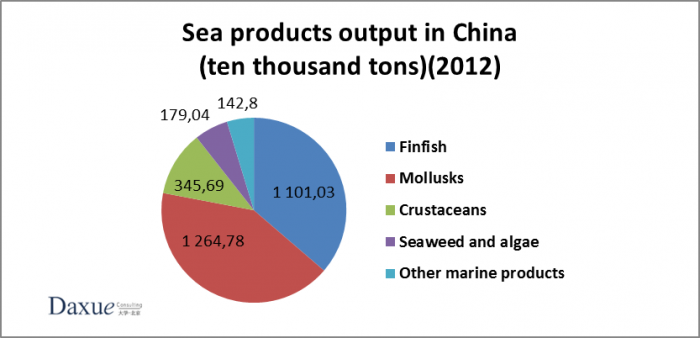

Pollution in inshore areas has significantly reduced the amount of sea water available for mariculture in recent years. A large proportion of co astal waters suitable for mariculture have been developed and mariculture far from the coast is quite costly to operate. This has restricted large-scale expansion of the industry over recent years. And due to limited sea water and intensifying competition, the farming of low value-added products, like finfish, oysters and seaweeds, is expected to decrease while more sea water will be used to cultivate more profitable species like sea cucumbers and abalone.

Pollution in inshore areas has significantly reduced the amount of sea water available for mariculture in recent years. A large proportion of co astal waters suitable for mariculture have been developed and mariculture far from the coast is quite costly to operate. This has restricted large-scale expansion of the industry over recent years. And due to limited sea water and intensifying competition, the farming of low value-added products, like finfish, oysters and seaweeds, is expected to decrease while more sea water will be used to cultivate more profitable species like sea cucumbers and abalone.

Imports of seafood in China

International trade accounts for a small share of industry revenue, since most imported or exported products are further processed and are not counted as fresh seafood. China is expected to import $416 million worth of marine products in 2014, accounting for 1.2% of total domestic demand. Import growth in the past five years slowed as a result of higher prices and increased government regulations. A moderate level of tarifs is imposed on imported aquatic products to alleviate competition from foreign products. DaxueConsulting, market research agency in Shanghai _ Mysimax