Hong Kong uniquely merges Eastern traditions with Western influences, creating a lively cultural and commercial environment. In contrast, Mainland China’s vast market is marked by rapid evolution, showcasing a distinct combination of historical richness and modern innovation.

Download our China luxury market report

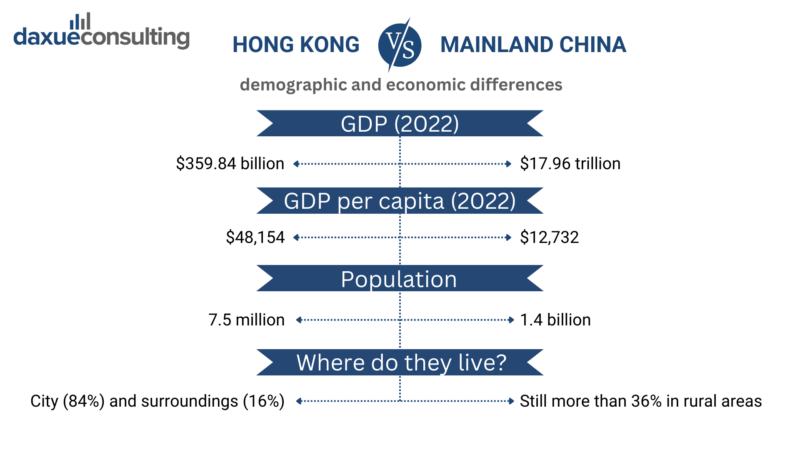

Although they might seem similar to the Western eye, consumers in Hong Kong and China differ in many aspects. There are only 7.50 million Hong Kongers, in contrast to more than 1.4 billion Chinese people, but the GDP per capita is 4 times higher than the one from Mainland China.

This article aims to present some core differences in their shopping behavior and consumer habits so that brands can adapt their marketing and sales strategies accordingly.

Hong Kong vs Mainland China: demographic and economic differences

To dive into consumer habits and shopping behavior differences, it’s important to understand the differing demographic and economic backgrounds. Hong Kong, one of Asia’s busiest hotspots and one of the financial capitals of the world, is the 44th largest economy in the world, with a gross domestic product (GDP) of USD 359.84 billion in 2022. In 2022, the GDP per capita accounted for USD 48,154.

Meanwhile, China is the second-largest economy in the world, accounting for USD 17.96 trillion as of 2022. China’s Gross Domestic Product (GDP) per Capita accounted for USD 12,732 in 2022. So, even though China offers a vast land of potential consumers, Hong Kongers are, in general, richer, but with a significantly higher cost of living.

It’s also important to note that Hong Kongers live either in the city (84%) or its surroundings (16%), while more than 36% of Chinese people still live in rural areas.

As it was under the jurisdiction of Great Britain for many years, people from Hong Kong differ significantly from their counterparts in China in terms of social media usage, shopping habits and preferences, food culture, and more.

Hong Kong vs Mainland China: consumer habits and shopping preferences

Social media platforms: Facebook vs. WeChat

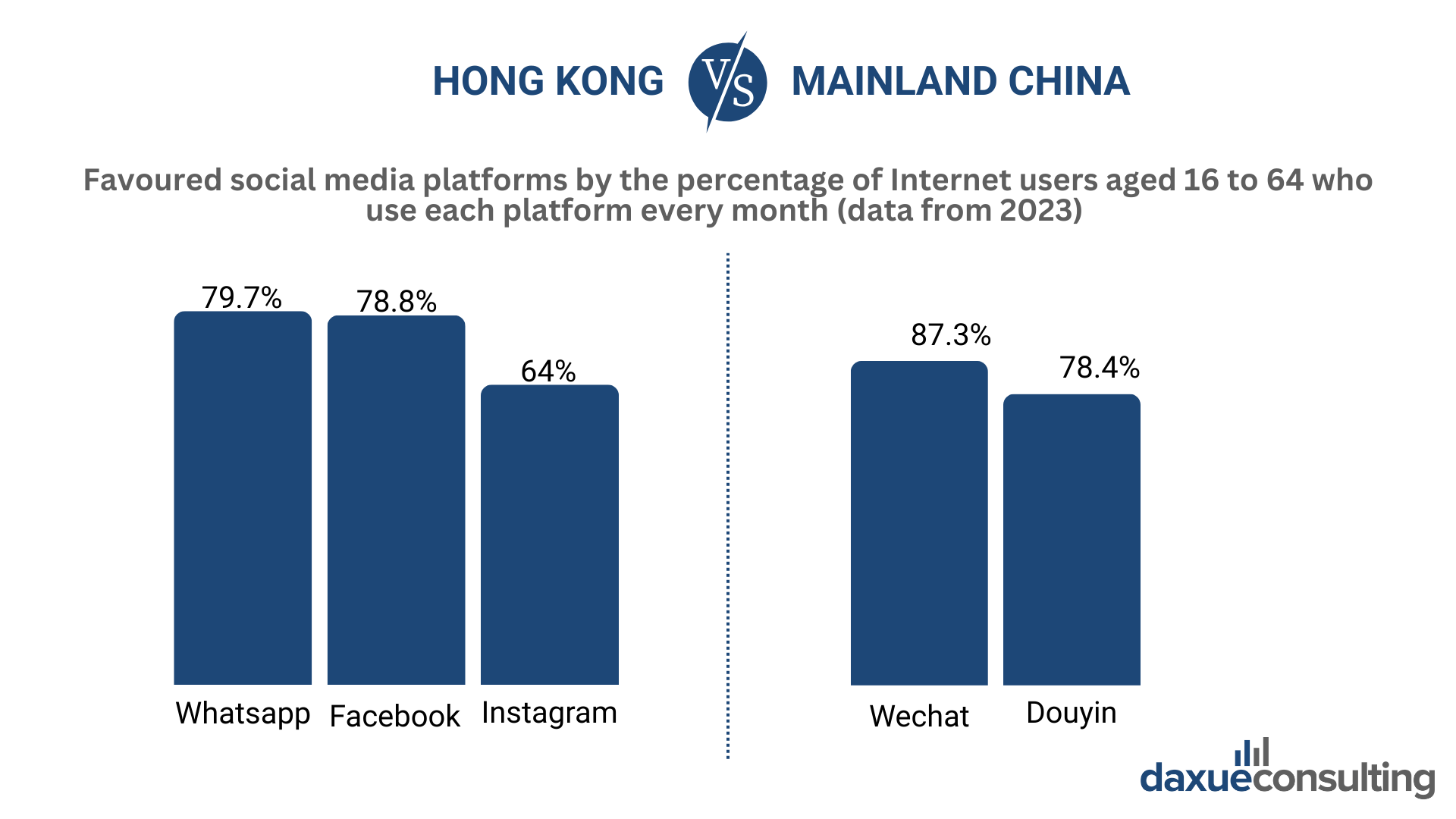

While Mainland China is secluded from the Western social media landscape, offering its citizens national platforms like WeChat, Weibo, Xiaohongshu or Douyin, Hong Kongers use the platforms well-known in the West, with Facebook leading the way.

According to Meltwater, WhatsApp (79.7% of internet users aged 16 to 64), Facebook (78.8%) and Instagram (64%) are the top three social media platforms used in Hong Kong in 2023, while in China WeChat (87.3%) and Douyin (78.4%) are the definite leaders.

Although brands can access a much larger market with WeChat marketing, Facebook allows for better consumer data access due to many restrictions in Mainland China. This is why it’s worth considering implementing Facebook and Instagram strategies when targeting Hong Kong consumers. Yet, on the other hand, WeChat is the most crucial element of any digital strategy in Mainland China.

Chinese platforms also have a core advantage when it comes to shopping, that shapes the preferences of Chinese consumers; integration of digital payments, mini-programs, and live-streaming, which speed up the decision-making process of its users, allowing them to go from discovery of a product to its purchase without the need of leaving the app.

Online Payments: Credit Cards vs. Digital Wallets

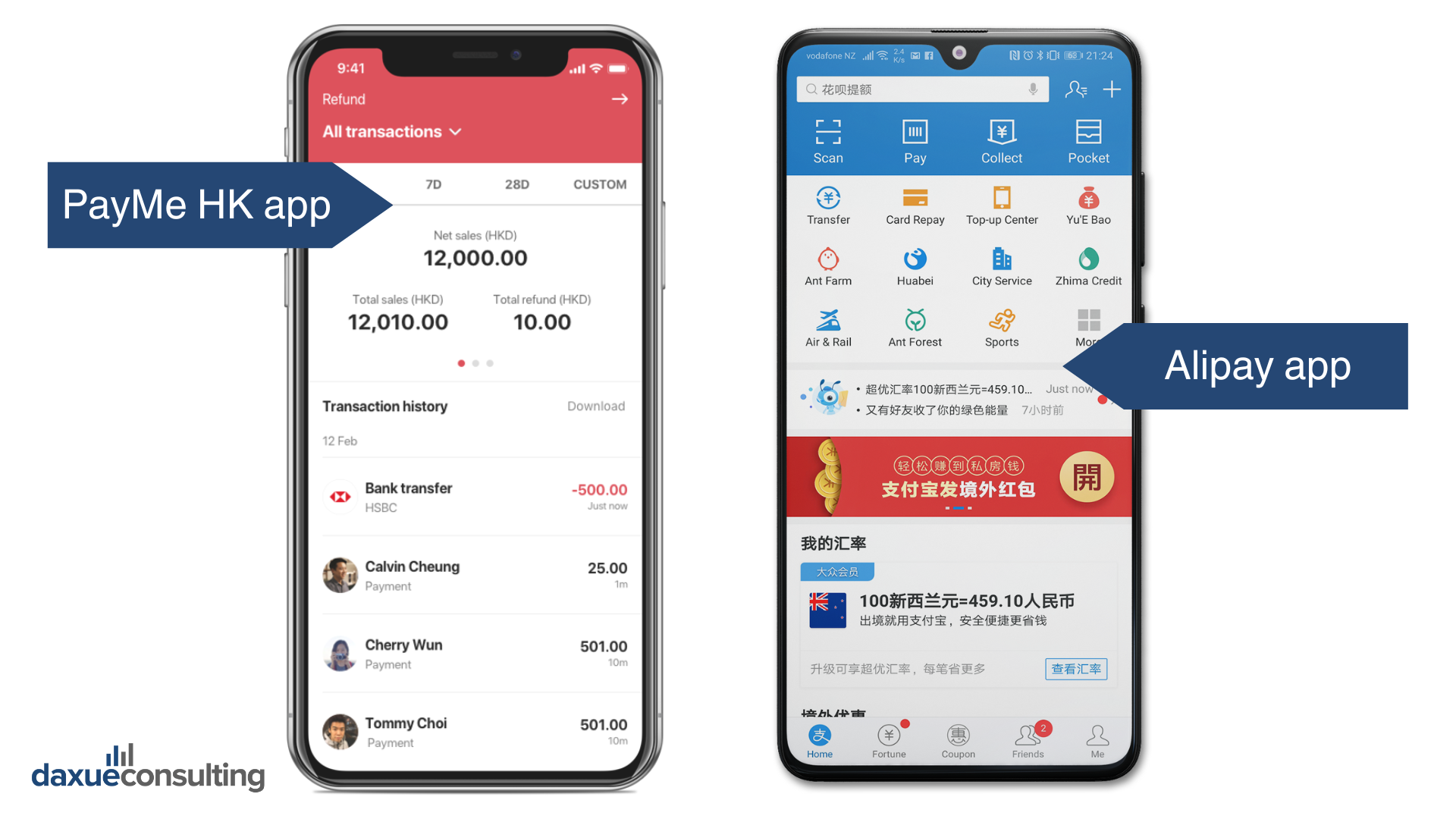

In Hong Kong, online payments are predominantly made through credit cards, reflecting the city’s robust banking system and consumer trust in traditional financial institutions. In the second quarter of 2022, consumers in Hong Kong spent USD 8.46 billion in card payments. Major credit card networks like Visa and Mastercard are widely accepted, offering convenience and security for online transactions. More than 95% of citizens have bank accounts and use them daily.

In addition to payments through digital wallets, online payments in Hong Kong are also through HSBC’s Payme app and the FPS function integrated into online bank accounts. Alipay has also released its own Alipay HK app for the Hong Kong market. However, WeChat and Alipay are often options at venues frequented by Mainland Visitors, though they are not often used by Hong Kongers.

China is a world phenomenon when it comes to online payments, as it witnessed a transition from cash payments straight to digital wallets, omitting the step of card payments. 9 out of 10 online payment users pay with the use of Alipay (92%) or WeChat Pay (85%), the two most popular digital wallets in Mainland China.

Shopping preference: Online vs. Offline

In Hong Kong, while online shopping is increasingly popular, there remains a level of skepticism among consumers regarding e-commerce platforms. Concerns over data security and product authenticity often influence purchase decisions, leading to a cautious approach toward online transactions. In fact, according to KPMG China’s survey on consumer behavior, as much as 80% of Chinese consumers prefer contactless shopping, while in Hong Kong it’s only 61% of the respondents.

Hong Kong is also not as convenient when it comes to home deliveries as Mainland China, with many products and companies adding additional door-to-door delivery fees. In China, deliveries are very fast, convenient, and free of charge.

Hong Kong’s demand for online shopping is still lagging behind China, with many customers still preferring to shop offline, which allows them to examine the product themselves. Although online shopping is becoming more popular in Hong Kong, especially after the COVID-19 pandemic, 63% of consumers still prefer offline experience (2022).

Food and drinking culture

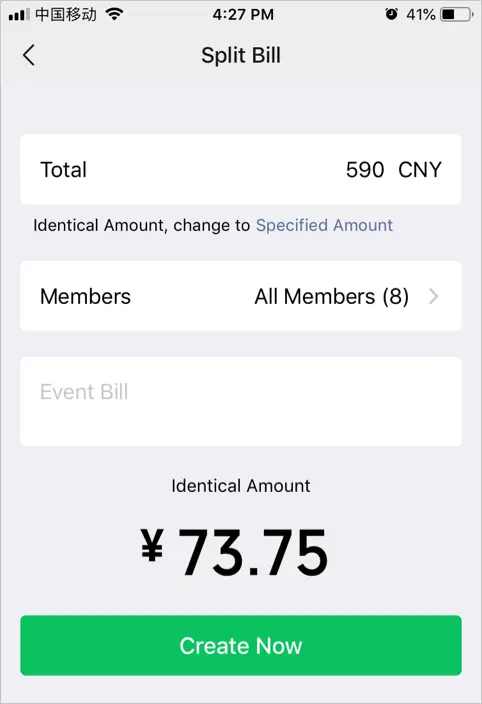

When it comes to food and drink culture, one of the notable differences discussed on the Chinese internet is the preference of Hong Kongers to split the bill, known as “going Dutch,” reflecting the city’s Westernized social norms and emphasis on individual financial responsibility. Whenever they go to a restaurant or a bar with friends, family, or colleagues, they will opt to pay individually for themselves.

Whereas it’s becoming more common among young Chinese people to split bills as well (especially since WeChat has a function of splitting bills in the app within seconds, as shown in the photo below), there’s a strong tradition of one person, often the host, paying for the entire group, a practice rooted in Confucian values of generosity and respect.

The roles have changed

Another interesting phenomenon is the fact that before the pandemic, Hong Kong was perceived as a shopping heaven, with many Chinese consumers frequently visiting the place for luxury shopping. But now the direction changed, and Hong Kongers are deciding to go for daily weekend trips to Shenzhen, where they can have fun, and visit restaurants and entertainment venues, spending less than they would in Hong Kong.

Hong Kongers are more money cautious in comparison to Chinese netizens. Even though they earn more (the average monthly salary amounts to USD 2,226 as of 2022, in comparison to around USD 1,336 in Mainland China), they don’t tend to spend their money so freely. This is why Mainland China, and Shenzhen in particular, noticed an influx of Hong Kong visitors in recent months.

One of the Hong Kongers admitted that he likes to go to Shenzhen because of its affordability, saying that “in Shenzhen, a meal for two can cost around RMB 200, but in Hong Kong, it may cost RMB 600 to 700”.

Hong Kong vs. Mainland China: key takeaways on consumer habits

- China offers a far bigger consumer market, with more than 1.4 billion people, as opposed to 7.50 million in Hong Kong.

- Both places require a different marketing and sales approach, with a focus on social media, cultural values, payment methods, and shopping preferences.

- Facebook dominates in Hong Kong (78.8%), while WeChat leads in Mainland China (87.3%).

- Card payments are the dominant payment method in Hong Kong, while Chinese consumers prefer to pay using Alipay or WeChat Pay (and other digital wallets).

- Hong Kong shows skepticism towards e-commerce (with 63% of consumers still favoring the offline shopping experience), while Mainland China embraces it, with fast and convenient deliveries.

- Before the pandemic, consumers from Mainland China frequently visited Hong Kong for tourism and shopping purposes, but now the roles have changed, with more and more Hong Kongers traveling to Shenzhen to save money on entertainment, shopping, and food.

We help brands better understand consumers from Hong Kong and Mainland China

Grasping the nuances of Chinese and Hong Kong consumers’ preferences, behaviors, and expectations is crucial for delivering tailored services and products. The diverse socio-economic landscape across regions, including the distinct characteristics between mainland China and Hong Kong markets, demands thorough and nuanced consumer analysis.

At Daxue Consulting, we specialize in employing advanced research techniques to not only gather consumer insights but also interpret them effectively, ensuring our clients make informed decisions to foster engagement and positive advocacy among their target audience. We offer:

- Extensive consumers research

- Focus groups analysis

- Tribes identification

- In-vivo research

Contact us at dx@daxueconsulting.com to get better results in Hong Kong and China with our help.