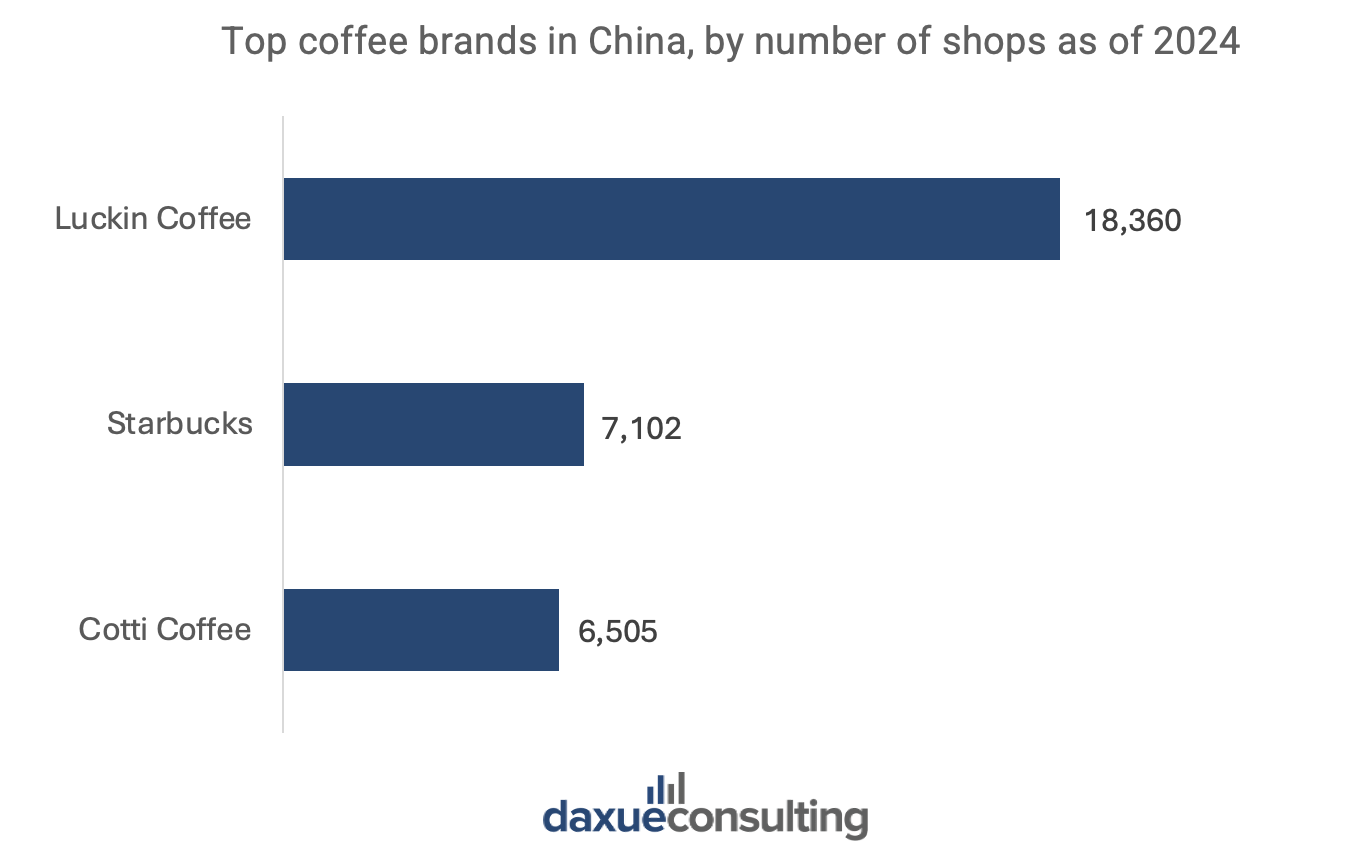

Founded in August 2022 by former Luckin Coffee executives Lu Zhengya and Qian Zhiya, Cotti Coffee (库迪咖啡) has experienced rapid growth. As of May 2024, it had the third-highest number of coffee shops, with 6,505 stores, following Starbucks with 7,102 stores and Luckin Coffee with 18,360 stores. Despite its meteoric rise and the growing number of coffee consumers in China, questions remain about whether its success can sustain in the long run.

Download our China F&B White Paper

A new chapter: Founders of Luckin Coffee fall and then return with Cotti Coffee

Luckin Coffee, founded by Lu and Qian in 2017, witnessed rapid growth, getting listed on the US stock exchange within just two years. Moreover, by the end of 2019, it opened 4,507 stores, surpassing Starbucks. However, this triumph was soon overshadowed by a January 2020 accounting scandal, when a prominent short-selling firm accused it of financial misconduct. Luckin later admitted to the wrongdoing and was subsequently delisted from the US stock exchange. Lu and Qian were also fired.

In the face of these obstacles, Lu and Qian teamed up once again to establish Cotti Coffee. On October 22nd, 2022, they announced the opening of their first store through WeChat. Rather than distancing itself from its Luckin Coffee roots, the new coffee brand proudly acknowledges its connection in its backstory, noting that it was established by Qian and key members of the original team. Within one year since its conception, Cotti ranked third in China’s coffee market in terms of the number of stores.

Maximizing accessibility with aggressive store expansion

Coffee consumption in China depends on three factors – product, accessibility, affordability – according to Li Yingbo, Chief Strategy Office of Cotti Coffee. Therefore, brand has been aggressively opening stores.

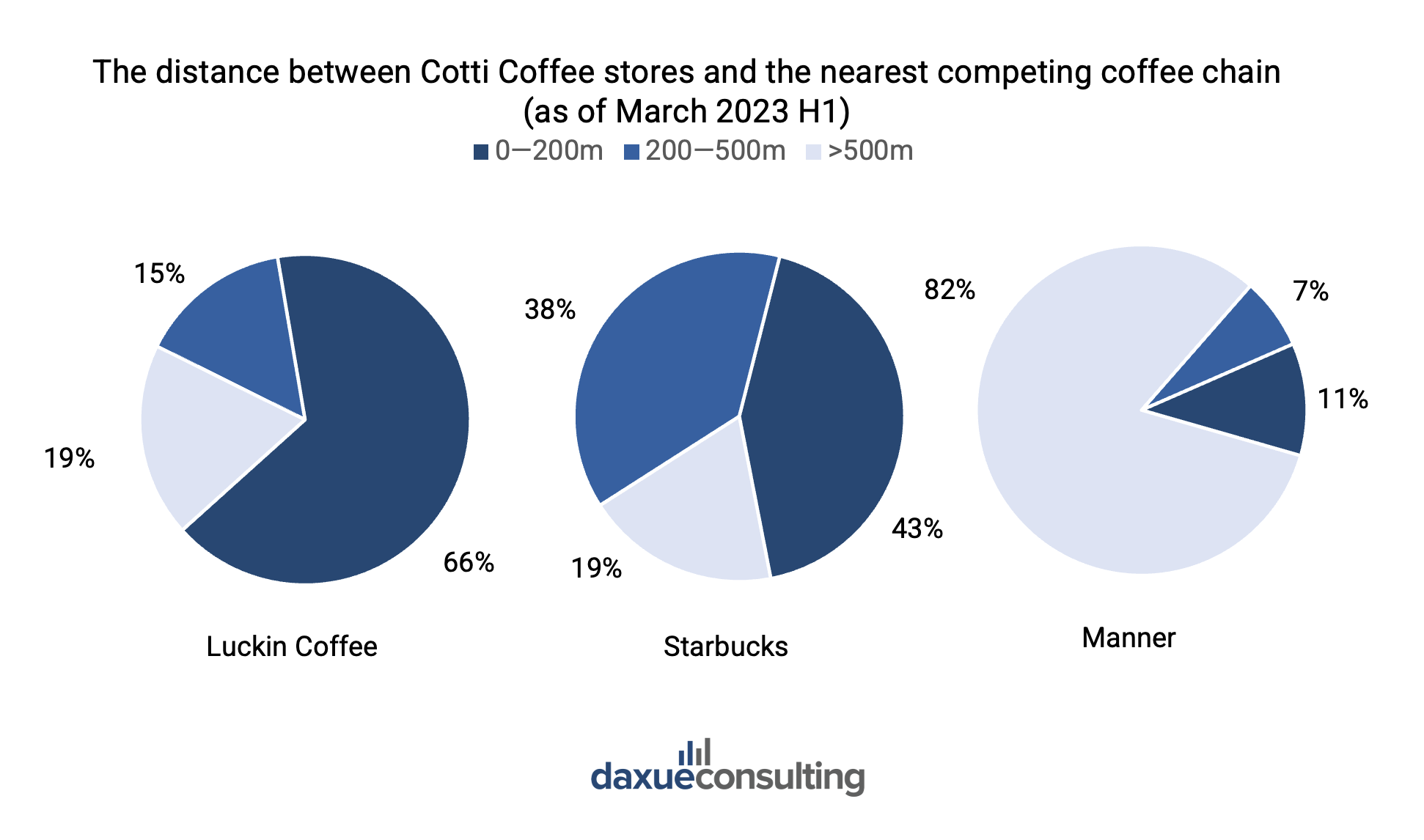

When it first opened, it strategically opened its stores very near its main rival, Luckin Coffee, intending to draw customers away from its competitor. On average, its shops are only 241 meters away from its competitors’, while the distance to Starbucks and Manner Coffee is over 400 and 500 meters, respectively.

In 2024, Cotti Coffee had the third-highest number of stores in China and the fourth-highest in the world. While it didn’t disclose the exact number of stories in China, it announced 10,000 stores worldwide, with most located in China. Moreover, it has an ambitious goal of raising the count fourfold to 50,000 by the end of 2025. The focus will be on opening convenience-type stores (便捷店). These stores can just be three to five square meters and can operate in a store-within-a-store model, requiring a smaller initial investment, having better cost structures, and offering greater convenience and flexibility in location selection.

“Cotti Coffee’s rapid expansion is largely attributed to its Cotti Express model. This store-within-a-store concept offers increased flexibility and facilitates market penetration, both significantly increasing the density of coffee shops within urban areas and expanding its reach into lower-tier cities.”

Mengxi Jiang, Project Leader at Daxue Consulting

Cotti Coffee’s 9.9 RMB per cup starts a price war with Luckin Coffee

In response to the demand for affordable options in China’s food and beverage industry and emerging coffee market, Cotti Coffee targets appeals to consumers with budget-friendly prices, encouraging newcomers to try coffee. While this low-price has attracted the masses, it has also put pressure on many coffee brands. In fact, in 2023, Cotti Coffee held an RMB 9.9 per cup campaign, starting a price war with Luckin Coffee. In mid-2023, Luckin Coffee responded with their own RMB 9.9 promotions.

This price war has made Cotti Coffee’s franchises run with lower profit margins. On April 29th, 2024, Cotti announced subsidies of up to RMB 14 per cup, valid until December 31st, 2026, to support new and existing stores.

“Concerns have been raised by franchisees regarding the long-term profitability of Cotti Express stores due to the brand’s persistent low-price promotions. This reliance on subsidies raises questions about the sustainability of the business model.”

Mengxi Jiang, Project Leader at Daxue Consulting

Cotti Coffee’s 2022 World Cup campaign

In 2022, the coffee chain made headlines by sponsoring Argentina’s national soccer team during the Qatar World Cup. The limited-edition coffee inspired by the team quickly gained popularity on platforms, including Xiaohongshu. Chinese consumers eagerly anticipated watching the World Cup while enjoying the special coffee. Following Argentina’s victory, Cotti’s popularity surged, and the brand continued supporting sporting events like the 2022 Chengdu Marathon, strengthening its connection with its young consumers.

Leveraging IP collaborations to reach more consumers and keep them engaged

Cotti Coffee often leverages co-branding in China to enhance its trendy and youthful brand image. It collaborates with popular characters, such as Miffy and Paddington, celebrities, such as Wang Yibo, and companies in other industries like Didi. While the drink remains the same, the packaging is refreshed with new designs and accompanied by exclusive merchandise, drawing consumers to visit Cotti Coffee.

Is Cotti Coffee’s aggressive expansion worth the risk?

- Founded in 2022 by former Luckin Coffee executives Lu Zhengyao and Qian Zhiya, Cotti Coffee is expanding aggressively. Within just two years since its establishment, it ranked third in terms of store count, following Luckin Coffee and Starbucks.

- Cotti Coffee’s strategy in China focuses on providing good-enough coffee, affordable pricing, and accessibility through aggressive store openings.

- Cotti Coffee is putting pressure on top coffee brands, especially Luckin Coffee. When it first expanded, it strategically opened stores close to it, with an average distance of just 241 meters. Moreover, since 2023, it launched a RMB 9.9 campaign, starting a price war with Luckin Coffee that has not ended as of January 2025.

- Cotti Coffee strives to maintain youthful and trendy image through various co-branding initiatives throughout the year. It collaborates with popular characters, celebrities, and other lifestyle brands.

- While Cotti Coffee has achieved significant popularity within a short amount of time, its long-term success remains uncertain. Expanding from 10,000 to 50,000 stores in a year may not be financially sustainable.

We offer consulting services for China’s F&B industry

China’s restaurant market is a dynamic sector, influenced by shifting consumer preferences, technological advancements, and evolving dining habits. Daxue Consulting offers expert market research in China, providing in-depth insights into the trends and challenges shaping the restaurant industry.

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with local diners. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us to discover how our expertise can drive your restaurant business’s success in China.