Growing Market for french wines

In recent years, China has become a new focus in the global wine market. Since 2010, China’s wine import has increased by 60%, much faster than the growth of domestic wine production. France is the largest import source of wine for China. In 2011, French wine export to China mainland and Hong Kong had year-on-year increases of 75.5% and 36.4% separately while a large portion of wines exported to Hong Kong were eventually sold to mainland. By 2012, 12 wine regions in France had been working on entering the Chinese market or expanding their market shares. The market share of French wines had increased from 11% in 2005 to 35.5% in 2012.

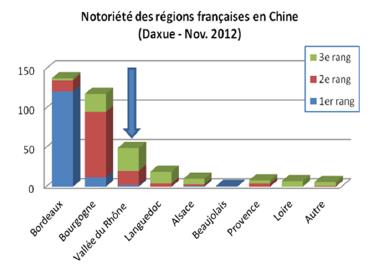

Among all the French wine regions, Rhone Valley was ranked third following Bordeaux and Burgundy for awareness in China according to the survey of Inter Rhone, the same as the awareness ranking in France. According to a study of Daxue Consulting in 2012, the sales of Rhone Valley wines in China is also ranked 3rd among all French regions and is almost equal to Burgundy which is ranked 2nd. The sales of Rhone had increased by 100% in 2010 and 105% in 2011. In 2012, the market share of Rhone Valley wines was 6.5%.

China is currently the most buoyant market for Rhone Valley wines. Over the past decade, the sales have grown exponentially. In 2012, Rhone Valley wines rose by 67%, an increase two times higher than the average of French wines.

An over-estimated market?

In 2011, average wine consumption per capita in China is 0.95 liter, much lower than the world average of 8 liters and French average of 55 liters. Analysts believe that in the following decade, the market in second- and third-tier cities will expand quickly, making China the center of wine consumption in Asia by 2020s.

However, the great potential may be over estimated. In a report on the global drink market, Rabobank pointed out that investors should be cautious and not over optimistic about the wine market of BRIC. Rabobank noted that in spite of the high expectation for the wine industry in China, the slowdown of China’s economic growth and the policy change aroused by the recent leadership change of CCP together reduce the optimistic moods for wine sales, particularly heavily weakening the high-end market for wine. And even though the sales will increase in the long term, the pricing will gradually approach the world standard.

Meanwhile, although Rhone Valley wines rank third among all French wines, the recognition is still limited. According to 400 wine professionals in China surveyed by Daxue Consulting, nearly 1/4 of all considered low awareness as the largest weakness.

Rhone Valley suitable for development in China

According to Daxue Consulting, the most obvious strengths of Rhone Valley wines are the unique taste, the good quality and the high price/pleasure ratio. In US, a quality ratings survey for red wines costing between 10 dollars and 20 dollars shows that Rhone Valley wines have the highest percentage of rating as fair, good or excellent among wines produced by all ten regions. These studies prove that Rhone Valley wines is suitable for developing on the Chinese market because the relative moderate prices among wines of similar quality satisfy the requirements of Chinese consumers. Under the current policy that prohibits luxurious lifestyle of government officials, the high-end market is quickly collapsing. In contrast, the low-end market will continue to grow. Rhone Valley wines which have a relatively higher recognition in second- and third-tier cities can focus on dinner wines that will enter millions of Chinese families with the price advantage.

You want to know more about wine market in China? Please contact us