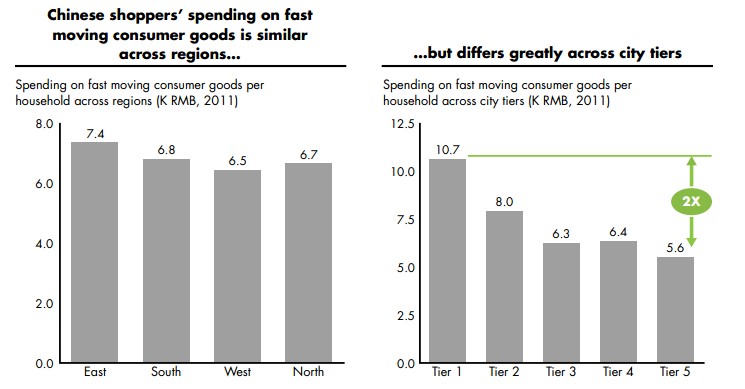

In this report, we divide China into four regions: north(Liaoning(辽宁), Heilongjiang(黑龙江), Beijng(北京), Tianjin(天津), Hebei(河北), Shandong(山东), Shanxi(山西)), south(Guangdong(广东), Fujian(福建), Hunan(湖南), Hubei(湖北)), east(Shanghai(上海), Jiangsu(江苏), Zhejiang(浙江), Anhui(安徽), Henan(河南)) and west(Sichuan(四川), Chongqing(重庆), Shaanxi(陕西), Guangxi(广西), Yunnan(云南), Guizhou(贵州)). All households spend between approximately RMB 6,700 to RMB 7,400 per household. However, there is big variation among city tiers. Take shoppers in first tier cities like Beijing(北京), Shanghai(上海), and Guangzhou(广州) as an example. They in general spend double the amount of money that people in 5th tier cities do on fast moving consumer goods. The accurate amount was 10,700 yuan, while that of 5th tier cities was 5,600 yuan. With the development of consumption and the rising living standard in China, by studying into the geographical differences in consumer behavior, brands will have valuable information and insight.

According to a certain market research, the city that shoppers live in influences their repertoires. For example, shoppers in first and second tier cities have more brands to choose from, and they indeed make purchases more frequently than those in 3-5 tier cities. Take biscuits as an illustration. An average household in Beijing, Shanghai and Guangzhou bought from 9 brands of biscuits for 22 times in year 2011, while those in 5th tier cities buy from 4 biscuit brands just 11 times. However, in categories where consumer loyalty is not that high, the brands that firs tier city consumers buy are not much more than those 5th tier city consumers buy.

It is not really realistic for most Chinese shoppers to develop deep brand loyalty in China in the coming years in repertoire categories. But, with the economy’s development, the frequency of purchasing in lower tier cities will increase, and consumers will have more brands to choose from.

Edited by Amy Wang from Daxue Consultant China