In recent years, with the growing penetration of the Internet and the spread of electronic products, people are straining their eyes more than ever. According to the 49th Statistical Report on China’s Internet Development released by China Internet Network Information Center (CINIC), as of June 2022, the number of netizens in China reached more than 1 billion, and Internet penetration rate reached 74.4%. Meanwhile, people spend more and more time in front of their electronic devices: livestream shopping, short videos, and online games have turned into mainstream entertainment. Eye fatigue has become a frequent issue in this digital age. Statistics show that netizens spend around 29.5 hours online per week. During the COVID-19 pandemic, people spent longer and longer time looking at screens as Chinese citizens greatly relied on electronic devices to keep on working or studying. Statistics showed that the average daily use of mobile phones was more than 10 hours in 2019.

Eyecare into the spotlight in China

Early laboratory research using animal models suggested that excessive blue light exposure could damage some sensitive cells in the retina, the layer of nerve cells behind the eyeball. Due to prolonged use of the eyes, optic issues such as eye fatigue, dry eyes, astringent eyes, and swelling are frequently found. Statistics also show that there are currently more than 600 million citizens suffering from myopia. Among them, the overall myopia rate of Chinese teenagers exceeds 50%, the highest percentage in the world. In addition to myopic patients, other eye diseases, including cataracts, glaucoma, fundus issues, and keratitis are also frequently found in China. There are currently 360 million dry eye patients, 160 million cataract patients, and 21 million glaucoma patients in China. Among the elderly, Age-Related Macular Degeneration (AMD) is one of the leading blindness-causing diseases in adults over 50 years old. China’s patient number for this illness exceeds 30 million in 2021, with the annual increase of 300,000 people.

Eye health has lately attracted attention nationwide. In the official 13th Five-Year Plan, it was stated that eyecare medical items are to be included in the national medical insurance system, in addition to stressing the importance of eyecare nationwide. Among the country’s efforts to provide more extensive eyecare services, the optic health of children and the elderly has become a focus. Local governments have stressed the accent on the overall myopia rate and consider it into the scope of government performance appraisal.

The Chinese eyecare market boasts great growth potential

With growing income levels and increased attention on eyecare, the demand for eyecare products in China continues to expand. According to Innova data, the global compound annual growth rate of new product launches with eyecare claims was 20% from 2017 to 2019. In China, statistics show that the eyecare market reached 170 billion yuan in 2019, and as of 2021 has increased by 30 billion yuan in just 3 years, now exceeding 200 billion yuan in market size. With the continuous expansion of the eyecare market, eyecare products in China are gradually diversifying, ranging from internal use to external use, from traditional to high-tech remedies. According to JD.com, one of the main e-commerce players in China, products for external use such as steam eye masks, eye massagers and warm eye masks grew rapidly in 2022, recording a 501%, 111%, and 109% YoY sales increase respectively.

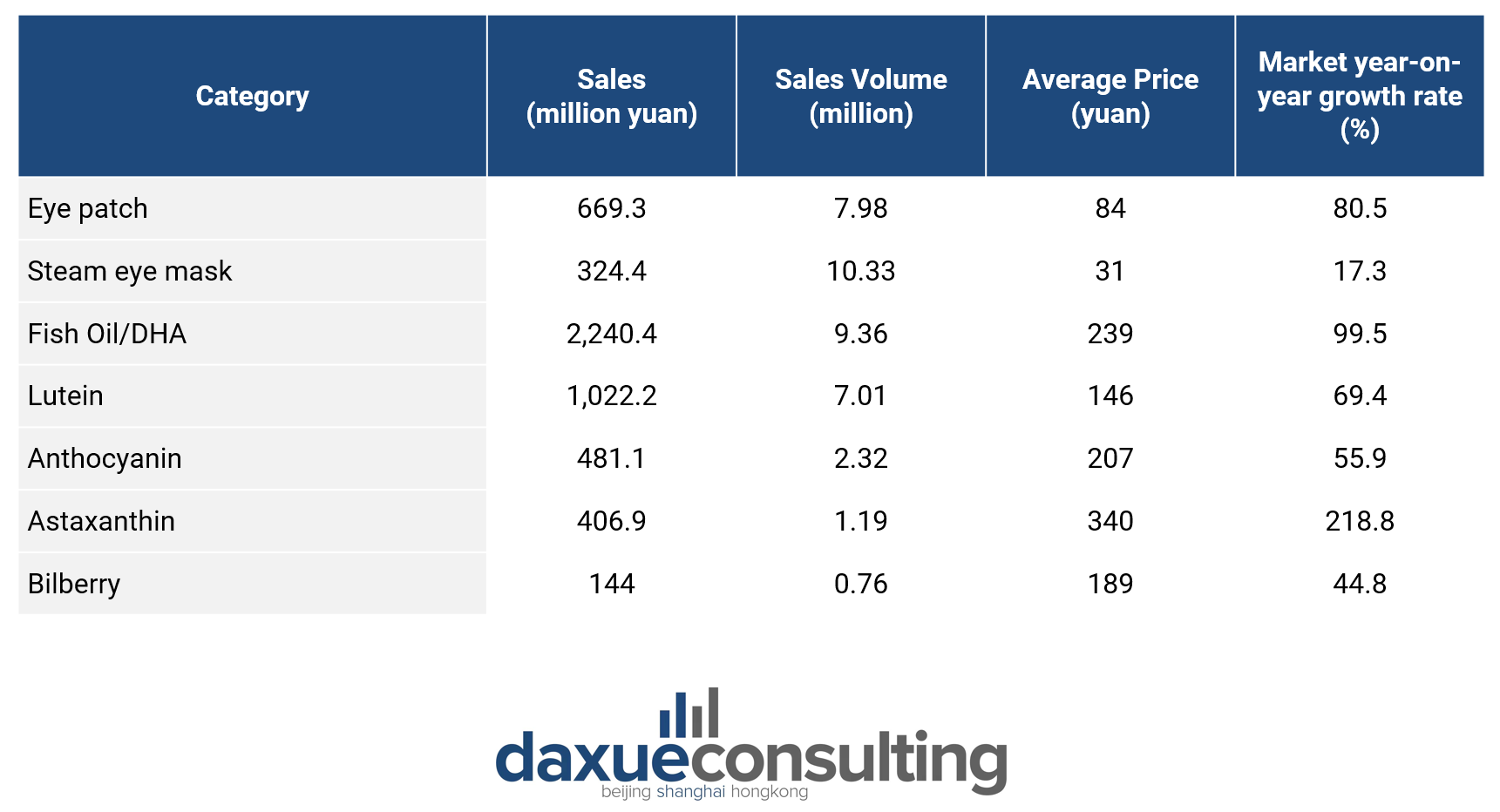

Eyecare product sales by categories in 2021

Innovation is a key feature for eyecare products in China

According to Tianyan search, there are currently 10,199 registered eyecare companies in China. Traditionally, consumers have used eye drops, ice eye masks, and eye massages to relieve their eyes. At present, innovative products such as steam eye masks and eyedrops have become the new preference of young consumers.

Hydron and ZSM are the two of the active players at the Chinese eyecare industry. Data provided by the senior vice president of Hydron also confirmed that the sales growth rate of Hydron’s steam eye mask reached 50% on the Tmall platform in 2020. ZSM entered the eyecare product market in 2014 and the revenue of eye masks and eye stickers reached 300 million yuan in 2018. After the launch of their eyedrops in the second half of 2019, the revenue of ZSM exceeded 600 million yuan in 2020 with the growth rate of more than 70%.

As a leader in smart portable massagers, Breo focused their business on eye massager products. From 2018 to 2021, the company’s operating income increased from 508 million yuan to 1.190 billion yuan, with a compound annual growth rate of 32.79%. It was officially listed on the Shanghai Stock Exchange in July 2021.

Eyecare products in China going beyond traditional items

Chinese brands have started to integrate eyecare ingredients into their existing products. In June 2017, goat milk formula brand, Kabrita, launched Jingying – Factor Goat Milk Powder. The main selling point of the product is the unique “crystal factor”, which provides multiple nutrients for vision development. With the addition of lutein, DHA, taurine, and vitamin A, the “crystal factor” claims to help reduce blue light damage, build retina, repair optic nerve, and maintain dark vision.

Another company expanding its product line to meet Chinese consumers’ eye health needs was the New Hope Group, which launched its eyecare youth milk in September 2019. The product is the result of a joint research between New Hope Dairy and Chengdu Traditional Chinese Medicine Da Yinhai Ophthalmic Hospital. It adds lutein ester, wolfberry, peony seed oil, and other raw materials said to protect the eyes into the milk.

The consumer electronics industry has also begun to pay attention to eyecare by introducing eyecare screens. For instance, Hisense has launched the color e ink mobile phone A5C and A5Pro CC in 2020, which deliver high-contrast, sunlight readable, low-power performance that further closes the digital divide between paper and electronic displays. During the Covid-19 pandemic, online classes were the norm in China. Parents were concerned that prolonged usage of electronic devices would damage their children’s eye health. Therefore, industry leaders from traditional hardware manufacturers, intelligent electronic products and semiconductor displays started competing in the field of eye protection screens to meet growing eye health awareness in China. They have launched eye protection screens made from different materials such as “IPS paper screen”, “nine-layer scattering eye protection screen”, “LTPS eye moisturizing screen”, “ink screen”, etc.

There is a big room to grow for eyecare products in China

- The number of netizens in China has grown rapidly and the time spent on electronic devices has extended.

- Eye-related diseases are frequently found in China. There is an increasing number of Chinese citizens who suffer from eye fatigue, dry eyes, astringent eyes, swelling and myopia.

- Functional eyecare products are growing rapidly in recent years.

- Chinese brands have integrated eyecare ingredients or elements into traditional products such as milk, specifically targeting the youth.

- Chinese consumers find the eyecare screen an attractive feature in the electronic devices.