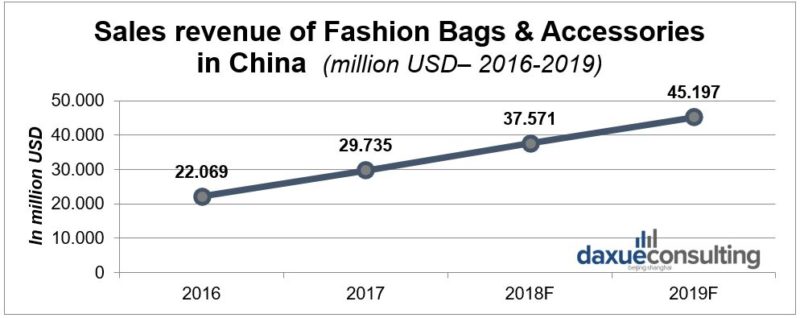

The fashion accessories market in China is showing a high-speed growth. For example, China has been the second largest jewelry market in the world in 2017 (around 671 billion RMB market size). As estimated, the sales revenue of fashion bags and accessories in China will be doubled from 2016 to 2019. Not only the market size is worth our attention, the consumptive concepts and habits of Chinese fashion accessories consumers are going through remarkable changes.

The Chinese Accessories Market is Being Pushed to a Higher-end Domain

With their rising purchasing power, Chinese consumers are not only willing to buy more fashion accessories, but they can now afford more expensive ones. On the other hand, the Chinese government has issued many environment-protection requirements, along with the rising labor costs in China, Chinese fashion accessory processing enterprises have been pushed to be upgraded. While the low-end fashion accessories manufacturing is shifting more and more to India and other South Asia countries, many Chinese enterprises are focusing more on the high-end market domain.

Chinese Millenials Want More International and Individualized Accessories

Chinese millennials desire to be acquainted with new fashion trends around the world. They purchase fashion accessories to present their unique personal style as well as their fashion taste. For example: in the last recent years, traditional Chinese jewelry brands have experienced a general sales decline while many western brands have achieved a great success on the Chinese market, for example, the brand Pandora. Since Pandora is a Danish brand which emphasizes DIY and individuation, it is a perfect match for Chinese Millennials who strive to be unique and show their own personalities.

The Chinese Fashion Accessories Market Is Getting More Diversified

Chinese consumers are willing to purchase fashion accessories from well-known international brands since these products enable them to show off their financial capabilities. However, the Chinese fashion accessories market is not dominated by a few brands. More and more niche and young innovative brands are getting Chinese consumers’ attention. Along with rising disposable income, the quality of life is also elevating. Chinese millennials are followers of fashion and highly image-conscious. Most market segments of fashion accessories are still on an upward climb due to the escalation in the demand of diversification.

Young Female Consumers Are the Main Buyers

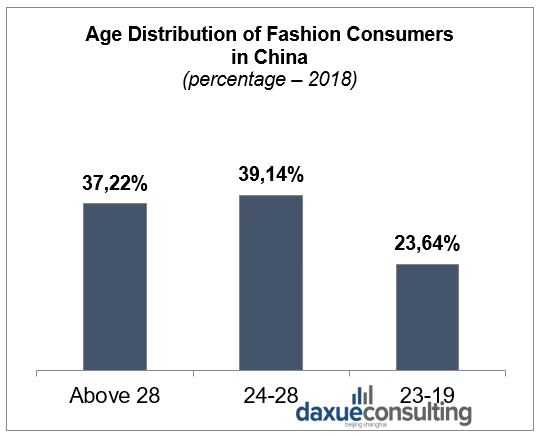

According to Euromonitor International, millennials in China number over 400 million and account for almost 30% of the nation’s population. The increasing base of fashion-conscious Chinese millennials (post-1980s and post-1990s generation) are the “super consumers” within personal accessories and eyewear.

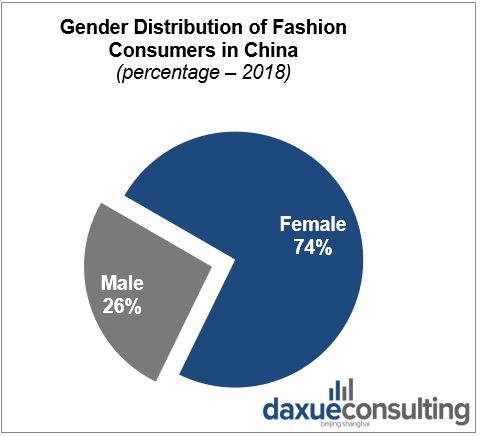

Young consumers care about the comments regarding their dress and accessories, especially young female consumers. That makes them the main consumer group of fashion products on the Chinese fashion accessories market. According to Min Chun, project leader of Daxue consulting: “Female consumers are willing to spend more on their outfits than any other categories to enhance their appearances.”

Online + Offline is Becoming the Main Purchasing Method

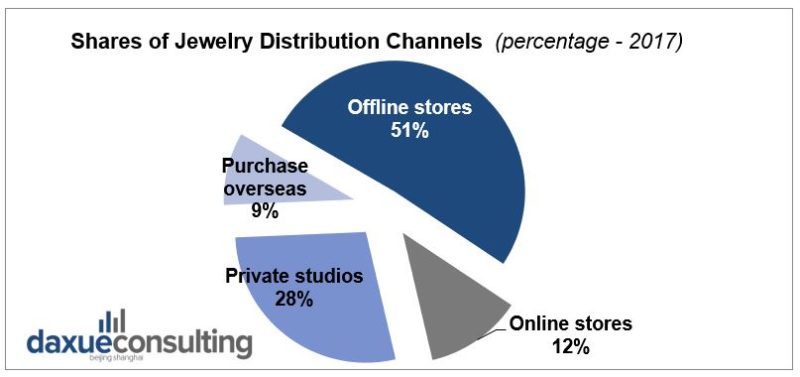

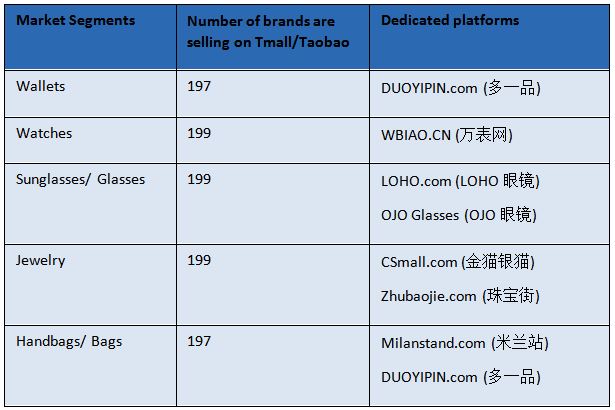

In 2017, offline stores were still the main distribution channel (slightly over 50%) of jewelry products on the Chinese market. A good offline-store-coverage is considered important since professional service is crucial in this sector. Nevertheless, a high internet and smartphone penetration in China along with the convenience of online shopping and the strong awareness of technology among Chinese consumers are boosting the development of internet retailing. A dedicated official website (with the Chinese language) and/or official online-shops on Chinese e-commerce platforms cannot be ignored. Besides the most popular platforms like Taobao and Jingdong (JD), there are many other less-known ones which international players can leverage.

“Chinese consumers have a very large choice of products, from domestic to international brands, so they are very concerned about the quality, design and small details.” Says Claire Gerard, the project manager of Daxue consulting. From international high-end fashion products to fine fashion accessories with very low prices, products for each category and price level have their own consumers.

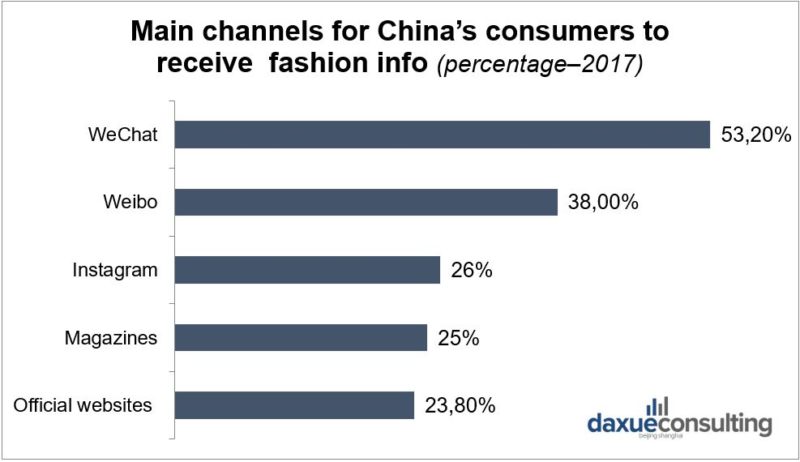

Social Media Platforms are an Impactful Way to Reach and Engage Consumers

“Chinese women are paying greater attention to fashion news and browsing fashion information is becoming an essential part of their daily life.” Says Min Chun, Project leader of Daxue consulting. The main source of fashion information for Chinese consumers is social media platforms. With strong digitalization in China, international fashion accessory enterprises are able to reach Chinese consumers directly and quickly through social media platforms. WeChat and Weibo are significant promotion channels for fashion accessories brands, followed by Instagram, which can also be considered as one of the most important promotion channels among all relevant mobile apps.

Source: Report of China fashion consumption survey

1. WeChat Is the Number One Chinese Social Media Application and A Must-have for Market Entry

WeChat is a Chinese social media application and an absolute must-have for a market entry campaign in China. The app has over 1 billion monthly active users. As more and more young consumers in China are looking for unique and tasteful fashion accessories, not only well-known brands but also many international niche brands are being mentioned by many posts on Chinese social media. Women’s fashion accessories are the main topics of most related posts on WeChat. The Chinese fashion accessories market is not even close to saturation, there is still vast room for growth.

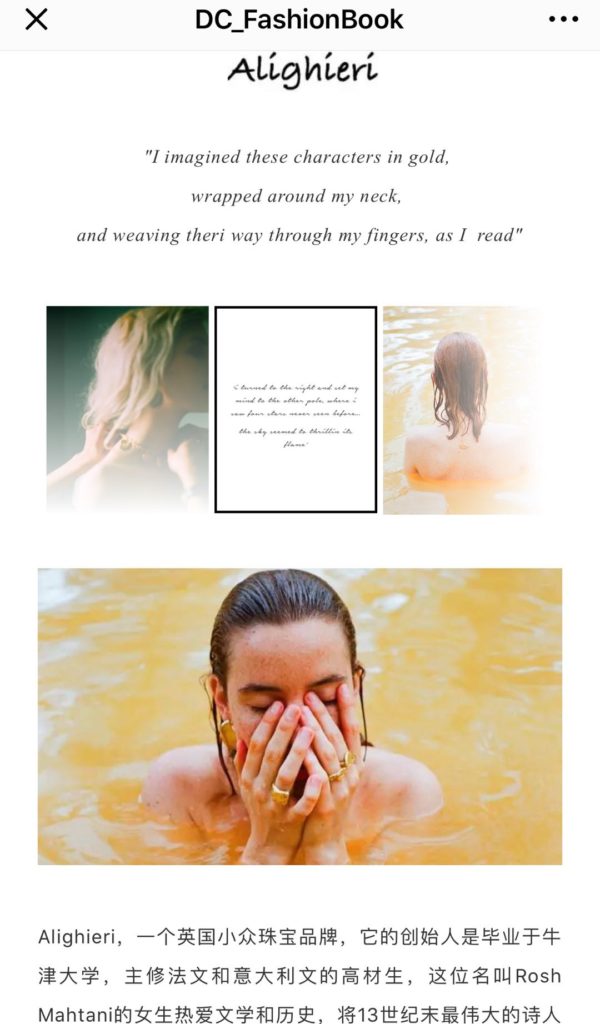

Below is an example of one article posted by a fashion and lifestyle KOL on WeChat: DC_FashionBook. This article is called 少女和她们的时髦配饰 (Girls and Their Fashionable Accessories, gained 9709 views by Oct. 17. 2018), in which several international niche brands have been introduced such as Alighieri (UK).

2. Weibo Is the Chinese Most Successful Microblogging Site and Well Leveraged Platform for Marketing in China

Sina Weibo is a microblogging site with nearly 400 million monthly users and is a well-leveraged platform to perform marketing campaign on the Chinese Internet. Women’s products dominate the most posts about fashion accessories on Weibo. Jewelry is the most popular topic among all fashion accessories.

Here is an example of a post about how to become fashionable with so-called coin-necklace. This blogger is called “时尚辣妈Ann” (Hot Fashion Mum Ann), who owns 610,000 followers on Weibo.

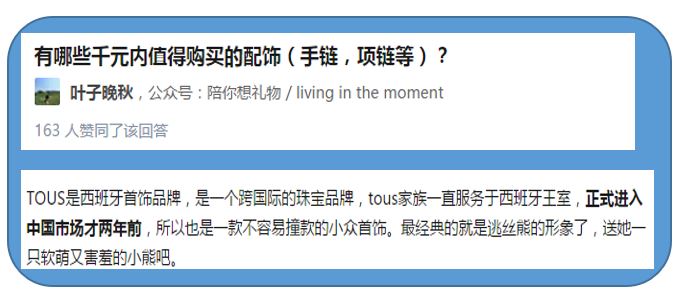

3. Using Chinese Q&A Social Media Platform Zhihu to Reach Higher-Educated Consumers

Zhihu (知乎) is the first Chinese Q&A website and has transferred to a social media sharing platform with more than 100 million answers on various topics. The platform is especially relevant for reaching higher- and well-educated social classes. More than half of the questions about fashion accessories are brands recommendation based on prices, gender and seasons. International brands tend to be more popular than domestic brands among those answers.

“TOUS is a cross-border jewelry brand from Spain. Tous Bear is the most classic image of this brand, it could be a cute present.”

“Kiel James Patrick is a bracelet brand from the USA with American vintage style. An anchor is the main symbol of the brand. Jack Fitz and Peter Wence are the classics.”

Competition Analysis of Different Segments of Chinese Fashion Accessories Market

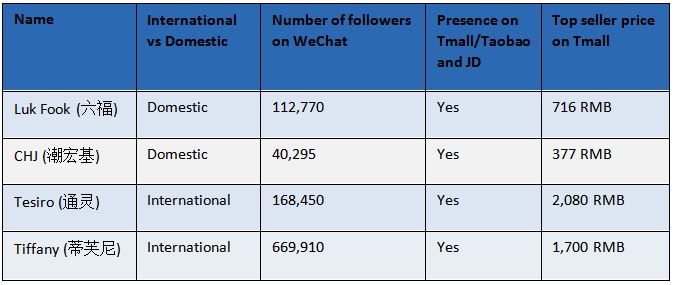

1. Jewelry Brands on Chinese Market

Generally, international brands such as Cartier, Tiffany and Swarovski are priced higher while prices of domestic jewelry brands are more affordable. However, a few big Chinese jewelry enterprises such as Chow Tai Fook are also building a higher-end brand image.

Baidu is the number one search engine in China. More than ¾ of the total search is made by Baidu. Baidu index collects and analyzes the statistical data of searching behavior, which reveals the market trend.

The related words of “jewelry” consist of relevant brands, such as LUKFOOK, Tesiro, Chow TaiSeng, etc. Most of those brands come from Hong Kong and Guangdong province. The orange circle is for upgoing searching amount and green for declining amount. Besides brands names, official websites of several jewelry brands are closely related to the keyword “Jewelry”, which indicates that Chinese consumers are trying to find information about the products and even ready to purchase jewelries from these official websites.

For more facts and information about Chinese jewelry market, please check out another article of Daxue Consulting: How millennials and low-tier cities are shaping China’s jewelry market

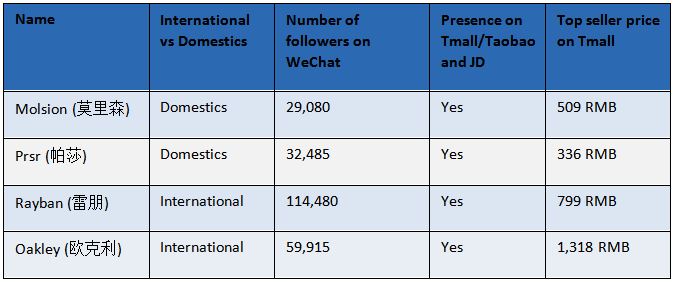

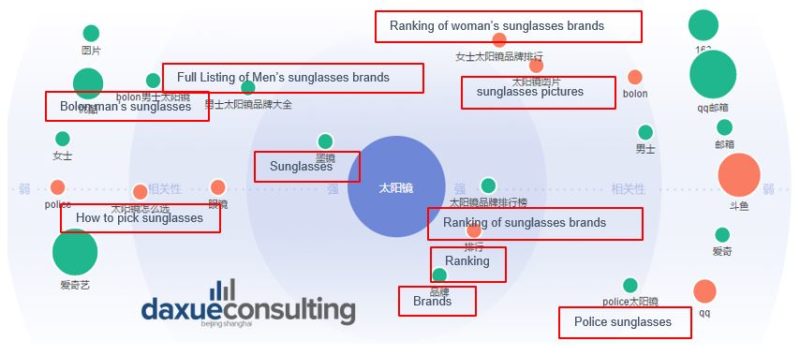

2. Sunglasses Brands on Chinese Market

Most well-known sunglasses brands (both international and domestic) have built official stores/flagship stores on Chinese shopping platforms. The majority of them have built official social media accounts such as WeChat and Weibo.

The related searching terms of “sunglasses” consist of men and women’s sunglasses brands, ranking, pictures of sunglasses and how to pick sunglasses. All mentioned brands on Baidu Index are international (Police and Bolon). Sunglasses are relatively new to many Chinese consumers, they tend to consider sunglasses as a fashion statement which is worn by young and fashion-conscious individuals. However, as the quality of life rising and fashion information getting more accessible to Chinese consumers, an increasing number of consumers are ready to purchase fashion accessories like sunglasses. What kind of sunglasses look good on them and how to choose a suitable pair of sunglasses are big concerns of Chinese consumers.

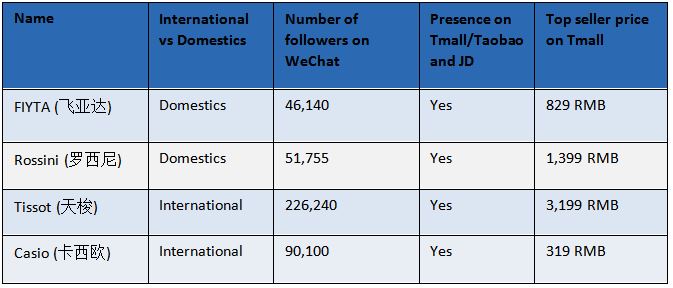

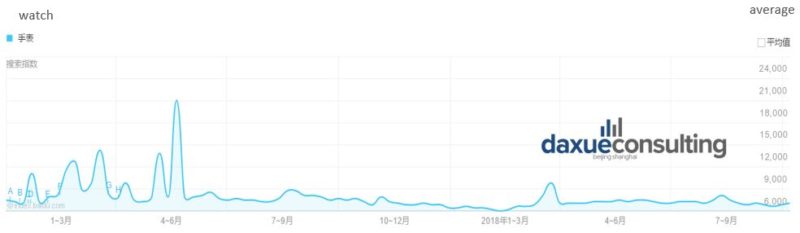

3. Watch Brands on Chinese Market

Most International brands come from a few countries: Switzerland, Japan and USA. Both domestic and international brands focus on mass as well as the high-end market.

The search traffic on Baidu for “watch” was significantly high in May 2017, because CASIO launched new products during this period.

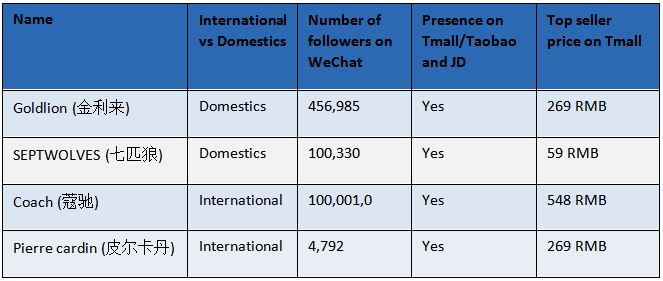

4. Wallet Brands on Chinese Market

Most international and domestic brands have built official stores/flagship stores on main shopping platforms. International brands mainly focused on high-end products while domestic brands working on both mass market and the middle to high-end markets.

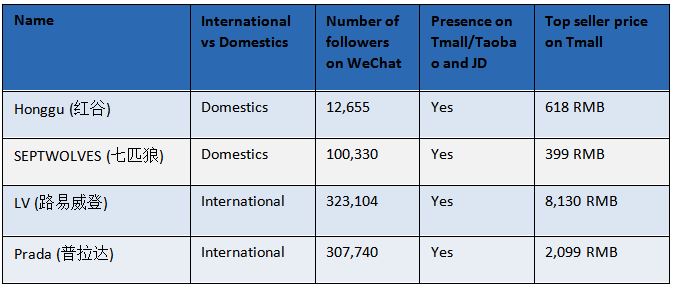

5. Handbag Brands on Chinese Market

The luxury handbag market is dominated by international brands while domestic brands primarily target the mass market. Most handbag brands have their official accounts on Chinese social media platforms, such as WeChat and Weibo.

The Chinese fashion consumption base is growing and prefers foreign products

With the rising of Chinese emerging middle class, Chinese fashion accessories market is no longer dominated by domestic and low-end brands. Chinese consumers are searching for fashion products with high-quality and distinctive design to present their financial capability as well as their taste. Over 60% of fashion consumers in China are under 28 and over 70% are female, this reveals the main consumption group of fashion accessories on the Chinese market. Chinese Millennials are highly fashion-conscious and are used to browsing fashion information on social media, this makes social media platforms such as Weibo and WeChat almost the must-haves to build brand image and promote products in China. As offline shops were still the main distribution channel, more and more Chinese consumers are turning to online shops purchasing fashion accessories. Both are non-negligible distribution channels for fashion accessories in China.

https://www.slideshare.net/AllisonMalmsten/the-fashion-accessories-market-in-china

Daxue consulting can strategize your entry into China’s fashion accessories market

As a business intelligence authority in China, daxue consulting has a thorough understanding of China’s jewelry market and millennial spending habits and can help your company strategize your China market entry.

If you want to know more about China’s fashion accessories market, do not hesitate to contact us at dx@daxueconsulting.com