During the pandemic, millions of future financial analysts have been fully immersed in the world of investment. Recently a new generation of investors has been emerging on social media. The proliferation of commission-free online trading has sparked a demand for inexpensive financial advice that can be obtained from the most easily accessible place, namely the Internet. A new generation of financial analysts has emerged on Chinese social media.

Many young people turn to financial influencers in China for free advice instead of paying traditional investment managers. Besides, young people tend to distrust financial institutions. In their opinion, they are ruled by an older generation that they do not understand. Therefore, this niche is filled by financial advisors from social networks called “finfluencers” – a type of influencers focusing on money and investment related topics.

What drives the growth of financial influencers?

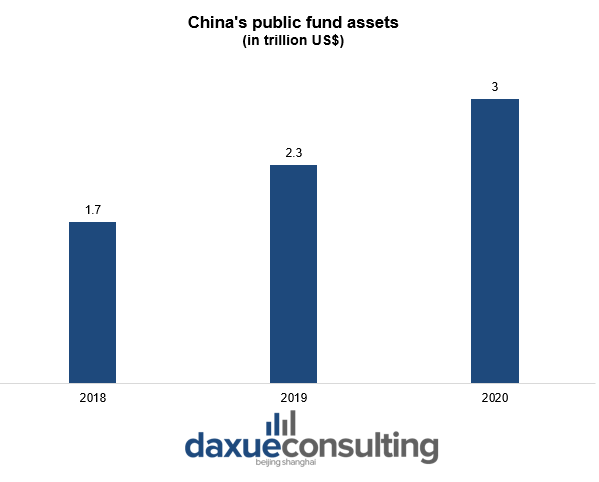

According to data from industry associations, China’s public fund assets have risen from US$2.3 trillion in 2019 to US$3 trillion in 2020. The same year, the industry’s profits increased by 70%, reaching a record 309 billion U.S. dollars.

A large driving force for the growth of China’s fund assets is the participation of young investors. According to a report from Shanghai-based research company Mob Tech, as of August 2020, more than 50% of China’s new fund investors were under 30. The Tencent Securities website, a subsidiary of the technology company Tencent, released a report on the behavior of Chinese stock investors in January 2021. The report showed that the younger generation of investors prefer funds to stocks and real estate.

Non-financial platforms became a place for finfluencers

Feeling the rising interest from social media users, more and more fund companies and fund managers are willing to keep in touch with new investors through social media. Some companies even sell funds through live streaming. For example, during the Spring Festival, more than 600,000 people watched financial-related live broadcasts on Alipay. The enthusiasm surrounding investment has even extended to non-financial platforms such websites like Bilibili, Weibo and Xiaohongshu. Take Xiaohongshu as an example, there are a lot of stock and fund videos on the platform. The videos range from introductory knowledge explanation, technical analysis, terminology popularization to stock pool recommendations, etc. The number of views ranges from thousands to hundreds of thousands.

There are several rules how financial influencers in China attract followers

Rule one: Demonstration of Success

According to experts, Gen Z pays more attention to cultural signs of wealth, such as expensive cars and fancy clothes, than to business education and financial certifications.

Rule two: rely on short run strategies

In most cases, day trading does not generate wealth in the long run. However, young people often think they will be the exception, and this is what financial influencers in China take advantage of. This combination leads to speculation and other extremely risky decisions.

Rule three: “bullish“ strategy attracts more views

In the investment environment “bulls” are those who buy securities, hoping that their value will rise. Bears, on the other hand, are selling them in anticipation of a fall in prices. Since the investment market is becoming more expensive for a long period, only those who demonstrate success receive views. Therefore, many content creators don’t use bearish views as they seem intimidating to viewers and present only one strategy.

Who are the key financial influencers in China?

As China’s millennials and Gen Z became the main force in the investment market, they are bringing online fan culture into the investment circle. In China, more and more young fund managers are gradually becoming “idolized”.

Zhang Kun: 4 million readers

One of the most popular financial influencers in China is Zhang Kun, the fund manager of the asset management company E Fund. He is often featured on the trending search list on Weibo and other Chinese social media platforms. Currently, his “E Fund Zhang Kun National Support Club” has 30,000 followers, and the “E Fund Zhang Kun Global Support Club” has more than 20,000 followers. He has his own Weibo blog “Yi Fangda Zhang Kun”, with a total reading volume of more than 4.4 million. In the past 8 years, Zhang Kun’s fund has achieved a return rate of nearly 700%, this also has contributed to his rise in popularity. He prefers stocks with large market capitalization, momentum effect, low turnover, high valuation, and high growth.

Financial Grandpa

This account gives followers recommendations regarding digital currencies. It has around 600,000 active subscribers on WeChat now. The main content includes success stories about investments in various currencies as well as introductions of projects that the owner of account intend to invest in the future.

Zhang Fang

This account currently has around 300,000 followers. It is a personal WeChat account of cryptocurrency advisor Zhang Fang. He publishes articles a couple times a week regarding blockchain regulations, cryptocurrency, as well as special reports on ICO policy and Bitcoin development in China.

Digital currency trend madman

This account has 36 articles published with 870,000+ readers. The author is anonymous, and he provides daily digital currency marketing analysis and tracks market trends. On the platform which focuses on blockchain blogs Tuoluocaijing, his posts got more than 60 million views.

Straight Guy Finance

It is a popular finance account on Douyin, which covers business history and practical financial management skills. “Straight Man Finance” already gained 830,000 followers. Users not only pursue “killing time” in entertainment content, but also seek to obtain knowledge in short videos, thereby “saving time” for their lives.

Crackdown on misleading financial information

Recently the Chinese government has launched crackdowns on several industries. One of them was related to financial blogs on social media. Namely, in summer 2021 the National Cyberspace Administration of China began to carry out a special rectification campaign to identify pages which publish misleading financial information. China’s major regulatory agencies will supervise and guide major commercial website platforms, clean up a batch of financial information released in violation of regulations, and strictly deal with a batch of serious problematic website platforms in accordance with laws and regulations. The Office of the Cyberspace Administration of China proposed to focus on cracking down on the following types of violations:

- making distorting interpretations of official financial policies and data;

- reposting misleading foreign news and comments; spreading rumors;

- making out-of-context, one-sided misinterpretation of financial news information;

- disrupting the normal financial market order;

- speculating negative information to threaten and intimidate relevant stakeholders and seek illegal benefits;

- speculate social events, negative extreme events, inciting sadness, anxiety, panic and other emotions.

These strict measures can have an impact on the whole sphere of financial influencers in China, especially those who do not have any license to do financial consulting.

Key takeaways about Chinese finfluencers

- Gen Z users are the key engine for the popularity of Chinese finfluencers. They look for advice to invest and become rich quickly.

- Some financial influencers have inspiring background and academic financial education; however, some financial bloggers do not have much experience in asset management, and even fewer have securities qualifications or relevant practicing certificates. Without the relevant qualifications, they still recommend stocks publicly and even use platforms to attract people to advertise and sell courses.

- Chinese government is getting stricter in the sphere of financial blogs, and many accounts have already been blocked. This will have a long-term impact on finfluencers.