Food and Beverage Market for Chinese Children: Baby Booms Spark Economic Growth?

According to statistical data from National Bureau of Statistics of China, there were 76,000,000 children between 5-9 years old in China in 2015, which represents 5.5 percent of the country’s population. Chinese children aged between 5-9 years old today were born during the fourth wave of the baby boom in China (2006-2012), when women born during the third baby boom (in the 1980s) began having children and getting married. This period also signaled the “golden fertility age” for these Chinese mothers, which Chinese society defines as between 24 and 29 years old. Only a few years later, China began rolling out the new two-child policy on October 29th 2015, with plans for it to be fully in effect by January 1st, 2016. With the implementation of the two-child policy, the number of children will be sure to expand in the next three years, but will slowly decrease in the long term. Inevitably the industries that correspond with such a dramatic demographic change will also experience growth. Sectors like the medical industry (children medicines), baby food, early education, and toys should all be ready to adapt and scale. This marks an excellent opportunity for international brands to enter China and occupy the share of expanding food and beverage market for Chinese children.

Upon recognizing the socio-economic implications of the two-child policy, a leading international brand in retail consumer products approached us to help bolster their performance in China. Specifically, they were looking to increase their market share in the children products sectors and outcompete local premium brands. We worked with the client to audit their China POS and in-store strategies based on best strategies. Across their wide range of products, the company was able to improve its market standing with our new “ideal” retail strategy. Here are our key findings on the food and beverage market for Chinese children.

Typical Consumers: Post-80s and Aging Grandparents

The most prominent customer groups for the 3 to 9-year-old food market are oft-divided into three parts. The parents, particularly the mothers, play a critical role in purchasing children food and drinks. Secondly, aging parents often take the responsibility of raising young children in China. Lastly, for 7 to 9-year-olds in primary school, most will have more autonomy in deciding their own food and beverage consumption preferences.

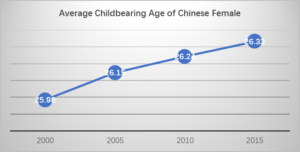

While economic concerns have forced childbearing age down, the two-child policy is likely to reverse it in the short run.

Source: Daxue Consulting

According to public statistical data, the average childbearing age of Chinese women was 26.24 in 2010, which places the parents of our target children between 29-35 years old. For parents whose ages range from 29-35 years-old, also known as the Millennial Generation, globalization, mobile purchasing, and social media applications, all highly influence their consumer preferences. According to our previous report, the Millennial Generation is largely using online platforms, both as a source of information and a purchase channel. They have a higher acceptance of the quality of international brands. Additionally, their standards for hygiene, nutrition, and general quality are also higher, and therefore scrutinize advertisements more closely, leading to more selective preferences.

Ageing parents

The skipped generation household is a significant phenomenon in China. Grandparents often assume the responsibility of child-rearing as opposed to young parents. According to a study by CBRE, 61% of the millennial generation in China lives with their parents because of unaffordable housing prices. However, it mainly happens in the pre-marriage and new marriage instances. With income of young newly-wed couples increasing gradually, they prefer to move out and take care of their children themselves. According to data of 2016, nearly 50% of Chinese children grow up with grandparents. Essentially, grandparents are a major source of consumers who buy food and beverages for 3 to 9 year-old children, but that margin is slowly decreasing.

Opportunities: Healthy Products and Tier-2 City

Health Products

As health awareness and disposable incomes growing, Chinese people are more willing to spend on health products. This trend has expanded to young children F&B market as well. According to Thibaud André, a senior project manager at Daxue Consulting, “the young children food and beverage market is directly benefiting from the various trends impacting the overall food industry in China for few months. Along with the infant formula market, the 3-9 years old segment has been a leading force for the development of imported food, with parents more aware of the health issue for their kids”. This is also supported by our previous research, which asserts that China’s health food and nutritional supplement market is estimated to be worth more than RMB1 trillion.

As opposed to western countries, there are no specific regulations for children’s food and beverages in China, especially those marketed to children older than three. The Chinese Standards of Food Additives was originally developed with the standard 60-kilogram adult in mind. In addition, although there is special stipulation in Food Safety Law of the People’s Republic of China for infant food, it only pertains to children under three. Additionally, the legislation almost exclusively covers milk and powder, while omitting any details on supplementary food. In the past, we have studied the effects that this legal conundrum has on companies in the baby product industry. With Daxue’s help, companies have used that expertise to increase their market performance in China. As these children age, the underdeveloped legal system will only contribute more problems than solutions to China’s childhood food and beverage industry. Wumao Snacks (五毛食品) is the latest example of the flawed system. Known for their popular, but low-quality products, Wumao was featured in a recent WeChat article highlighting their poor-quality goods, which received over 595,208 views and 10,596 likes after only 30 days in May 2017, according to Newrank Index.

The Newrank Index of Wumao Snacks (五毛食品) on WeChat

Wumao products shot up in popularity this year.Source: Newrank 年第亿升

Because the absence of legislation has effectively saturated the market with low-end domestic products, incoming international brands have the advantage of high-quality goods and better reputations compared with local brands.

Moreover, “the healthy aspect of this market has been reinforced by the recent local policies, as the government has stated the development of health food and nutrient fortified food one as a top priority by 2020”, according to Thibaud André. “In reaction to this growth, we have seen a lot of international brands in needs of a better understanding of the local needs and behaviors in the family.”

Expansion of target consumer

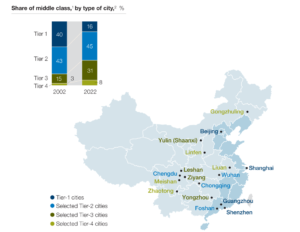

Another critical opportunity for international brands is the changing features of target consumers. With the rise of middle-class consumers in China, international brands should consider the expansion of the food and beverage market for Chinese children with respect to location and consumers. As the income level of Chinese consumers is growing, middle-end consumers are demanding more high-quality international children’s products. Not only are first-tier cities affected, but also smaller cities located in western and northern China. By 2022, middle-class consumers in Tier 2 and Tier 3 cities are expected to reach 71 percent of the total Chinese middle-class population.

The distribution of middle class citizens by type of city in 2002 and 2022

Caption: The majority of China’s middle class will shift to lower tier cities within the next few years.

Source: Mapping China’s Middle Class, McKinsey & Company.

Label Fever: ‘Children’ Label and International Brands

According to news reports from Xinhua News Agency, the special ‘Children’ label on food and beverage products could create additional value in China’s market. In many cases, the label is associated with higher quality and stricter regulations, and as a result, a higher cost. For a burgeoning Chinese middle-class however, many of them are willing to pay those higher prices. Some of these products double the price because of the ‘children’ tag on the package. The cost, packaging and even the ingredients are nearly identical to the adults versions.

The one-child policy, in some extent, intensified the anticipation of the ‘Children’ label. As a result of one child policy, the structure of Chinese families for the Millennial Generation is “4-2-1”, consisting of four grandparents, two parents, and one child. Consequently, more attention and resources are given to the single child, which leads to a relatively low price sensitivity on the price of children products in China. The anticipation of the ‘Children’ label, when coupled with the lack of related legislation, makes the quality of domestic products in the market poor. International brands have a better reputation.

Competitive international brands stand to capitalize on a high-potential Chinese market. Over 81% consumers in first-tier and second-tier cities usually opt for imported food products over domestic ones. Dairy products (49%) and children’s food (40%) are the two most popular types of imported goods purchased by Chinese consumers. To have a better performance, market participants should know more about the competitors and consumers. Daxue Consulting provides professional analysis from both demand side and supply side. This includes helping clients evaluate direct competitors as well as conduct sensory research.

International Brands & Domestic Brands: Fujiya(不二家)and Xufuji(徐福记)

Success of Fujiya

Brand Share on Chinese Online Candy Market in May 2017 (Tmall and Taobao)

International Firms share relatively equal shares of the Chinese market. Source: Daxue Consulting

Fujiya(不二家) is a well-known Japanese food manufacturer founded in 1910. Their main product lines offer chocolate, sugar, biscuits, beverages, and ice-cream. In the Chinese candy market, consumers once again prefer international brands. According to data from Taobao and Tmall, Fujiya, which mainly focuses on young children, ranked 3rd in this market in May 2017. For instance, the average price of a Fujiya lollipop is three times more expensive than those of Xufuji(徐福记), a domestic brand. The turnover of Fujiya (4,919,814 RMB in May 2017) is slightly higher than Xufuji (4,862,107 RMB) during the same period. Fujiya created the image of Peko, which is popular with Chinese children, to make it recognized among its competitors. Fujiya has also insisted on eco-friendly production practices and natural ingredients to improve their brand reputation. Additionally, Fujiya set up their official Tmall store site in 2010. Cooperating with the offline high-end flagship store, Fujiya succeeded in occupying a considerable share of the Chinese confectionery market. Other multinational competitors could realize tremendous success by investing in an expanding food and beverage market for Chinese children.

Success of Xufuji: Spring Festival Market

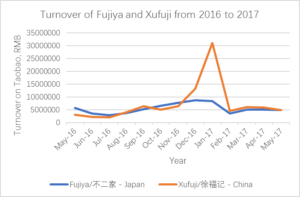

The Turnover of Fujiya and Xufuji from 2016 to 2017

Xufuji realizes skyrocketing sales during the Lunar New Year in 2017. Source: Daxue Consulting.

The Spring Festival is one of the most important Chinese cultural events of the year. Usually held around February of each year, the Chinese Lunar New Year sees Chinese citizens displaying a much higher propensity for consumption and spending. Xufuji(徐福记)usually achieves peak sales during Spring Festival and the in few weeks before and after. This is partially attributed to Xufuji’s use of Chinese-sourced traditional ingredients. Packaging is colorful and full of traditional patterns which make it popular across Chinese demographics, especially for aging grandparents. This presents a rare opportunity for increased spending and consumption. Another brand that performs well during the Festival is Wangzai milk (旺仔牛奶). Belonging to Want Want China Group, which is headquartered in Taiwan, Wangzai milk is famous for its Spring Festival series of products. It also experienced a significant increase in turnover between January and February 2017.

As more Chinese parents become health and quality-conscious, international brands are well-positioned to seize expanding market share as well as the new trends.

Further Client Results

Any effective multichannel strategy requires diligent research, analysis, and knowledge of the target market. At Daxue, we harnessed our skills in all three to help a client successfully expand into the Chinese children food market. For this project, we divided our service into three parts. First, we briefed our client on the critical market factors, trends, consumer profiles, and growth drivers in the Chinese market. We then followed with our research of the market, where we conducted countless interviews and investigations into consumer habits and brand identity. Lastly, we summarized our findings in a final analysis report, which we discussed with the client to guide through the ideal course of action. Our analysis revealed that the online market would be the most successful strategy. The increase in online shopping by Chinese consumers, combined with the ease of use for Chinese online platforms, both lead our client to recognize healthy sales upon entering the market.

To know more about the food and beverage market for Chinese children , contact our team by email at dx@daxueconsulting.com