In the pulsating heart of China’s ever-evolving logistics landscape, a titan, Full Truck Alliance (满帮集团) emerged in 2017, forged from the fusion of two formidable forces: Jiangsu Manyun Software Technology Co. (operating under the app brand Yunmanman, 运满满), Ltd. and Guiyang Huochebang Technology Co., Ltd (operating under the app brand Huochebang, 货车帮).

As the largest digital freight platform in China, Full Truck Alliance reported a revenue of RMB 8.44 billion in 2023, marking a 25.3% increase from the previous year’s RMB 6.736 billion. Its net profit for 2023 stood at RMB 2.227 billion, reflecting a remarkable 440.7% surge from the RMB 412 million of the previous year.

Source: Xueqiu, the company’s slogan: Making Logistics Smarter (让物流更智慧)

How Full Truck Alliance become the largest digital freight platform in China?

Driving digital disruption

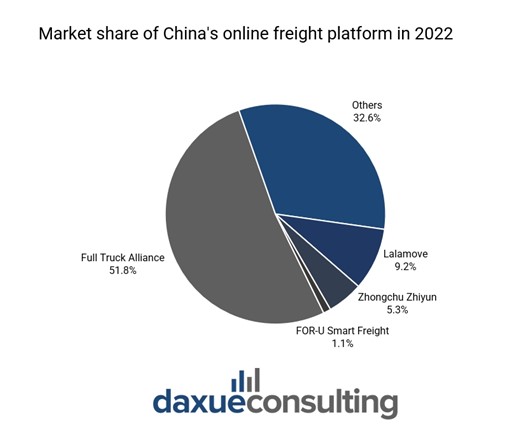

In today’s China, an increasing number of orders from freight owners are being processed through online freight platforms. In 2022, the CR4 of China’s online freight platform industry was approximately 70%, and Full Truck Alliance alone held more than half of the market share. The core reason behind this trend lies in the uneven distribution of goods along various routes, often leaving some drivers unable to swiftly match with high-quality cargo destined for their routes.

Source: Zhiyan Consulting, designed by Daxue Consulting, Market share of China’s online freight platform in 2022

However, the company seizing upon the digitalization trend, leverages its data analytics technology to dynamically analyze real-time cargo availability. By doing so, it efficiently plans new routes, matching cargo sources in departure areas, along routes, and near destinations, thereby enhancing drivers’ success rates in finding suitable cargo.

Moreover, amidst consecutive fuel price hikes, the company introduced features such as “Raise Freight Rates Alert” on the platform, reminding users to consider fuel price fluctuations to ensure the effective matching of transport orders.

By effectively linking transportation, warehousing, distribution, and station resources through the platform, the company successfully connects freight owners and drivers. The digitization process not only optimizes asset utilization but also helps the company reduce production costs and improve circulation efficiency.

Source: Guizhou Daily, the company’s staff operating digital demonstration APP

Pioneering sustainable development through green initiatives

As China’s ’30·60′ decarbonization goal has been put forward, the transportation industry in China is facing new demands for green development. According to People’s Daily in 2022, transportation emissions currently account for approximately 11% of China’s total carbon emissions, with road transportation contributing over 80% of that figure, making it a significant focus for carbon emission reduction efforts within the transportation sector.

Firstly, the platform utilizes advanced data technologies to optimize cargo matching and route planning, boosting vehicle capacity utilization and slashing idle time, thus reducing carbon emissions and promoting energy efficiency. According to calculations, in recent years, the platform has cumulatively reduced carbon emissions by ten million tons, equivalent to saving 4.65 billion liters of fuel for drivers. In terms of social value, if each tree can reduce 18 kg of carbon emissions per year, the platform is equivalent to planting 500 million trees, covering nearly 420,000 hectares.

Moreover, in June 2023, Full Truck Alliance launched the first driver carbon account system in China’s freight sector, creating a carbon-inclusive platform. On this platform, drivers have personal independent carbon accounts to record data related to carbon emissions during transportation. Currently, the platform has collaborated with provinces and cities such as Tianjin and Guizhou to implement carbon reduction technology assessments.

Source: China Federation of Logistics & Purchasing, the company hosted the inaugural launch ceremony for China’s first driver carbon account system in the freight industry

Furthermore, the company plans to increase research and development investment in autonomous driving and new energy trucks to empower low-carbon and zero-carbon supply chains with hardcore technology.

Challenges on the road: Full Truck Alliance’s financial and market struggles

Troubled waters in lending operations

Since 2019, the company’s lending business has seen rapid growth, consistently contributing over 70% of its value-added service revenue. In the first three quarters of 2023, revenue from value-added services reached RMB 214 million, RMB 330 million, and RMB 359.5 million respectively, with year-on-year growth rates of 24.4%, 27%, and 22.1%. Notably, the lending business has been the primary contributor to this growth, with its revenue increasing by 25% since 2023.

However, the lending business operates in a regulatory grey area, posing challenges to the company’s sustainable development. According to Tianyancha, as of April 17, 2024, Huochebang Small Loan (货车帮小贷), a subsidiary of the company, was involved in 417 judicial cases, with 362 cases related to loan contract disputes and 14 cases related to small loan contract disputes, accounting for 90% of the total. Multiple legal judgments have ruled that the interest calculation method for the company’s “driver loans” is excessively high and does not comply with legal requirements, resulting in court non-support.

Especially in recent years, China’s government has been strengthening regulations on lending services. In November 2023, Huochebang Small Loan received its first penalty since its establishment, which was fined RMB 370 thousand for “providing personal adverse information without prior notice to the data subject.”

Allegations of potential short-selling activities

According to J Capital Research in 2023, the company allegedly inflated its transaction volume, which may have been exaggerated by 6 to 10 times. Moreover, the report pointed out discrepancies between the company’s disclosed revenue and transaction volume compared to its tax payments and commission income. It suggested that Full Truck Alliance established shell companies to fabricate “transactions” to inflate transaction volumes, with the cash seemingly being ultimately returned, indicating a lack of genuine orders.

The veracity of the short-selling institution’s report remains to be seen, but the impact of these allegations led to a significant downturn in the company’s stock price. The company’s total market value at the time of its listing was USD 23.358 billion. However, its stock price plummeted thereafter, with the company’s share price closing at USD 6.68 per share on January 22, 2024, compared to the IPO price of USD 19 per share, representing a decline of 64.85%.

Future prospect: overcoming regulatory hurdles and shifting profit models

The company has publicly stated that the profitability of its freight intermediary services has to rely on subsidies provided by local fiscal departments. If the company cannot obtain these subsidies or if the subsidy levels decrease, its financial performance will be significantly affected.

Therefore, to navigate through 2024 successfully, this giant needs to urgently address various compliance issues and effectively manage the interests of executives, drivers, investors, and the company. It also needs to find sustainable new profit models for its digital road freight services, beyond relying solely on local tax rebates.

What do you need to know about Full Truck Alliance in China?

- Emerging in 2017, Full Truck Alliance, born from Jiangsu Manyun and Guiyang Huochebang merger, dominates China’s logistics with substantial growth.

- The company drives digital disruption, optimizing freight matching and route planning, enhancing efficiency. Also, it reduces emissions and innovates green initiatives to embrace sustainability.

- The company faces financial and market struggles, particularly in lending operations, amidst tightening government regulations and penalties. Allegations of inflated transaction volumes further impact its stock price.

- The company faces profit reliance on local subsidies, requiring compliance resolution and diversified profit models for sustainable growth.

We can guide you in navigating the logistics landscape in China

At Daxue Consulting, we specialize in navigating the evolving logistics landscape in China. Leveraging our deep understanding of the industry, we offer tailored solutions to optimize your logistics operations.

Whether you’re seeking to streamline your supply chain, enhance efficiency, or explore new opportunities, we have the expertise and resources to support your goals. Contact us today to initiate or review your logistics strategies and unlock growth potential in the dynamic Chinese market.