From livestream deals to ancient herbal remedies, China’s health supplement industry is rapidly transforming. As brands navigate this fast-moving landscape, health supplement market strategies in China increasingly center around visibility, relevance, and trust.

Download our China F&B White Paper

From shelves to streams: E-commerce dominates supplement sales

Direct selling, once a dominant force in the industry, has declined, while e-commerce has rapidly gained momentum. This shift is driven by the broader consumer reach and a more convenient shopping experience. Furthermore, the e-commerce big data model enhances marketing precision through data analytics. The shift of consumer trust was accelerated after the offline direct selling scandals, such as the 2019 Quanjian scandal, which revolved around pyramid selling and false advertising. It pushed buyers towards online platforms which are deemed to be more transparent. Additionally, online platforms help brands reduce intermediary costs, thereby improving profit margins. By 2023, e-commerce had become the largest sales channel for vitamin and dietary supplements in China, accounting for 56% of the market share, up from just 14.4% in 2013.

When views turn into sales: Douyin’s takeover of health commerce

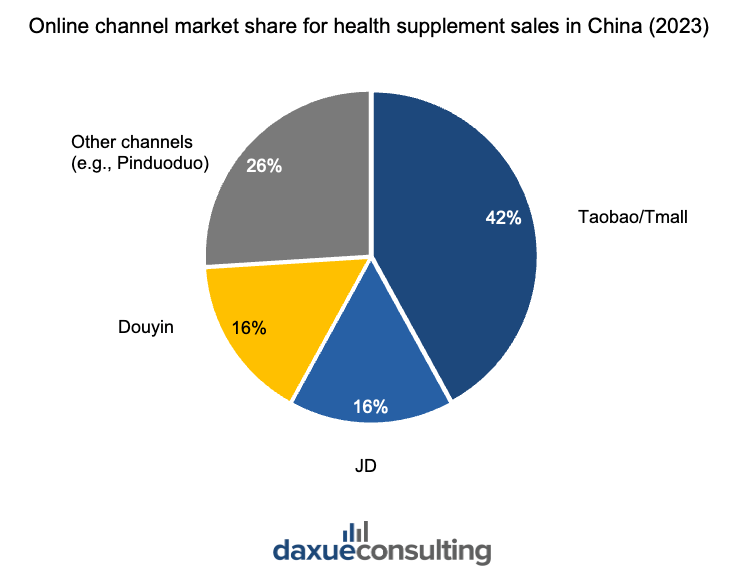

Douyin e-commerce has rapidly risen to become a strong force in China’s health supplement market, now standing shoulder to shoulder with traditional giants. While Taobao/Tmall maintains the lead with 42% of market share, Douyin and JD are tied at 16%. By leveraging its unique short-form video and livestream ecosystem to convert content engagement into product purchases, Douyin demonstrated its influence through events such as the 2024 Double 11 shopping festival, where three health supplement brands surpassed RMB 100 million in sales on Douyin Global, including Swisse, which reached RMB 150 million. These livestreaming sessions boost sales by offering real-time Q&A, demos, and limited-time discounts.

With 47% of Chinese consumers viewing influencers as trustworthy sources of health information, above the global average of 34%. This reflects China’s strong social media influence in shaping health-related purchasing decision, where Douyin’s content-led, influencer-driven model is redefining health supplement market strategies in China.

Import momentum vs. homegrown power: The new balance in China’s supplement space

Market scan of the top 100 brands on Douyin e-commerce from May 2023 to April 2024 showed a 12% increase in the sales volume of health supplements by international brands compared to the previous year, outpacing domestic players in growth. Much of this surge was fueled by brands from Australia and the US such as Swisse, Jamieson, and OLLY.

Among top-selling products, collagen oral liquids dominate, with anti-aging and firming as the leading purchase motivations, followed by brightening and hydration. Popular names like HECH, 180theconcept, and EnerVite rank high, reflecting the appeal of international labels. Foreign brands often win consumer trust due to their advanced production technologies and longer R&D history. This gives them an edge in health supplement market strategies in China.

While domestic brands maintain a stronghold in liver health, many are also expanding into or doubling down on the beauty segment. For instance, Nutrend (诺特兰德) spans daily wellness, sports nutrition, and liver support; Renhe (仁和) targets all age groups with functional and aesthetic health products; Five Doctors (五个女博士) focuses on collagen peptide drinks; and WonderLab (万益蓝) specializes in probiotic blends for gut health and weight management.

Celebrity endorsements & beauty-focused marketing

As primary decision-makers in household health purchases and key buyers in the beauty supplement market, women aged 24-30 represent a large and fast-growing consumer group, reflecting a broader youth-driven trend.

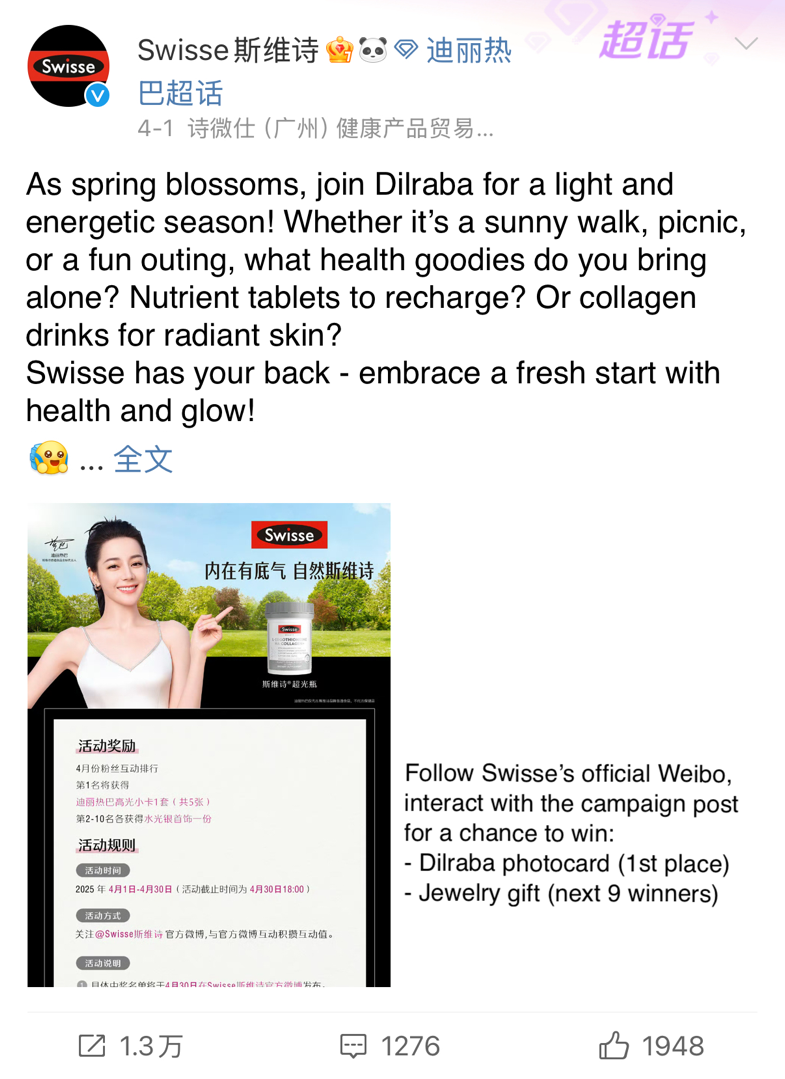

Swisse, an Australian brand, leads with its international credibility and focus on core functional products like collagen drinks and liver detox supplements. Its performance is driven by high-profile celebrity partnerships, including actress Dilraba. For instance, the brand launched interactive campaigns to boost fan engagement through giveaways and branded merchandise. This strategy amplified visibility and exemplified health supplement market strategies in China. As such, related Weibo posts garnered over 10 million likes in March 2025.

BY-HEALTH (汤臣倍健) combines scientific credibility with youthful, lifestyle-oriented marketing. Recently, its flagship “Yep” collagen drinks have been featured prominently on Douyin. Its content emphasizes beauty, confidence, and everyday self-care. The brand targets young female consumers and positions supplements as part of a modern skincare routine. Beyond marketing, BY-HEALTH reinforces its brand with strong R&D capabilities, holding a total of 451 patents and 155 registered health supplement approvals as of end-2024.

Liver rescue & late nights: How scenario-based marketing gets personal

As Chinese consumers increasingly seek solutions that match real-life stressors, brands are leaning into scenario-based marketing to make their products feel more relevant.

Liver health, in particular, has become a focal point for this approach. On XHS, searching for “护肝片” (liver supplements) reveals a surge of recommendation posts. Users group products into categories like “detox group,” “drinking group,” and “staying-up-late group.” So, brands echo this framing through lifestyle-themed ads and relatable slogans such as “stay up late without hurting your liver” and “drink and socialize without discomfort.” These messages position liver health supplements not just as long-term health support, but as daily recovery tools tailored to modern, high-pressure lifestyles.

Reviving the tradition: New Chinese wellness goes mainstream

As “New Chinese Wellness” (新中式养生) gains popularity among younger consumers, brands are leveraging traditional Chinese medicine (TCM) in distinct ways.

Infinitus, a long-established TCM brand under the Lee Kum Kee Group, promotes “Guochao Yangsheng” (国潮养生national-style wellness) by combining Chinese herbal traditions with modern lifestyles.

Its signature product, the Oriherb Health Tonic, has sold over 7.5 billion bottles since 1994. Infinitus emphasizes a holistic wellness philosophy rooted in diet, sleep, exercise, and emotional balance —an approach deeply embedded in health supplement market strategies in China. Meanwhile, its supply chain is fully traceable, with over 70 standardized herbal sourcing bases across China.

Nature meets innovation: How herbal supplements are winning over young consumers

Driven by rising interest in natural, organic, and “medicine-food homology” (药食同源) concepts, Chinese consumers are embracing supplements made from herbal extracts. Products featuring milk thistle (奶蓟草), lutein ester (叶黄素酯), and nattokinase (纳豆激酶) highlight the value consumers place on safety and tradition. Moreover, these time-tested, food-based remedies are seen as gentle yet effective.

This trend sets the stage for new-generation brands like JUZTLAB (草本未来) that fuse herbal traditions with lifestyle-driven innovation. Founded in 2021 by two Cornell-educated Gen Z entrepreneurs, the brand targets 25–34-year-old urban consumers with a modern take on “food as medicine.” JUZTLAB began with a Kudzu-based herbal candy for alcohol recovery (葛根解酒糖). The product aims for quick effects in high-frequency lifestyle scenarios like social drinking. JUZTLAB is viewed as a high-potential player in the young, low-penetration herbal health space due to its full online channel coverage and plans to expand into Southeast Asia via cross-border e-commerce.

At a glance: How brands are shaping health supplement market strategies in China

- E-commerce is now the top sales channel, making up 56% of China’s supplement market in 2023 as brands tap into online convenience and targeted marketing.

- Douyin has become a major player, turning short videos and livestreams into sales. Swisse sold RMB 150 million during Double 11 alone.

- International brands are growing faster, with 12% year-on-year sales growth, led by popular beauty-focused products like collagen and anti-aging drinks.

- Celebrities and lifestyle content drive appeal, helping brands like Swisse and BY-HEALTH connect with young, image-conscious consumers.

- Scenario-based marketing is on the rise, linking products to daily challenges like drinking, staying up late, and fatigue with relatable slogans on XHS.

- New Chinese Wellness is gaining popularity, as brands like Infinitus and JUZTLAB mix herbs with trendy formats to meet demand for safe, natural solutions.

- These marketing strategies and trends show that smart product positioning matters most. As shoppers care more about function, convenience, and trusted ingredients when choosing what to buy.