The most important sales channels for health food distribution in China can be divided into different types of distributors.

- Supermarkets and hypermarkets

- Premium sales channels

- Warehouses and new concept shopping

- E-commerce

- Direct sales

Supermarkets, hyper markets remain the most important and popular sales channels for the health food distribution in China. Super and hyper markets are divided into traditional brands that offer a mid-range pricing and imported product offering. This section of the sales distribution channel normally consists of brands like Auchan, Walmart and Vanguard.

Premium sales channels predominantly known for offering a broad selection of imported products of high quality and high price positioning are also available to consumers. Brands such as Ole supermarket by Vanguard, City Super and City Shop comprise of the premium sales channels.

Warehouses and new concept shopping also offer plenty health food options through their unique sales channels. Warehouse based shopping consists of brands like Sam’s Club by Walmart or Costco, where member based only shopping offers consumers huge discounts.

Dynamic changes in consumer behavior

More than half of the Chinese consumers today are having access to the internet. The simultaneous tech boom and introduction of payment apps in China has resulted in it being an everyday feature of Chinese consumer’s lives. Alibaba’s Alipay and Tencent’s WeChat pay applications are used across the country in all businesses. Since these payment products are conveniently linked up with e commerce platforms it has become a common practice for Chinese consumers to purchase their fresh foods on e-commerce platforms.

Distribution channels for health supplements in China

Pharmacies and supermarkets

Pharmacies are traditional drug stores normally with the over the counter (OTC) sales. People normally patronize pharmacies when they really need to purchase medicine of health supplements. Despite, medicines being sold online, in special OTC’s in a shopping mall, according to Euromonitor’s research by the end of 2019 pharmacies accounted for 18.3% of the health supplements market in China.

Supermarkets are an extension of the traditional format of selling health supplements or healthy foods in China. While supermarkets in general remain an attractive sales channel for fast moving consumer goods, health supplements and health related foods account for a small 2.5% of the sales. However, supermarkets remain a firm and established sales channel.

Direct selling

Direct selling is a person to person rather than business to business method of selling products. This method has been quite a controversial manner of doing business in China. Recently in February 2019, China suspended the registration of direct selling firms after two scandals emerged and created resentment among Chinese consumers. These steps had to be taken by the Chinese government after consumer complaints mounted regarding exaggerated claims in advertisements regarding health products. The country biggest and most popular product Infinitus’s product had allegations that it damaged a toddler’s heart. In a much worse case, a Tianjin based company Quanjian nature medicine technology exaggerated in their advertisement how their product can cure cancer. It ultimately led to the death of a young girl.

Despite the controversies by the end of 2019, direct selling accounted for 47.3% of the health supplements market share in China. In contrast to traditional direct selling where a seller would knock door to door to sell products, in China the advent of technology and apps have allowed companies to leverage the social convenience of the internet. The most popular method of direct selling in China is through the super app WeChat.

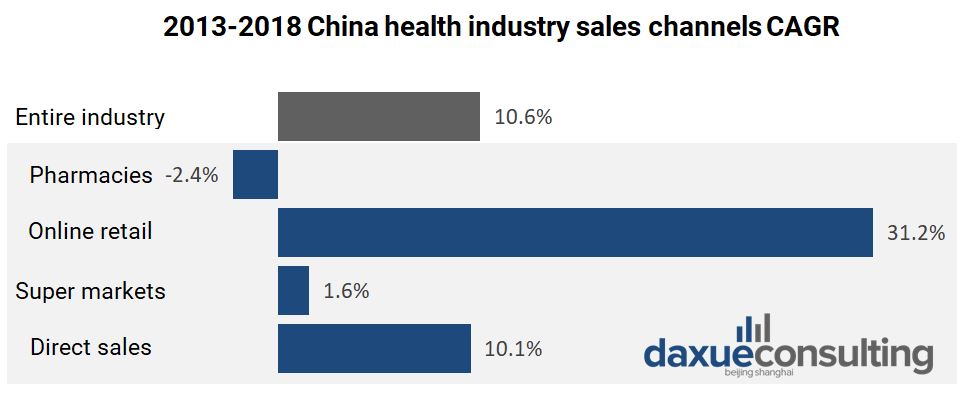

Data source: Euromonitor, Northeast Securities 2019; From 2013-2018 the compound annual growth rate for online retail outpaces other retail channels in health food distribution in China

Online retail

Online retailing for health supplements and health foods distribution in China has been growing rapidly. Along with convenience and cost-effective pricing it has also introduced a variety of products creating a healthy choice of options for Chinese consumers. Local and foreign brands are both able to display their offerings at competitive prices. Foreign brands have benefited the most from online health food distribution in China as they have been able to establish the selling of their products and services without legally and physically having to be present in China. Foreign brands for health supplements like Blackmores see China as their largest and profitable market as China accounts for almost 40% of their global annual sales.

By 2019 online retail accounted for 31.9% of the health supplements market share in China. Online retailing is growing three times faster compared to the next fastest growing channel in the health supplements market, which is direct selling having accounted for 31.2% of the health supplement market in China.

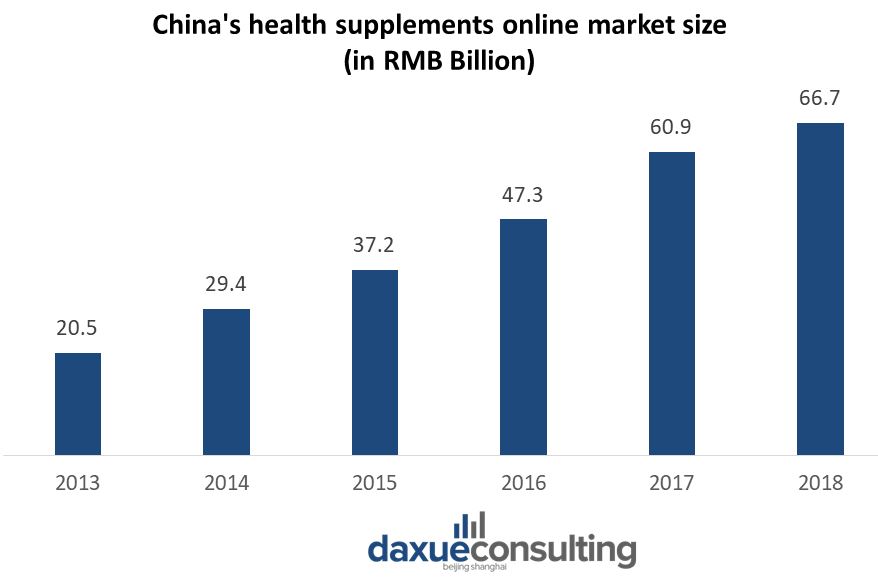

Data source: Prospective Research Institute 2019; The market size is valued in RMB billions. CAGR for online market of health supplements in China was 22.77%.

The E-Commerce market for fresh foods in China

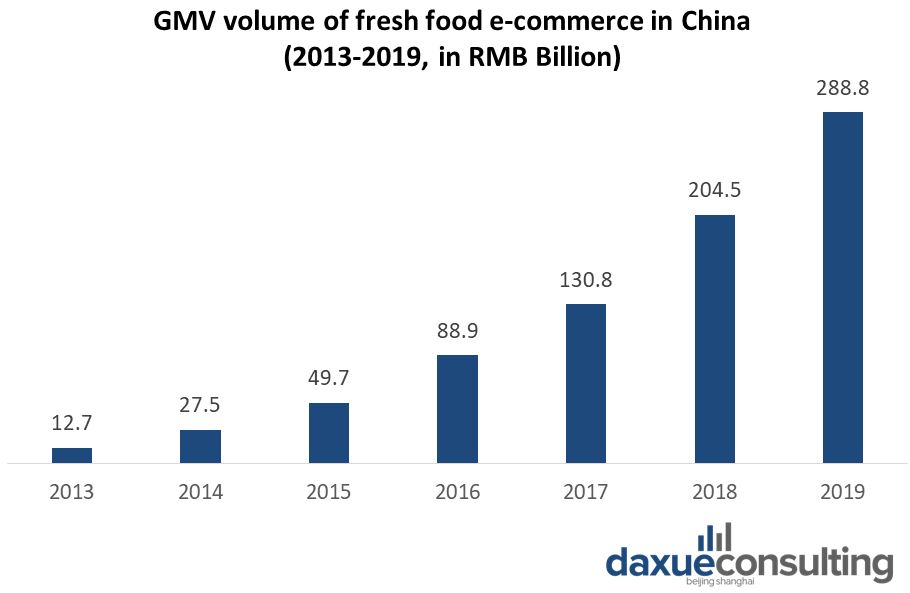

According to research conducted by iResearch, the e-commerce market in China will be worth 800 billion RMB by 2023 with the market’s revenue having a CAGR of 19.87% from 2017-2021. In 2019 the e commerce accounted for 23% of retail market and is expected to grow to 27% by 2021.

However, growth has been slowing down over the years and while the health food market in China will continue to grow, brands need to understand consumer needs across a vast China with different tier cities which consists with people of different lifestyles. Additionally, brands need to make sure that they clarify the benefits of their products and not make exaggerated claims that may lead to stricter regulation on the industry.

Data source: Gross merchandise volume of fresh food e-commerce experienced a constant increase and has become a rapidly developing e-commerce sector in China.

Fresh food business experiences a surge

As COVID-19 forced Chinese consumers to buy healthy and fresh foods online, JD’s fresh food business experienced an 800% increase in sales in 2020 during the first hour of their 618-grand promotion. Initially, the brand expected this trend to only stay until severe lockdown measures prevailed, however, now JD expects the trend of buying healthy fresh foods online to continue post COVID-19 lockdowns.

In an interview with Food-Navigator-Asia Carol Fung, president of JD FMCG omnichannel mentioned that during the peak of the pandemic the company experienced its fresh meat and vegetables sales exceed by 400% and 450% year on year.

However, since the trend to purchase healthy fresh foods has continued JD has managed to grow their customer base by 100%.

During the pandemic contactless payments increased exponentially among all sections of the population. China, a country that is already a mobile first nation where mobile payments through Alipay and WeChat have become the main means of payment paved the way for online fresh food and food delivery. While the online consumption for products grew because of the pandemic, fresh food sales has been a big hit among consumers. A research conducted by Questmobile showed that that during the Chinese New year of 2020, while Chinese consumers were in lockdown, the fresh food e commerce sector experienced a staggering 10+ million users daily compared to 5 million over the same period from the year before.

Sales channels in the fresh food market

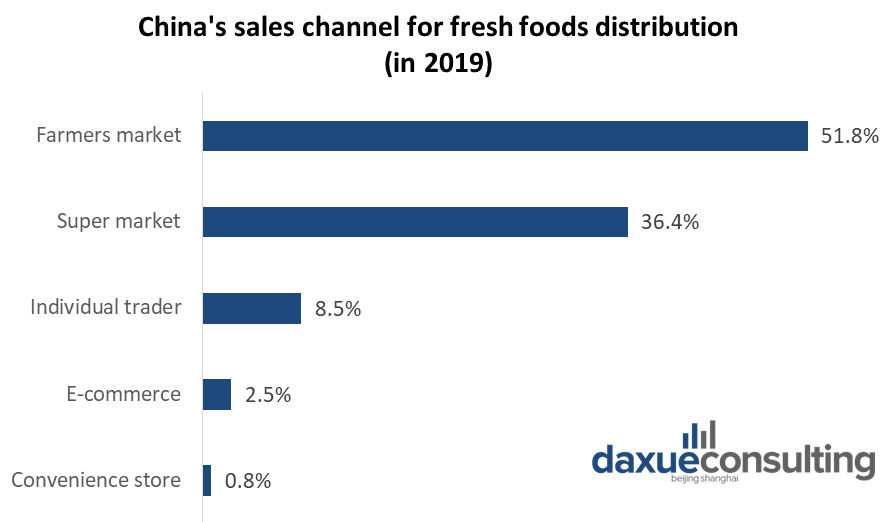

Chinese consumers are now buying fresh foods across two channels. Despite the surge in fresh food e commerce channels, traditional channels such as supermarkets and the farmers market remain as the main source of distribution channels and venue for where Chinese consumers buy their fresh foods.

A Research conducted by Deloitte indicates that farmers markets produce contribute to more than half of the fresh food produce on Chinese family’s dinner tables. The traditional supermarkets accounted for the second largest distribution channel for Chinese consumers to buy their fresh foods. The supermarkets accounted for 36.4% of the total fresh food market. The increased growth in supermarkets is a result of some government initiatives like “Vegetable Basket” which helps complete a transition from farmers markets to supermarkets.

Data source: data.iiMedia.cn. Deloitte Research: Farmers markets and supermarkets still dominate the fresh food market in China for now. E commerce is catching up and disrupting the industry.

The other main channel for sales and one that is growing rapidly for fresh foods has been e commerce companies selling fresh foods. Powered by the internet and coupled with the accelerated usage of apps during the pandemic these innovative fresh food business models show a positive and promising trajectory for growth. The e commerce sales channels are further spread out through various sales concepts such as warehousing, the online-offline e commerce that is coupled with supermarkets.

Despite e commerce accounting for just 2.5% of the fresh food market in China, it is expected to grow as consumers shift their buying behaviour not only in adjustment with the pandemic but also the convenience factor that e commerce shopping provides. According to Sootoo research the penetration rate of the fresh food e commerce market grew from 3.1% in 2015 to 14.8% by the end of 2019.

Sales distribution channels for the organic food market in China

A growing health awareness in China is rapidly increasing the interest in Chinese consumers to purchase organic food products. This has directly benefited a booming sports and fitness market in China as well as the health food market. In China, the organic food market in particular has opened an array of opportunities for local and foreign brands that produce foods through organic methodologies compared to conventional agricultural methodologies. The organic food market in China is estimated to be worth a staggering $US 13 billion by the end of 2024.

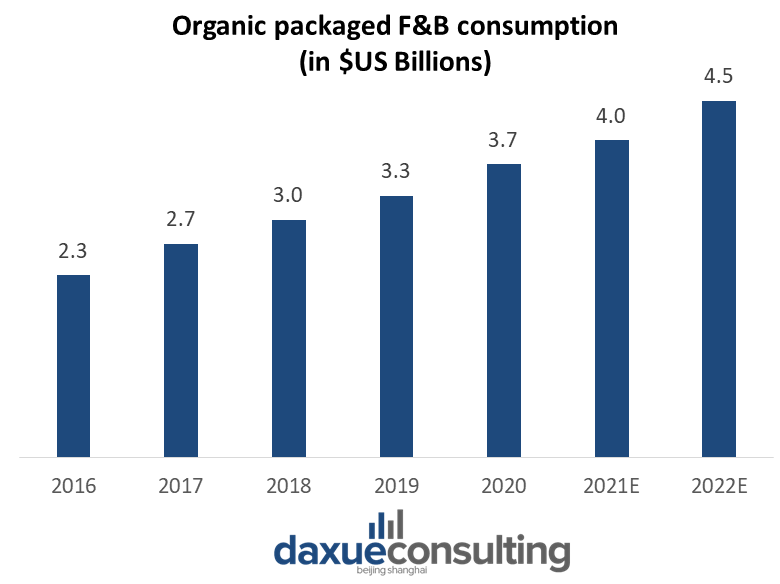

Data source: Global organic trade guide; CAGR for 2016-19 was 12.6% and CAGR estimate for 2020-2022 is 10.2%

Main distribution channels in the organic food market

There are several distribution channels in the organic food market such as, hypermarkets, supermarkets, grocery retailers, small grocers, and e commerce retailing. The hyper markets and supermarkets dominate the organic food market in China, while COVID-19 accelerated the e commerce sector which is fast catching up. As the proposed “Vegetable Basket” initiation from the Chinese government aims to phase out farmer markets, farmers are increasingly selling their produce directly through the online to offline markets. Both farmers and supermarkets are benefiting from this. As Chinese consumers grow more conscious and aware of food quality posting organic certified status through quality assurance tests have assured farmers to sell a high level of produce individually as well as online markets.

Data source: A screenshot of certified organic food stickers which is increasingly being used to certify organic and health food distribution in China

Social media influence O2O channels

The use of WeChat, Douyin has created a whole new dynamic for farmers. For instance, organic farmers who regularly post photos and videos of the process of planting seeds, growing vegetables, farm animals running around and produce growing in a pesticide free environment. This social connection has enabled consumers to feel closer to the farm. This has led farmers to sell not only at locations in the city but also distribute a huge amount of their produce through delivery companies to fulfill rising orders. Through the regular posting on social media some organic farmers have become online celebrities.

COVID-19 lockdown protocols have propelled local farmers accelerate an online transition and as of March 2020, 60,000 farmers had registered to use Taobao Live, which is a livestreaming feature of Alibaba.

In an initiative led by the Ministry of Agriculture and Rural Affairs of China, livestreaming has been seen as an innovative approach to expand the sales channels of fresh and healthy foods in China. Since this initiative was launched in March 2020, selling of agricultural products has witnessed a positive upward trend with experts estimating that 2020 would record as much as 15 billion RMB in sales.

Key takeaways for health food distribution in China

Health food distributions in China is experiencing a fresh and renewed wave of creativity and innovation with e commerce and live streaming propelling sales, consumer behavior and adding a creating a paradigm shift in health food products are marketed and sold.

After successfully managing to keep COVID-19 cases at bay, Chinese consumers thirst for healthy eating is driving the organic food market in China, both online and offline. E commerce platforms are enabling Chinese consumers to directly get in touch with farmers through their online video marketing and creating a whole new experience of buying healthy foods.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s digital ecosystem, see our report on WeChat mini-programs

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast