Health supplement consumption trends in China are evolving rapidly, unlocking massive demand and reshaping the wellness landscape. From 2018 to 2023, China’s health supplement market achieved a CAGR of 6.9%.

In 2023, the market size of health supplements in China reached RMB 387.9 billion, marking a year-on-year increase of 29.8% – a surge reflecting post-pandemic recovery and driven by rising health awareness. It is projected that by 2028, the market size will reach RMB 506.7 billion.

Download our China F&B White Paper

What’s hot: The products dominating wellness carts

Among emerging products, collagen peptides, enzyme drinks, and instant probiotic sachets are gaining widespread popularity during events such as Tmall’s Double 11 in 2023. The popularity supports the strong projected CAGRs of categories including probiotics (16%), oral beauty (10%), and weight management (7%) in the five years to come. This surge also reflects rising disposable income, as consumers become increasingly willing to pay for aesthetics and convenience.

Meanwhile, fish oil, CoQ10, calcium, and glucosamine continue to anchor demand among older adults and fatigued professionals. Fish oil, particularly high-Omega-3 and prescription-grade EPA products, dominates the cardiovascular segment by consumer preference, while CoQ10 is increasingly favored for post-pandemic recovery, heart health, and anti-fatigue, especially in new formats like gummies.

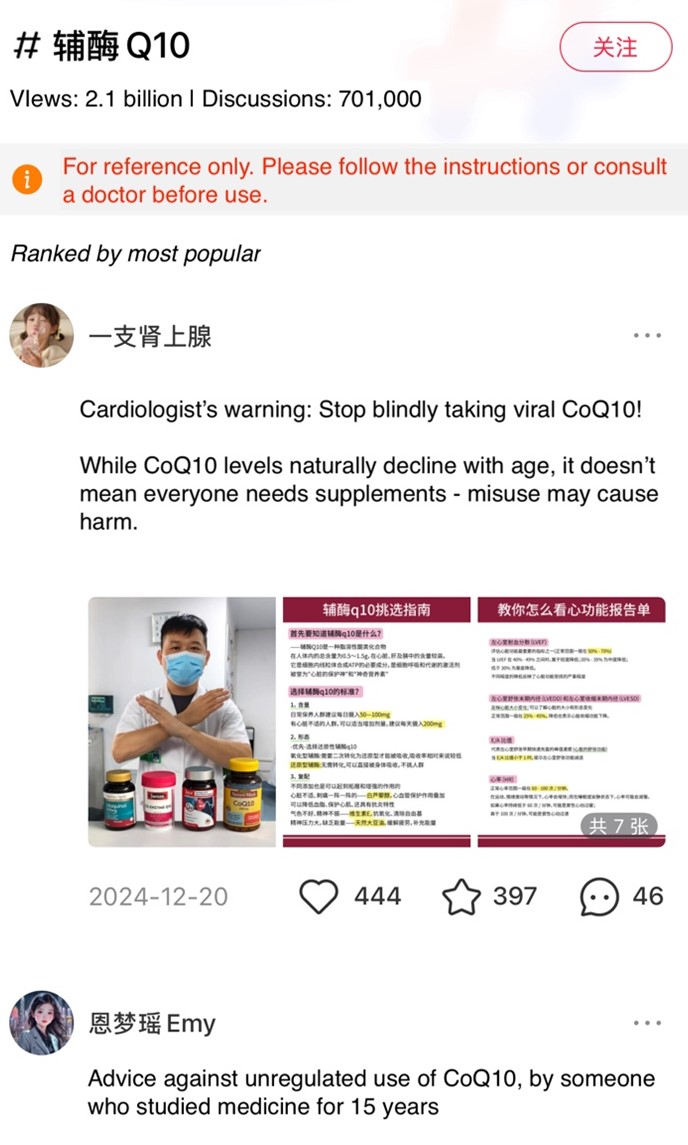

CoQ10’s popularity is also reflected in social media trends. On XHS, the topic “Coenzyme Q10” (辅酶Q10) has garnered 210 million views and almost 700,000 discussions. Many top posts are cautionary, advising against blindly following trends or self-medicating. The trend suggests that its widespread use may have sparked concerns over misuse or side effects.

Take and go: Effortless health for a fast-paced generation

Young consumers prefer convenient “on-the-go” supplements for busy lifestyles. Low-effort solutions, such as oral supplements, are increasingly popular for delivering perceived health benefits with minimal time and effort.

This preference for low-effort wellness reflects broader health supplement consumption trends in China, particularly among post-90s and post-00s, who struggle with late nights, high stress, and poor sleep. According to Tmall Health data from 2023, post-90s accounted for 30% of CoQ10 sales and 45% of liver supplement sales, with 15% of liver supplement orders placed during late-night hours. This highlights the direct connection between consumption behaviors and real-time health concerns.

Meanwhile, the market is diversifying beyond traditional vitamins, with new sub-segments gaining traction. For example, according to CBNData, over 50% of post-90s self-reported hair loss or weakened eyesight, while around 40% experience obesity or reduced physical ability, driving demand for products for hair loss prevention, vision protection, and gut health.

Silver spenders: Older adults are choosing smarter, not just cheaper

The rapidly aging population represents a defining force behind health supplement consumption trends in China. As of 2024, 22.0% of the population is aged 60 and above, a figure projected to exceed 50% by 2080, positioning seniors as a core consumer group.

To support this demographic shift, the State Council issued “Opinions on Developing the Silver Economy” in January 2024. The government circular encourages the development of nutrition products tailored to older adults’ chewing, swallowing, and dietary needs, reflecting growing health awareness among senior consumers.

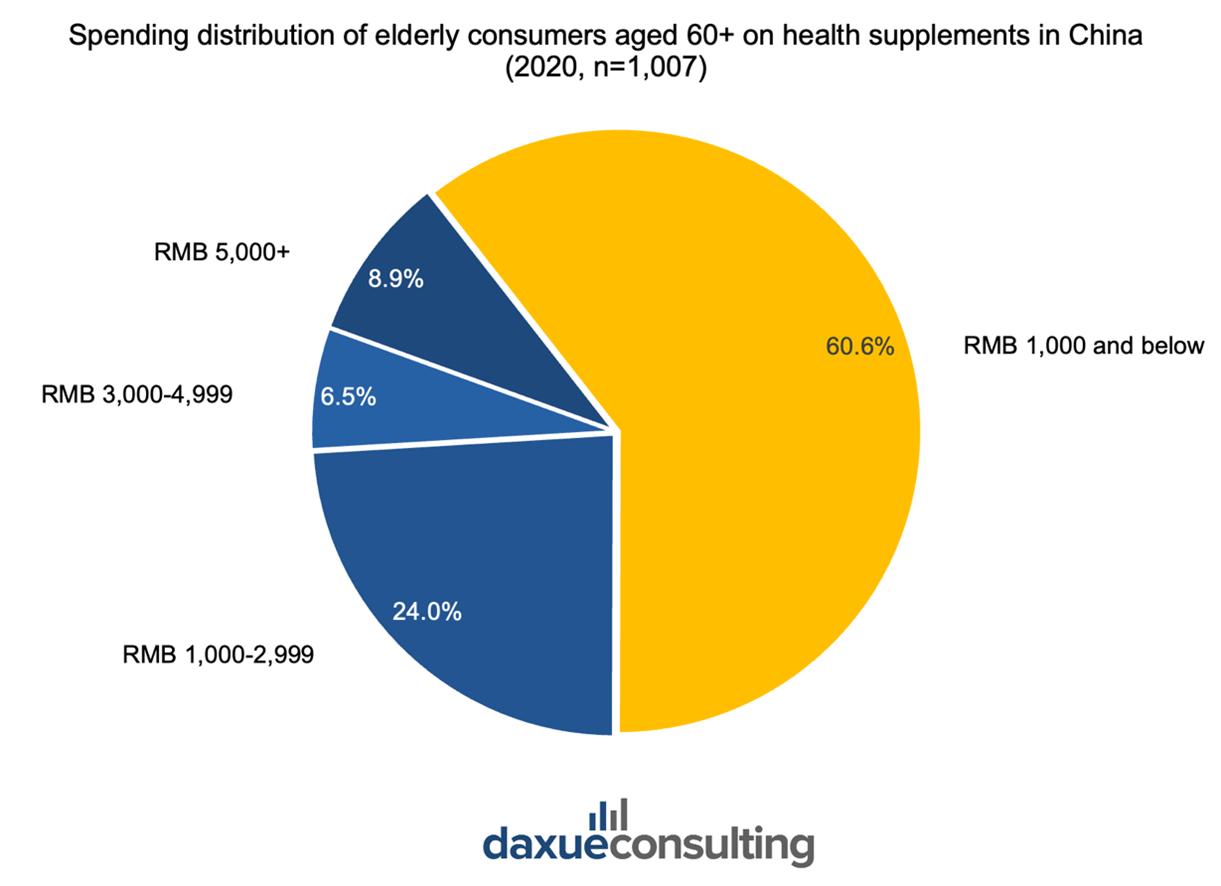

According to a national survey published in October 2024, 16.6% of seniors use supplements, with 60.6% spending less than RMB 1,000 annually, underscoring strong price sensitivity or income limitations within this group.

Notably, a 2021–2022 survey of 1,007 seniors across three cities found that 71.5% make supplement purchases independently. This autonomy indicates active research and evaluation, often seeking out options that balance quality with affordability.

As such, the price sensitivity observed is not merely a reflection of financial constraint but also of informed decision-making, where cost-effectiveness becomes a key consideration. Pharmacies (72.3%), hospital pharmacies (37.1%), and shopping malls (12.7%) remain the most trusted channels. This is likely due to their perceived reliability and transparency in pricing.

However, e-commerce may represent an underexplored opportunity. It offers lower pricing, greater product variety, and enhanced convenience for older adults. Combined with their preference for making independent choices, the ability to browse and compare online may position e-commerce platforms as a viable growth channel, provided trust and accessibility are addressed.

Purchase triggers: What Chinese consumers care about most

During 2024, categories like digestive health and growth-focused products such as liquid calcium, DHA, and probiotics experienced double-digit to 100% year-on-year growth on Tmall. Responding accordingly, Tmall Health announced a multi-billion RMB investment in seven high-potential tracks for 2025. This includes vitamins, calcium-iron-zinc, fish oil, children’s vision health, sports nutrition, digestive health, and immune-supporting protein powders.

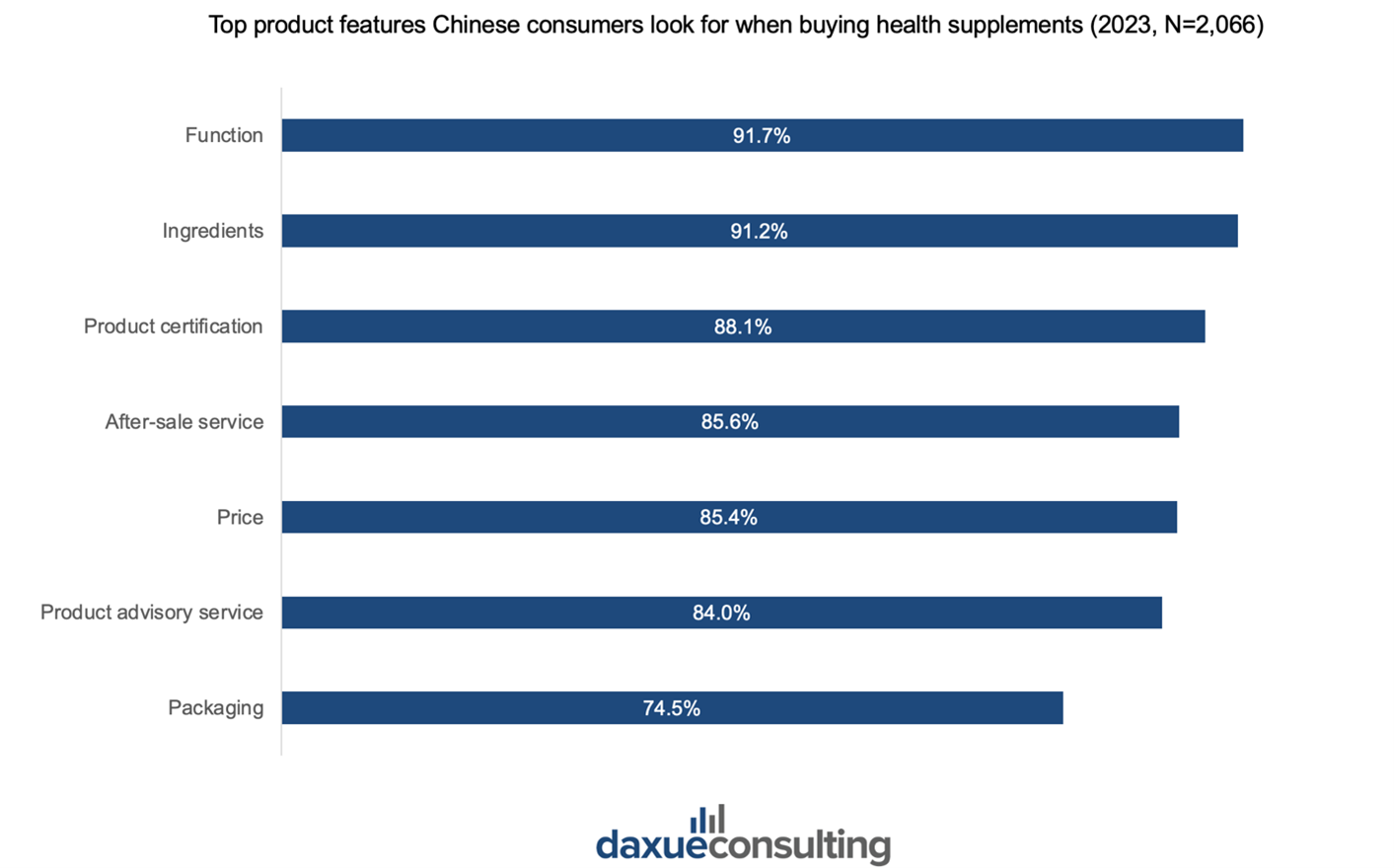

When purchasing health supplements, Chinese consumers prioritize function, focusing on specific goals like immunity or fatigue relief. Ingredients are nearly as important, with a strong preference for safe, natural, and additive-free formulations. Other factors, including product certification — such as licenses and regulatory labels – also play a key role in shaping consumers’ purchasing decisions.

While KOL (key opinion leader) marketing has broadened the landscape of health-related information, the credibility of influencer voices varies widely, with exaggerated claims often drawing skepticism from increasingly savvy consumers. In this climate, professional endorsements – particularly those from doctors – are regaining trust and influence among Chinese consumers.

Trust over trends: Why doctor endorsements outperform KOLs in China’s supplement market

McKinsey’s latest Future of Wellness survey, which covered over 5,000 consumers across China, the UK, and the US, explores the shifting trends in the wellness market. As consumers grow more skeptical of “healthwashing,” professional endorsements are regaining influence. While doctor recommendations rank third in driving supplement purchases in the US, they are the top influence in China, particularly for categories like mental wellness, sleep support, and overall health regulation. This highlights the opportunity for brands to collaborate with healthcare professionals to build long-term trust.

Other major factors shaping Chinese consumers’ choices include in-store displays, family and friend recommendations, social media ads, and online reviews. These evolving decision drivers reflect broader health supplement consumption trends in China, with consumers becoming increasingly discerning and function-focused.

In China, doctor recommendations are the most influential factor in health supplement purchase decisions, especially in areas like mental wellness, sleep support, and overall health regulation. This suggests that collaboration with healthcare professionals may serve as a powerful strategy to build long-term consumer trust. These evolving decision drivers reflect deeper supplement consumption trends in China, where consumers are becoming more discerning and function-focused.

What are “Blue Hats”? Navigating China’s strict health supplement regulations

China has established a strict regulatory framework for health supplements to ensure their safety, efficacy, and quality. These health supplements, commonly known as the “Blue Hats” (蓝帽子), must display the standardized logo prominently on the packaging to ease customer identification. Approved products receive a Health Supplement Registration Certificate, valid for five years.

Health food claims are tightly controlled and related enterprises need to select among 24 approved functional categories that align with their products from the directory. Any disease-related claims, such as “cure”, “success rate”, are strictly prohibited. In addition, labels must include the disclaimer: “This product cannot replace medicine”.

Directory of health functions available to be claimed by health supplements

Cognitive & Energy Support

- Improves memory

- Improves sleep

- Enhances hypoxia tolerance

- Alleviates physical fatigue

Immunity & Internal Protection

- Enhances immunity

- Improves nutritional anemia

- Promotes lead excretion

- Provides auxiliary protective function against radiation hazards

Metabolic & Cardiovascular Support

- Helps lower blood lipids

- Helps lower blood sugar

- Helps lower blood pressure

- Weight loss

Digestive & Liver Support

- Promotes digestion

- Relieves constipation

- Regulates intestinal microbiota

- Provides auxiliary protective function against chemical liver damage

Skin, Beauty & Anti-Aging

- Anti-oxidation

- Improves skin moisture

- Eliminates acne

- Eliminates skin chloasma

Sensory, Bone & Respiratory Care

- Alleviates eye fatigue

- Clears the throat

- Increases bone density

- Provides auxiliary protective function for gastric mucosal damage

Data source: Joint announcement by SAMR, National Health Commission of the People’s Republic of China, and National Administration of Traditional Chinese Medicine

With severe penalties for non-compliance, including fines (RMB 10,000-30,000) and certificate revocation, regulators prioritize consumer protection and market transparency. This balances industry innovation with strict oversight to prevent misleading claims and ensure product reliability.

What are the latest health supplement consumption trends in China

- China’s health supplement market reached RMB 387.9 billion in 2023, and is projected to reach RMB 506.7 billion by 2028.

- While Gen Z and Millennials crave convenience, seniors prioritize value and credibility, being both price-sensitive and independent.

- Hot categories include probiotics, oral beauty, gut health, and post-pandemic recovery, such as CoQ10.

- Function, ingredients, and certification matter most to buyers. Meanwhile, doctor recommendations beat KOLs in consumer influence.

- Importantly, “Blue Hat” approval is a must-have for functional claims and market credibility.