It’s no secret that the quality of sleep determines an individual’s health and life quality, yet many Chinese are facing sleep deprivation and sleep problems. CCTV News reported that more than 300 million people in China have sleep disorders. Therefore, there is a considerable sleep tech market demand in China.

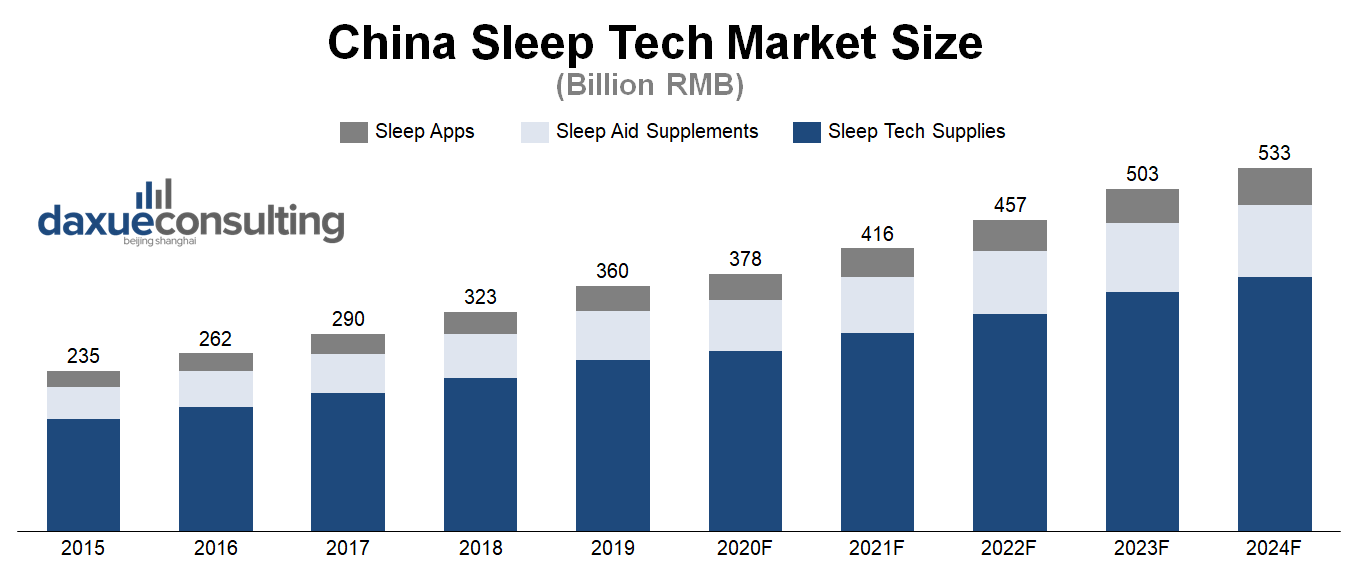

The sleep economy in China refers to the economic phenomenon arising from the need for people to get rid of sleep problems. Due to China’s fast development speed, nowadays Chinese pays close attention to sleep quality as high-quality rest gets harder to come by; there is an increasing number of people suffering from sleep disorders. Technology provides a solution to such disorders, giving rise to the sleep tech market in China. From 2015-2019, the market size (revenue) of the sleep economy in China raised from 235.36 billion RMB to 359.9 billion RMB, with a CAGR of 11.2%.

Data source: LeadLeo, designed by daxue consulting, China Sleep Tech Market Size

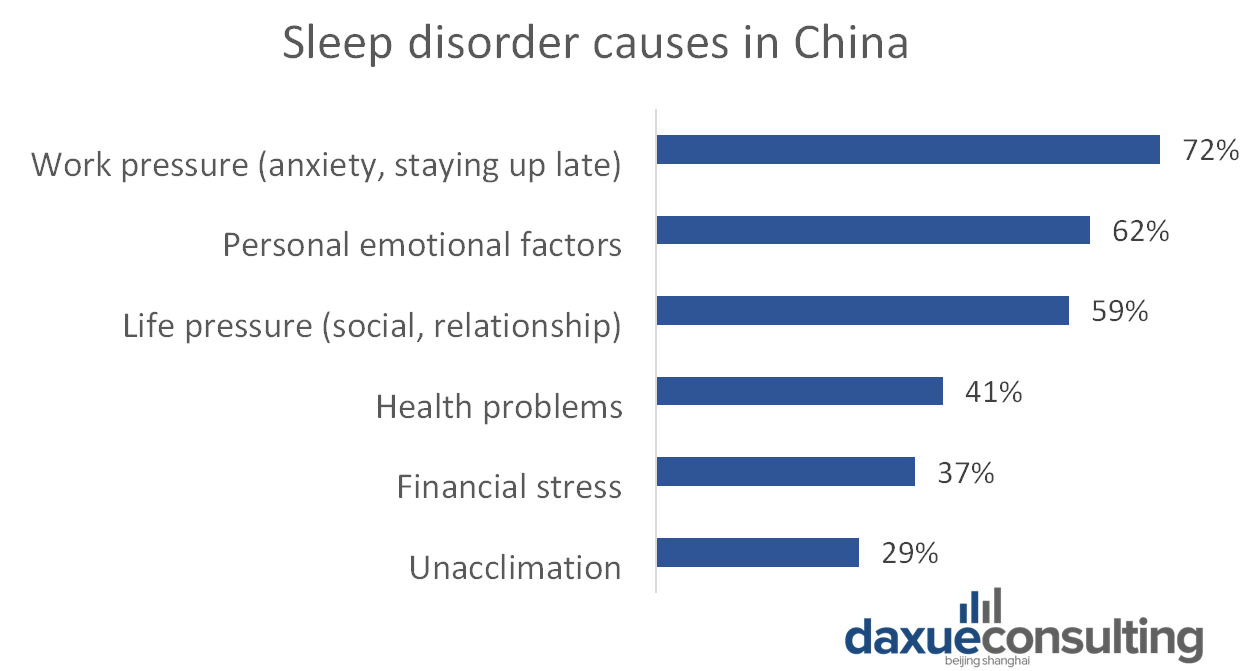

More than 50% of Chinese have reported having sleep problems. A majority of those who suffer from sleep problems such as insomnia were born since 1990. Culprits to sleep loss are, pressures from work, life, and emotional factors. Sleep disorders that the Chinese usually talk about include drowsiness, insomnia, dizziness, continuous light sleep, etc.

Data source: JD Big Data, designed by daxue consulting, reasons causing sleep disorders in China

The sleep tech market in China can be categorized into three submarkets: sleep bedding and tech supplies, sleep aid supplements, sleep aid Apps. According to LeadLeo, the sleep tech supplies market contributes the most in the overall market (around 70%), following by sleep aid supplements by 20% and sleep aid apps by 10%. Here is the market breakdown of these three submarkets.

Sleep tech devices market in China

The global technology giants are constantly deploying sleep technology products, which will be the new track with the most development potential. The sleep tech devices market in China continues to grow Smart bracelets, smart health devices, and smart watches are the three most popular types of sleep aid tech products.

When searching for “sleep” related words on Chinese e-commerce platforms, you can find products like white noise sleep aids, sleep aid lamps, music pillows, sleep detection taps, etc. In addition to a wish of a deep sleep, facing frequent business trips and overtime, young people, especially from the new middle class, also wish to have relaxing fragmented rest. The increasing sales of massage chairs, noise-reducing headphones indicates their need to quickly recover from body and brain fatigue.

Sleep-aid apps in China

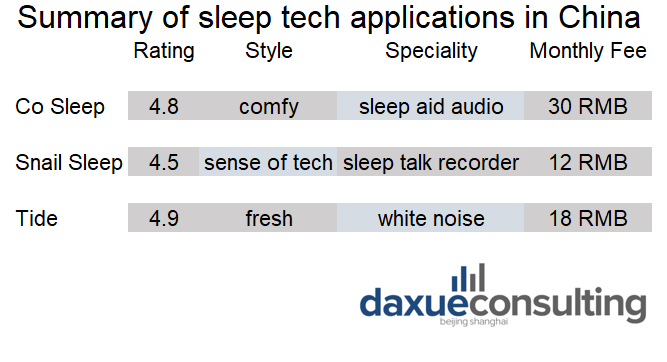

There are various sleep aid applications in China. These sleep aid apps offer services such as white noise, ASMR, relaxing music, sleep aid courses, sleep sound audio, etc. Some apps also add functions like sleep monitoring, sleep talk recording, and sleep analysis. According to Qimai data, among the top 30 most downloaded apps on the Chinese iOS app store within a year, there are five sleep tech apps under the health and fitness category.

The top sleep-aid apps in China

No.4 Huawei Health

Rating: 2.6

Huawei health integrates Huawei wearable products to better provide users with a complete, convenient, and consistent experience. It functions similarly to Apple health. For sleep function. It records users’ sleep time, including deep sleep, light sleep, and awake time.

No. 9 Mi Fit

Rating: 4.7

Dveloped by Xiaomi and similar to Huawei Health, Mi Fit tracks users’ exercise and analyzes users’ sleep and activity data by synchronizing with Mi devices such as Mi Band and Mi Scale. It analyses various factors affecting sleep quality and gives suggestions for improvement.

No.10 Snail Sleep: Dreamtalk recorder

Rating: 4.5

The new version of snail sleep integrates with Apple devices and the Apple health app. It purely functions as a sleep aid app. The app records dream talks and snores and analyzes sleep status. It provides ASMR or sleep music when users are falling asleep. It also has smart alarm clock and e-commerce functions; users can buy other sleep tech devices directly from the app.

No.27 Tide: Sleep, focus, meditation

Rating: 4.9

Tide is an app to help people relax. It aims at physical and mental care through integrating sleep, meditation, and relaxation. The app displays massive relaxing audio, including natural soundscapes and mindfulness practices. It indicates that users can fall asleep with the sounds of nature. Just like other sleep tech app, it also has light wake-up alarms and sleeps analysis.

Co Sleep – White noise

Rating: 4.8

Co sleep is a sleep tech-focused app, which has hundreds of originally designed white noise. Users can edit and combine white noises. Co-Sleep also helps users develop a sleep routine, set bedtime reminders, and provide sleep quality analysis. In addition, Co Sleep has sleep FM; just like the podcast app, people can listen to a piece of story before sleep.

Data source: Zhihu.com, designed by Daxue Consulting, Summary of sleep-aid apps in China

There is no study indicating that sleep apps improve sleep quality, but they monitor sleep activities so users can be aware and make personal corrections. Except for the first two mentioned fitness related apps – Huawei Health and Mi Fit, the leading sleep aid applications includes Snail Sleep (蜗牛睡眠), Co Sleep (小睡眠) and Tide (潮汐). However, such apps often lack adequate means of monetization, and most of them rely on advertising revenue to maintain operations. In addition, the general trend indicates that Chinese consumers demand a transfer from sleep condition monitoring to sleep quality improvement.

Sleep bedding tech

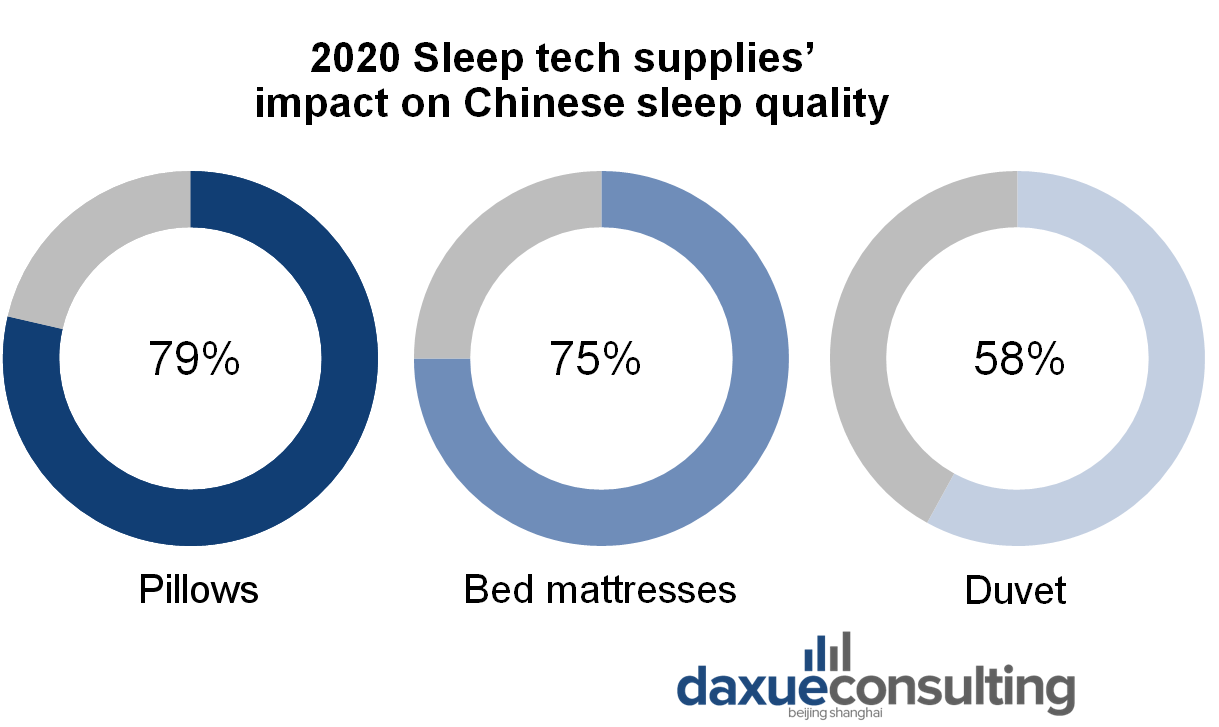

Data source: iResearch, designed by daxue consulting, 2020 Sleep bedding impact on Chinese sleep quality

Sleep bedding and tech supplies include any sleep-related tech equipment includes pillows, mattresses, duvet, and other sleep tech devices. In China, people have more prominent shoulder, neck and waist problems because they are sitting at work all the time. People hope that sleep can relieve physical fatigue, soreness, and other problems, and the pillow directly affects the comfort of the neck during sleep. So, the Chinese pay the most attention to pillows and mattresses.

Memory foam dominates the high-tech pillow market in China

As one of the necessary sleep products, pillows have huge market demand. From 2015 to 2019, the sales volume of pillows in China increased from 2.32 billion to 2.82 billion, and the industry market size (in terms of sales) climbed from 116.19 billion RMB to 141.23 billion RMB.

Memory pillows are the most popular sleep tech product in China. The memory pillow is made of memory foam material, which can slow rebound and form a unique shape according to people’s sleep habits. Compared with ordinary pillows, memory pillows can fit the curve of the human cervical spine more closely, which helps consumers to sleep soundly, relieving spinal pain and detaining shoulder and neck fatigue. From 2015 to 2019, the market size of China’s memory pillow industry rose from 6.68 billion yuan to 11.68 billion yuan, and its market share in the pillow industry gradually increased from 5.7% to 8.3%.

Chinese consumers are still price-sensitive to memory pillows. In the market, the price of best-selling memory pillows is between 50 to 299 RMB. The tech entry barrier of memory pillows is relatively low. At this stage, the memory pillows industry in China is hardly concentrated and highly competitive.

Smart mattresses drive the upgrading of the mattress market in China

China has become the world’s major mattress production and consumption market. In 2019, the demand for mattresses in China reached 44.35 million, with sales of approximately 4.48 billion RMB, a year-on-year increase of 9.4%.

Smart mattress, as a sleep tech product in China, has been favored by consumers. Smart mattresses are designed for human sleep habits and problems, using high-quality and healthy raw materials, combining advanced technology to create mattresses with different levels of softness. Benefiting from the popularity of smart home technology and the increase in per capita income of residents, the market size of China’s smart mattress industry grew from 630 million RMB to 3.23 billion RMB from 2014 to 2018, with a CAGR of 50.5%. According to the JD database, in 2019, the transaction of smart mattresses increased by 96%.

Duvet market in China has room to become high-tech

Only 58.0% of Chinese believe that duvet has a significant influence on sleep quality. The lack of attention to the duvet is mainly due to the insignificant feedback on the body experience of the duvet and the inadequate product marketing, which causes Chinese people to pay less attention to the duvet than pillows and mattresses. These factors lead that the development of duvet tech products falls behind.

The existing quilt technology products in China’s sleep tech market are mainly divided into the following two categories: one is related to human health care products, including anti-mite, anti-virus, far infrared, etc.; the other one is more advanced in textile and manufacturing technology, which fits the needs of the human body, such as wind-proof design, body-fitting design, etc.

Chinese consumers are not price-sensitive to duvet tech products. Instead, they care about whether the tech product can bring real technological effects. The development of duvet tech products is still in the initial stage. According to iResearch report, Chinese people have a low awareness of the concept of quilt technology terms.

Sleep aid supplements

In China, sleep aid supplements refer to nourishments that help to improve sleep quality, such as melatonin, spine date seed, sesamin, etc. China’s sleep aid supplement market continues to increase. From 2014 to 2018, the market size (in terms of sales) increased from 11.21 billion RMB to 12.80 billion RMB, with a CAGR of 3.4%.

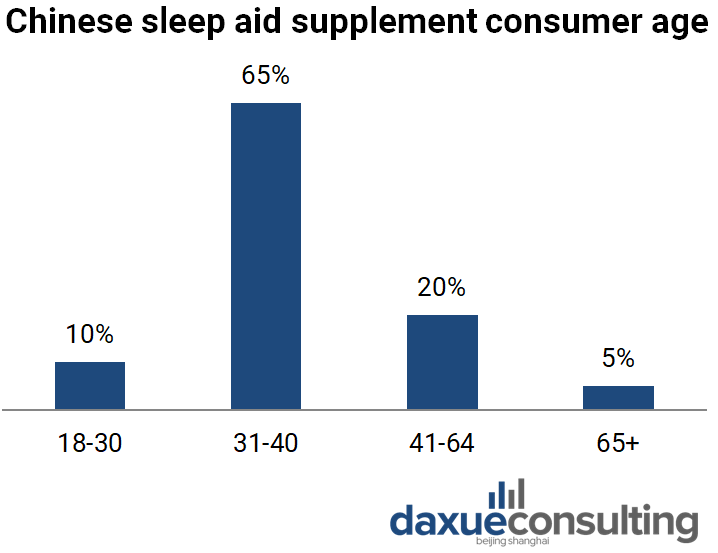

Most of the transactions are concentrated in tier 1 and tier 2 cities. Sleep aid supplements in China can be divided into melatonin and herb supplements such as spine data seed, sesamin, etc. The middle-aged consumers (36-45 years old) holds a conservative opinion towards sleep aid supplement. They believe in the traditional ways to deal with sleep disorders such as drinking milk and foot baths. Thus, they prefer to buy herb sleep aid supplements while young people (26-35 years old) prefer to buy melatonin supplements. In general, 70% of Chinese consumers purchase melatonin products, 30% purchase herb-based sleep aid supplements.

Data source: LeadLeo, designed by daxue consulting, Chinese sleep aid supplement consumers’ age

Takeaways for sleep tech market in China

- Healthy sleep is an urgent need for modern Chinese people, which has given birth to the development of the sleep technology market in China.

- In China, Consumers demand sleep tech products not simply to monitor sleep activities but to effectively see the improvement of sleep quality.

- The sleep tech market in China is a new blue ocean for companies because it is still in the initial stage of exploration. There are still obvious shortcomings in different types of products: severe product homogeneity, low entry barriers, chaotic system.

- As enterprises continue to explore and promote the continuous iteration of products, the pace of development of the sleep economy in China will surely accelerate.

Author: Tong Zhu

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s sleep economy and the mattress market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast