China’s healthcare system is undergoing reforms to improve public hospital operations and integrate advanced technologies. Key changes in 2024 aim to control costs, enhance drug procurement, and open up the medical sector to foreign-owned hospital operations. These changes reflect the government’s efforts to balance rising healthcare demands with fiscal sustainability, all amid China’s rapidly aging population and growing middle class.

Download our China’s samples economy report

China’s healthcare policy: Insights on regulatory shifts, drug procurement, and public health reforms

China’s healthcare market is constantly evolving to provide better access to medical services and integrate more advanced technologies. The National Medical Products Administration (NMPA) is the key regulatory body responsible for approving pharmaceuticals, medical devices, and other healthcare products.

In 2024, the most recent healthcare market reforms include enhancing public healthcare services, improving public hospital operations, and expanding drug procurement. Key measures include deepening medical insurance reforms, improving primary healthcare, and reducing medical costs. The reform also emphasizes medical technology, digital services, and reducing wait times. There are over 5,500 hospitals offering “one-stop” services and online medical options.

In mainland China, 69.2% of hospitals are state-owned public hospitals, and there were 3.56 billion visits to public hospitals in 2023 (83.5% of total hospital visits). Physicians in public hospitals are required to maximize the use of medicines (both local and imported) that are already covered by the National Health Insurance (NHI). Medicines that are under the National Reimbursement Drug List (NRDL) are eligible for reimbursement under NHI. As such, both domestic and foreign pharmaceutical companies are looking to be listed on the National Reimbursement Drug List (NRDL) to expand market access. Meanwhile, under healthcare market reform, the government often uses volume-based procurement (VBP) to negotiate lower prices for drugs.

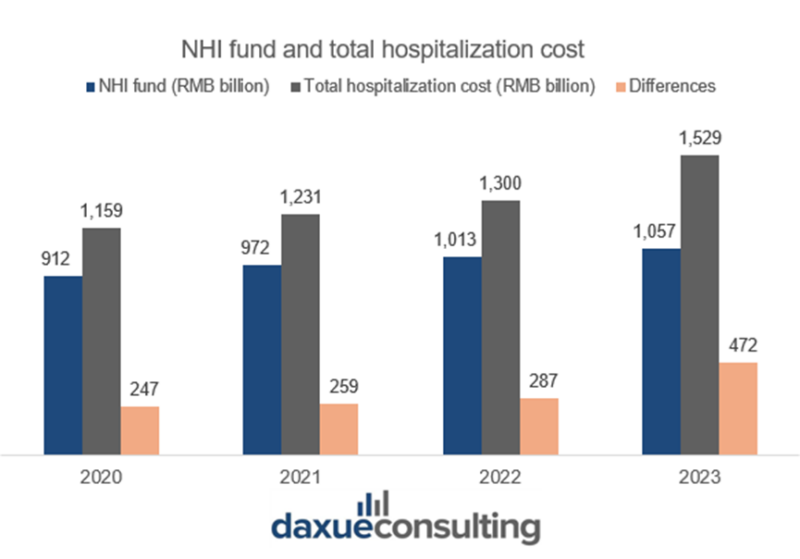

China’s healthcare market: Managing the growing gap between NHI funds and rising hospital cost

As China’s middle class becomes more health-conscious and general living standards improve, private clinics and hospitals are expanding to provide faster and more personalized healthcare services. In China’s healthcare market, private healthcare institutions outnumber public healthcare institutions by number. Up to 69% of all registered healthcare institutions (i.e., private hospitals, clinics, dental care, plastic surgery, dermatological, etc) in China are privately owned.

As most hospital visits are to public institutions, public hospitals are the backbone of China’s healthcare system. They accounted for over 70% of all health spending in China. Physicians in public hospitals are required to use medicines (both local and imported) that are covered by the National Health Insurance (NHI). That means the NHI fund is responsible for a large portion of health expenditures.

While the NHI fund (blue) is also growing, it is not growing as fast as hospitalization costs (dark gray). As the gap between the two widens, the NHI fund is under more pressure and may even run out of money. Since the NHI only covers a portion of medical costs (for example, it reimburses 70% of the cost of foreign drugs), the NHI fund may not be enough to cover all of the rising hospitalization expenses.

The primary driver behind the sharp increase in hospitalization spending is China’s rapidly aging population. From 2010 to 2022, the percentage of the population aged 55 and above grew from 19% to 27%. t is projected to reach 34% by 2030. An older population brings a higher incidence of illness and the prevalence of chronic and severe conditions in this demographic leads to significantly greater healthcare costs. Additionally, unequal access to healthcare in various regions also requires substantial investment in expanding and improving healthcare resources and capabilities, thereby presenting significant cost increases.

China’s emergence as a global healthcare manufacturing powerhouse

Due to its robust supply chain ecosystem and manufacturing capabilities, China has become one of the world’s largest healthcare manufacturers. This includes the production of pharmaceuticals, medical devices, medical equipment, and other healthcare-related products.

China is a key global player in generic medicines, including antibiotics, cardiovascular drugs, and cancer treatments. The pharmaceutical market in China includes generics, patented medicines, and over-the-counter (OTC) medications. While generics currently dominate the market, patented drugs are steadily growing as China shifts from being a manufacturing base to a more strategic research and development hub for the pharmaceutical sector.

The medical devices market in China is estimated to reach USD 48.8 billion in 2026. The market is fragmented with over 26,000 manufacturers with the majority producing medical equipment. This was followed by consumables and in-vitro diagnostics devices. Major manufacturing hubs for healthcare products are located in Shanghai, Beijing, Guangzhou, and Shenzhen.

Despite being one of the largest medical device manufacturing hubs globally, China imports advanced medical technologies and high-end pharmaceuticals. The top three countries from which China imported medical instruments are the United States, Germany, and Japan. To reduce this dependence, as part of the “Made in China 2025” initiative, the Chinese government is focusing on self-sufficiency and lowering reliance on foreign imports. Local production capabilities in high-tech sectors like pharmaceuticals, medical devices, and biotech are ramped up. The goal is to strengthen domestic industries and foster innovation. As such, China can take a larger share of the global market, particularly in the pharmaceutical and medical device sectors.

One area seeing notable progress is the production of traditional Chinese medicine (TCM), which has both domestic and international growth potential. Additionally, domestic pharmaceutical companies are making advancements in areas such as diabetes treatments, with new drug innovations gradually reshaping the market. As China’s healthcare infrastructure improves and local production increases, the country is moving towards greater self-reliance. Chinese government aimed to have local manufacturing to dominate in medical technologies within the next decade.

R&D in Chinese healthcare: From generic medicine to medical innovation

From being a global hub for generic medicine, China’s healthcare market is rapidly evolving into a center for medical research and development. Since 2019, the Chinese government has streamlined the regulatory approval process for drugs. This has led to a substantial increase in investigational new drug (IND) applications—from 688 in 2019 to 2,298 in 2023. Among these, chemical drugs account for the largest proportion. There is a strong focus on oncology, neurology, dermatology, and circulatory system diseases.

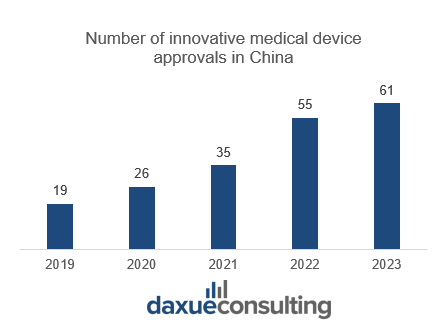

At the same time, the government has reformed the volume-based procurement of high-value medical consumables, accelerating its scope. Items such as coronary stents, orthopedic consumables, and artificial lenses are now purchased in bulk by the state. This was aimed to save costs and reduce pressure on medical insurance funds. In addition, the government has been encouraging innovation in the medical devices sector. Priority approval is granted to medical equipment with invention patents or that demonstrate significant clinical application value.

With the rise of precision medicine, AI, and robotics, Chinese companies are making significant strides in developing advanced medical devices and diagnostic tools. The government also provided a green channel for innovative medical devices. In 2023, up to 61 innovative medical devices are approved for listing. This is the largest number of innovative products approved in recent years.

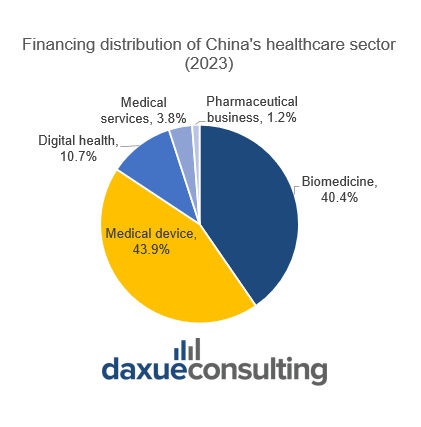

Healthcare capital access: Rise of domestic funding and shifting investment preferences

Capital for R&D in China’s healthcare market primarily comes from government initiatives, venture capital, and large pharmaceutical companies. The major government agencies are the Ministry of Science and Technology, the National Natural Science Foundation of China, and local government agencies. The funding by the government is usually given out through grants, subsidies, or tax breaks. In 2023, the most active representatives of government-led funds. For instance, Jiangsu High-tech Venture Capital Group, Huajin Capital, Yuexiu Industrial Fund, and Nanjing Innovation Investment Group.

Meanwhile, private investors in healthcare are primarily done through venture capital investment or increased R&D spending through pharmaceutical companies. The top sectors that receive the funding are medical devices, biomedicine, and digital health. According to SPD Silicon Valley Bank, the most active private institutions are Qiming Venture Partners (9 cases), Dalton Venture (9 cases), and Legend Capital (8 cases).

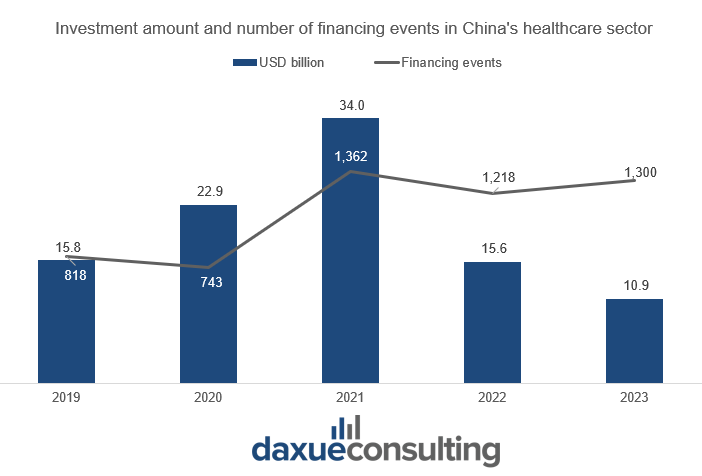

However, there has been a sharp drop in the amount of investment in China’s healthcare market since 2022. According to SPD Silicon Valley Bank, the proportion of foreign investment has dropped to about 12% in 2023. It was due to the uncertainty in exit strategies for medical companies driven by factors like the performance of Hong Kong-listed stocks and changes to the STAR Market’s listing standards. Additionally, some USD funds have shifted their investments towards Southeast Asia and North America. Foreign capital sought greater certainty from new projects, which led to less frequent investment in new opportunities.

Consequently, domestic RMB funds now dominate the market’s financing, replacing USD-based investments. Additionally, financing rounds are shifting to later stages. Investors prefer mature targets with proven track records and clearer growth potential.

While the number of financing events has increased, the overall investment amounts have decreased. This indicates that healthcare investors have become more conservative in recent years, preferring to diversify their portfolios.

What to know about China’s healthcare market:

- China is reforming its healthcare system, focusing on public hospital efficiency, drug procurement, and expanding medical insurance. Digital services and cost reductions are also regarded as priorities.

- China is a global leader in healthcare manufacturing, with the government aiming for greater self-sufficiency in high-tech sectors through initiatives like “Made in China 2025.”

- China’s healthcare R&D sector is transitioning from generics to innovation. There was a significant growth in new drug applications and a focus on advanced treatments in oncology and neurology.

- Domestic funding now dominates China’s healthcare sector. A shift toward later-stage investments and a more cautious approach amid economic challenges occurred.