As of March 2022, the Chinese government released the country’s first-ever long-term plan for hydrogen vehicles. By 2025, the government aims to have 50,000 hydrogen fuel-cell vehicles on the road, more than 6 times the existing units of 8,000 in 2020. The gap in the market and the explicit support from the government for the industry are making hydrogen vehicles the next hot topic of development in China.

With both hydrogen fuel-cell vehicles and pure electric vehicles (EVs) being the key development areas in China, how do hydrogen-powered vehicles stack up against EVs in terms of sustainability, efficiency, and useability?

Hydrogen cars vs electric vehicles: Which one is more sustainable?

Fuel cells in hydrogen vehicles use hydrogen gas as a source of fuel, generating electricity through a chemical reaction to power the vehicle. Unlike conventional petrol vehicles that emit carbon dioxide, hydrogen vehicles are “zero-emission”, which release water and heat.

Hydrogen gas can be produced in a clean manner through the electrolysis of water, but this process is very energy-intensive and expensive. Much of the world’s hydrogen gas is also derived from natural gas reformation, which produces harmful carbon dioxide and carbon monoxide in the process. Hydrogen production has received criticism for being inefficient since energy needs to be used twice: once when producing hydrogen gas, and again when it is used in the vehicle.

On the other hand, EVs obtain electricity directly from the electricity grid, storing it as a source of fuel in rechargeable batteries. Like hydrogen vehicles, EVs are also zero-emission. However, electricity grids in most parts of the world are still powered by fossil fuels such as coal or oil, meaning EVs still have a carbon footprint. Furthermore, lithium-ion batteries have a limited lifespan and need to be replaced when they run their course.

Today, both hydrogen vehicles and EVs are not fully zero-emission due to the production of hydrogen gas and electricity generation. However, by producing hydrogen gas and generating electricity through renewable energy sources, both hydrogen vehicles and EVs have the potential to become fully zero-emission.

While the energy-intensive hydrogen gas production process makes EVs more accessible for now, support from the government can ease the push toward hydrogen vehicles in China.

Hydrogen cars vs electric vehicles: Which one has a better fuel efficiency?

Hydrogen vehicles are able to achieve longer distances than EVs due to their energy storage being more condensed. While most EVs can travel between 100-200 miles on a single charge, hydrogen ones can get up to 300 miles, making hydrogen vehicles more attractive in this area.

The amount of time it takes to pump hydrogen into the tank is also much shorter than EVs. A hydrogen car may take 5 to 10 minutes to refuel, like any conventional petrol car. In contrast, EVs may take hours to recharge, like the BMW i3 which takes up to 4 hours, or the Nissan Leaf which takes about 8 hours to get fully charged.

In addition, hydrogen vehicles have longer driving ranges and are faster to refuel simply because 1kg of hydrogen gas stores 236 times more energy than 1kg of lithium-ion batteries.

However, although EVs hold less “fuel” and take longer to recharge, the existing infrastructure for EVs, such as powering stations far outstrips the existing infrastructure for hydrogen vehicles, making EVs generally more attractive and accessible to consumers.

The hydrogen vehicle market in China

Unlike the EV market, the hydrogen-powered vehicle market is still in its infancy.

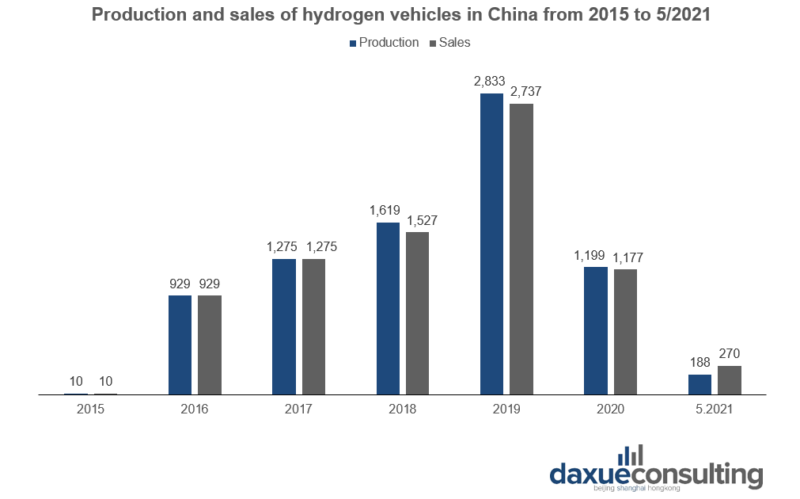

In China, 1,586 hydrogen vehicles were sold in 2021, with 17,000 such vehicles sold worldwide. The same period coincided with explosive growth for EVs in China: there were 1.11 million EVs sold, an increase of 14.75% year-on-year, 1,000 times more than hydrogen vehicle sales.

Still, China is a leading player – China is the largest hydrogen gas producer in the world, with an annual production output of about 33 million tons. According to the National Development and Reform Commission, by 2025, China is expected to master the core technologies and manufacturing processes. China’s annual hydrogen production output from renewable energy is also expected to reach 100 to 200 thousand metric tons by 2025.

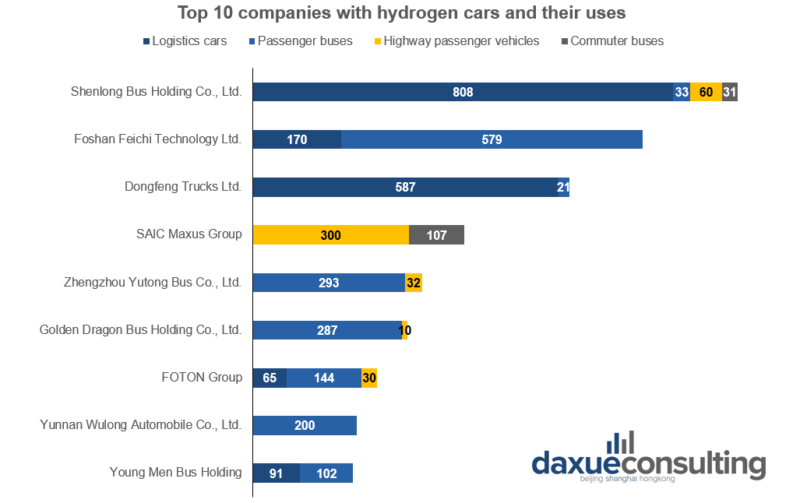

Hydrogen vehicles in China are currently predominantly used in enterprises for logistics and passenger transportation, such as cold-chain logistic vehicles. The top 10 companies with the most hydrogen vehicles already account for over 90% of hydrogen vehicle ownership. Such circumstance indicates that there is a huge gap in the consumer market.

Main players in China’s hydrogen car market

Grove (格罗夫)

Grove is an early mover in the Chinese hydrogen car market. In 2018, the Wuhan-based company launched a hydrogen vehicle that claimed to have an endurance of 1,200km, far more than the battery life of standard EVs. In 2021, Grove introduced a hydrogen-powered heavy truck with an endurance of 1,000km under ideal conditions. At present, it is regarded as one of the most promising hydrogen car companies.

GAC Group (广州集团)

Automaker GAC Group also launched its first hydrogen-powered vehicle, the Aion LX FUEL CELL, at the end of 2020, which can run for over 650km.

SAIC Group (上海汽车集团)

SAIC Group also has its own hydrogen cars. As an established car manufacturer, SAIC Group is one of the brands with the largest variety of hydrogen vehicles, with four hydrogen vehicles in its product portfolio. In addition, the state-owned automaker plans to increase this number to 10 by 2025. To achieve that goal, SAIC has also invested 2 billion RMB to build an industrial chain capable of producing modern hydrogen trucks in Inner Mongolia.

Electric vehicle manufacturers in China

China’s EV market, at 686.2 billion RMB in revenue, far outstrips the hydrogen vehicles market, which had an estimated market size of 12.3 billion RMB in 2021.

There are also about 500 EV manufacturers in China, the highest in the world, making China the leading player in the global Electric Vehicle market. Recently in 2022, Chinese EV manufacturer BYD became the leading EV producer globally by sales, selling 641,000 units in the first 6 months of 2022. Other major EV producers in China include SAIC, NIO, Xpeng, and Li Auto, which all ship tens of thousands of units each.

Hydrogen vehicles also face pressure from foreign EV manufacturers, including EV giant, Tesla, as well as established manufacturers like BMW, Nissan, and Volkswagen.

Issues with EV battery production

The production of lithium-ion batteries may not be environmentally friendly. Lithium-ion battery production in South America uses up large amounts of water, causing devastating water-related conflicts among locals. A whopping 1.9 million liters of water is needed to produce one ton of lithium. Lithium extraction also harms the soil and can cause air contamination.

While lithium-ion batteries can be recycled, this is not a universal practice and there has been little progress in battery recycling in recent years considering the trajectory of the EV market. This will become highly important as more and more lithium-ion batteries come to the end of their lifespans.

The recent Russia-Ukraine conflict has also harmed the production and supply chains of lithium-ion batteries. Lithium, nickel, and cobalt are metals used in EV batteries, and Ukraine’s breakaway regions of Donbas possess abundant lithium reserves. Production in the region has stalled because of the war.

Currently, the use of cobalt may be of even greater concern. Cobalt reserves are concentrated mainly in the politically unstable Democratic Republic of the Congo, and its extraction raises many social, ethical, and environmental concerns, such as child labor. In addition to the environmental need for recycling, there are also ethical concerns with the materials supply chain, creating a greater need for battery recycling and a circular economy.

Incentives from the Chinese government

Incentives for the hydrogen vehicle market

The Chinese government supports the industry with subsidies to enterprises that produce hydrogen cars and contribute to the supply of hydrogen energy. Beginning of 2020, the Chinese government offered several cities 1.5 billion RMB each in subsidies for producing and promoting hydrogen-powered vehicles.

Another 200 million RMB is available to each city for meeting targets related to refueling infrastructure, such as: reaching a certain threshold of total hydrogen gas provided, ensuring carbon emissions are minimized and reducing the cost of hydrogen at the pump.

In 2020, the Chinese government rolled out subsidies to all companies developing hydrogen vehicle technology, even foreign automakers.

In 2021, 35 projects related to fuel cells, fuel-cell vehicles, and hydrogen refueling stations worth a combined 110 billion RMB were launched in China with the support of government subsidies.

Incentives for the EV market

China’s expansive incentive program for EVs has been credited with creating the world’s largest EV market. Beginning in 2009, 100 billion RMB in subsidies have been handed out to EV buyers, including commercial fleet operators up to the end of 2021. The subsidies for EVs from the Chinese government greatly exceeded the subsidies for hydrogen vehicles. There has also been no purchase tax for EVs, although that is set to be increased to 5% by 2023.

However, China will cut subsidies on EVs by 30% this year and will eliminate all subsidies by the end of the year. The end of this close government support for the EV industry will lead to slower growth and is likely to make conditions more difficult for EV startups. However, the end of subsidies may also bring down fragmentation, over-capacity, and low-quality product issues. With fiercer competition in the market, top brands will need to innovate with better quality, performance, safety, and new features.

Despite this, the Chinese government has set in place other stimulus measures to boost the market and achieve its objectives. EVs will still be excluded from vehicle purchase tax until the end of 2022. The government will also prioritize investments in “new infrastructure,” which includes EV charging stations, sustainable energy, and IoT technology, to make EVs more appealing to the ordinary customer.

Challenges in the hydrogen car market in China

Nevertheless, the cost is the main reason as to why hydrogen cars have such a low share. From the upstream supply chain (hydrogen production and transportation) to the downstream supply chain (hydrogen stations and refueling), all aspects of the hydrogen industry require a cost reduction.

Hydrogen energy can be divided into three categories based on its production:

- Grey Hydrogen: Hydrogen produced from fossil fuels, such as natural gas, which causes pollution in the form of carbon emissions;

- Blue Hydrogen: Hydrogen made from fossil fuel, but with efficient means of capturing and sequestering the carbon emissions in the process;

- Green Hydrogen: Green hydrogen refers to hydrogen energy that is completely clean. Hydrogen is separated from water by electrolysis through utilizing renewable energy, such as wind power and hydropower.

The production of green hydrogen

China’s current production of hydrogen is mainly grey hydrogen and blue hydrogen. However, such production tends to cause high treatment costs and is not consistent with the intention of becoming a zero net emitter by 2060. Therefore, an affordable production, transportation, and storage solution of green hydrogen is essential for the development of hydrogen vehicles in China.

However, there is no mature green hydrogen production industry chain in the world, including China, which leads to a high cost of producing green hydrogen. According to Zeng Tao, the Chief New Energy Analyst of CICC, compared with the cost of grey hydrogen (7-8 RMB per kilogram), the cost of green hydrogen (20 RMB per kilogram), is obviously not competitive.

Transportation and storage of hydrogen in China

The transportation and storage of hydrogen in China are also very costly, and there is still a relatively large gap in technology with Western countries.

Using tubetrailer to transport gas and hydrogen is the most common means to transport hydrogen over a short distance. At present, the pressure of the gas storage tank used in China is 20MPa, which is lower than the foreign standard of 50MPa. As a result, tubetrailer in China can only deliver a small amount of hydrogen each time, so it will incur huge logistics costs to meet a large amount of hydrogen demand in the future.

Converting hydrogen to liquid hydrogen and utilizing a liquid truck for transport can significantly increase the amount of hydrogen in a single transport, but maintaining the hydrogen at a liquid state requires a temperature of -252.8 °C, which tend to create significant energy costs.

Although transporting hydrogen through pipelines can avoid the disadvantages of the above two methods, the construction of pipelines requires a large amount of initial investment, which is obviously unrealistic in the current situation of weak profitability of hydrogen energy enterprises.

Hydrogen stations and refueling

A hydrogen station that can supply 500 kilograms of hydrogen a day requires an initial investment of 7-12 billion RMB, about three times as much as a regular gas station. In addition, because of the property of hydrogen, the maintenance and operation costs of a hydrogen station are higher than those of a gas station.

Key takeaways of the hydrogen vehicles market in China

- The Chinese government is committed to helping the industry reach its long-term development goals for hydrogen vehicles.

- Hydrogen vehicles are powered by hydrogen gas, which is energy-intensive and expensive to produce when compared to electricity.

- Both EVs and hydrogen vehicles are zero-emission by themselves, but the production of electricity and hydrogen may release harmful emissions.

- Renewable energy is key to further reducing the carbon footprint of both EVs and hydrogen vehicles.

- Hydrogen vehicles have longer ranges and recharge faster than EVs.

- EV batteries face sustainability and ethical issues in their supply chains and production.

- The market for EVs in China dwarfs the hydrogen vehicle market.

- The infrastructure for hydrogen vehicles is underdeveloped compared to the infrastructure for EVs.