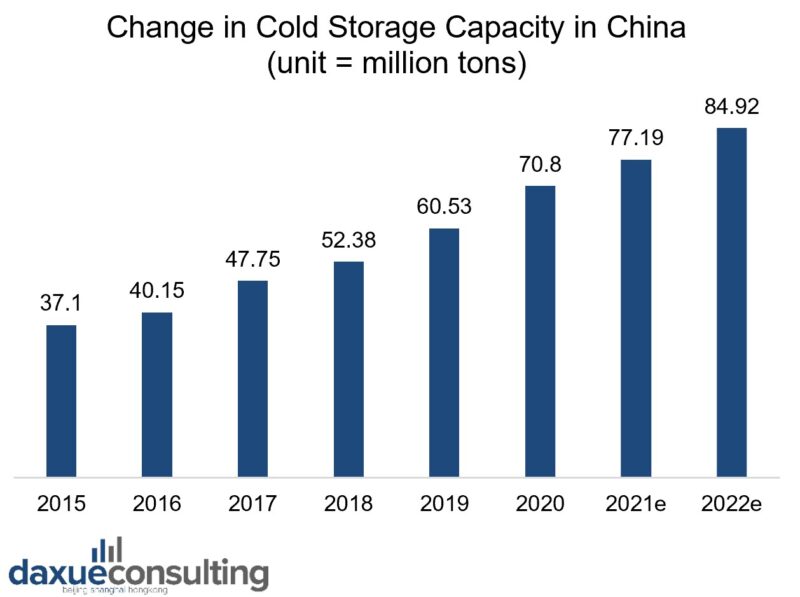

The cold supply chain in China was worth 380 billion yuan in 2020, with double digit growth, and is expected to reach RMB 512.25 billion in 2026. The cold supply maintains the quality and freshness of food and beverage products in transport. Cold chain logistics refers to the pre-cooling treatment, processing, transportation, storage, distribution, sales and other logistics links, with a specific temperature and humidity controlled environment, so as to ensure the safety of the product quality. It is mainly driven by meat, seafood, quick-frozen food, produce and dairy industries in China. Since 2015, China’s cold supply chain has been growing by more than 15% annually.

On the eve of reform, China’s food consumption was based on rations. The era of opening up allowed for an explosion of agricultural technology and productivity followed by a wide range of food choices. Today’s food consumption is rich, increasing both in quality and diversity, with fresh food products satisfying a massive demand. Every year, China consumes more than 300 million tons of fresh food products. In 2020, the fresh food retail market hit five trillion yuan.

Supply for cold supply chain logistics has not met demand

Given the rapid development of Chinese food preferences, the demand for cold chain logistics in China is huge and growing. Between 2018 and 2019 the demand for cold chain logistics in China increased by 29% in terms of volume. Such demand, along with advancements in technologies for cooling processes, and government regulations have been key factors in driving the construction of a cold supply chain in China.

Despite tremendous growth and innovations over the last several years, the cold supply chain in China is still insufficient to meet the quantity and quality efficiency of the current and future demand. Currently, less than 50% of China’s main agricultural products are transported through cold chains and stored in cold chain facilities, hence the current market is at less than half of its potential. The result of not using a cold supply chain are worse food quality, shorter fresh food shelf life, and increased food waste.

The farmer-supermarket model emerges in the Chinese fresh food supply chain

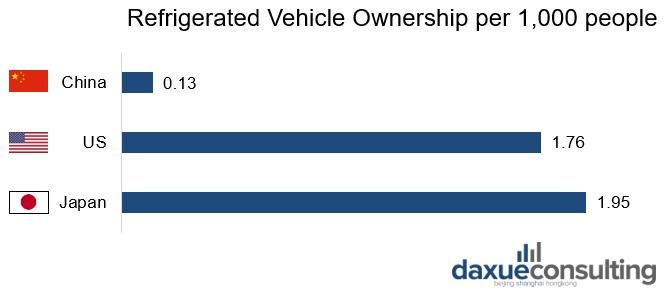

There are different cold chain supply models. Japan, for example, adapts a long chain model with multi-level wholesale markets. In this model, there is a lot of B2B exchange between the production and final consumers. In contrast, the US maintains a short-chain model with large distribution centers. Both countries present well-established facilities and high circulation efficiency.

Furthermore, both countries, along with other developed economies’ wholesale market trading are dominated by futures trading. China in comparison presents a complex and diverse cold chain supply model with a multi-level wholesale market system with a lower level of efficiency, logistics facilities, and organization capacity. On top of that, wholesale market trading is dominated by spot trading which exposes the cold supply chain in China to higher risk.

Whilst fresh food is sourced from agricultural associations in Japan and cooperatives in the US, 91% of fresh food products come from small individual farmers in China. As a result, the ‘farmer-supermarket model’ (农超对接模式) has spread throughout the country. It is a new model that aims to reduce intermediation and associated risks of long supply chains by connecting small Chinese farmers with retail markets.

Regional fresh food demand, production, and cold chain logistics development

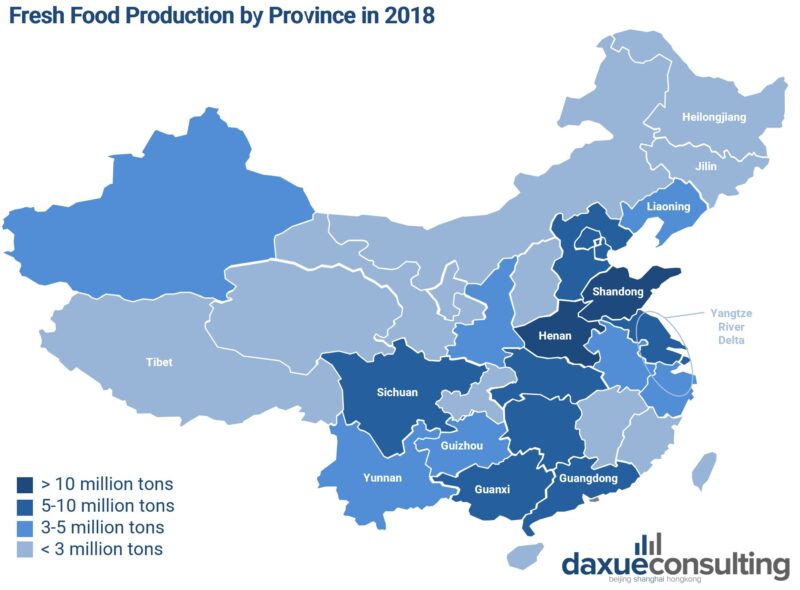

China has a dense agricultural production in the east and a rather sparse one in the west. Therefore, efficient cold chain logistics in China are all the more important to bring fresh food to the entire nation.

East China forms the strongest fresh food logistics capacity, most modernized transportation network as well as cold chain network. For instance, the Yangtze River Delta region has the strongest modernization and highest consumption capacity in China, while neighboring Shandong is the number one province of production, import, and export of agricultural products.

Southern China produces a large amount of tropical fruit, with the main production coming from Guanxi. Guanxi’s neighboring province, Guangdong is one of China’s largest fruit consumption markets. Central China is set to become the core axis of the fresh food cold supply chain in China with Henan’s annual production of fresh products exceeding 100 million.

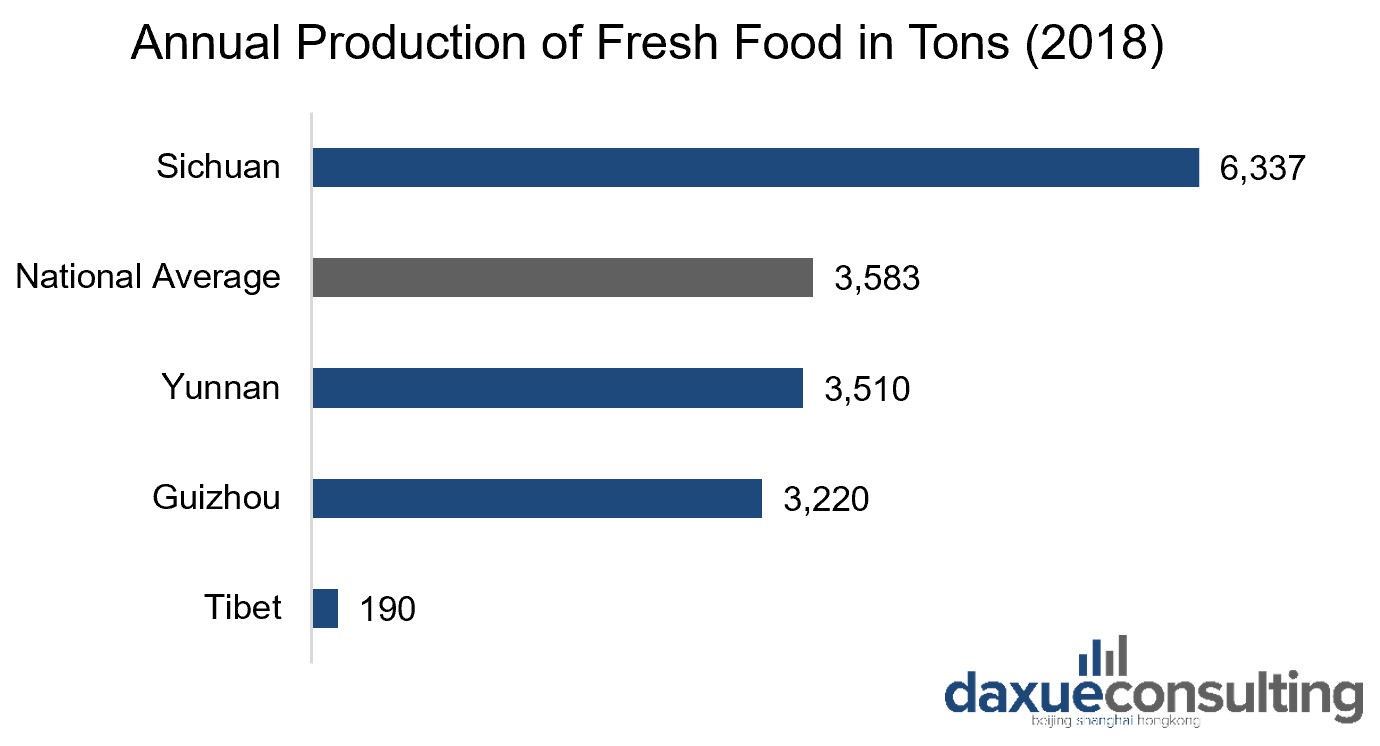

Northwestern China has a high per capita production due to its vast land area with a limited population. However, it lacks supply chain facilities making it difficult to move products upstream. In Southwestern China, Sichuan and Guizhou represent the production of unique agricultural products. While Sichuan’s production is well above the annual provincial average, the infrastructure and cold chain logistics in Southwestern China are insufficiently structured. The Northeastern region’s fresh food production is relatively low. The main producer is Heilongjiang with aquatic products and grain crops whilst Liaoning and Jilin are making an effort to increase their production.

Players of the Chinese cold chain logistics network

Cold chain logistics in China is highly competitive, fragmented, and characterized by distinct regionality. Nevertheless, there are a handful of major players which mostly engage in both cold storage and cold transportation. Jingdong Cold Chain (京东冷链) officially launched its cold chain logistics network in 2018 and is considered a logistics giant in China. It relies on the trinity of cold chain storage, transportation, and distribution network. Similarly, Shunfeng Express (顺丰速运) offers safe, efficient, and fully integrated cold supply chain solutions for fresh food businesses. Sinotrans Cold Chain Logistics advertises having nationally leading technology and network resources for temperature-controlled storage, transportation, and distribution.

Major operators are also Beijing Ershang Group, an SOE mainly focusing on cold chain storage, Shanghai Jinjiang International Cold Logistics Development Company, a rising player offering 500,000m2 cold storage space in Shanghai, and Nichirei Logistics Group, a Japanese player with its strength in cold chain transportation, storage, and processing. Other prominent players are Swire Group, Articold Logistics, Shandong Gaishi International Logistics Group, and Xianyi Holding Group.

Small and medium-sized enterprises also compete within the industry. The downside of the market fragmentation and high demand for cold supply chains in China is that it allows many players with a low degree of specialization to enter the market. As a result, they induce high operating costs as well as unbalanced and insufficient development.

The challenges of the cold supply chain in China

The main challenge of the fresh food supply chain is to maintain and deliver the safety, quality, and freshness of products. The cold supply chain in China however struggles to effectively meet this requirement which is a major concern for its B2B operators and raises the quality liability question. The quality of fresh food products refers to product quality and process quality. Usually, there is a quality check of products before storing them. Yet, there is no professional technology to comprehensively measure fresh food quality. One approach to help B2B cooperation along the supply chain is a third-party certification system. For instance, the “three brands one label” ( 三品一标 ) certification led by the Chinese government assures organic, green and pollution free agricultural fresh food products. If the certification can gain in value, producers and operators alike will benefit.

The need for monitoring and traceability

Monitoring mechanisms along the whole cold supply chain could also alleviate the issue of liability. The resulting traceability of fresh food products would improve cold supply chain management, ensure food quality, and safety and help solve quality problems. The current health crisis has further amplified the demand for traceability. However, within the cold chain logistics in China, operators are hesitant to cooperate to establish a traceability system.

The need for better technology

Moreover, the industry is in need for better technology in terms of packaging, conservation transport and information monitoring. Such technology improvements are more innovative cooling technologies as well as information systems to forecast purchase orders and process inventory information. Apart from previously mentioned lack of cold chain logistics infrastructure, cold chain logistics in China shows poor coordination and management between warehousing, transportation, distribution, processing, packaging and sales. On top of that, the incomplete monitoring system impedes data accumulation needed to establish an operation standard resulting in low digitization, automation and thus low efficiency. These factors play together to produce an immature cold supply chain in China.

How the government promotes the development of a cold supply chain logistics network

The Chinese government recognized the need for an efficient cold chain logistics network and attributed concerns over food quality and safety. Zhang Jiangbo, deputy director-general of the economic and trade department at the National Development and Reform Commission (NDRC) said in December 2021: “The public not only aspires to eat better, but also to eat food that is safe and healthy. That is why cold-chain logistics has gained more and more attention.”

As a result, in December 2021, the General Office of the State Council issued the “14th Five-Year Plan for Cold Chain Logistics Development” (FYP). While the Chinese government has been issuing a number of initiatives and regulations to support the construction of a cold supply chain in China in recent years, this is the first five-year plan of such kind. It indicates the increased importance of the government subscribing to cold chain logistics in China and signals more investment, more actions, and implementation plans across provinces in the future.

China’s cold chain logistics goals in the 14th Five Year Plan

It aims to leverage regional synergies and develop an integrated cold chain logistics network, meaning to advance the cold chain logistics infrastructure network, upgrade the transportation technology and equipment, innovate cold chain service models, improve regulations and standards as well as strengthen guidance for high-quality development. The plan focuses on the “6+1” key categories, including meat, fruits, vegetables, aquatic products, dairy products, quick-frozen foods, and other major fresh foods, as well as pharmaceutical products.

By 2025, the plan expects cold chain logistics to connect the origin and sales area, covering urban and rural areas as well as to connect the domestic market with international ones. In February 2022, the National Supply and Marketing Cooperatives announced to build 600 cold chain logistics centers at production origins, 100 national cold chain logistics bases, and 200 cold chain logistics centers in cities all for agricultural products.

In February 2022, the General Office of the Hebei Provincial Government issued the Hebei implementation plan for the FYP. It proposes to integrate and improve the resources of the three major cold chain logistics areas around Beijing, Tianjin, and Hebei. It targets to improve the level of supervision and traceability, the layout of logistics facilities, the efficiency of transportation and distribution as well as to accelerate digital development within the whole process of the cold chain network. Also, the implementation plan declares that the average annual growth rate of cold chain logistics in Hebei shall remain above 10%.

Opportunities in China’s cold supply chain

The strong development, the lack of good execution, as well as the government’s commitment bears opportunities for enterprises delivering services along the full cold supply chain in China, be it in terms of hardware or software. Opportunities lay in logistics coordination and management, distribution efficiency, cost optimization, innovative cooling and transport technologies, online and offline integration, reliable traceability systems, quality control and branding, forecasting technologies, you name it.

Enterprises should find a way to encourage monitoring as it would benefit a number of aspects such as forecasting, coordination, safety, digitation and automatization. The value of certification and its branding should be highlighted and used for the cold supply chain’s advantage. However, the industry remains highly competitive. Therefore, a comprehensive business plan with a well-elaborated value added and solid execution are pre-requisites to profit from this development. On the upside, the fragmentation leaves room for new innovative business models to enter the market.

Contact our market research team at dx@daxueconsulting.com to learn more about China’s food and beverage industry and supply chain.

Author: Lucia Toth