Food production and supply in China are some of the key challenges to work on for the Chinese government. The aging rural population, supply chain tensions, and the pandemic highlighted the structural issues that this crucial industry is facing. To resolve this, Beijing decided on strong policies that are aimed at developing the rural food-producing areas further by pushing investments and development of new agricultural technology in China.

Opportunities for foreign investors and bearers of innovative projects that would help the country produce better and cleaner food are numerous.

Agricultural technology could solve China’s food production system’s most urgent shortcomings

The pandemic, labor shortages, and a disadvantageous land allocation system are some of the main pain points affecting food production in today’s China.

The Covid-19 pandemic severely disrupted food supply chains in China

In early 2020, the numerous lockdowns put a heavy burden on agriculture. Roadblocks and restrictions have affected the supplies of both food and workers who couldn’t return after the Chinese New Year holidays.

The China Seed Association reported that the outbreak affected the production and operation of more than 90% of seed production companies.

With companies and farms closing down, prices went up.

It is estimated that the total food price index increased by 15.5% for the whole of 2020, with vegetables being the worst case – at an increase of 26.3% in early 2020.

Chinese agricultural companies that export products abroad encountered even more issues, with plummeting external demand, trade restrictions, and labor shortages. While dealing with the situation in China, the government realized the urgent need to stabilize the food production for the 1.4 billion Chinese citizens.

“Food and agricultural trade should not fall victim to public health emergencies” – Yu Lu, vice-chairman of the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce, and Animal Husbandry.

Labor shortages in China’s agricultural industry

Rural areas, which represent the majority of arable land in China, are facing two major issues.

First, an aging workforce. Among the population of China, the majority (it is estimated to be two-thirds) of older people live in rural areas and are close to retirement.

Second, the main workforce in rural areas has left to urban areas. “They would prefer doing 10 hours in an assembly line than in a farm,” said Liu Baocheng, Dean of the Center for International Business Ethics from the University of International Business and Economics. It is estimated that nowadays, 498 million people live in rural areas and 914 million live in the cities in China.

Legal and system challenges in China’s agricultural industry

Small farms account for 70% of food production in China. By small, it is typically about 0.1 hectares for each parcel (roughly ¼ of an acre).

Farm size typically increases with economic development in many other countries but is not observed in China due to national land allocation laws.

In the US, farmers can purchase large areas of land for agriculture. However, China’s historical land policy has distributed arable land evenly amongst farmers to guarantee employment.

In China, over 92% of farmers are small-scale farms averaging less than two hectares or five acres (For comparison, the average US farm size is about 444 acres or 1.8 km2). This makes investments in large-scale agriculture technology difficult to operate.

The government is focusing on solving the issue using agricultural technology in China

In recent years, multiple government plans focused on modernizing agriculture to assure that food production would match the demand in the country of 1.4 billion people.

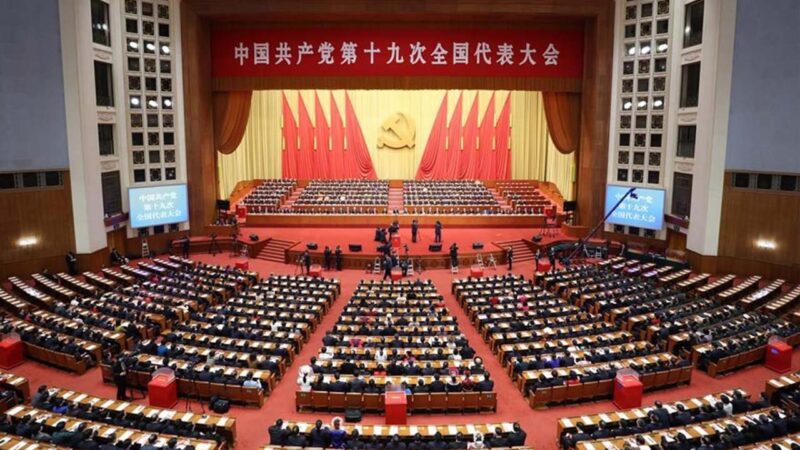

19th CPC National Congress in late 2017: focus on food security

Some key numbers are representing the difficulty of growing crops in China. The country has 7% of arable land for 20% of the world population. At the same time, China is self-reliant on its grain supply – it is estimated that China supplies 95% of its own needs for grain, but with an aging rural population and the loss of attractiveness of the countryside, how long will this last?

The 19th CPC National Congress sets the tone to improve the efficiency of food production at a national level. Applying high-technology such as automation, big data, and the Internet of Things (IoT) to agriculture was set as a focus point.

E-commerce and retail are commercial solutions that gave more chances for farmers to earn a living. The 13th Five-Year plan showed that the per capita income of farmers has doubled from 2010, assuring that the goals of poverty alleviation and rural revitalization are on track.

The 14th Five-Year Plan (2021-2025) agricultural modernization plan

Grain production is highlighted as a key indicator to monitor in the recent report describing the last Five-Year Plan, “Improve the supply guarantee capacity of grain and important agricultural products” (提升粮食和重要农产品供给保障能力).

The Chinese government puts a large focus on the development of rural areas and agriculture, underlining the fact that it “must be done quickly”.

Some of the objectives in this report are to reach an output of more than 1.3 trillion kilograms of grains, such as to develop the pig industry, improve the quality of agricultural products and the level of food safety, as well as to continuously grow the income of farmers.

The implementation of the agricultural and rural modernization plan was launched too, with the following key objectives:

- Strengthen the support of modern agricultural technology and material equipment (强化现代农业科技和物质装备支撑)

- Adhere to the self-reliance and self-improvement of agricultural science and technology

- Improve the stable support mechanism for basic research in the field of agricultural science and technology

- Establish a number of innovation base platforms

- Carry out in-depth scientific and technological support actions for rural revitalization

- Support colleges and universities to provide intellectual services for rural revitalization

- Build a modern rural industrial system (构建现代乡村产业体系)

- To rejuvenate the nation, the countryside must be rejuvenated (民族要复兴,乡村必振兴)

Largest tech firms are investing in agricultural technology in China, fostering growth in this sector

Following the technology crackdown at the end of Summer 2021, China’s biggest tech firms had to re-orient business activities towards actions that match the new “Common Prosperity” vision. One of them is to improve the livelihood of the rural population by fostering business in agriculture. Recently we saw Jack Ma (马云) visiting greenhouses in Europe and Colin Huang, Pinduoduo CEO, stepping down to dedicate his time to studying new farming technologies.

Representing a 13.8 trillion RMB ($2.1 trillion) market and a 3% annual growth, agricultural industries (including agriculture, forestry, animal farming, fisheries) show a promising future, employing around 25% of China’s population.

Most big technology companies are now launching programs aimed at facilitating business in this sector, some of them include Taobao’s to e-commerce villages, Tencent’s environment pledges, and Pinduoduo’s AI-supported agriculture competition. High-tech greenhouses, for example, have soared during the Covid-19 pandemic. Chinese policymakers pushed to develop these to keep a steady supply of crops. These large networks of greenhouses are serving as strategic reserves for China.

One company from the Netherlands, FoodVentures, is one of the emerging firms running a network of greenhouses across the country. They aim at solving issues with transportation and logistics by localizing as much as possible food production.

Labor shortages push for automation: drones and automated farming machinery in China

Tests of automated agriculture machinery are held in Heilongjiang and Jiangsu provinces since the end of 2019. Locals emphasize that “trials are the foundation for future commercialization”.

“Without mechanization, you cannot move forward…” Liu Baocheng

Drones, for example, are another hot staple in China’s agricultural tech scene. The agricultural and forestry drone sales market in China is expected to be worth 20 billion RMB (US$2.9 billion) by 2025, according to iiMedia Research

Drones are able to gather data at scale and automatically spray pesticides instead of farmers, avoiding excess exposure to these products. The technology can save time, improve spraying precision, and dosage in large fields.

One company: XAG states that their agricultural drones can spray 300 Mu (20 hectares) of farmland per day.

Peng Bin, the founder stated that drones usage in agriculture is increasing from less than 1% in 2017 to 5% in 2018. XAG, founded in Guangzhou in 2007, became the largest manufacturer of agricultural drones and provider of “smart agriculture” solutions using Artificial Intelligence (AI) in China.

E-commerce, grocery shopping, and agricultural logistics

A document from The State Council Information Office of the People’s Republic of China published in 2019 states that logistics capacity has increased markedly, and the efficiency of food logistics has seen steady improvement.

All major channels of food logistics have been integrated to form a multimodal transport network composed of highways, railways, and waterways. Food logistics now involves more unprocessed grain, bulk grain, and finished grain products transported by container.

Better infrastructure represents opportunities for growth in agricultural products distribution and e-commerce sectors.

The Asian Development Bank recognizes that E-commerce platforms played a more important role than the traditional supply chain in guaranteeing food supply in Wuhan in 2020.

Since then, JD Farms announced that the company will use advanced technologies including cloud computing, big data, and drones to monitor and analyze water, soil, pesticides, fertilizer, weather, diseases, and pests; providing highly accurate estimates for pesticide use; and increase the traceability of agricultural products.

Pinduoduo is tackling the question of how to help farmers to grow crops and products that are in demand. For this, they will use data analysis from existing e-commerce websites.

Cooperation with local government and universities are helping the company to launch projects such as the “Smart Agri-competition”, consisting of engaging experts from around the world with local farmers to work on IoT solutions to develop remote automated farming.

The middle class is more concerned with food quality and organic products

Young Chinese consumers are turning to these greenhouse and automated farms goods, citing food safety concerns in traditional agriculture.

The price for these products remains higher, but it’s the choice for the urban middle class with higher income, as they are increasingly growing concern about food contamination.

In parallel, these aspects have been highlighted as key points during the 14th Five-Year plan:

- Comprehensively promote rural consumption (全面促进农村消费)

- Promote the green development of agriculture (推进农业绿色发展)

Takeaways and opportunities for foreign investors interested about agricultural technology in China

- The Agricultural industry in China suffers from a lot of shortcomings, ageing rural force, complex land system and supply chain disruptions.

- The Chinese government is aiming at tackling the issues of food production by pushing investments and research in agricultural technologies.

- China’s most well known tech enterprises such as Pinduoduo and JD are investing heavily in the sector, bringing with them bearers of innovative tech solutions to agriculture.

Foreign actors that are aiming at bringing new agricultural technologies to China would mostly be encouraged in this fast-developing industry. In-depth interviews with farmers or agricultural companies executives would uncover more about how to tap into China’s growing agricultural technology market.