LA MER has a legendary brand story that distinguishes it from any other cosmetics company. While most skincare products come from laboratories, LA MER is developed by a space physicist – Max Huber. Huber had suffered burns during an experiment and therefore spent years searching for ways to heal his damaged skin but could not find a product for that purpose. However, Huber did not give up, quit his job, and used the garage of his house as a laboratory to develop a cure for his face. After over 6,000 experiments in 12 years, LA MER was born. It was the only product that could heal his deformity. Although this brand never advertises its products, it has successfully sold its products solely because it works and as a result, spreads through word of mouth.

According to Estée Lauder’s Q4 earning release, LA MER delivered double-digit growth in every region, led by the Asia Pacific, with significant strength in mainland China. This reflected the brand’s significant strength with Chinese consumers. Net sales growth was driven by increased hero products, including The Treatment Lotion, Crème de LA MER, The Concentrate, and The Moisturizing Soft Cream. The launch of Genaissance de LA MER, The Concentrated Night Balm, and targeted expanded consumer reach also contributed to its growth. LA MER was the top-selling luxury beauty brand at Tmall’s 11.11 Global Shopping Festival in 2021.

LA MER’s history in China

Following the success of Estée Lauder and Clinique, Estée Lauder acquired LA MER in 1995, aiming to transform LA MER into a cutting-edge luxury brand. LA MER has since become Estée Lauder’s third brand to reach China. In 2004, LA MER officially entered the Chinese market by opening a second special counter in Shin Kong Place (新光天地), which, together with Sitech Plaza, represented two locations within the CBD of Beijing. Under LA MER’s marketing strategy for a new market of a “single product at each counter”, only Crème de LA MER was available for the Chinese counters. At that time, the limited 60 bottles of LA MER 500ml face cream, priced at RMB 14,000 a bottle, were sold out by Chinese consumers in just 2 days. Later in 2007, LA MER opened a third special counter in the Lane Crawford on Finance Street in Beijing. In 2009, another counter was opened in Yansha (燕莎) Friendship Shopping Mall.

Today, LA MER has 92 special counters in 27 cities. In top-tier cities (Beijing, Shanghai, Guangzhou, and Shenzhen), LAMER has an average of 6 special counters, which already covered 26% of the total stores in China. This reflects the strong consumption power of top-tier cities.

LA MER’s secret in China: target younger consumers and tap into online stores in the early stage

Strong sales in Tmall

Back in 2015 when luxury brands were still hesitantly trying to keep up with digital trends, LA MER took the lead in running its Tmall flagship store, aiming to reach more consumers. According to Jiemin, 77% of its online customers are under 35 years old, which is 5 years younger than the brand’s regular consumers on average. Most of them live in second or third-tier cities that have no access to LA MER physical stores.

LA MER spent over a year preparing for its Tmall launch. For example, the brand designed the front page with its signature aquarium theme and employed beauty advisors as online customer service staff to answer consumers’ questions. Upon its grand opening, LA MER released RMB 15,000 worth of limited-edition face cream, with the packaging made out of pearl designed by Boucheron.

To further expand the target consumer base, LA MER offered its products in smaller packages. For instance, A 15ml face cream sold at RMB 760 was once the top seller. This reflected LA MER’s effort to target younger consumers by lowering the price to increase the accessibility of luxury products. Moreover, LA MER combined its online and offline membership programs so consumers’ activities could be analyzed together to provide a more seamless experience.

According to the 2021 data of TMall, LA MER experienced a growth in sales by 57% YoY and growth in volume by 93%, which is far more than the average growth by industry level.

Strong sales in Douyin and Little Red Book

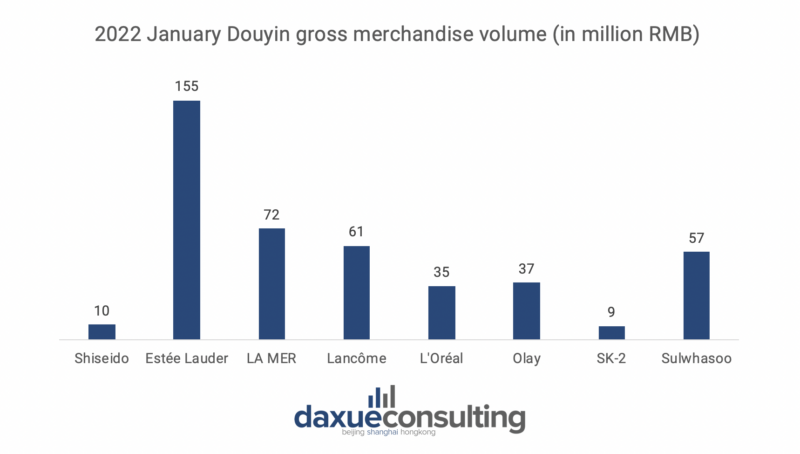

Compare to traditional e-commerce, new platforms such as Douyin (Chinese Tiktok) and Little Red Book use an interest-based live e-commerce model. Through algorithm and recommendation technology, these platforms connect personalized product content with potential interested users. This fully taps into consumers’ need to achieve a higher sales conversion rate. Thus, more and more beauty brands have since utilized these new e-commerce platforms to perform digital marketing. For LA MER, it has 72 million sales on Douyin in January 2022, only below Estée Lauder’s 155 million.

LA MER also has a vast influence on Little Red Book. According to the Intelligence Research List of Month in March 2022, LA MER ranked first among the top 30 skincare brands, with over 1.6 million interactions, 11,447 related notes, 1 million likes, and over 176,000 comments.

LA MER faces the accusation of false advertising in 2018

LA MER came under scrutiny from Chinese netizens due to a Weibo post published by a beauty blogger nicknamed Doctor Big Mouth (大嘴博士), titled “Yin-yang (阴阳) website, fake ads, LA MER, how long are you going to lie to Chinese consumers?” on 26 September 2018.

Doctor Big Mouth compared the description of LA MER’s hero product Miracle Broth on its Chinese, Japanese, and American websites. He found that LA MER claimed the product has a “restorative” effect on the Chinese site, while for non-Chinese sites, only the word “soothing” was used to describe the product’s function. Also, there were anonymous product reviews complaining about the failed restorative effects of Miracle Broth. Thus, Doctor Big Mouth accused LA MER of exaggerating the effect of the product, which had violated the Chinese advertising law.

This post immediately went viral and Estée Lauder provided a public declaration saying that “Experiments have shown that the Miracle Broth can improve dry wrinkles, provide moisture to promote natural repair, strengthen the skin, and slow down the aging of the skin.” However, the brand did not respond to whether the products have a “restorative” effect. Although no further action is found by the blogger and the brand, this news is likely to shake up the reputation of LA MER in China.

Key takeaways from LA MER in China

- Brands need to be creative in order to attract young consumers. From special counters to traditional e-commerce and to new social e-commerce platforms, LA MER demonstrated how to utilize online distribution channels and give consumers a unique experience

- Since Douyin and Little Red Book carry high traffic, they are currently the main windows to interact with consumers. Hence, these platforms have an increasing significance in brand marketing that foreign brands should invest in

- Brands need to be cautious in maintaining their luxury image. Not only the website design and product package but also the product description. As Chinese consumers value authenticity more nowadays, they have a higher demand for products’ quality and function. Foreign brands should pay attention to the improvement and innovation of scientific and technological research and the development of their products

Author: Lydia Choi