Lululemon, once known as a niche brand targeting those who aspire to have an active lifestyle, has shown great market growth with its net revenues in the Chinese mainland market reaching USD 964 million throughout the fiscal year of 2023, marking a remarkable 67% increase from the previous year. The women’s apparel line plays a critical role for Lululemon, as evidenced by its robust performance in recent years. With a 17% year-over-year increase in net revenue in the fiscal year 2023, totaling USD 6.147 billion, it not only outperformed the growth rate of the men’s apparel line but also contributed significantly more to the company’s overall revenue, nearly tripling that of men’s products.

Download our report on Gen Z consumers

Beyond women’s apparel: Lululemon’s male demographic expansion

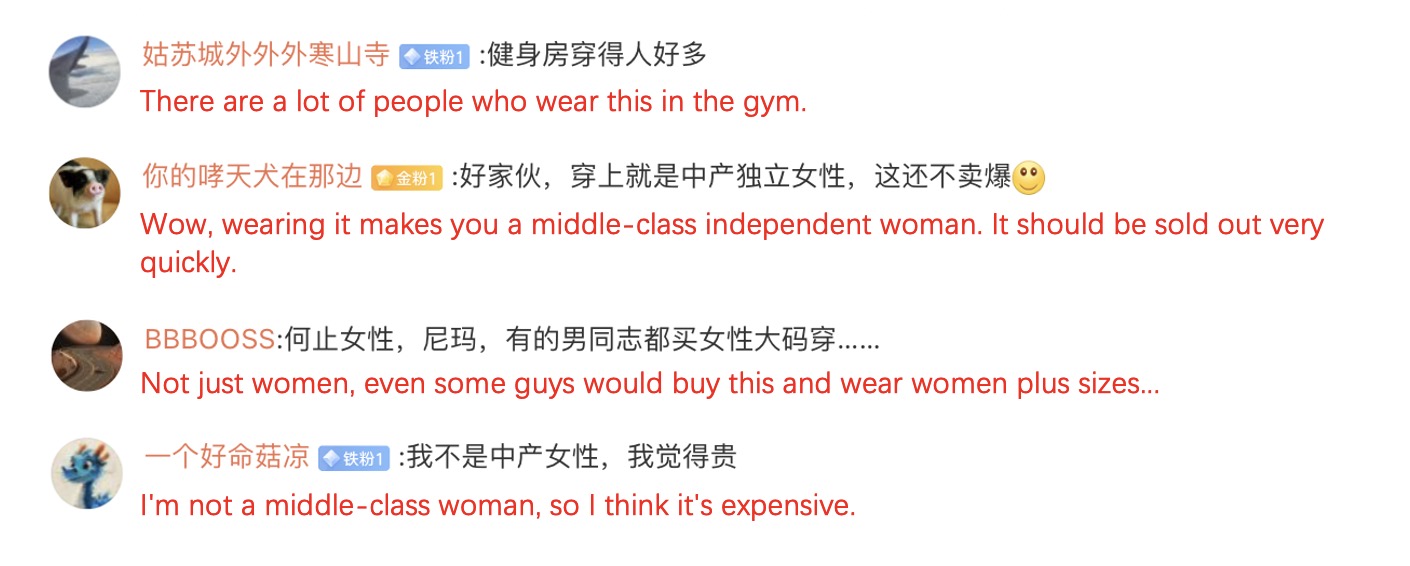

Due to Lululemon‘s rising popularity among China’s middle-class female consumers, the hashtag #the middle-class women have given Lululemon steady happiness# (中产女性给了Lululemon稳稳的幸福) went viral on Weibo in the last week of March, garnering 9.75 million views. Under the hashtag, many netizens expressed satisfaction with Lululemon’s quality and durability, despite it being relatively expensive. Some also viewed wearing Lululemon as a symbol of empowerment for middle-class women. However, there were also some negative reactions, with some netizens criticizing its association with a particular lifestyle or social class. Some comments took a more observational or humorous tone, acknowledging Lululemon’s popularity across all genders and its association with gym photoshoots in particular.

On a side note, despite the dominance of its women’s apparel line, Lululemon has also recognized the significance of tapping into the male demographic, with a 15% revenue growth in its male apparel line in the 2023 fiscal year, exhibiting strong market potential.

The rise of middle-class influence in China’s fashion scene

Lululemon capturing the middle-class wave: China’s rising consumer power

Lululemon’s success in China indicates its effective penetration into new markets and demographics. Revenue increase suggests that the brand has achieved visibility outside of its traditional Western markets, which is especially evident among female consumers from the Chinese middle class. Moreover, Lululemon’s popularity among China’s middle-class women also reflects these women’s increasing purchasing power and demands for a luxurious lifestyle. As disposable incomes rise and customers’ tastes evolve, there is a higher demand for expensive and high-quality fashion that combines both style and functionality.

Harnessing brand identity: a key to success

The positive sentiment towards Lululemon among Chinese consumers reflects the importance of brand identity and perceived value in driving purchase decisions. Investing in building strong brand identities that resonate with their target audience and communicate value beyond just the product itself. This includes factors such as brand reputation, quality, sustainability, and lifestyle associations. Brand identity evolution is an essential element of success in the wake of China’s consumers’ increasing global connectivity and fashion awareness. The competition between local and foreign manufacturers vying for a share in China’s market has intensified. Therefore, developing and implementing branding strategies that meet Chinese market requirements can be seen as a way for brands to maintain their relevance and appeal to changing tastes among Chinese consumers in this competitive environment.

Take away from Lululemon’s rise among middle-class consumers

- Lululemon’s staggering growth in China, with net revenues reaching USD 964 million in 2023, showcases its expanding market presence and a remarkable 67% increase from the previous year.

- The women’s apparel line emerges as a cornerstone of Lululemon’s success, contributing significantly to its revenue with a 17% year-over-year increase. It outpaces the growth of its men’s line, highlighting its pivotal role in the company’s performance.

- The viral hashtag #the middle-class women have given Lululemon steady happiness# on Weibo reflects the brand’s rising popularity among China’s middle-class female consumers, sparking both positive and negative reactions regarding its quality and lifestyle association.

- Despite the dominance of its women’s line, Lululemon recognizes the potential in the male demographic, evidenced by a 15% revenue growth in its male apparel line in 2023.

- Lululemon’s success underscores the growing influence of China’s middle-class consumers in the fashion industry. It emphasizes the importance of brand identity and adaptation to capture evolving preferences amidst increasing competition.

We offer consulting services for China’s fashion industry

China’s fashion market is a dynamic sector, influenced by shifting consumer preferences, technological advancements, and evolving dining habits. Daxue Consulting offers expert market research in China, providing in-depth insights into the trends and challenges shaping the fashion industry.

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with Chinese consumers. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us today to discover how our expertise can drive your fashion business’s success in China.