Online audio refers to the audio content that is listened to through network or streaming media, which can also be downloaded to personal digital devices, thanks to the development of mobile internet. Online audio takes many forms including audiobooks, podcasts, network radio stations, voice live streaming, audio drama shows, interactive entertainment and so on. The podcast market in China and the West has different features and models. Online audio platforms in China represent a booming industry worth RMB27 billion in 2020. They cover many types of content such as audio dramas, humanities and history, talk shows, parent-child education, cross talk & storytelling, news and business.

Overview of the online audio market in China

China’s online audio industry can be traced back to 1997 when pioneering companies began to explore the possibility of transferring broadcasting stations to online forms. After 2000, with the development of internet technology, the appearances of the iPod and the MP3 player made “podcasting” a new trend. Then China’s mobile internet rose rapidly, facilitating the foundation of leading online audio platforms like Ximalaya and Lizhi, which came to the market in 2012 and 2013, respectively. After 2015, online audio platforms in China began to differentiate and extended to various applications and scenarios.

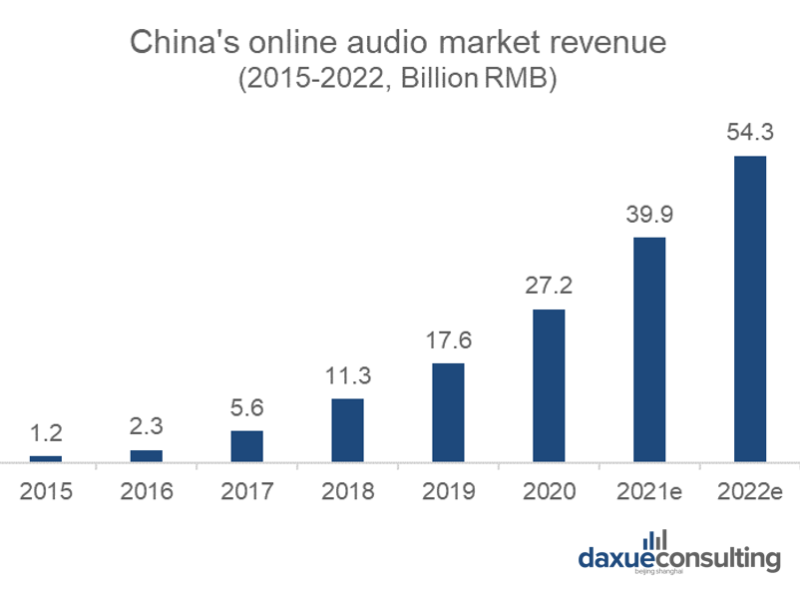

According to data from iResearch, China’s online audio market revenue has increased significantly from RMB1.2 billion in 2015 to RMB27.2 billion in 2020, accounting for 17% of the world’s total market scale. It is expected to reach RMB54.3 billion in 2022.

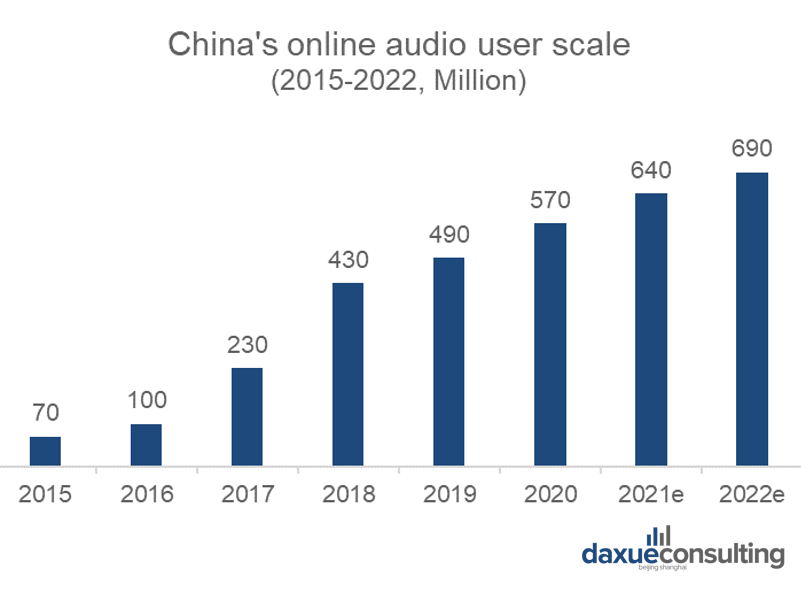

China’s online audio industry has accumulated a massive user base after years of development. The number of online audio users in China has increased from 70 million in 2015 to 570 million in 2020, with 66.7% of users under 30 years old. It is expected to reach 690 million in 2022.

What are the top 5 online audio platforms in China?

Ximalaya Inc.

Ximalaya was founded in 2012 and is now the largest online audio platform in China. It filed to list on the New York Stock Exchange in May 2021, going to be the second Chinese online audio platform debuted in the US following Lizhi.

Ximalaya is a comprehensive audio platform with the types of Professionally Generated Content (PGC), Professional User Generated Content (PUGC) and User Generated Content (UGC). Its’ audio offerings include podcasts, audiobooks, audio drama shows, livestreaming, education programs, and audio comics and its average MAU reached 250 million through mobile, IoT devices, and other platforms in the first quarter of 2021

Ximalaya has held the “123 Knowledge Carnival” since 2016 and the total content consumption during the festival has been rising every year since then. Ximalaya has also launched a series of creator support plans to encourages more people to join and upload original content. The procedures to be a creator include real-name registration (individuals or organizations), sound recording, album release, album optimization such as cover, title and tag, and album promotion by paying for recommendations and distributions. Creators have to upgrade themselves by uploading more high-quality original contents to obtain higher levels, at which they can have access to more channels, functions, resources and benefits.

Find our own podcast series “Daxue talks” on Ximalaya.

Lizhi Inc.

Lizhi was established in 2013 and has built a global audio ecosystem integrating audio community, podcasting and drop-in audio chat with applications of Lizhi App, Lizhi Podcast, Tiya and other sub-brands. Lizhi was listed on NASDAQ in January 2020, becoming the first Chinese online audio platform that went public.

Lizhi is the second largest online audio platform in China in terms of average MAUs, but Lizhi’s highlight is UGC and audio entertainment, which makes it the largest online UGC audio community and largest interactive audio entertainment platform in China.

Compared with other online audio platforms, Lizhi has always been in the lead in developing innovative business models such as launching podcast, audio livestreaming, tailored App for overseas and social network based on voice.

Lizhi launches an “echo plan” to support and sponsor its creators. After registration and login, there are two options for creators to start with, one is sound recording and the other is voice livestreaming. Lizhi is relatively more young generation oriented, easier to register and more effective on content approval.

QingTing FM

QingTing FM, also known as Dragonfly FM, was launched in 2011 as China’s first online audio platform. It has a total user scale of over 450 million and average MAUs of 130 million. The platform includes 1,500 radio stations across the country, with more than 350,000 certified anchors. The content covers culture, finance, technology, music, audiobooks and other types.

In order to cope with the fierce competition, QingTing FM focuses on the direction of content production and scenario extension especially on the layout of the vehicle terminals. As a veteran player in the online audio industry, QingTing FM has accumulated a stable user base after years of development and has a mature content ecological model. QingTing FM has more features and functions of online FM compared with other platforms. The real-name registration and audit is a must if you want to be a creator.

Lanren Changting

Lanren Changting, once called Laren Tingshu, was launched in 2012. Tencent Music Enterprise (TME) acquired Lanren Tingshu in January 2021 and announced that Kuwo Changting and Lanren Tingshu merged and upgraded to a new brand “Lanren Changting” at a brand release conference in April 2021. TME claimed that as of the end of 2020, Lanren Changting’s MAUs of long-form audio had exceeded 100 million.

Lanren Changting focuses on providing users with audio books, audio programs, and other audio content services. The user scale is 480 million, with 52 million monthly active users and 18.5 million daily active users.

So far, Lanren Changting has reached cooperation with more than 1,000 brands from over 20 categories such as e-commerce, automobiles, mobile phones, tourism, and games to share the commercial value of audio.

Penguin FM

Penguin FM is a mobile audio content sharing platform launched by Tencent Technology (Shanghai) Co., Ltd in 2015. It provides free listening to audiobooks and news and other digital listening services. It took advantage of Tencent resource to establish a diversified content model and form a “UGC (user generated content) + PGC (professionally generated content) + Copyright” one-stop audio ecological chain.

Profit models of online audio platforms in China

In the initial stage, online audio platforms offer most content for free to attract a large user base. Since 2016, with the prevalence of “pay for knowledge” and live broadcasting, the business models of the online audio platforms began to differentiate. Some platforms like Ximalaya and QingTing FM switched to the knowledge payment model based on professionally created content while Lizhi took a different path to focus on UGC and established the voice live broadcasting mode. Since 2018, most players have tapped the markets of audio livestreaming, IoT devices, long-form audio and drop-in audio chat services.

The profit model of China’s online audio industry is diversified and can be roughly divided into 2B-side and 2C-side. The 2B-side is mainly based on advertising revenue and publication commission of popular IP works. On the 2C-side, payment for content is an important profit model, including membership purchases, premium album subscriptions and education services. For the big base of free users, platforms can also generate revenue through sales of virtual gifts to users in relation to audio entertainment. In addition, some online audio platforms also profit from the sales of smart speakers, headsets, wearables and other smart home hardware devices.

Drivers and challenges of online audio platforms in China

Drivers of China’s online audio market

- Technology development

With the development of technology such as 5G, AI, big data and IoT, the application of online audio is extended to various devices and scenarios. The sound quality and transmission stability will also improve due to the upgrading of audio hardware, bringing better user experience.

- Hunger to learn

People are now facing greater competition in their work and studies. According to data from iiMedia Research, users have a preference for listening to content about new knowledge acquisition, information and science, education and culture. With the development of the knowledge economy, the public’s demand for high-quality and diversified content is increasing.

- Fragmented time

People commonly listen to online audio before going to bed, while commuting, walking and doing housework. Online audio has good companionship attributes and less disturbance to users. Online audio service offerings create a parallel world for users’ daily life, delivering diversified and personalized audio content to help users take advantage of fragmented time.

- Podcast prevalence

The number of Chinese podcasters has grown rapidly, indicating that there is a strong demand in the market. While podcasts in the US and Europe enjoy a big user base, Chinese podcasts are still in the early stage of commercialization. In the future, as the scale of the podcast market expands, various platforms may attach more importance to podcasts, which will then move them a niche to mainstream.

- Long-form audio gets attention

Since 2020, major internet giants such as Tencent Music Entertainment (TME), Bilibili, ByteDance and NetEase have announced to enter the long-form audio field and launched long-form audio applications or portals. Lizhi has also vigorously introduced long-form audio creators. Long-form audio is a good approach to attract users’ attention, retain traffics, increase subscription rate and convert to paying users.

- The rise of drop-in audio chat

The voice social market is developing rapidly. In October 2020, Lizhi launched the audio social software Tiya to tap into the market. At the beginning of 2021, Clubhouse brought up a wider discussion on this domain, despite being blocked. The visual fatigue of users stimulated the demand for audio-based social products.

Challenges of China’s online audio

- Content quality

The online audio user experience depends largely on the attractiveness of the content. Online audio content that was once well-received may become less attractive if user preferences evolve. Online audio platforms have to keep enriching content, improving the overall quality, and upgrading matching algorithms for better user experience and stickiness.

- Creators’ scale

The size of user base and the quality of the audio content are closely related to content creators, including celebrities, performing artists, professional audiobook narrators, radio drama performers and people from all walks of life who share their interests and life stories. It takes big cost to attract, retain and cultivate talented and popular content creators.

- IP Copyright audit

There are increasing disputes against the audio platforms due to some uploaded content not obtaining all necessary copyright licenses. The online audio platforms play an important role in maintaining quality content copyright, but it is hard to identity all the copyright ownerships of the audio content offered on the platform. As competition intensifies, the cost of IP rights licensing is also increasing.

- Regulation control

The internet in China is highly regulated and the government may further tighten the real-name registration requirements. Online audio platforms are required to adopt enhanced measures to improve their content monitoring system. As the service provider, online audio platforms may be held liable for their creators’ or users’ infringement of the rights.

- Profitability dilemma

Most online audio platforms have incurred net losses for several years. They have to continue to attract and retain users, convert non-paying users into paying users, and increase spending of paying users on the products and services. The production and procurement of content is the main cost. Although advertising is a big source of revenue, it also affects user experience and satisfaction.

Key takeaways of online audio platforms in China

- The Chinese online audio industry will continue developing and expanding to full-scenario services, especially with the technical support of 5G, AI, big data and IoT.

- Audio livestreaming, podcast, long-form audio and drop-in audio chat are expected to be a new trend and unlock greater growth potential.

- Diversified high-quality content and multi-field qualified creators are the key to competitions among the online audio platforms.

- Platforms have to pay more attention to the copyright ownership issues and strictly abide by relevant regulations.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about technology development in our report on AI in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast