As natural and organic cosmetics products contain plant ingredients, manufacturers must acquire certification for using organic plant extracts. In accordance with a wide range of international standards, organic products cannot contain artificial spices or skin pigments nor can they make use of oil chemicals, such as preservatives and surfactants. Natural and organic cosmetics manufacturers cannot test products on animals or use radiation sterilization at any point during the manufacturing process. Except for providing component labels and accurate ingredients and directions to consumers, information on decomposability and recycling problems, packaging, and responsibilities should be included in the manufacturer’s specifications. In China, there are currently no certification standards specifically for organic cosmetics. However, according to the Organic Product Certification Regulations, cosmetics with more than 95% of raw materials being organic can be certified as organic cosmetics in China.

China’s cosmetics market is the largest in Asia

In 2013, China overtook Japan as the world’s second largest cosmetics market, and in 2017 the market size of Cosmetics in China accounted for 11.5% of the global market, second only to the United States’ 18. 5%. In the era of people paying more and more attention to their own image and face value, cosmetics are rapidly growing in demand. According to the China Food and Drug Administration (CFDA) statistics, more than 5,319 enterprises are qualified to produce cosmetics in China, which has relatively strict cosmetics regulations.

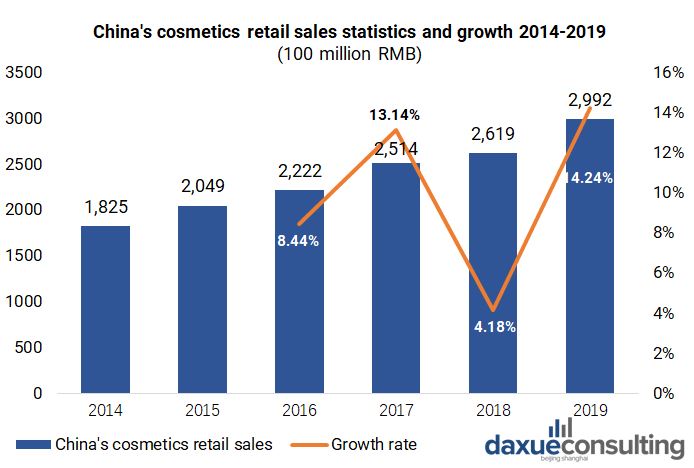

[Source and charts: Daxue Consulting “China’s cosmetics retail sales statistics and growth”]

With an increasing demand for healthy products, China has now become a new outlet for organic cosmetic brands to develop themselves and expand globally afterward. Hence, organic cosmetics in China are also becoming more and more popular.

Organic cosmetics: A fast-growing global market

The use of natural and organic products has become a global trend. Grand View Research, a U.S. market research firm, predicts that the organic skin care market will reach 110 billion yuan globally and 20.6 billion yuan in the Asia Pacific by 2020. From a global market point of view, the United States, Europe and Asia-Pacific region have more room for development. In the United States, the market value of organic personal care products is currently $2.95 billion and is expected to grow steadily at around 9.8% over the next few years; In Europe, organic personal care accounts for 30% of the market, with a compound annual growth rate of between 9.6% and 10%; the market value of the Asia-Pacific region is $2.01 billion, with a compound annual growth rate of 9.3%.

In 2012, many leading retailers began investing in organic cosmetics, and British supermarkets began using their own trademarks to sell organic cosmetics. However, most of the retail investment agents were in Germany, where even Parity Supermarket had launched certified natural cosmetics. Large cosmetics companies have been focusing on the scope of the global natural cosmetics industry mergers, acquisitions and investments.

Organic cosmetics in China: Driven by young consumer

Driven by the concept of domestic consumers, natural ingredients have become the top priority of consumer concern in China. In recent years, the discussion of moisturizing ingredients has changed from the previous “laboratory-developed ingredients” to various types of “natural extracts”. Consumers talk the most about plants, extracts and other factors in terms of the social platform’s discussion of moisturizing ingredients. It is worth noting that current users’ concern about the natural composition of moisturizing products has become a trend.

At present, consumers purchasing organic cosmetics in China usually choose foreign organic brands, such as France’s L’Occitane, America’s Origins and Germany’s Jurlique. However, there are few well-known organic cosmetics brands in China. On the one hand, because organic cosmetics originated in foreign countries that have developed a mature sales system, technology and raw materials supply are more developed than domestic. Thus, the product is more trusted by consumers. On the other hand, China has not yet had organic certification of cosmetics, so consumers have difficulty distinguishing authenticity, which also affects the development of domestic organic cosmetics brands.

Chinese certification for organic cosmetics

High quality organic cosmetics have complex formulas and processes, short shelf lives, and easy deterioration. In order to increase preservation, anticorrosive ingredients and chemical compositions are often added into cosmetics. Therefore, it is difficult to break through the bottleneck of preserving pure organic cosmetics. This is a challenge for Chinese manufacturers in the short-term. As the production and use of organic cosmetics have stringent technical requirements, ordinary cosmetics will likely continue to be the main product consumed for a long time. However, when the techniques of producing and saving organic cosmetics mature, the market will dramatically change.

Lack of a single organic certification agency

In China, certification for organic cosmetics was canceled by the state certification and accreditation administration on July 1, 2012. There are now no regulatory agencies or standards to do organic cosmetics certification. The brand itself often finds organic raw materials to make products, but there is no third-party agency screening nor any strict market regulation management in China.

Therefore, Chinese consumers are also more in favor of organic brands with the European Union organic certification, German natural organic certification or New Zealand Natural Organic Association.

[Source: Daxue Consulting “World Organic Certification System”]

Since 2017, several of these certification bodies have been integrated into new certification body called Natural. Among the current organic certification bodies, Cosmo and NaTrue are recognized as the strongest. It is these organizations and institutions that have maintained the orderly development of organic cosmetics in Europe.

Most popular organic or natural cosmetics products in China

Franic法兰琳卡: Franic has been looking for a closer approach to natural skincare, so it is working hard to study the world’s organic skincare trends and move closer to the international concept of advanced skincare. Nearly half of Franic’s natural skincare products are developed and produced in accordance to the EU organic formula standard.

Saselomo 三草两木: Saselomo is a natural skincare brand. It gets amazing energy from nature and develops sustainable, healthy and safe skin care products. Its organic ingredients have been certified through the ECOCERT. It has its own international standard production plant and international process management to ensure the quality of its products.

Chando自然堂:From the selection of raw materials to market sales, all need to go through at least 60 different safety and efficacy verifications to ensure that the product provides safe, trustworthy, functional and high-quality products.

Pechoin百雀羚:The company is committed to creating natural and gentle quality skin care products for consumers. Their company ethics are the perfect interpretation of “China Legend, the beauty of the East.” Their main productions are skin care supplies, shampoo supplies, personal cleaning supplies, dew water and beauty cosmetics.

Organic cosmetics in China: a fad or long-term trend?

Many Chinese preferences for organic or natural ingredients is not only rooted in a desire to be eco-friendly, but also for personal health. Chinese consumers tend to be very cautious of using polluted ingredients. Since the COVID-19 outbreak, our research on beauty consumption shows an even higher awareness of natural ingredients.

Author: Celeste

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast