Born in California in 1998 under the name of “Confinity”, PayPal is an online payment system which allows users to send and receive money around the world after associating a credit card or bank account. The platform has the record for the world’s first digital payment platform, and the it’s the oldest which is still active. The popularity of PayPal is worldwide recognized: in 2022, it counted more than 435 million accounts. Plus, in Q3 2023, it generated a revenue of more than USD 7.3 billion, with a 8% year-on-year increase. The US are PayPal’s largest consumers’ base, where around 76% of its worldwide consumers are from. However, starting from 2019, the company showed clear interest in the Chinese market due to their extremely high usage of e-payments. As of June 2023, indeed, more than 884 million people in China had shopped online at least once. Thus, the digital payment sector represents a flourishing part of the Chinese economy.

How PayPal became the first western digital payment provider in China

The history of PayPal in China started in December 2019, when the American platform bought 70% of the total equity stakes of GoPay, formally becoming the first foreign payment platform in China. Only two years later, in 2021, the company completed its acquisition. The platform that PayPal acquired is an Indonesia-based online payment institution officially licensed by the People’s Bank of China and legitimated to provide online transaction services in the country. So, merchants and private consumers can freely carry on cross-border purchases and trades through PayPal. This would have never been possible without specific regulation changes in 2010, when the government adopted policies for third-party payment providers. From that year on, foreign non-bank related transaction services could apply for a license to the People’s Bank of China. Following the rapid development of Fintech (Financial Technology), these laws have been reformed in 2023, when the government applied more regulations to the financial sector. The plan was announced during the 14th National People’s Congress in March 2023 and clarified the guidelines for transporting China in a new era of digital transformation, including a wholesale payment system specialized in RMB transactions.

PayPal never aspired to be the n.1 digital payment platform in China

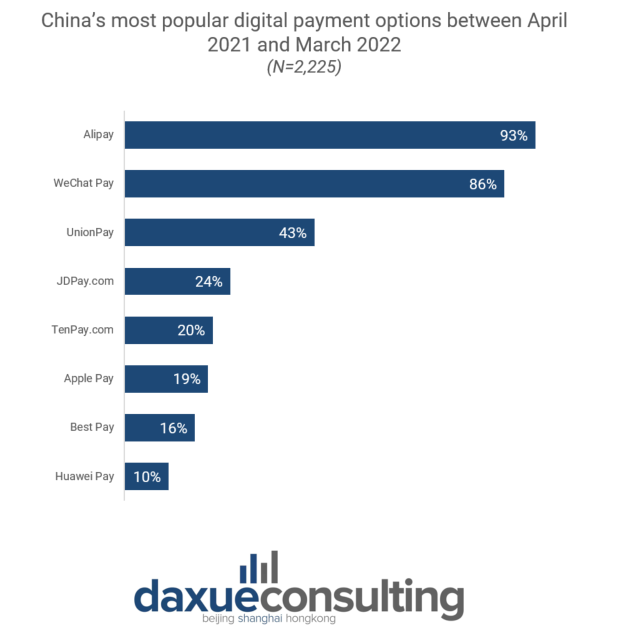

PayPal falls behind in terms of popularity compared to local players. WeChat Pay and Alipay, with 1.1 billion MAUs and 652 million MAUs, respectively, as of July 2023, far outpace PayPal. Remarkably, PayPal doesn’t even make the list of the top 8 most popular digital payment methods in 2022.

However, PayPal never wanted to become a competitor of these platforms. Actually, the American company prefers concentrating in its overseas market and in cross-border payments, providing its users with the best experience possible for trading from and to China.. The strategy adopted seems to give positive results, as more than 26% of the total cross-border purchases on PayPal reported as of October 2023 are in China.

PayPal’s marketing strategy in China: Cross-border trade at the core

Apart from the initial acquisition of GoPay in 2019, which allowed PayPal to enter the Chinese market as a foreign digital payment service, the platform launched other partnerships and innovations throughout the years. In 2020, the American company announced a strategic agreement with UnionPay, the biggest bank card service in China, to enhance cross-border trades. With this deal, PayPal became accessible to all the consumers who wanted to pay with UnionPay in China and, vice versa, UnionPay became available to every PayPal user outside of the country. With this manoeuvre, Chinese consumers are now allowed to pay into PayPal partners’ stores around the globe by using their Chinese mobile wallet. The platform is not new to such partnerships. Even before entering the Chinese market, in 2017, PayPal announced a similar agreement with Baidu. From that year on, every PayPal merchant across the globe could accept Baidu Wallet, Baidu’s own payment platform, as a payment method. On July 2023, the company announced on its Weibo profile a new faster and easier paying method for recently subscribed PayPal users. Plus, the transaction process is now totally embedded into the platform’s ecosystem, preventing from long waiting time for both sending and receiving money.

PayPal’s emerging presence in the Chinese digital payment market

- With more than 435 million accounts worldwide, PayPal is one of the most popular digital payment platforms. Despite its biggest user base is in the US, the company is also gaining popularity in China.

- The history of PayPal in China began when the company acquired 70% of GoPay in 2019. This was only possible after the non-bank payment provider laws enacted in 2010. After being officially licensed by the People’s Bank of China, it was legitimated to operate in the country.

- Despite the Chinese digital payment platform market is very competitive, PayPal never aspired to challenge other platforms such as Alipay and WeChat Pay. Instead, the app prefers focusing in cross-border trades.

- PayPal’s marketing strategy in China firstly consisted in signing agreements with Baidu and UnionPay. This allowed their users to pay with their own Chinese digital wallet in any store in the world which accepts payments with PayPal.

- Other than launching collaborations with other payment platforms, there was a big update of the platform’s cross-border trades functionalities in July 2023. This upgrade made overseas transactions faster and easier.