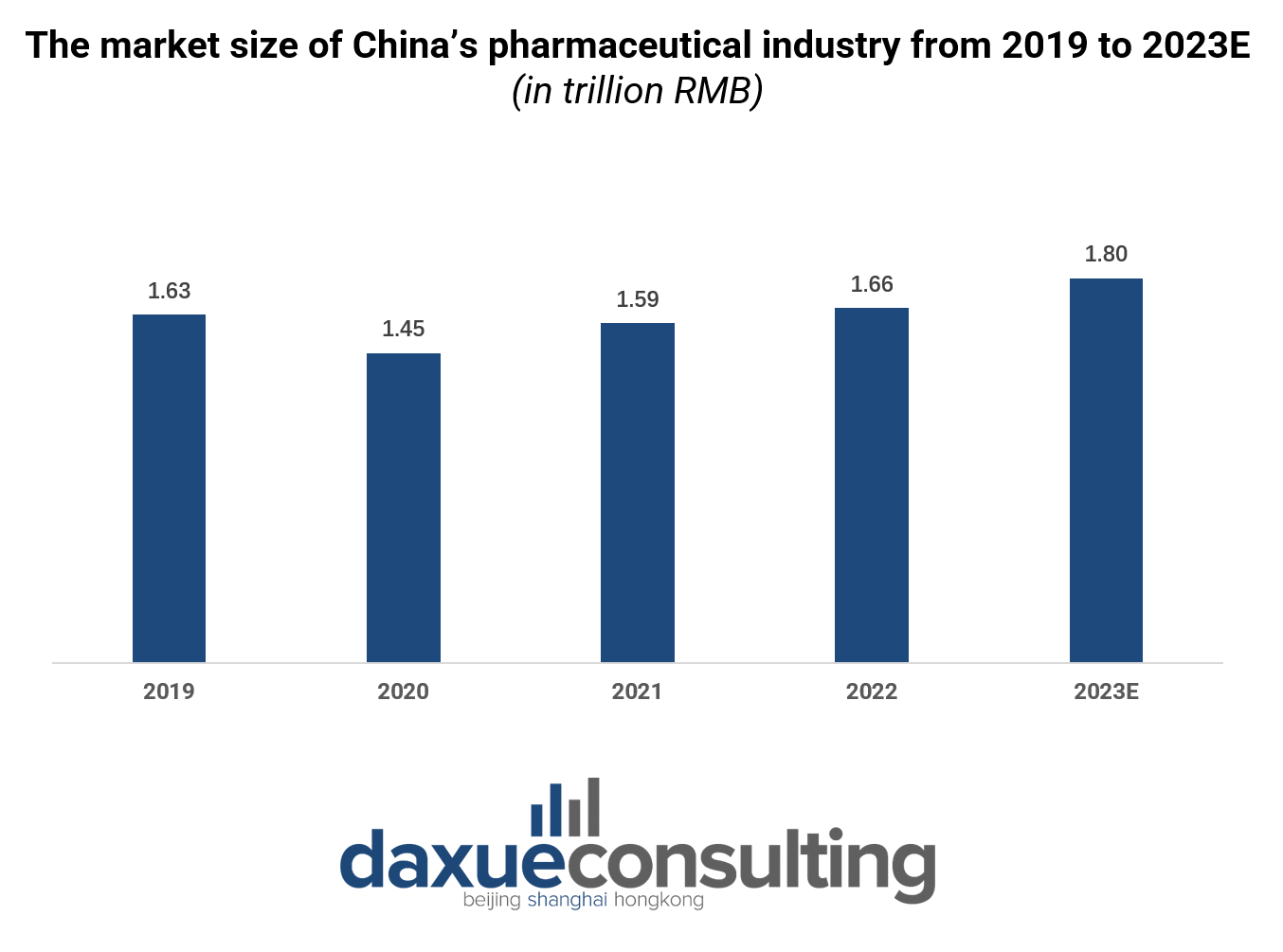

Since joining the World Trade Organization in 2001, China’s pharmaceutical industry has experienced remarkable growth. In 2021, it accounted for 12% of the global pharmaceutical market, second only to the United States, which accounted for a substantial 40% of the world’s total revenue. By 2022, despite challenges from the COVID-19 pandemic, the industry demonstrated resilience, reaching approximately RMB 1.7 trillion, and is projected to achieve RMB 1.8 trillion in 2023.

Download our report on the she economy in China

Over the past decade, China’s healthcare industry has evolved into a strategic R&D hub, transitioning from a manufacturing base, and government incentives continue to drive the integration of research, production, and sales with emerging technologies, positioning the country as a major player in the global pharmaceutical market.

Generic medicine dominates China’s pharmaceutical market

The Chinese pharmaceutical market is divided into three segments: generics, patented pharmaceuticals, and over-the-counter (OTC) medications. Due to the low purchasing power and a robust local manufacturing sector, generic medicine accounts for 54% of China’s pharmaceutical market, with a market size of around USD 107.7 billion in 2020 (RMB 786.6 billion).

According to Huaon Research, in 2021, the size of China’s generic drug market was USD 134.4 billion (RMB 982.2 billion), with a compound growth rate of 0.45% from 2017 to 2021. However, the generic medicine market in China is currently undergoing a gradual reform, leading to the elimination of a significant number of substandard generic drugs. As a result of these changes, it is anticipated that the growth of the generic drug market will slow down in the future.

China’s patented medicine market is on the rise

In recent years, China’s patented medicine market has experienced significant growth, outpacing the global market for patented drugs, boasting a compound annual growth rate of 5.5% between 2017 and 2021.

Several factors contributed to the expansion of China’s market for patented medicines. First, the Chinese government has implemented policies designed to promote innovation and safeguard intellectual property rights. This has created a favorable environment for pharmaceutical companies, both domestic and international, to invest in research and development in China’s patented medicine market. In addition, as the middle class in China continues to expand and healthcare needs increase, there is a growing demand for patented pharmaceuticals of superior quality.

China is one of the world’s most promising markets for over-the-counter medications.

Driven by an increasing health-conscious population and the growing prevalence of self-medication, China’s OTC medicine market has witnessed a robust development rate, with its market reaching RMB 359.6 billion in 2022. From the perspective of product types, the OTC drug market is diversifying, and a wide range of products such as health supplements, and sleep aids have attracted the attention of Chinese consumers.

The COVID-19 pandemic has significantly influenced Chinese consumers, fostering a comprehensive understanding and heightened awareness of immunity enhancement. This shift in health perspectives is reshaping the pharmaceutical industry’s future, with a transition from disease treatment to prevention and control.

What are the major sales channels for pharmaceuticals in China?

1. Urban and rural hospitals

Hospitals and clinics are the primary sales channels for pharmaceutical products in China. These institutions purchase medicines directly from pharmaceutical manufacturers or wholesalers to meet the demands of their patients. In 2021, 63.5% of all pharmaceuticals sold domestically were sold through public hospitals. An additional 9.6% were sold through private hospitals, private clinics, and rural clinics.

2. Retail pharmacies

Retail pharmacies play a significant role in distributing pharmaceutical products in China. They are accessible to the general public and provide over-the-counter medications as well as prescription drugs. Through expansion and increased coverage, it has become the second-largest sales channel for pharmaceuticals in China, accounting for 26.9% of drug sales in 2021. Retail pharmacy chains, such as Nepstar, have a widespread presence across the country. These chains have over 4,000 stores in China by the end of 2021.

3. Online sales

In line with the quickly rising popularity of online shopping, the Chinese pharmaceutical e-commerce market also started to grow before the COVID-19 pandemic. Jianke, a Guangzhou-based company with 100 million customers and over 680,000 SKUs in 2018 was the leading pharmaceuticals e-commerce platform before the COVID-19 pandemic. However, since the outbreak of COVID-19, many Chinese customers have started purchasing medicine through food delivery platforms like Meituan and Ele.me. This has significantly impacted Jianke’s market share because Ele.me and Meituan can deliver medicine within thirty minutes, compared to the one to two days it took to Jianke.

China’s pharmaceutical e-commerce market has experienced significant growth due to the implementation of various policies. For instance, the gradual liberalization of online prescription drugs has untapped immense opportunities. In 2022, the market reached RMB 248.60 billion, recording a 10% increase. It is projected to further rise to RMB 341.02 billion by 2026.

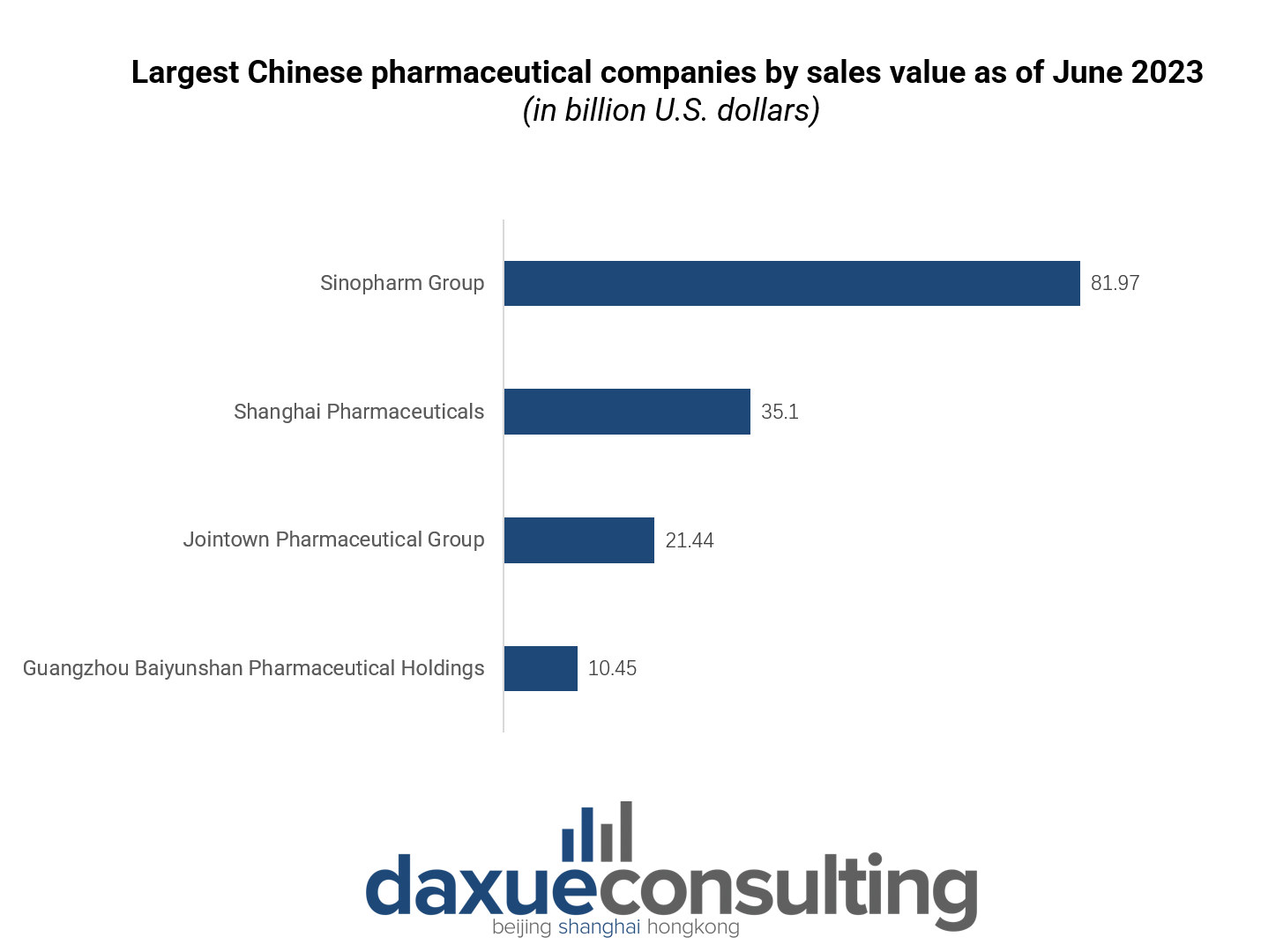

Unveiling China’s pharmaceutical giant: Sinopharm Group

In 2023, China’s pharmaceutical industry is dominated by 4 key players: Sinopharm Group (国药控股股份有限公司), Shanghai Pharmaceutical (上海医药), Jointown Pharmaceutical Group (九州通医药集团), and Guangzhou Baiyunshan Pharmaceutical (广州白云山医药).

Sinopharm Group stands as the largest enterprise in the country, with a comprehensive national presence. Its core business focuses on pharmaceutical and medical device distribution, achieving an operational revenue exceeding RMB 500 billion in 2021.

All four major pharmaceutical companies in China place significant emphasis on traditional Chinese medicine (TCM). Among them, Sinopharm Group is a notable leader, committed to the global modernization of TCM and housing the world’s largest modern Chinese medicine industry cluster. This includes a diverse array of Chinese medicine varieties, extensive industrial parks, cultural heritage preservation, and exclusive pharmaceutical products.

What you should know about China’s pharmaceutical industry?

- Since joining the World Trade Organization in 2001, China’s pharmaceutical industry has made significant progress. It has evolved significantly, evolving from a manufacturing base to a strategic R&D hub.

- The pharmaceutical market in China includes generics, patented medicines, and over-the-counter (OTC) medications. Nowadays, generics dominate the market, but patented drugs are growing faster.

- Major sales channels include urban and rural hospitals, retail pharmacies, and a growing online sector, responding to the rise in online pharmaceutical purchases.

- Dominated by major players like Sinopharm Group, Shanghai Pharmaceutical, Jointown Pharmaceutical Group, and Guangzhou Baiyunshan Pharmaceutical, the industry places a significant emphasis on TCM, with Sinopharm leading in global TCM modernization efforts.