In the bustling streets of modern China, a new trend is quietly reshaping the nation’s perception of beauty and self-improvement. Plastic surgery, once a taboo topic, has surged in popularity from both reconstructive and aesthetic aspects. Cosmetic surgery, a subset of plastic surgery, is now reshaping beauty standards, particularly among younger generations. Propelled by social media, digital platforms, and a cultural shift toward self-optimization, plastic surgery has become a central part of China’s growing “beauty value” economy. The Chinese plastic surgery market grew quickly at a CAGR of 17.2% from 2021 to 2025 and is expected to reach RMB 410.8 billion by the end of 2025.

Social media and digital platforms amplify existing beauty pressures, contributing to the industry’s growth

The core demographic for plastic surgery in China includes individuals born in the 1980s and 1990s, living in first- and second-tier cities, with high purchasing power. Women accounted for 89.17% of those consumers in 2022, primarily driven by desires for anti-aging and facial harmony. Despite a smaller market share, men are more and more interested in cosmetic surgery, with a 150% increase in consumers between 2020 and 2022 and a 27% market growth in 2023. For both genders, growth can be explained by increasing appearance anxiety fueled by constant exposure to filtered images on social media and the normalization of the industry. While social media amplifies beauty standards, other factors like professional competition also drive demand.

Appearance anxiety among Gen Z and Millennials

According to Mob Research Institute, nearly 80% of Chinese individuals born after 1995 experienced appearance-related anxiety in 2021, with 4.5% suffering severe symptoms such as depression, eating disorders, and social withdrawal. Cosmetic surgery is increasingly viewed not just as a luxury, but a necessity to enhance attractiveness and stay competitive, socially and professionally.

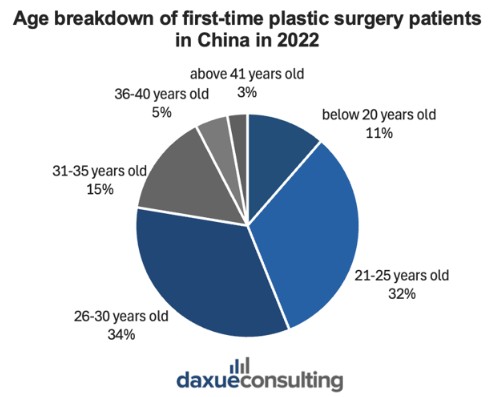

Cosmetic surgery is indeed increasingly common among younger generations. 15.48% of medical aesthetic consumers in 2021 were teenagers or young adults, with a sharp rise in procedures following college entrance exams in June and July, representing 22.41% of the platform’s total annual orders. Furthermore, in 2022, 74% of consumers having their first attempts in plastic surgery were below 31 years old. This suggests a trend toward earlier adoption, started their plastic surgery journey in their youth, and late adopters are quite uncommon.

The common usage of filters on Xiaohongshu and Douyin also changed beauty perception, as most people appear better looking than in real life and often fit a specific face and body type. Models on Taobao and JD.com are commonly filtered, photoshopped, or even AI-generated, increasing comparison possibilities with unrealistic standards, especially when purchasing clothes or cosmetic products.

The role of online platforms in normalizing cosmetic surgery

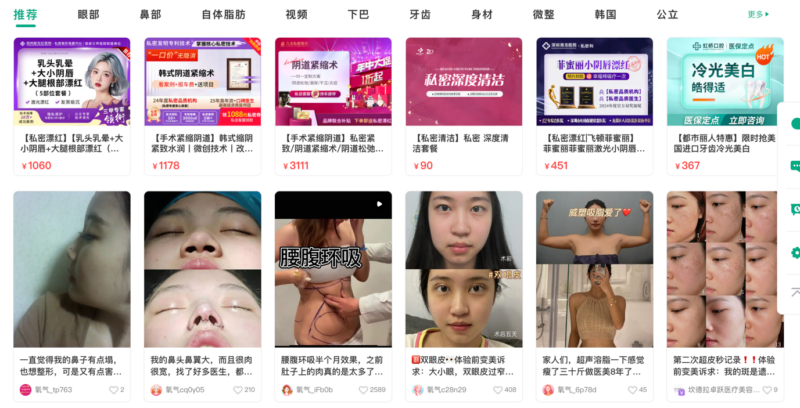

The rise of short video platforms and live streaming has heavily impacted cosmetic surgery growth. Influencers often share their surgery transformations on social media, generating social proof and trust. The cosmetic surgery influencer ecosystem has emerged as a major force, with those doing live streaming in China offering procedure discounts and personal endorsements to large audiences, thereby expanding access and visibility.

Hashtags like #One Sentence Summary: What Should We Do for Medical Aesthetics (一句话总结医美该做啥) are trending on Weibo, making medical aesthetics a topic of nationwide discussion and participating in normalizing procedures. The overall hashtag #medical aesthetics (医美) on Weibo has garnered 1.31 billion reads as of May 2025.

Trends reshaping the plastic surgery market

The risks behind the “light” plastic surgery procedure

China’s market has witnessed the rise of “light cosmetic surgery” (轻医美), a minimally invasive category marked by accessibility, convenience, and high repeat rates. iiMedia Research estimates that the light plastic surgery market was worth RMB 147 billion in 2023, with a projection to reach RMB 175 billion in 2024. This segment is becoming the primary growth engine of the industry, particularly attractive to younger, risk-averse consumers. It is especially popular on online platforms. In 2022, it accounted for 84% of online procedure orders, up from 62% since 2017. In reality, no cosmetic surgery is free of risks, and the perception of light plastic surgery’s danger is often underestimated.

Wealthy Chinese consumers fly to Korea to have their makeover

In 2022, Chinese patients accounted for 17.7% of South Korea’s medical tourists, with many seeking plastic surgery. Drawn by the allure of K-pop beauty standards and competitive pricing, these travelers often undergo procedures like jawline contouring and double eyelid surgery. However, some face challenges upon returning home, as their new appearances may not match passport photos, prompting the Chinese Embassy to advise carrying medical certificates post-surgery. This trend underscores the growing influence of South Korea’s cosmetic industry on international beauty ideals.

The digitalization of plastic surgery in China

So Young: The leading aesthetic app ecosystem

Platforms like So Young (新氧) exemplify how online ecosystems influence consumer choices. Users upload selfies, receive AI-driven procedure suggestions, browse institutions, book appointments, and later share their outcomes through “beauty diaries”. This closed-loop engagement model has driven So Young’s 2019 listing on Nasdaq, reinforcing the viability of such platforms. It normalized and widely simplified access to cosmetic surgery.

Localized procedures and beauty standards

The Chinese ideal for women: Small faces and big facial features

China’s plastic surgery preferences reflect localized beauty ideals for women: V-shaped faces, double eyelids, high nose bridges, and even protruding ears, which contrasts with Western tendencies to reduce ear prominence. V-shaped face and high nose-bridge also showcase specificities in Chinese beauty standard as sharp jaw line and small nose are quite popular in other regions. Chinese patients often seek holistic enhancements rather than localized procedures, guided by recommendations from surgeons or platforms like So Young.

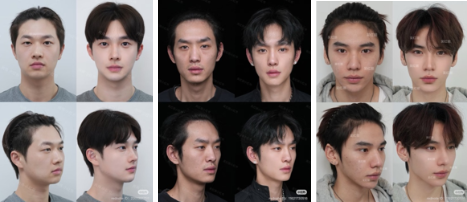

The Chinese ideal for men: Soft contours and youthful precision

Regarding men, cosmetic surgery preferences also reflect distinct local beauty ideals. Beauty trends often emphasize a youthful, delicate yet sharp appearance, characterized by a V-shaped face, high nose bridge, smooth skin, and larger, defined eyes with double eyelids as well. Unlike Western ideals that may prioritize rugged or highly masculine features such as strong brow ridges, tanned skin and prominent jaws, Chinese aesthetics for men favor softer contours, light skin, symmetrical facial structure, and even subtle lip enhancement.

Porcelain pursuit: The obsession with fair skin

Cultural emphasis on fair, flawless skin continues to drive demand for skin-whitening and rejuvenation procedures. As of April 2024, Xiaohongshu featured over 4.9 million posts under the tag 美白 (skin whitening). Photon-based treatments, such as rejuvenation therapy, ultra-pulse, and Thermage, are gaining traction, especially among college students, who often select these as their first cosmetic experience.

Navigating the illegal market landscape

A market rife with informal institutions

Despite booming demand, China’s plastic surgery sector is undermined by a shadow market where informal and unqualified providers dominated over 70% of the landscape, leading to widespread safety risks, inconsistent surgical outcomes, and a rising number of medical disputes. Many of these underground clinics operate under the guise of “beauty salons” or “aesthetic studios,” exploiting regulatory loopholes to offer cut-price, high-risk procedures.

Even licensed institutions are not immune: 14% engage in illegal practices, such as deceptive plastic surgery ads, unapproved treatments, and the use of counterfeit injectables. Regulatory efforts are tightening, but enforcement remains uneven. As noted by the director of Shanghai United Family Medical Beauty Clinic, while unlicensed practices are declining in top-tier cities, they remain common in lower-tier markets.

More alarmingly, many lack a comprehensive understanding of the procedures. In lower-tier cities, many consumers struggle to distinguish between legal and unqualified services, highlighting a growing need for market education and transparency.

How is the Chinese government cracking down on illegal clinics?

China is stepping up its crackdown on illegal plastic surgery clinics. Authorities are shutting down unlicensed operations, seizing illegal profits, and issuing fines under Article 44 of the Medical Institution Management Regulations. Serious cases are sent to court under Article 336 of the Criminal Law. Industry groups are urged to set standards, and whistleblower reward programs are being introduced. Still, much work remains to fully clean up the market.

The evolution of plastic surgery in China

- Plastic surgery is gaining mainstream acceptance in China, driven by shifting beauty ideals and social media influence.

- Women, especially in urban areas, dominate the cosmetic surgery market, motivated by anti-aging and facial enhancement goals, but men are quickly gaining interest

- Gen Z and young adults are increasingly turning to cosmetic procedures, often seeing them as essential rather than optional.

- Minimally invasive “light plastic surgery” is booming, thanks to its convenience, affordability, and appeal to younger users.

- A large part of the market operates informally, with many procedures performed by unqualified providers, raising safety concerns.