Programmatic advertising: started late yet is finding its way to thrive in China

Programmatic advertising has paved its way in China’s advertising market, with rapidly growing market size and revenue. This article will be focusing more on real-time bidding (RTB), which is one of the methods to achieve programmatic ad buying, in order to provide a better picture of the role and influence of personal data in China’s programmatic advertising market. Real-time bidding is achieved by the interaction of demand-side platforms, real-time bidding exchanges, supply-side platforms, and ad publishers, to be explained in more details later in this article.

Key findings:

- China’s programmatic advertising market is at a starting stage yet fast growing compared to that in Canada, the US, and UK

- The programmatic ad landscape is more blurry in China, where internet giants BAT dominate the DSPs, SSPs, while also serve as large ad publishers

- Personal data is both the driver and inhibitor of programmatic advertising under China’s unique tech landscape

- This market in China is less transparent, which requires collective efforts from all of the players

What is programmatic advertising?

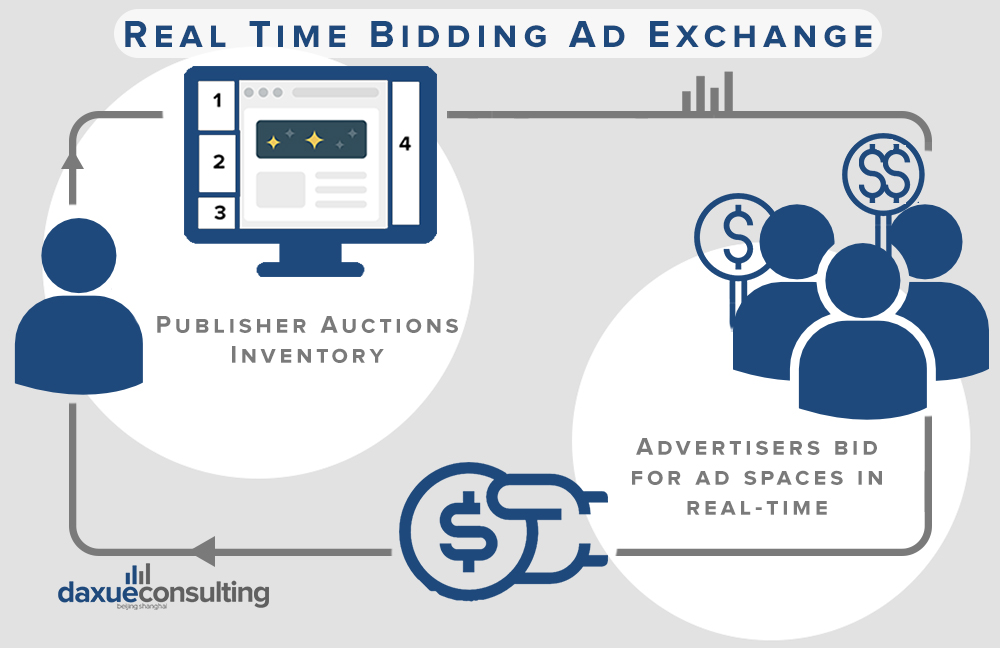

Programmatic advertising is “the use of software to automate the process of online ad buying and selling. It can be done either through Real-Time Bidding (RTB) on open exchanges or private marketplaces or by the direct purchase of guaranteed or fixed-rate deals”. Firstly, RTB is the process where publisher inventory is placed into an Ad exchange and many buyers will enter an auction and bid in real time for the impressions they choose.

In a private marketplace, publishers can control the buyers they allow to bid in a smaller auction; this gives both seller and buyer more exclusivity and control. Finally, publishers and buyers can also enter a one-to-one agreement, determine a price upfront and see set allocations of inventory earmarked for one buyer. This is called programmatic direct.

Compared to traditional manual buying, where advertisers need to negotiate with human salespersons for advertisement prices and placements, programmatic buying allows advertisers to use data analytics and technologies to decide where and when mobile advertisements are placed. This digital, automated and systematic approach in China can greatly enhance the efficiency of advertising transactions, expand the transaction scale and optimize the effectiveness of advertising. It is advantageous for advertisers, who can better segment audiences and reach target audience more accurately. For the media, they can price the same advertising differently according to various time and regions and sell to different advertisers. Besides, advertisers who purchase advertising positions and run advertisements through programmatic buying will also receive effective feedbacks from media platforms.

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

Programmatic advertising is growing rapidly in Mainland China

The development of programmatic advertising in China still lagged that in the US and UK. Compared with the US and UK, the number of publishers in China is also limited, which could restrain large-scale competition and spending.

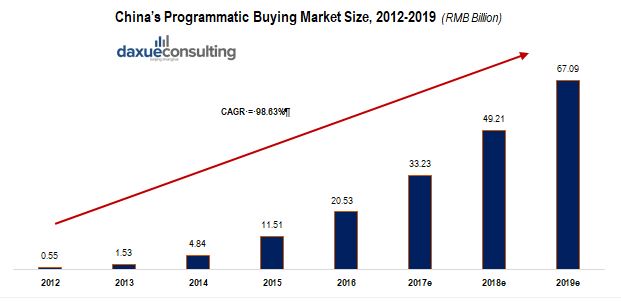

Nevertheless, programmatic buying has already nestled its way into the advertising industry in China, whose market size and revenue have both been growing disproportionately. The market size of programmatic buying ads is expected to reach RMB 67.09 billion in 2019. With a 7-year CAGR of 98.63%, programmatic ad buying market is growing rapidly. According to iResearch, in the long run, China’s programmatic buying market has promising prospects. Medium to high growth rate is expected to continue (iResearch, 2016). This is owing to rapid growth of the number of internet users and the amount of time they spent on the internet, as well as the continuous improvement of the online advertising industrial chain and the increasing maturity of advertisers, agents, and media.

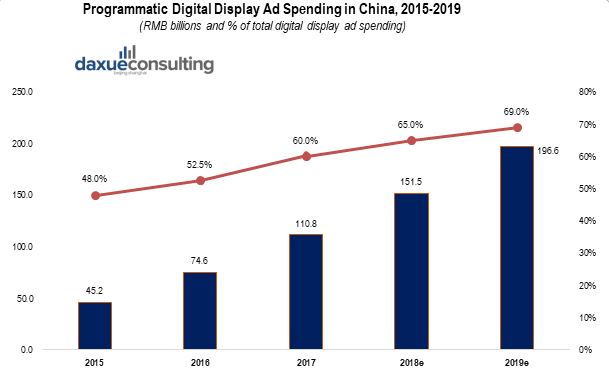

As shown in the figure, the revenue of programmatically purchased display ads was also growing fast for the past 5 years and is expected to reach RMB 26.3 billion in 2017. Likewise, the proportion of programmatically digital display ads in a total amount of display ads is 60%, as shown by the red line. Though this number is still quite low compared to those in Canada, the US, and the UK – where 81%, 78%, and 77% respectively, of digital display ads would be traded programmatically, the growing proportion shows a promising Chinese market.

Digital display ads include everything from publisher-erected APIs to more standardized RTB technology; includes ads on e-commerce platforms, advertising that appears on the desktop, mobile phones, and other internet-connected devices.

The process of programmatic ad buying through RTB

As mentioned, programmatic advertising can be done either through real-time bidding (RTB), private marketplaces or direct purchase. However, the rest of this article will be focusing more on RTB since it better demonstrates the role of personal data in programmatic advertising in China clearly.

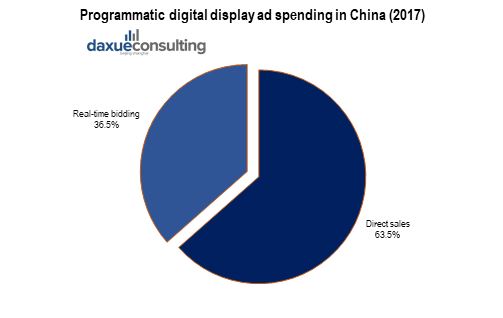

In recent years, real-time bidding has become an important way to achieve programmatic advertising – in 2017, programmatic digital display ad spending through real-time spending in China account for 36.5%.

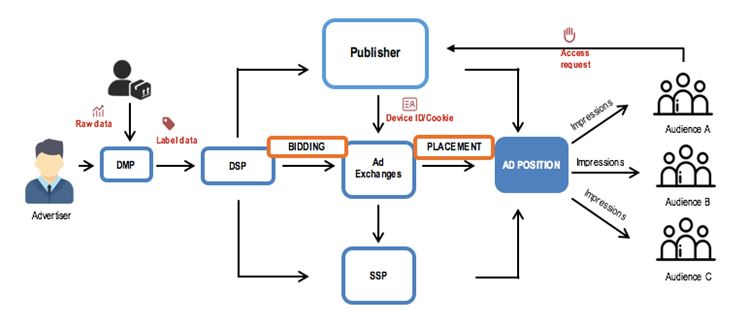

Real-time bidding is achieved by the interaction of the demand-side platform (DSP), real-time bidding exchanges (RTB exchanges), and supply-side platform (SSP). SSPs enable web publishers (online/ mobile advertising) to manage their advertising space inventory, fill it with ads, and receive revenue. SSPs send impressions (advertising traffic) to Ad exchanges, where DSPs purchase them on marketers’ behalf, depending on marketers’ advertising needs.

Firstly, as shown by the left side of the figure above, the data management platform (DMP) gets raw data from marketers/advertisers and through other channels, such as internet companies or data crawling. Through data analysis, DMPs find target users, analyzing their natural attributes (e.g. ages, gender, occupations, income, and etc.) and social attributes (e.g. social interaction, hobbies, location, purchase intentions), then draw accurate user portrait based on data analysis results. Specifically, users’ behavior and preferences are analyzed and based on that, they are given different data labels (e.g. “keen to travel”; “makeup lover”). After that, when the real-bidding begins, DMPs can supply labels or tags to DSPs and RTB exchanges immediately.

On the right side of the picture, the process of how publishers show specific ads to specific users is shown. It is common nowadays that big internet giants in China like Alibaba, Tencent, and JD analyze their own users and draw user portrait based on various things from browsing history, device data, consumption behavior to their interests and preferences. For instance, Tencent gives each user over 300 data labels. Users are often identified by their unique device ID, to be shared among different platforms without violating their privacy or disclosing personally identifiable attributes.

For instance, take real-time bidding on Tencent AdExchange (owned by Tencent) to explain the actual real-time bidding process in China; when a user sends an access request to the publisher (eg: a request to watch a video on Tencent Video (video streaming platform owned by Tencent)), the publisher will transfer this user’s device ID or cookie immediately to Tencent AdExchange. Knowing the user behavior and data labels represented by the specific device ID, Tencent AdExchange sends bidding requests to DSPs whose advertising demands are in accordance with these data labels. Through a matching of labels on the demand side (marketers/advertisers) and supply side (users), the DSP who responds with the highest bid will get the right to expose its advertisement to a specific user.

The whole process of real-time bidding only takes about 100 milliseconds, which means as a user, when you click on a video, after 100 milliseconds, an advertisement based on your preference or the things you may be interested in is displayed to you. This also explained why some Chinese consumers complain that after they browsed something on the website, later when they shop in an e-commerce platform, similar content or products are promoted to them on their homepage.

Programmatic advertising landscape in China dominated by big players, mainly internet companies

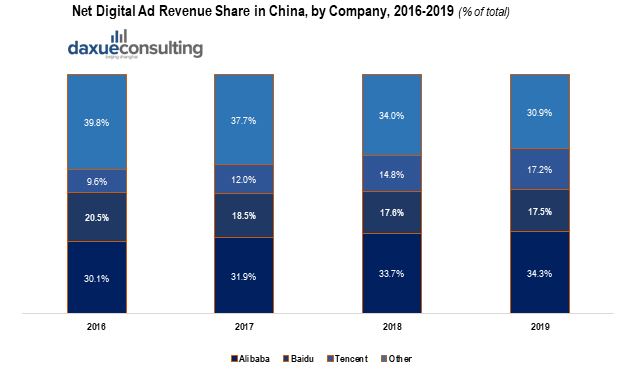

DSPs – the programmatic buying market in China is mainly dominated by 3 giant internet companies — Baidu, Alibaba, Tencent, which collectively known as BAT. To be specific, Alibaba alone accounts for about 60% of all programmatic advertising. When counting Baidu and Tencent in, the BAT companies take up about 90% of the market. Their dominance position is expected to continue. For example, with regard to net digital ad revenue (net ad revenue is revenue after companies pay traffic acquisition costs (TAC) to partner sites), BAT represent 62.4% market share in 2017, and is expected to increase to 69% in 2019. BAT serve as main DSPs in China; beyond them, major independent DSPs include iPinYou, Limei, and AdSame.

SSPs – similarly, since China is a mobile-first country in terms of internet access, most SSPs are major apps, such as Youku and Tencent Video both providing video services and live streaming services. There are few independent SSPs in China because large publishers prefer building their own SSPs to sell traffic at the highest price possible, while small publishers typically sell their ad inventory to big ad networks like the BAT.

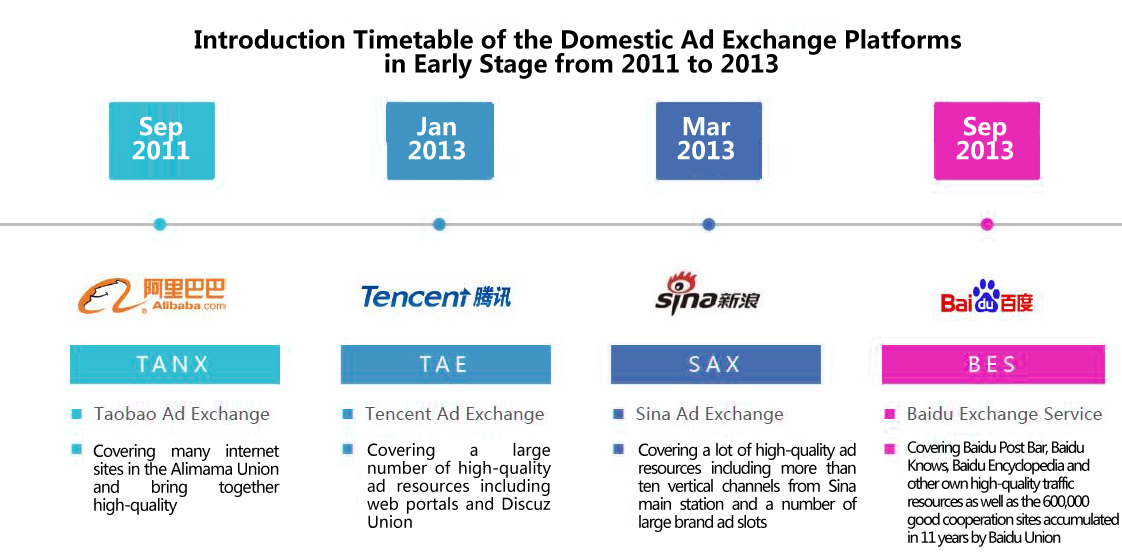

Alibaba, Tencent, Sina, Baidu and other domestic internet icon companies have built their own Ad Exchange platforms, which on one hand, provided plentiful high-quality biddable resources, and on the other hand, had relatively rich and complete functional modules and connected with a number of third-party DSPs in the market. Below are 2 biggest Ad exchanges, owned by Alibaba and Tencent.

Taobao Ad Network and Exchange (TANX)

TANX is owned by Alibaba, and is one of the earliest and largest real-time online advertising exchanges in China. Publishers, merchants and DSPs are participants of TANX, as well as third-party data and technology companies, who serve as DMPs, enabling participants to identify potential customers.

With the help of DMPs, TANX leverages rich consumer data collected from China retail marketplaces and utilize its proprietary algorithms to select online advertising inventory automatically for participants. It also makes a prediction on click-through rates and conversion rates of advertising. Apart from increased consumer targeting efficiency, TANX’s transparent pricing of advertising inventory upgrades marketers’ ROI. Alibaba has sizable revenue from advertising, most from providing ads services to merchants on Taobao and Tmall (both owned by Alibaba) to improve performance. In 2016, Alibaba began to expand its business. Cooperating with AdChina, an advertising technology company who serve as both SSP and DSP in China, Alibaba provides programmatic advertising services to brands. They have also built an enterprise-level DMP, allowing a number of large advertisers and agencies to have a chance to tap into Alibaba’s user data, under the management of Alibaba and AdChina. They are expected to build the largest mobile ad exchange in the China market.

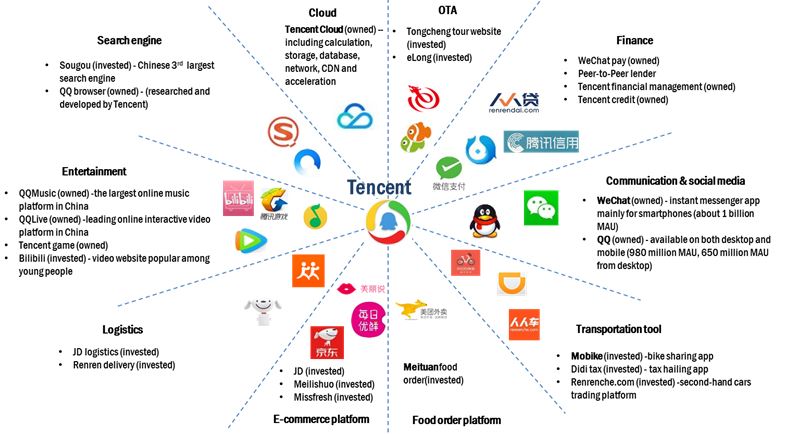

Tencent Ad Exchange (TAE)

The staggering scale of Tencent’s audiences paves the way for its Ad exchange platform – Tencent Ad Exchange (TAE). Since Tencent dominance in social media platforms, 25% of Chinese mobile internet users are involved in Tencent’s platforms, such as WeChat, QQ, Tencent Video and Tencent News, which allows Tencent to have a wide coverage and insight into user behaviors. With 871.6 million monthly user accounts on WeChat, it has become the most popular social networking platform among all age groups. The ads can be presented on WeChat within seconds, which is equal to Facebook’s news feed. In terms of monetization, however, Tencent tends to take a slow but safe way. Concerned about user experience, it currently only shows one ad per user per day on WeChat.

The role of personal data in China – driver and inhibitor of programmatic advertising

On the one hand, personal data drives the development of programmatic advertising market. As aforementioned, users’ personal data is the cornerstone in drawing user portrait and forming data labels. Thus, plays a vital role in programmatic advertising. Through matching of data labels between demand side and supply side, customized advertising and precision marketing can be achieved and real-time bidding can be realized in such a short time.

Nowadays, both DMPs and DSPs own abundant data sources. For example, iPinYou (Chinese name: 品友网络公司), a leading DSP in China, has more than 3,000 user attribute labels, and Adsme (Chinese name:传漾科技), the forerunner of Chinese intellectualized digital marketing, collects one billion cookies and divides them into 33 large classes, 168 medium classes, and 857 small classes. Based ownership of large-scale data then through data mining and big data analysis, these companies are able to extract in-depth data (e.g. consumer behaviors, lifestyles) from mass and trivial data (e.g. content contact marks, consumer behavior data), achieving the overall portray of target consumers.

On the one hand, RTB exchanges also need user data and through big data analytics, user behavior is analyzed in order to understand which companies with advertising needs are most suitable for each spot from advertising publishers. Then, those suitable companies can enter the bidding. On the other hand, the unique tech landscape in China inhibits data sharing and aggregation thus can somehow hinder the development of programmatic advertising.

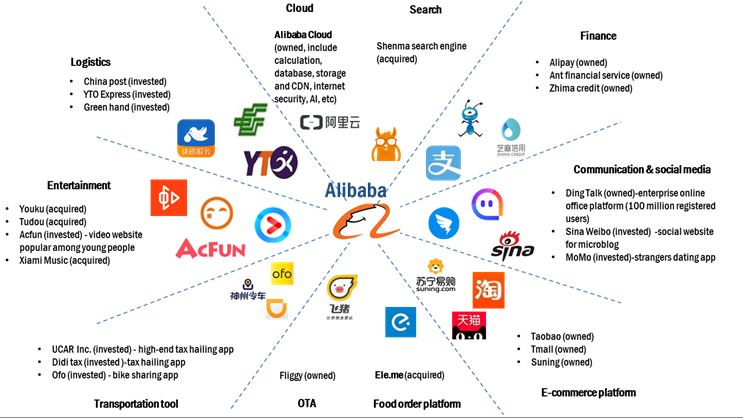

Since China is a mobile-first market for internet access, digital advertisers have followed consumers by investing in mobile ad formats. In 2017, 79.9% of programmatic outlays were dedicated to mobile advertising. According to iResearch, mobile programmatic purchasing has become and will continue to be the main development accelerator of programmatic purchasing in China. The share of programmatic purchasing via mobile surpassed that via PC and will continue to grow in a higher growth rate. This gives BAT huge opportunities to leverage their advantage in the mobile market into programmatic advertising. BAT has a huge advantage in the mobile market since they have developed, invested and acquired companies in various industries, providing apps ranging from transportation, entertainment, mobile gaming, to mobile payment and etc.

To sum up, consumers spending more time on their digital platforms, they get hold of the larger scale of aggregated data in various industries and rich dimensions. These data have become valuable assets and competitive advantage for BAT and other big service providers, thus, consumers are not keen on sharing data outside of their own ecosystems. Even within their own ecosystem, data sharing is very strict and limited. This means small players have difficulty gaining large-scale data. According to iResearch, in the short term, substantive action is still difficult to be implemented with regard to data opening. This trend will probably help BAT to maintain their dominant position yet inhibit the development of programmatic advertising in China.

Potential challenges of programmatic advertising in Mainland China

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

Lack of high-quality, large-scale, and integrated user data in China

Generally, advertising companies or various platforms can obtain data from several channels. Internet enterprises, mobile network operators, Ad exchange, advertisers, and third-party data management companies are common data sources for advertising companies. However, in the Chinese market, it is difficult for an advertising company to get high-quality, large-scale, and integrated user data. As aforementioned, although giant internet companies like BAT hold large-scale data, other companies have no chance to acquire it from them even for those in cooperative relationships with BAT. Mobile network operators (MNOs) in China operate their business in their own particular regions separately, resulting in dispersed data. In addition to data from internet enterprises and MNOs, data from advertisers and third-party suppliers also tend to be scattered. This opens opportunities for relevant companies such as MNOs to monetize data in a legal and acceptable way that is visualized and organized without violating users’ privacy.

The lack of transparency in pricing can be costly for Chinese marketers/advertisers

The second obstacle for programmatic advertising in China is about transparency. Traditional ad networks make money through arbitraging. They buy low and sell high, which is not the way DSPs are supposed to work, most of whom should charge a transparent service fee. Though ad tech players that buy low and sell high also exist in the U.S., it is more non-transparent in China.

The main reason is that the Chinese market lacks third-party validation. According to Digiday, big Chinese publishers typically do not allow external measurement companies to access their inventory.

In addition, China has a different tech landscape – the line between a SSP and a DSP (or even a DMP) is blurry in China. According to Accenture, China’s DSPs, due to its initial resistance to transition into an exchange inventory, adopted a hybrid model, DSPAN, where it is common for companies to own a DSP and an ad network. This type of model allows picking from a fixed ad network publisher list to fulfill the needs of an advertiser, while also buy inventory through the exchange for performance-oriented advertisers. As a result, DSPs were given preference to sell their own ad network inventory to buy on the exchange, undermining brands’ interests and yielding financial losses. ADBUG’s 2017 Q1 China Media Report states that “…out of 12 billion impressions verified in the Real Campaign, China saw an average of 29.5% invalid traffic and only 25.5% viewability rate on personal computers and mobile websites”. The role of programmatic advertising is to reach out to target customers at the right time and place. However, the above numbers show that the effectiveness of programmatic advertising is not high in China; consequently, the profit and brand reputation of companies with investments in digital advertising in China can get impacted.

Daxue Consulting leverages unique experience and data extraction capabilities to support your advertising strategy in China

PR and Advertisement businesses in China require strong and reliable knowledge on the overall market and on the culture and custom of its customers. Daxue Consulting conducts all the market research and consulting services you might need to develop your PR and advertisement business in China. To know more about digital advertising in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.