China is heavily investing in renewable energies to stay within the limits of its two carbon emission goals: to reach peak emission by 2030 and neutrality in 2060. While China is the biggest investor in renewable energy globally, it is simultaneously also the biggest emitter of CO2, as energy supply stability and continued economic growth drive consumption of cheaper fossil fuels.

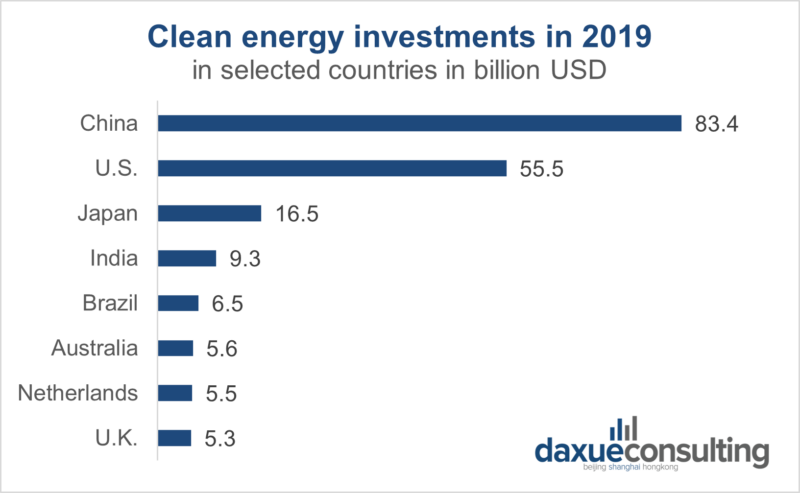

Since surpassing Europe in 2013, China has continually been the leading renewable energy investor worldwide. In 2019, global renewable energy investment totaled 282 billion US dollars, while investments worth 83.4 billion USD stemmed from China.

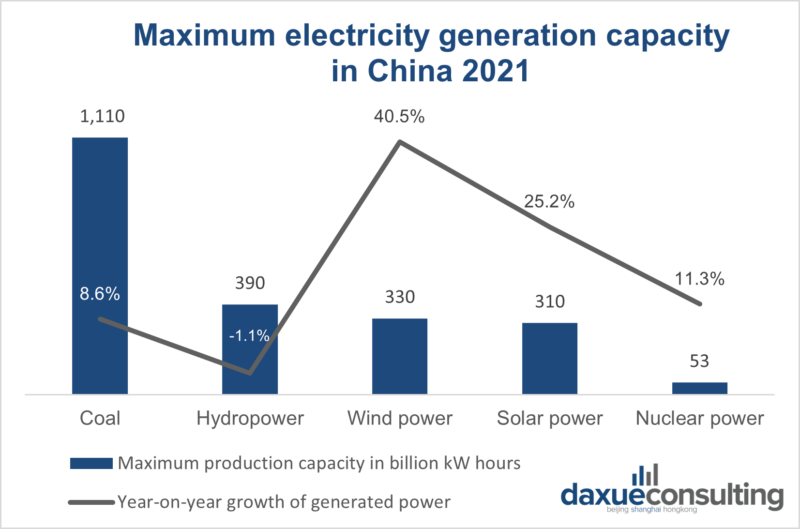

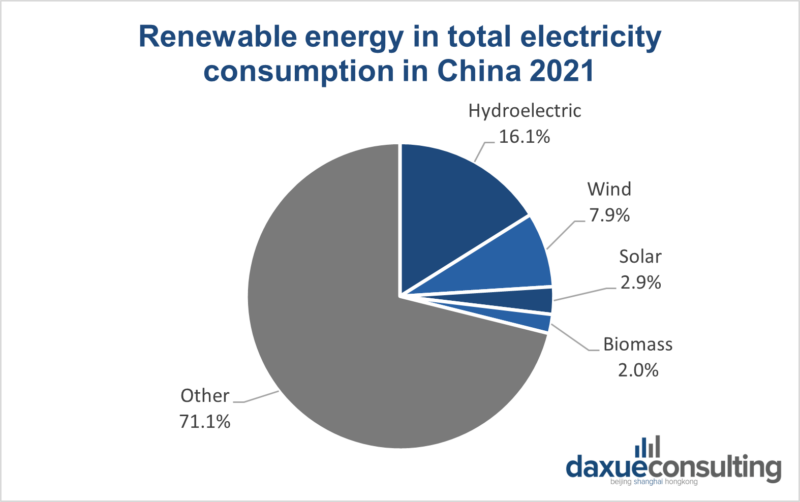

According to China’s National Energy Administration, all renewables combined in 2021 reached a maximum capacity of 1.1 billion kilowatts, which equals 44.8% of total power generation. However, in terms of total energy consumption, renewables only reached a 29.9% share in 2021 (2.4 trillion kilowatt-hours). This still marks the highest recorded total energy output from renewables in China to date.

China: the biggest CO2 emission contributor is still increasing coal consumption

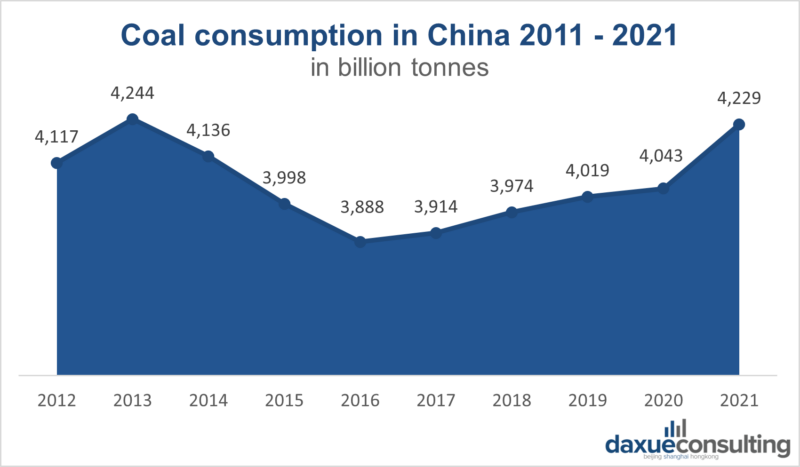

China’s overall increased energy demand has resulted in a renewed growth in coal consumption since 2016. Simultaneously, with the rise of renewable energy sources, the energy produced from coal in China’s energy mix has seen an all-time low: Energy produced from coal continuously hovered around 77% between 2000 and 2012, before dropping year on year to the current lowest share of 63% in 2021.

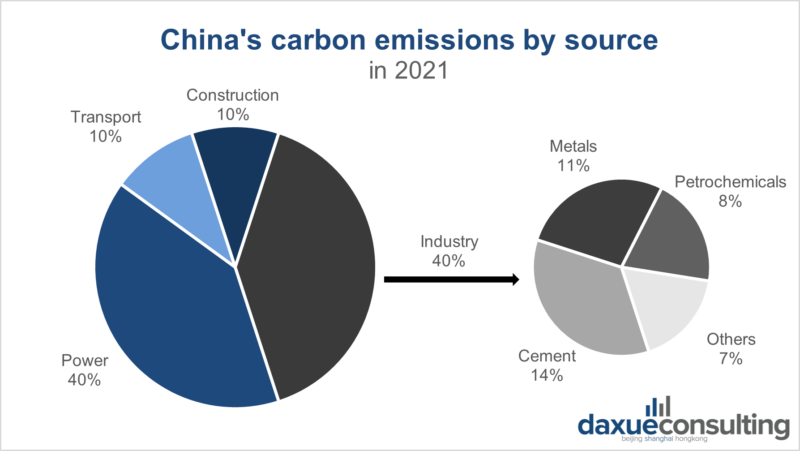

Accounting for about 30% of global emissions in 2021, China is the biggest CO2-emitting country worldwide. Total global emissions in 2021 sat at 36.3 gigatonnes of CO2 while 11.9 gigatonnes of CO2 were emitted in China. With per capita CO2 emissions of 8.4 tonnes in 2021, China sits between the European Union with 6 tonnes and the United States with 14 tonnes of emissions per capita in 2021.

While CO2 emissions in most economies dipped at the start of the COVID-19 pandemic and only had a slight upwards trajectory since 2021, CO2 emissions in China continued growing throughout the pandemic, in part due to increased global demand for goods and services. This increase can partly be attributed to the large share of coal in China’s energy mix (approx. 60%) in comparison with the average of 27% in advanced economies.

Following several incidents of power cuts and subsequent factory shutdowns in late 2021, energy supply stability has been a top priority for energy policy in China. Along with the country’s overall need for more energy to keep its production and construction sectors running, cheap and accessible coal has also become a safety net to prevent future power cuts from occurring again.

Renewable energy policies: China’s 2060 carbon neutrality plan

In 2020, China has pledged to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. In contrast to the 1.5-degrees goal of the Paris Agreement, China’s carbon neutrality plans align more with a 3-degree goal. According to a working guidance released by the government in 2021, China aims to gradually increase the share of non-fossil energy consumption to 20% by 2025, 25% by 2030, and over 80% by 2060.

By 2030, China aims to:

- Increase the share of non-fossil energy consumption to around 25%

- Reach energy efficiency levels of developed countries in key energy-consuming industries

- Decrease CO2 emissions per unit of GDP to 65% compared with the 2005 level

- Install wind and solar power capacities reaching over 1,200 gigawatts

- Reforest up to 19 billion cubic meters, with forest coverage of 25%

China’s climate goals for 2060 include:

- Becoming carbon neutral

- Reaching a share of non-fossil energy consumption of over 80%

- Having comprehensive energy efficiency at the advanced international level

- Establishing a green, low-carbon, and circular economy and a clean, low-carbon, safe and efficient energy system

To reach its climate goals, China will expand its green energy sources and reduce the usage of coal, heavily invest in research, development, and expansion of green technologies, as well as improve energy intensity for the industry sector. Additionally, a standardised system to record carbon emissions and provide more accurate data is currently under development, set to be unveiled by 2023 and completed by 2025.

Significant responsibility will be given to local governments for regional implementation. As the policy is still under development, further documents detailing goals and concrete steps will be published continuously.

Which renewable energy sources does China use?

Hydropower: reduces coal consumption, but devastating effect on China’s largest rivers

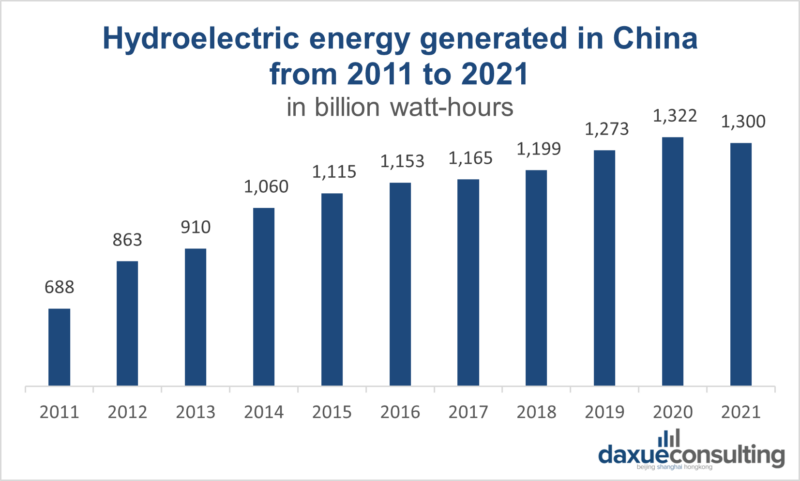

Hydropower is China’s second-largest energy source after coal. Although absolute energy generated from hydropower has almost doubled from 688 billion kilowatt hours in 2011 to 1,300 billion kilowatt hours in 2021, the share of hydropower in China’s energy mix has consistently oscillated between 15% and 20% since 2000 all the way up to 2021.

More than half of the world’s dams are located in China. If China exploits its hydropower resources at full capacity, it can meet one-fifth of its own energy demand and replace about 1.3 billion tons of coal. Hydropower generates far less CO2 emissions than coal, but not without consequences for the ecosystem.

While the active use of hydropower will make the air cleaner for the inhabitants of China’s east coast, the large number of dams creates additional risks. For example, a new round of dams in the untouched nature of China’s Tibetan regions will destroy river ecosystems and fish habitats. People living in the southwest, where 80% of new dams are constructed, will pay the environmental price as well.

The concentration of dams on the Jinsha River (upper Yangtze) is especially high. These dams increase the risk of large sedimentation in the Yangtze Delta and flooding in major cities such as Shanghai. In addition, for every new hydropower plant in southwest China, there is an additional coal-fired power plant in reserve.

Recent incidents of flooding and droughts have caused heavy fluctuation in China’s hydroelectric energy production. In May 2022, China has seen an increased energy production of 27%, setting a new energy production record of 121.7 billion kilowatt hours for the month. However, in August of the same year, water levels of the Yangtse sat at an all-time low, causing energy production to be cut in half and propelling an increased consumption of coal, to compensate for energy losses; especially in Sichuan Province, which covers 80% of its energy demand through hydroelectric power.

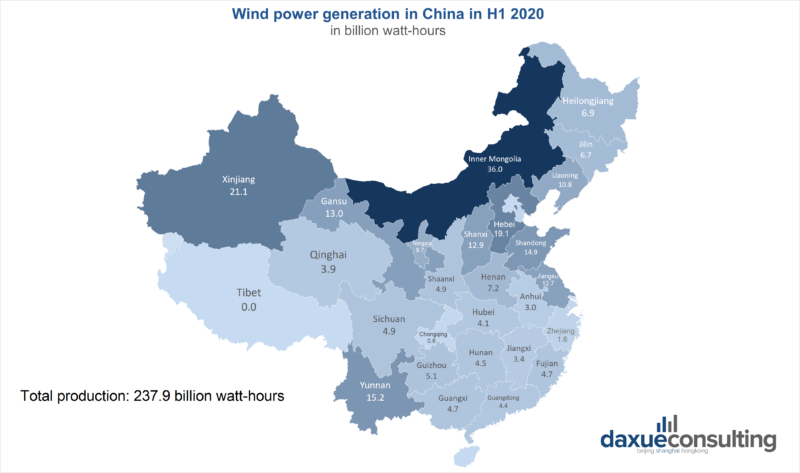

Wind parks in China: top wind installer in the world

China ranks first in the world for the installation of wind turbines. The main problem with wind turbines in China is that they are mostly located in the South China Sea provinces. In the northern regions, coal is still the number one energy source, although wind energy has huge potential there.

The Gobi Desert, near the Mongolian border, is an important destination for China’s wind power industry, as it records extremely heavy winds. Construction of the Jiuquan wind power base began in 2009. However, the strong desert winds simply produce too much energy for the surrounding rural villages, some turbines were taken off the grid. Wind energy produced in Inner Mongolia could be in better use if the government had built out the grid to transfer excess energy throughout the country. Although this type of infrastructure is still missing.

Since 2015, China also decided to focus on offshore wind energy. China’s east coast, especially south of the Yangtse Delta and in the Taiwan Strait, boasts the strongest offshore winds, reaching up to 10 m/s at 100m altitudes. While global wind energy capacities reached 48.2 million kilowatts by the end of 2021, 40% of which (19.7 million kilowatts) are installed in China. The majority of these wind parks were only built in 2021, as China added capacities in the range of 12.7 thousand kilowatts within one year. This resulted in China surpassing both Germany and the UK between 2021 and 2022; now possessing capacities more than both other nations combined. Additionally, dozens of further offshore wind parks are still being constructed.

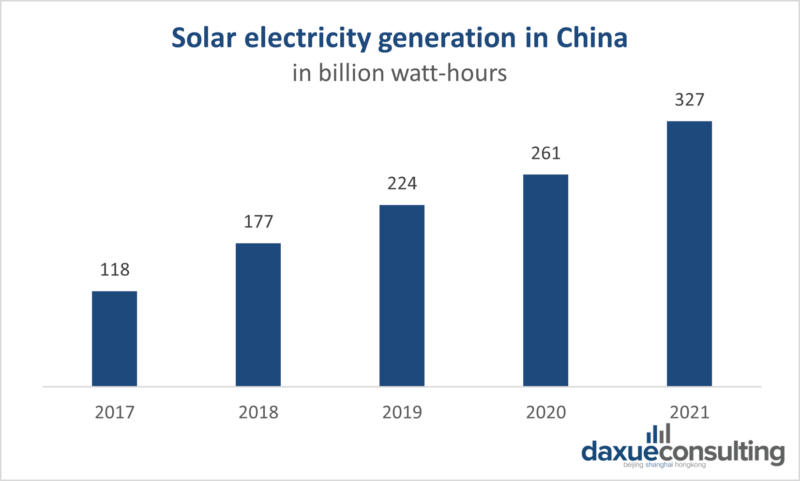

Solar power in China: largest solar energy market in the world

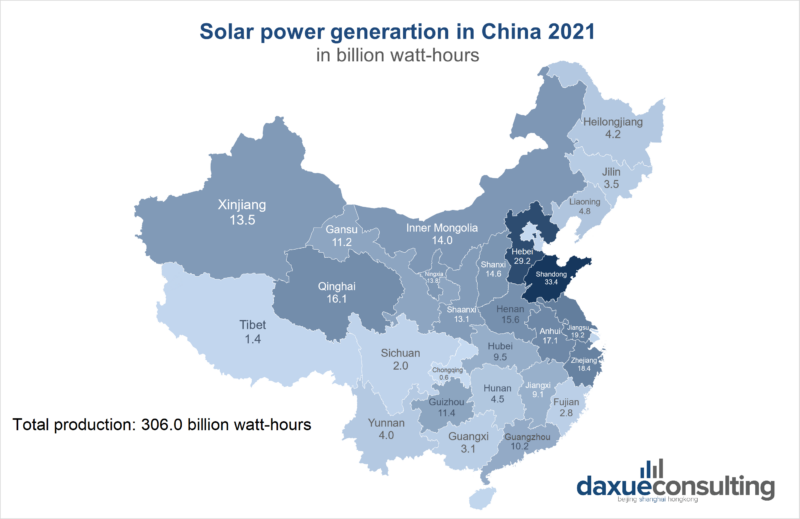

China has become a leader in the installation and manufacturing of solar photovoltaic panels, which generate electricity through the exposure of semiconducting materials to sunlight. In 2021, China added new capacities of roughly 55 million kilowatts and produced more than 327 billion kilowatt-hours. By 2022, China is set to break last year’s record and install capacities for an additional 75 to 90 million kilowatts. In fact, solar power overtook wind globally in 2019 and is predicted to be twice as large by 2030 – as it has become more cost-effective than wind, especially in sunny regions.

The Qinghai-Tibet Plateau and Sichuan Basin are the most profitable regions for solar power generation, as both areas reach daily mean values of direct normal radiation of roughly 9 kWh/m2. With the Longyangxia Dam Solar Park China operates one of the world’s largest solar power plants in Qinghai province. In early 2022, a 320 thousand kilowatts floating photovoltaic farm was completed in Shandong province, making it the biggest solar pharm in the world.

Policy-wise, China plans to build more large-scale photovoltaic farms in the sunny Gobi Desert and the country’s western regions, as well as encourage the installation of rooftop solar panels in the cloudier eastern and central regions, to bring solar production in the latter two areas closer to consumers.

China is in need of cloud risk-reducing systems

In most areas of China, cloudy skies are a destabilising factor for continuous solar energy production. Thus, the Chinese company, Consin Solar (previously known as Supcon Solar), has created systems to reduce the risk of cloudiness, which are already in use at the Delingha solar thermal power plant. Despite the harsh weather conditions, it took only 18 months to finish the plant’s construction and reach full capacity in April 2019. Due to its location, Delingha has to withstand temperature extremes and frequent clouds, and thanks to new technologies, the power plant can provide stable electricity during a short cloudy period.

In winter, China’s skies turn grey due to smog, which also reduces the amount of sunlight reaching solar panels. In the most polluted regions of China, solar energy generated by the panels falls by 35% or 1.5 kilowatt-hours per square meter per day.

New mines for rare earth minerals are important for the renewable energy industry in China

The development of solar energy depends on an adequate supply of rare earth minerals. These include neodymium, terbium, indium, dysprosium, and praseodymium and are used for the production of solar panels. China currently produces 85% of the world’s rare earth oxides and 90% or rare earth metals, alloys and alike, while Europe and the United States depend on rare earth minerals from China. However, a boom in solar panel production in the United States and across Europe is starting to rival China.

Rare earth minerals are also used for developing batteries for new energy vehicles and smartphones. While these minerals help build green technology, rare earth mineral mining causes environmental risks such as producing toxic waste. This is why rare earth mining is greatly restricted in many other countries, and one of the reasons why China has become one of the main exporters.

China’s biofuel market: producing green gasoline

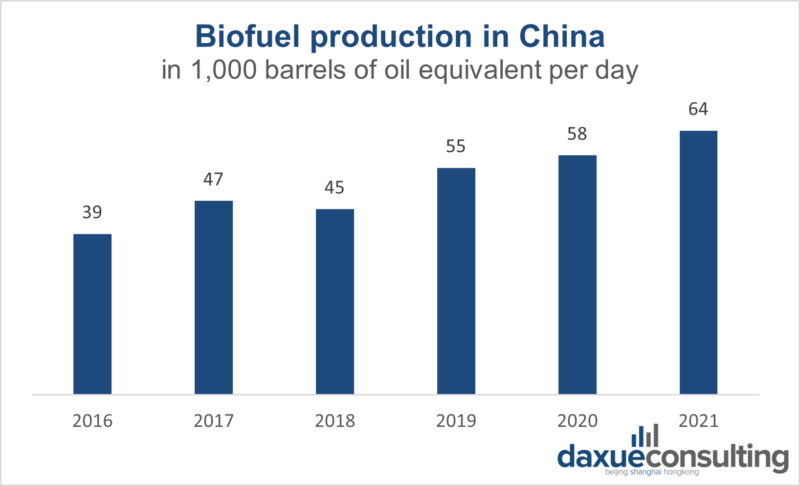

China’s car market is one of the largest in the world, which leads to an increase in greenhouse gas emissions. The development of the Chinese biofuel sector was first mentioned in policy plans in 2002. Yet, the demand for biofuels fell short of expectations, and most biofuels produced in China were subsequently exported to the EU, as higher production costs make non-subsidised biofuels more expensive than standard diesel.

Only in the last couple of years did the biofuel market gain momentum, especially since the announcement of the dual carbon goals, support for the development, subsidised production in addition to state-driven demand were set as policy objectives. The 13th Five Year Plan called for tax breaks for companies researching and developing biofuel technologies and offered a 70% reduction in consumer taxes on biodiesel.

Currently, fuels in China have to include 15% biodiesel, which will increase to 20% in 2023. In May of 2022, the National Development and Reform Commission announced plans to trial the use of biofuel in aviation during the period of the 14th Five Year Plan (2021–2025). Marked policy support for biofuels has been observed in Shanghai. The city started using biodiesel for public buses and street-cleaning vehicles. By the end of 2021, all gas stations citywide were supplied with B5 biodiesel.

Between 2002 and the end of 2021, China’s biofuel output increased on average by 61 thousand barrels of oil equivalent daily. In 2021, China’s daily biofuel production reached 64 thousand barrels of oil equivalent, making China’s biofuel output account for 4% of global biofuel production in the last year.

China’s demand to diversify feedstock for biofuel production

Biofuels include bioethanol, biodiesel, and biogas. Although China tries to move from grain biofuels to non-food biofuels, it is difficult to expand bioethanol production from cassava and sweet sorghum (To produce bioethanol, crops high in starch or sugar are needed. Cassava and sweet sorghum both produce ethanol). The main raw material for biodiesel is edible vegetable oil, both used and unused. As producers turned to fresh corn as a resource for biofuel production, they began to compete with food crops for land and undermine China’s food security. The rise in vegetable oil prices from biodiesel production has hit China particularly hard.

On the other hand, making the recovery of used cooking oil feasible would require oil recovery points in every apartment complex. The lack of accessible land and difficulties in sourcing used cooking oil are the most serious obstacles to the expansion of biofuel production in China. In response, the government has expressed policy support in developing technologies to utilise used cooking oil to produce biodiesel.

What is the future outlook for renewable energy in China?

China can reap significant benefits by switching to green energy sources, but the difficult part lies in finding solutions that are not harmful to the environment in various ways. These solutions will not only help combat climate change but also meet the growing global demand for solar panels and wind turbines. Government incentives and subsidies will play a key role in the development of renewable energy in China. This will make China a market leader in the production of green energy technologies.

The Chinese government is tightening its spending and subsidy policies. As a result, wind and solar installations must now compete directly in auctions with other forms of electricity generation.

In the coming decades, the energy sector in China will see an accelerating shift towards large and small green projects. Especially as the rapid expansion of solar energy plants and offshore wind parks in the last couple of years have shown. Thus, in the future, renewable energy companies will have more opportunities to expand their businesses. These industries welcome foreign investors who can contribute to the industrial and technological development of renewable energy in China.

Key takeaways on China’s renewable energy sector

- China pledged to reach peak carbon emissions by 2030 and carbon neutrality by 2060

- China is the global leader in renewable energy investments, renewable energy production, Co2 emissions, wind and solar energy production

- Total energy consumption in China has been rising year-on-year for decades and is forecasted to grow continuously

- Absolute coal consumption will likely rise until 2025 and then be slowly phased out in line with China’s 2060 carbon neutrality plan

- The relative share of energy produced from coal has decreased continuously since 2013, hydropower is the only source with a virtually unchanged share since 2000, and wind energy has been growing the strongest out of all energy sources

Author: Alexandra Schirmer