Software as a Service (SaaS) presents a groundbreaking model of delivering software via subscription over the internet, eliminating the need for installation on customers’ hardware. This innovative approach has seen widespread success, significantly influencing business practices globally, including in China’s extensive market. Despite the ample potential for growth in China, foreign SaaS companies face a challenging environment marked by both vast opportunities and daunting obstacles.

Download our China luxury market report

Understanding the intricacies of one of the globe’s most dynamic digital economies is therefore crucial for allowing these companies to navigate and flourish in their complex regulatory and cultural landscapes.

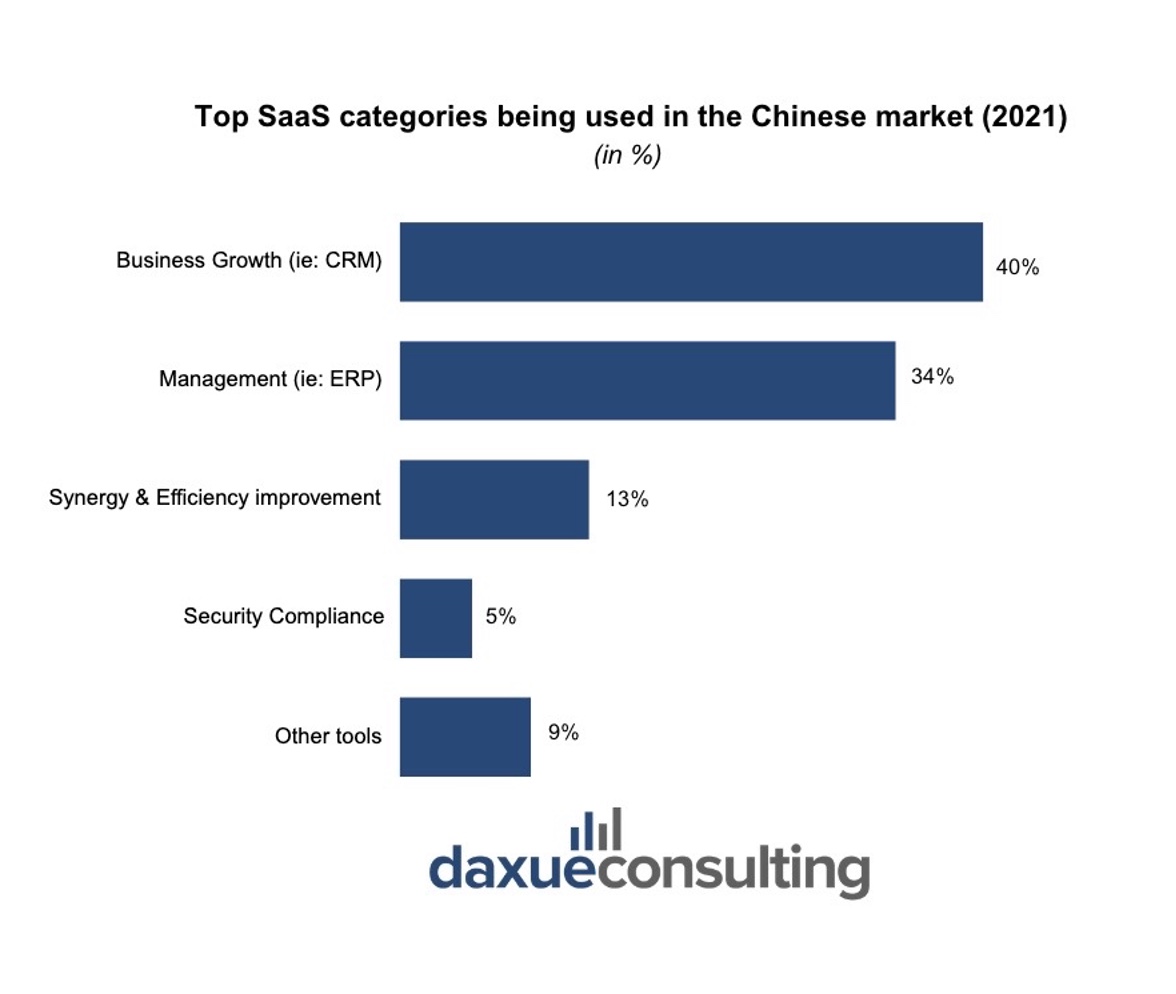

The landscape unfolded: sizing up China’s SaaS ecosystem

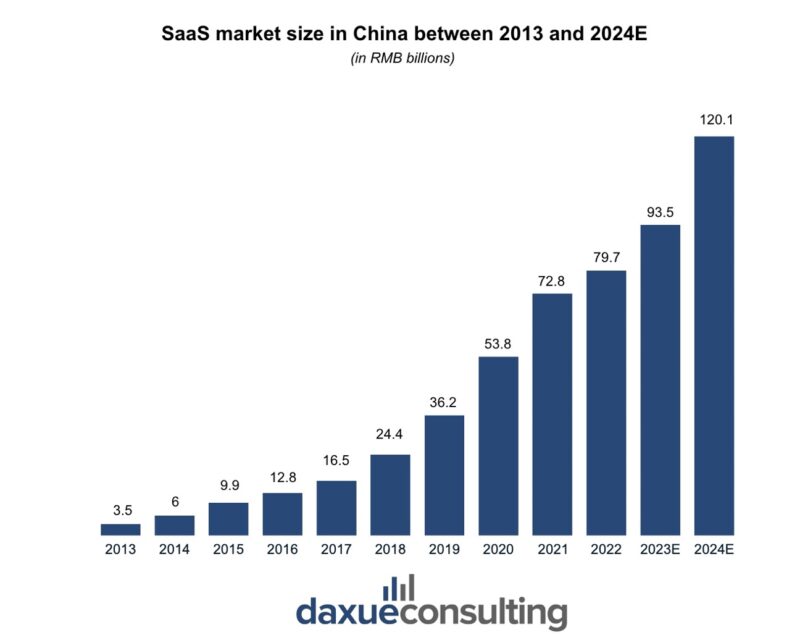

As of 2024, the SaaS market in China is estimated to reach nearly RMB 120 billion (USD 17.5 billion), showcasing significant development in sectors such as Customer Relations Management (CRM), Enterprise Resource Planning (ERP), Artificial Intelligence (AI) customer service, and Human Resource Management (HRM). The demand trends in the market indicate a strong preference for business management, data analysis services, office communication tools, and information security services. These segments have experienced rapid growth since 2019, reflecting the evolving needs of businesses in the digital era. Currently, the most popular categories of SaaS services are those tailored for CRM, ERP, and security compliance. The sectors that have seen the greatest rise in demand for SaaS services are retail (22%), e-commerce (15%), and manufacturing (12%)

Emerging trends in China’s SaaS market indicate rapid growth in cloud computing, including Platform as a Service (PaaS) and Infrastructure as a Service (SaaS), essential for supporting scalable and flexible business operations. According to McKinsey, the market size for cloud-based infrastructure in China is forecasted to grow from USD 32 billion in 2021 to an estimated USD 90 billion by 2025. Digital marketing, e-commerce, telehealth, and online education sectors are also expanding, driven by digital transformation across healthcare and education. Additionally, supply chain and logistics software are expected to grow significantly as companies aim to enhance efficiency and resilience amid global disruptions.

This growth opportunity will be however spread very unequally across the Chinese market. If we look at regional differences, in 2020 the SaaS market size in eastern China had reached RMB 40.02 billion (USD 5.62 billion), accounting for 80% of the total output. In terms of market size, the top 5 provinces were Beijing, Guangdong, and Shanghai, closely followed by Shandong and Zhejiang.

Past and prospected growth: a decade of digital transformation

The SaaS market in China embarked on experimental development between 2004 and 2005, with a notable phase around 2010. The growth rate surged in 2018, further accelerated by the COVID-19 pandemic in 2020. By the first quarter of 2021, the market peaked at RMB 53.8 billion (USD 7.56 billion). Overall market expansion is expected to follow a year-on-year growth of 35%, at least until 2024.

The growth is also propelled by the dynamic expansion of SMEs, which make up 97% of all Chinese companies. Despite the slow adoption rate among larger corporations and state-owned enterprises due to data security concerns and prior investments in traditional infrastructure, SMEs are increasingly drawn to the SaaS model, attracted by its cost-effectiveness. This trend is bolstered by the private sector’s growing contribution to the economy, highlighted by an average 12% increase in private sector wages from 2010 to 2021. As labor costs rise, SMEs are leveraging SaaS solutions to enhance efficiency and productivity, deepening the market penetration of SaaS products amidst challenges in cultivating enterprise software interest among these smaller entities.

Clash of titans: navigating the competitive SaaS maze in China

The SaaS market in China is notably fragmented, with no large market leaders dominating the scene. Kingdee the biggest Chinese software provider, stands out among its competitors. Yet the top 10 companies collectively control only 35.6% of the market. This fragmentation reflects the market’s developmental stage, with rapid domestic demand outpacing supply capabilities.

Both Chinese and international firms compete on equal footing, leveraging the absence of comprehensive solutions and integration challenges among local players. This scenario allows foreign companies with high-quality products and strategic approaches to make significant inroads. Notable among these are firms like Shopify, SAS Institute, and Lightspeed, which challenge local leaders such as Kingsoft Cloud and China Youzan.

Such a dispersed landscape and presents a prime opportunity for foreign SaaS providers to penetrate the Chinese market, suggesting a fertile battleground for those ready to navigate its complexities effectively.

Blueprint for victory: carving out success in SaaS frontier in China

Navigating the Chinese SaaS market requires foreign companies to overcome significant regulatory and operational challenges, including compliance with Internet Content Provider (ICP) requirements and data residency laws. Strategies such as forming partnerships with ICP license holders, establishing joint ventures with local firms, or setting up Wholly Foreign-Owned Enterprises (WFOEs) are pivotal. Each approach offers distinct advantages and challenges, which underscore the importance of strategic planning and understanding local regulations for choosing the most adapted strategy for a successful market entry

Partnerships

Most often, foreign software companies in China decide to adopt a licensing model to comply with the regulatory environment. This approach involves licensing their SaaS products to Chinese entities holding an Internet Content Provider (ICP) license, allowing them to offer services via local servers and meet regulatory standards. A prime example of this partnership approach has been Microsoft, which teamed up with 21Vianet, a prominent internet data center provider in the country. This collaboration enables Microsoft to offer cloud-based SaaS solutions like Azure and Office 365 to Chinese customers in compliance with stringent local regulations.

Securing a local licensee, however, presents challenges. The financial and managerial burden of obtaining and maintaining an ICP license falls heavily on the licensee, including revenue collection, URL ownership, and responsibility for the platform’s content and performance. This arrangement places a significant regulatory and operational load on the licensee, especially important when operating cloud-hosted SaaS platforms within China’s strict regulatory framework.

The process of finding a suitable ICP licensee is also extremely complex, hindered by stringent, inconsistently applied regulations across provinces. For example, in Beijing, an ICP license requires the entity to be entirely Chinese-owned, possess a minimum capital of RMB 1,000,000, and operate from a physical office with at least 8 full-time employees. These requirements pose substantial challenges for SMEs, complicating their ability to participate in the SaaS market and navigate the intricacies of China’s internet business regulations.

Joint ventures

Forming a joint venture with a local firm offers foreign SaaS companies strategic benefits for entering the Chinese market. Local partners provide crucial insights into market dynamics, allowing for the customization of software to meet local needs, comply with China’s specific regulations, and enhance user experience with accurate Chinese translations. This collaboration can significantly aid in navigating the complex regulatory environment and cultural nuances, establishing a competitive presence in China.

A prominent example is SAP, a German company, the leader in ERP software. SAP partnered with China Telecom to offer cloud-based services tailored to the Chinese market. This strategic alliance allowed it to leverage China Telecom’s extensive infrastructure and local expertise, providing the company with the necessary insights into Chinese market dynamics and regulatory requirements.

However, foreign SaaS providers must approach joint ventures cautiously. Without scrutiny, such partnerships could inadvertently breed competition, especially with intellectual property (IP) risks, as local partners gain access to data and software on Chinese servers. Despite these concerns, the SaaS model, which restricts direct access to the software code, offers a relatively safer option for entering China, mitigating some IP theft risks compared to traditional software distribution.

Setting up wholly foreign-owned enterprises (WFOEs)

Establishing a Wholly Foreign-Owned Enterprise (WFOE) is the final option that can offer foreign companies a pathway into the Chinese market. Its advantages rely on its ability to provide the foreign SaaS company, full control over its operations and direct oversight of its financial and business strategies. This strategy also benefits the company with protection against IP thefts since it doesn’t need to share sensitive information with any local partner. Additionally, the company has the capability to directly recruit its personnel, manage resources effectively, and adapt its business model to optimally align with the dynamic shifts observed in the Chinese SaaS market.

Despite its advantages, the WFOE option is not widely favored due to significant challenges. Primarily, the foreign company is left alone to navigate China’s complex bureaucratic and legislative landscape to secure the necessary operational authorizations. Adhering to Chinese data security and compliance standards becomes the sole responsibility of the company, posing a considerable challenge for companies unfamiliar with the local legal system. This could hinder a successful market entry and position unprepared foreign entities at a disadvantage compared to local SaaS competitors.

Mastering regulatory strategy in the Chinese software domain

In China, the digital business environment is tightly regulated, with a significant focus on the ICP Commercial license requirement for websites of foreign commercial entities. This government-mandated license is essential for e-commerce and online payments, underpinning the legal operation of SaaS businesses. To obtain an ICP Commercial license, foreign companies must engage in a complex application process involving a partnership with a local Chinese firm, submission of detailed business documentation, and a comprehensive review by the Ministry of Industry and Information Technology to verify compliance with Chinese Internet laws.

The introduction of the 2021 China Data Security Law has also introduced substantial challenges for foreign SaaS firms in China. This law provides a stringent framework for data management and cross-border transfers, enforcing strict data handling controls and suggesting potential government access to data. This development has heightened concerns among international businesses about data security and compliance with cross-border data transfer regulations, emphasizing the challenging balance between adhering to China’s strict digital regulations and maintaining operational efficiency.

Cultural symphony: harmonizing SaaS solutions with Chinese market identities

For foreign SaaS companies targeting the Chinese market, understanding China’s unique cultural complexities is crucial. The failure of many international businesses in China stems from a generic approach that overlooks the country’s diversity. Success requires more than just transplanting Western models; it demands a thorough grasp of local culture, consumer behaviors, and preferences.

First localization is key for SaaS companies entering China. The software’s product delivery and documentation must be tailored to local languages, content, and functionalities. For instance, a project management tool should integrate with WeChat for communication, aligning with the preferences of Chinese users over Western alternatives like Slack. Moreover, designing SaaS platforms with an appreciation for Chinese user experience and cultural significance can set foreign companies apart. Incorporating culturally resonant features, such as digital red envelopes for Chinese New Year, can enhance relationships with clients, reflecting an understanding of local traditions and values. Finally, engaging with China’s user community for feedback is also essential. This engagement helps foreign SaaS providers to continually refine their offerings, ensuring alignment with the evolving needs and expectations of Chinese customers.

Future perspectives: adapting to China’s evolving SaaS marketplace

- The SaaS market in China reached nearly RMB 73 billion in 2021 and is expected to reach RMB120 billion by 2024 with significant growth in CRM, ERP, and cloud services.

- The Chinese SaaS market is notably fragmented, with no large market leaders dominating the scene, thus providing room for growth for foreign SaaS providers.

- Strategies for market entry include partnerships, like Microsoft’s with 21Vianet, joint ventures as seen with SAP and China Telecom, and WFOEs for direct control, a path chosen by Salesforce.

- Navigating China’s regulatory environment is crucial, with the ICP Commercial license and 2021 Data Security Law presenting hurdles for compliance and operation.

- Effective localization and cultural adaptation are essential, emphasizing the need for engagement with local preferences and traditions to ensure resonance with Chinese consumers.