China’s food & beverage market has experienced steady expansion in recent years. From USD 0.76 billion in 2022, it is projected to reach USD 1.62 billion by 2029. This growth makes China a prime market for SEA food & beverage chains in China looking to expand their reach.

Download the ASEAN x China business relations report

One of the key drivers behind this market growth is China’s massive population of 1.41 billion people. With such a large consumer base, there is high demand for both fast-food and premium dining options, offering SEA brands a wide range of opportunities to cater to diverse tastes and preferences.

The F&B market in China: Expanding opportunities for SEA flavors

SEA food & beverage chains have taken advantage of China’s large consumer market and acceptance of SEA flavors. Brands like Jollibee, S&P Syndicate, Ya Kun Kaya Toast, and Putien have successfully entered the market. Moreover, Thai cuisine—representing a key segment of SEA flavors—has particularly flourished. In fact, Thai restaurants in China saw an impressive store opening-to-closing ratio exceeding one in 2021, signaling the growing popularity and broader acceptance of SEA food offerings.

Key strategies driving the success of SEA food & beverage chains in China

Among the most successful SEA Food & Beverage chains in China, Jollibee stands out as a prime example. As of 2023, Jollibee reached its 500th store in China, a milestone largely attributed to its strategy of localizing offerings and acquiring established local brands. In 2025, Jollibee partnered with SaaS company Anhui Zhimai Technology to digitalize its stores, improving the customer experience across outlets.

Jollibee’s strategy includes the acquisition of local chains such as Yonghe King, Hong Zhuang Yuan, and Tim Ho Wan, which specialize in popular Chinese fare like congee and fried dough sticks (油条), and Michelin-starred dim sum. This approach allowed Jollibee to strengthen its market presence rapidly, reduce entry risks, and cater to local tastes. By acquiring well-established local brands, SEA chains can accelerate market penetration, learn from existing customer bases, and adapt their offerings more quickly.

Additionally, Jollibee’s ability to standardize its product offerings across locations has played a critical role in maintaining consistency, ensuring brand identity, and facilitating scaling while delivering a consistent customer experience.

Challenges encountered by SEA food & beverage chains in China

Despite its growth potential, the Chinese Food & Beverage market presents significant challenges. Over the past decade, food consumption patterns in China have shifted, driven by socio-economic and cultural influences. Younger generations are increasingly favoring healthier dining options, which has led some fast-food chains to scale back their presence in the market. While the market is large, it is also highly competitive, with established local chains such as Haidilao and HeyTea posing significant entry barriers.

Putien, a Singaporean SEA chain with operations in Hong Kong, Macau, and mainland China, is an example of a brand that has faced challenges in adapting to the market. Despite having a solid presence, having 9 stores in Hong Kong and Macau, and 34 stores in mainland China. Putien decided to close its Hong Kong operations teams in 2024 due to declining revenues, highlighting how even successful SEA chains can struggle to keep up with rapidly changing consumer preferences.

Leveraging recognition and awards: Key to SEA food & beverage chains’ success in China

Despite facing challenges in 2024, Putien’s success in entering the Chinese market as a SEA brand can be largely attributed to its Michelin star, a key achievement for any new restaurant globally. The Michelin Award serves as a mark of assurance, signaling high-quality food and taste that can win over Chinese consumers, who are often skeptical about unfamiliar brands. This strategy of gaining awards is commonly adopted by localized Food & Beverage brands to build trust and enhance credibility.

In addition to the Michelin Star, awards from popular social media platforms, such as the 大众点评 (Dazhong Dianping) Food Rank, Bubble Tea Rank, and high-end dining rankings like the Black Pearl Restaurant Guide, which is comparable to the Michelin Star for Chinese consumers, have also been essential for rapid brand expansion.

For example, the SEA food chain 泰香米 (Thai Xiang Mi) achieved great success in the Chinese market through its strategic use of such recognitions. Recognized by the Thai Ministry of Commerce, the brand operates more than 70 stores across 23 cities in China and has over 100 million fans. It has also earned a spot on the “must-eat” lists of various food rankings. With all these awards, the brand strongly resonates with consumers seeking genuine international flavors.

The future outlook of SEA cuisine in Chinese food & beverage market

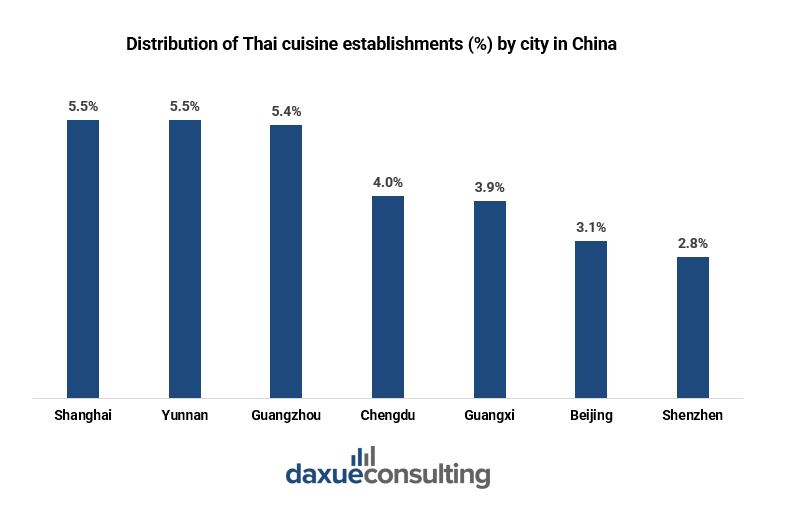

By 2024, there were over 15,000 SEA cuisine restaurants in China, with Thai cuisine making up over 50% of the market share. The cities with the highest concentration of SEA cuisine establishments are Shanghai and Yunnan, each with 5.5%, followed by Guangzhou at 5.4%, Chengdu at 4%, Guangxi at 3.9%, Beijing at 3.1%, and Shenzhen at 2.8%.

Yunnan cuisine is known for its use of spicy and sour flavors, often incorporating ingredients like chilies, lemongrass, lime, fish sauce, and orange peel, which are also common in many SEA dishes. Similarly, Guangxi cuisine features flavors that closely align with those of SEA cuisine. For example, the local Guangxi rice noodles share similarities with Thai rice noodles, helping to enhance the appeal of Thai and other Southeast Asian cuisines in the region.

The cultural alignment between SEA cuisine and local tastes in Yunnan and Guangxi offers a strong opportunity for SEA Food & Beverage chains in China to expand into these regions. With shifting consumer preferences and emerging dining trends, these areas could be key entry points for growth in China.

The rise of SEA food & beverage chains in China: Opportunities and challenges

- China’s food and beverage market is growing fast. It’s expected to reach USD 1.62 billion by 2029, driven by a large population and rising demand for all types of dining.

- Southeast Asian (SEA) food brands like Jollibee and Putien are thriving in China. Thai cuisine, in particular, is becoming very popular.

- Jollibee has grown quickly in China by localizing its menu, acquiring local brands, and improving customer experience with digital tools.

- SEA brands face challenges from changing consumer preferences and strong competition from local chains.

- Michelin stars and rankings on platforms like Dazhong Dianping help SEA chains build trust and grow quickly in China.