Southeast Asia (SEA) is a remarkably diverse region, home to eleven distinct countries. This expansive region extends approximately 4,000 miles from its northwest corner to the southeastern tip. Thus, it covered a vast territory of around 5,000,000 square miles which comprised both land and sea. Notably, an extensive portion, approximately 65.28% or 3,264,000 square miles, comprises expansive seas, emphasizing the maritime nature of the area. SEA is also widely acknowledged as a maritime region, a fact further underscored when focusing solely on maritime coastlines. Within this context, several SEA countries, including Indonesia and the Philippines, have garnered global recognition for possessing some of the world’s lengthiest coastlines, ranking 4th and 8th, respectively. Given this abundant connection to the sea, it comes as no surprise that the seafood market in SEA thrives, with fish being a popular dish throughout the region.

Download the ASEAN x China business relations report

Charting the course: SEA’s seafood market on the rise

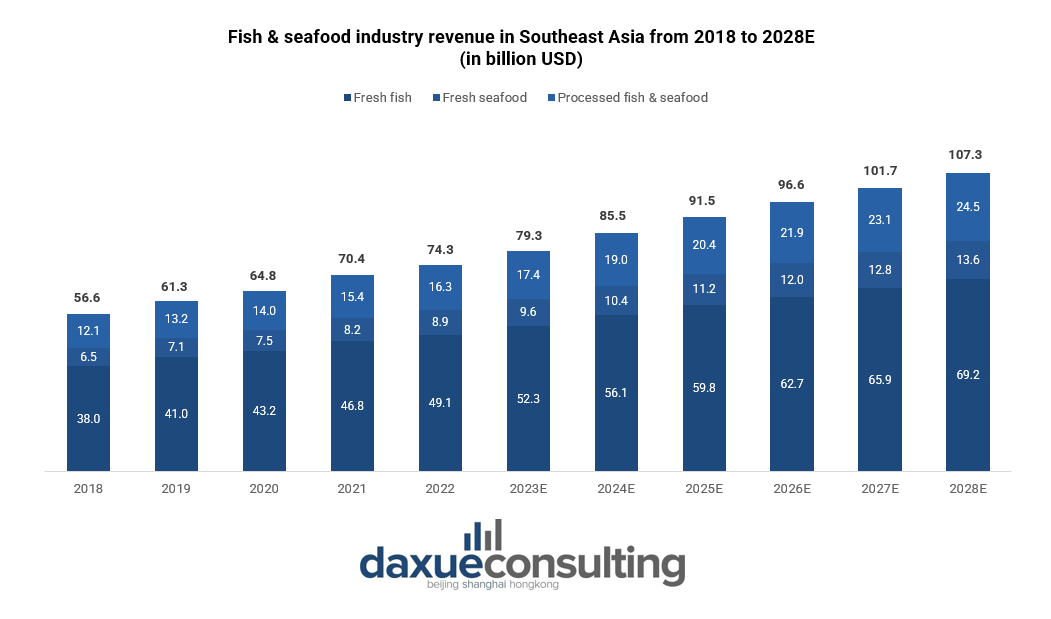

The SEA’s seafood market is poised for substantial growth, with a projected value of USD 79.3 billion in 2023 and a steady CAGR of 6.23%, ultimately reaching USD 107.3 billion by 2028. In terms of per capita income, the SEA’s seafood market is anticipated to generate approximately USD 115.30 per person in 2023. Furthermore, the volume of seafood sales is estimated to reach 5.8 billion kilograms by 2028, indicating a 4.9% volume growth in 2024. Moreover, each person is expected to consume an average of 7.2 kilograms in 2023.

Southeast Asia’s bountiful waters: Giant exporter players

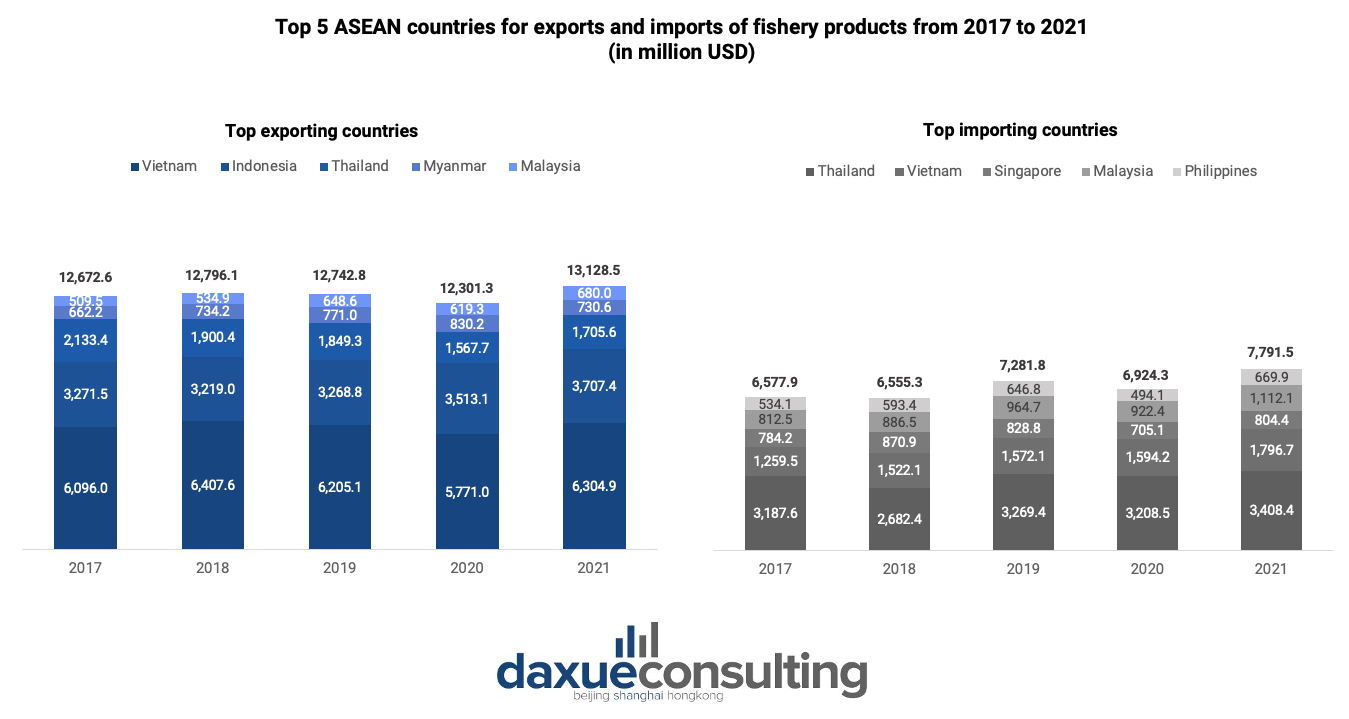

Southeast Asia boasts the world’s most diverse marine ecosystems. The region has long served as a significant source of fish and other aquatic resources. In the year 2020, Southeast Asian Member States, excluding Timor Leste, contributed to nearly 22% of the global fishery production. Three out of the eleven countries in Southeast Asia – Indonesia, Thailand, and Vietnam – rank among the top 10 fish-producing nations worldwide. In 2021, the total value of ASEAN’s trade in goods, specifically related to the export of fish, crustaceans, mollusks, and other aquatic invertebrates to the rest of the world, reached USD 13.7 billion.

In the SEA region, Vietnam, Indonesia, Thailand, Myanmar, and Malaysia are the top exporters of fishery products. These five countries collectively contributed approximately USD 13.1 billion in fishery product exports in 2021. Yet, despite being the top exporting countries, Thailand, Vietnam and Malaysia are also the top importers of fishery products within the SEA region together with Singapore and the Philippines. Taking a closer look at Thailand as an example, the country is a major seafood exporter. Primarily, it is known for canned tuna and shrimp. In 2018, it exported seafood worth USD 4.54 billion. However, Thailand faced challenges such as overfishing and shrimp issues. The shortage of tuna led to raw tuna imports for canned tuna production. In 2018, Thailand imported seafood worth USD 3.1 billion including tuna, salmon, and shrimp. Additionally, Thailand’s salmon market has seen substantial growth, driven by both domestic consumption and the rising number of Japanese restaurants.

Deep dive: SEA countries

Indonesia’s thriving fish and seafood market: Government promoting the increase of fish consumption

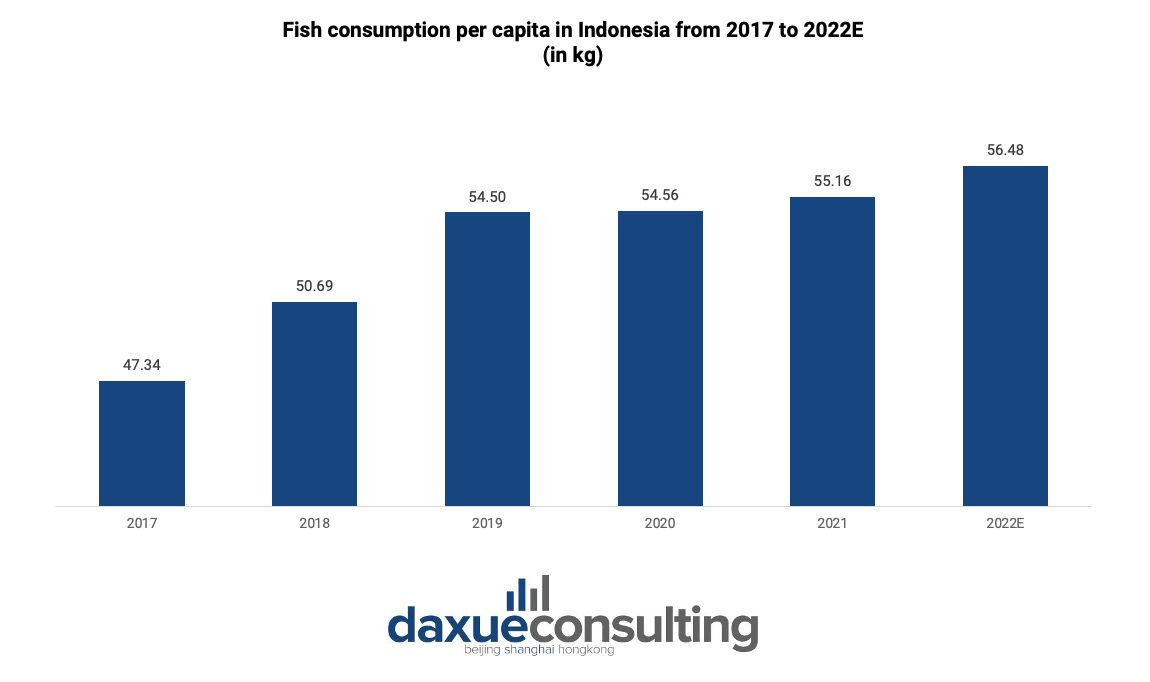

Indonesia‘s fish and seafood market is on a dynamic trajectory. It is projected to reach a substantial value of USD 28.0 billion in 2023 and to have a per person revenue of USD 99.30. The market also has an impressive annual growth rate of 5.69% (CAGR 2023-2028). In terms of sheer volume, the fish & seafood market is expected to reach an impressive 2.1 billion kilograms by 2028. An expected 4.5% volume growth is specifically targeted for 2024.

Notably, fish consumption in Indonesia is on the rise, as indicated by data from the Ministry of Maritime Affairs and Fisheries. In 2022, per capita fish consumption is projected to hit an impressive 56.48 kilograms. Delving into regional specifics, Maluku leads the pack in 2022, boasting the highest fish consumption at 79.04 kilograms per capita. Maluku Utara and Kalimantan Utara follow at 77.27 kilograms and 75.41 kilograms per capita, respectively. The government continues to promote fish consumption, aiming to reach its target of 62.5 kilograms per capita by 2024. One of the initiatives to achieve this is by intensifying the “Love Eating Fish” campaign (Gerakan Memasyarakatkan Makan Ikan or Gemarikan) across all provinces in Indonesia.

Singapore’s seafood scene: Balancing imports and local production”

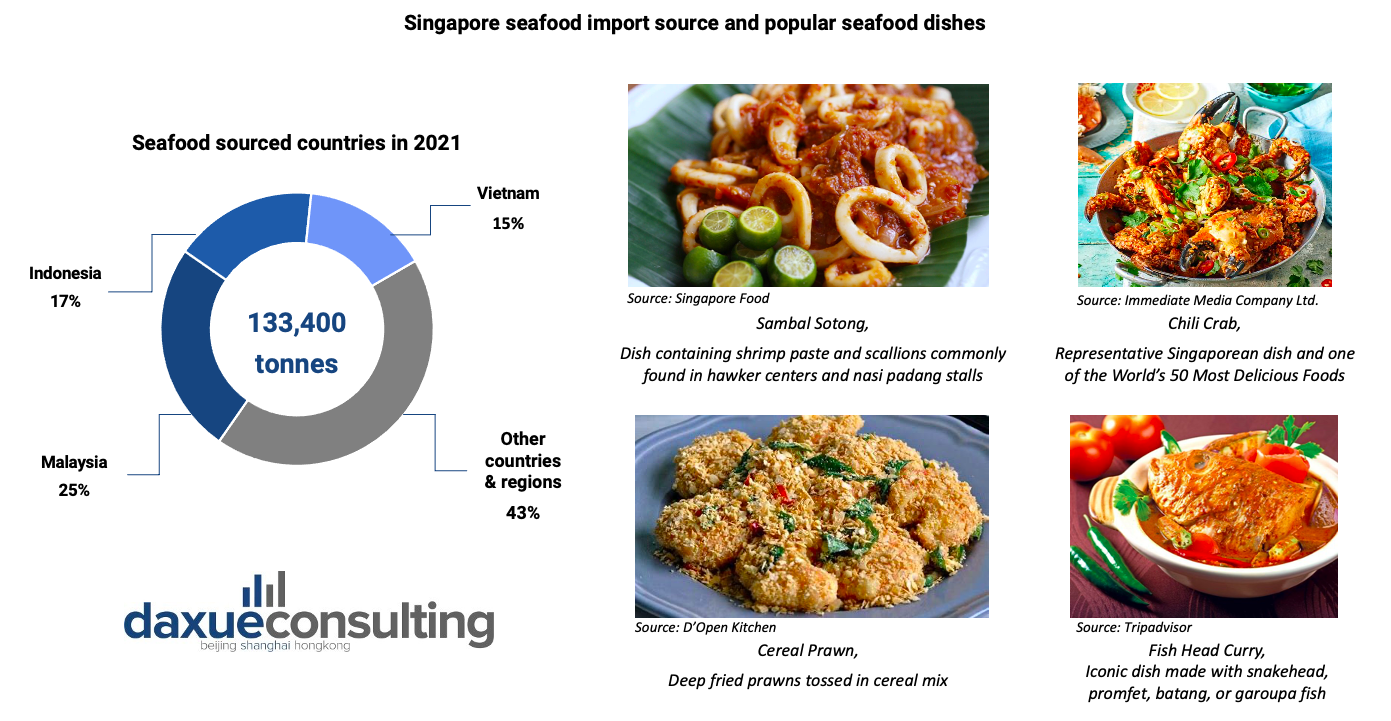

Although most seafood consumed in Singapore comes from international markets, the local seafood market has seen significant recent growth and is expected to continue expanding. Singapore’s seafood market is anticipated to achieve a CAGR of 0.37%, increasing from USD 231.7 million in 2022 to USD 236 million in 2027. In 2020, the average seafood consumption per person in Singapore amounted to approximately 22 kilograms.

Singapore has adopted a strategy of diversifying its sources of seafood imports while also striving to bolster local production. Notably, Singapore imports a significant portion of its seafood products, with more than 50% originating from countries such as Malaysia, Vietnam, and Indonesia. The local agriculture sector primarily comprises hen shell eggs, vegetables, and seafood farms. While locally sourced seafood has maintained a relatively stable contribution of about 7% to 8% of the total food consumption from 2019 to 2021.

Malaysia’s seafood cuisine: Fish at its culinary heart

The future of Malaysia‘s seafood market looks promising, with projections indicating significant growth in the coming years. Anticipated to expand at a robust CAGR of 6.76% from 2022 to 2027, the seafood market is set to flourish. Notably, fish holds a special place in the hearts and diets of Malaysians, being a staple source of protein. A substantial portion of fish from the marine capture sector is made available to consumers in fresh, cooled conditions. This is to ensure the quality and freshness of the seafood. Fish products from aquaculture are often sold live to restaurants. These products are transformed into delectable dishes, adding to Malaysia’s culinary heritage.

Vietnam’s seafood market: Rising tide of growth and exports

The seafood market in Vietnam is estimated to have an upward trajectory with a CAGR of 6.87% from 2022 to 2027. The upward momentum is driven by a growing demand for seafood. However, a significant portion of these products is earmarked for export. As disposable incomes rise, consumer demand for seafood is growing. It’s projected that per-person seafood consumption will increase by about 3.6%. This increase will take the average from 20.5 kilograms in 2018-2020 to 21.2 kilograms by 2030.

However, it is also worth noting that seafood products, while in high demand, often come with a relatively higher price tag compared to other food items, owing in part to the costs associated with distribution and sales. In March 2022, Vietnam’s seafood exports were estimated at USD 920 million, demonstrating a steady albeit gradual growth rate of 25%. Key export markets include the United States, Japan, China, and South Korea. Popular products like shrimps, striped catfish, pangasius, and hard clams drive Vietnam’s thriving seafood industry.

SEA’s fishing powerhouse: A global hub for fisheries

- SEA’s seafood market is projected to reach USD 107.3 billion by 2028, driven by a 6.23% CAGR.

- In the SEA region, fishery production contributes nearly 22% to the global total. The top fish producers in SEA are Indonesia, Thailand, and Vietnam. In 2021, the ASEAN’s fishery trade was valued at USD 13.7 billion.

- Indonesia’s seafood market is valued at USD 28.0 billion in 2023. The Indonesian government is also promoting higher consumption of fish through various efforts such as the Gemarikan campaign.

- Singapore’s seafood market is expected to reach USD 236 million by 2027. The country diversifies its seafood imports and focuses on local production.

- In Malaysia, fish is a dietary staple, with fresh marine capture seafood and popular aquaculture products.

- Vietnam’s seafood market grows with a 6.87% CAGR, driven by demand and exports.