The luxury market in Southeast Asia is often overlooked compared to China, Japan, and South Korea. However, the luxury market in this region is on the rise. It generated USD 14.38 billion in revenue in 2022 and is expected to continue to grow. The ASEAN comprises 10 member states, six of which, namely Singapore, Thailand, Vietnam, Malaysia, Indonesia, and the Philippines, have promising economic growth. Bain & Company predicts Southeast Asia’s growth will surpass other emerging regions such as the Middle East and Latin America over the next decade.

Luxury brands are shifting focus to Southeast Asia, hosting events and engaging consumers online. They’re also appointing Southeast Asian celebrities, especially from Thailand, as brand ambassadors.

Download our report on ASEAN x China relations

Strong and steady growth in Southeast Asia’s luxury market

Southeast Asia’s luxury market value has been growing steadily over the years. The market is anticipated to experience an annual growth rate of 4.16% from 2023 to 2028, reaching a market share of USD 18.77 billion by 2028. Due to the long period of lockdown and strict COVID-19 policies, people have limited freedom of movement in China. According to Nick Bradstreet from Savills, the economic slowdown in China made luxury brands realize that they can’t just rely on one country. Diversification is needed and Southeast Asia is the best option as a result of emerging markets such as Singapore, Thailand, and Vietnam.

Singapore is a leader in the region with a mature and developed market. The country has a high density of luxury shopping centers such as The Shoppes at Marina Bay Sands, ION Orchard, and Paragon. There’s been a recent surge in Singapore’s luxury retail sales, and luxury market revenue is estimated to reach USD 4 billion in 2023.

From 2020 to 2023, Thailand’s luxury sector had an aggregate growth of over 400%, putting the country on many luxury brand’s radar. The country’s luxury market share is expected to reach USD 4.64 billion in 2023.

Over the past two years, luxury brands such as Dior and Louis Vuitton opened flagship stores in Hanoi, and Vietnam-based luxury retailer, Runway, opened its largest flagship store featuring a wide variety of brands in Ho Chi Minh. The luxury market revenue of Vietnam is estimated to reach USD 957.2 million in 2023. It is expected to grow annually by 3.23% (2023-2028), suggesting that Vietnam’s luxury market is becoming more visible on a global scale.

High-quality products as consumer’s main purchase intention

In March 2023, a survey of 3000 luxury consumers in Southeast Asia by Milieu Insights revealed that 42% of luxury consumers in the region are likely to maintain their spending regardless of recent inflations. Moreover, 25% of consumers in Vietnam, Malaysia, and the Philippines are inclined to increase their spending on luxury goods. The survey also found that the main reasons consumers considered buying luxury goods are the high quality of products, product longevity, and product uniqueness.

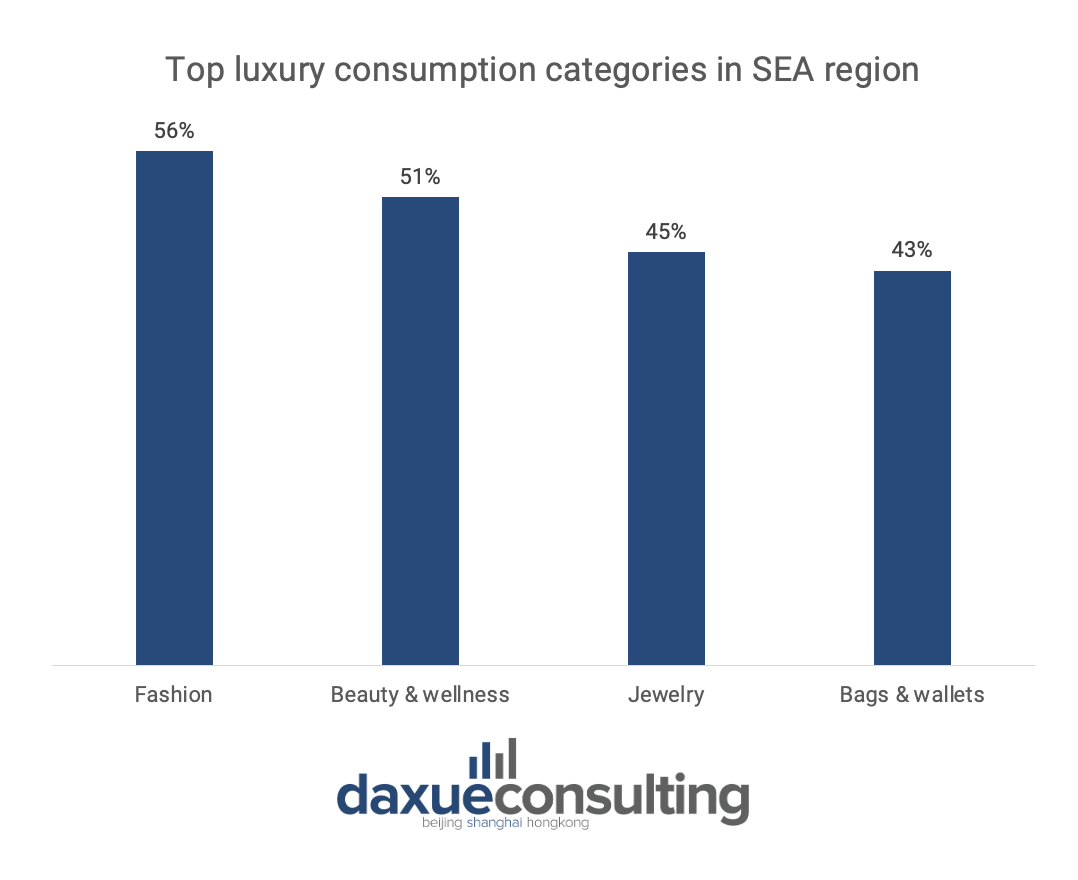

Furthermore, fashion clothing is the most frequently purchased luxury goods, followed by beauty & wellness (skincare, cosmetics, fragrances), jewelry (watches, rings, bracelets), and bags & wallets. 80% of the survey respondents purchased these luxury goods for personal use, while the other 20% bought them as a gift for other people.

A young and digitally driven consumer base

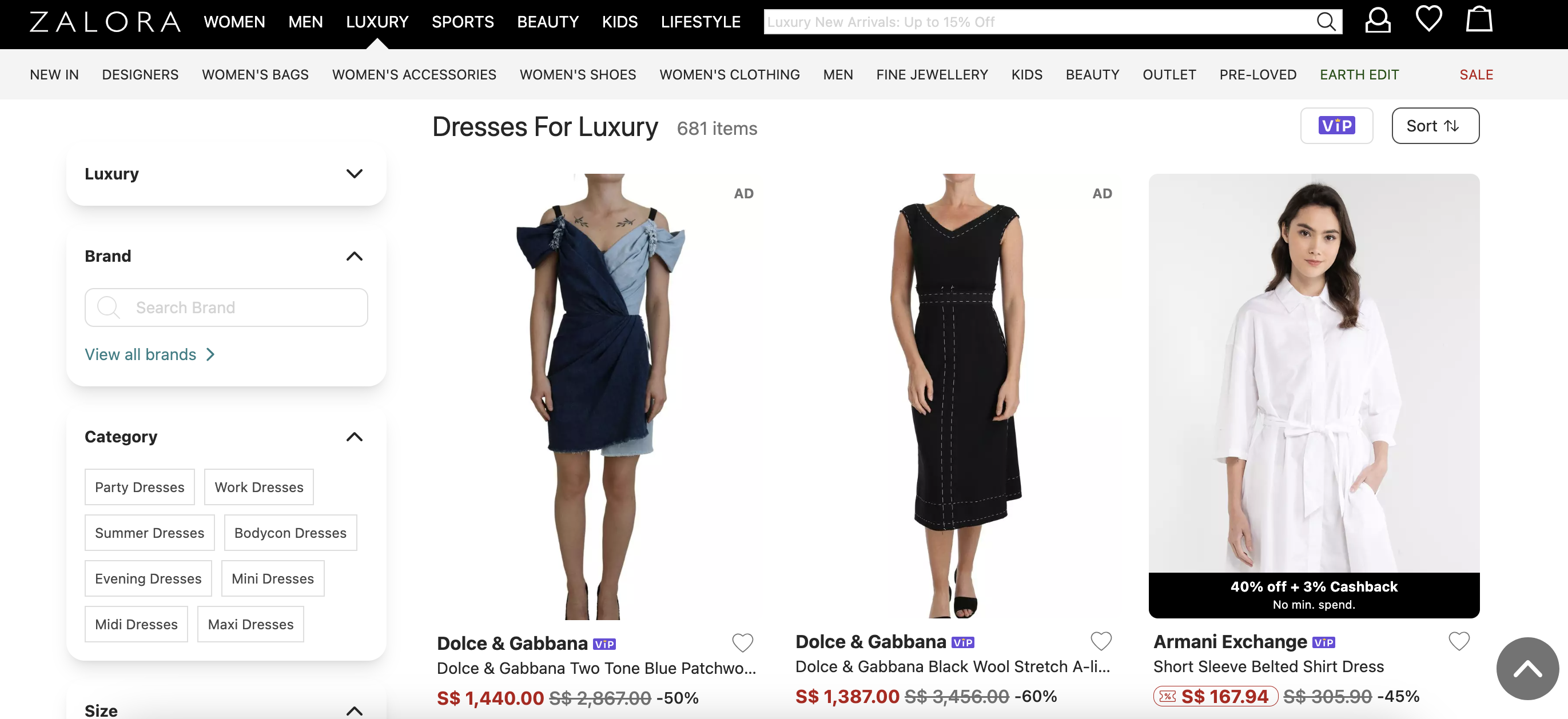

Following the global trend, Southeast Asian consumers are spending more time online, especially after the pandemic lockdown. In McKinsey’s State of Fashion 2023 report, Southeast Asian consumers spend an average of eight hours online per day, and e-commerce revenue grew by 40% annually from 2016 to 2021. This growth is a result of the internet becoming more accessible in the region and the rise of e-commerce sites such as Shopee, Lazada, and Zalora. Zalora has a wide variety of luxury brands ranging from well-established names such as Gucci, Chloé, and Fendi to high-end streetwear brands such as Off-White and Palm Angels. The countries in which Zalora had the most significant market growth in its luxury sector are Singapore, Malaysia, and the Philippines.

Furthermore, young luxury consumers are even more enthusiastic about e-commerce. Approximately 10% of luxury consumers from the Asia Pacific region are Gen Zs and 52% are millennials. As digital natives, they are naturally tech-savvy and buy luxury goods from various online channels.

Reaching Southeast Asian consumers online

COVID-19 prompted luxury brands to have a stronger presence online as consumers couldn’t shop in physical stores. Then in 2022, many luxury brands took a big step by entering the metaverse and blockchain to engage consumers, including those in Southeast Asia. Gucci launched an NFT film and partnered with gaming platform Roblox. Prada and Adidas Original collaborated on a limited edition NFT collection. Louis Vuitton launched “Louis the Game” as part of the celebration of the 200th birthday of its founder. Bain & Company’s 2022 report on Southeast Asia’s digital economy found that usage of e-wallets, cryptocurrency, and NFT is more common in the Southeast Asia region than in other markets. They also found that approximately 70% of Southeast Asian consumers have used metaverse-related technology at least once from 2021 to 2022.

In addition to that, luxury brands are working with influencers and celebrities from Southeast Asia to increase their market share in the region. Brands such as Fendi and Longchamp work with Singaporean influencer He Yingying and Malaysian influencer May Ho. Furthermore, luxury brands are also appointing celebrities from the region as their brand ambassadors. K-pop star Hanni from NewJeans, who’s ethnically Vietnamese, is Gucci’s brand ambassador, and Lisa from Blackpink who is Thai, is the brand ambassador for Céline.

A deeper dive into Thailand’s luxury market

More and more Thai celebrities have become luxury brands’ ambassadors since Lisa’s appointment by Céline in 2020. Back in July, Balenciaga announced Thai celebrity, Krit Amnuaydechkorn (PP Krit) as its global brand ambassador along with the French actress, Isabelle Huppert. PP Krit has also been Balenciaga’s first brand ambassador since being founded. Moreover, Davika Hoorne became Gucci’s first Thai ambassador, representing Gucci and Gucci Beauty. Dior named actors, Nattawin Wattanagitiphat (Apo) and Phakphum Romsaithong (Miles) as their ambassadors earlier this year.

Thai actors and singers are becoming influential figures in the Southeast Asia region as T-pop becomes more popular. Thai media corporation, BEC World’s revenue reached USD 8.7 million in 2022 compared to just USD 1.7 million in 2017. The rising influence of Thai celebrities is leading to luxury brands collaborating with Thai celebrities since this allows luxury brands to reach new and younger communities as well as localize into the Thai market.

Another factor that has been attracting luxury brands to Thailand is the continuous expansion of high-end shopping malls in the country. The Siam Piwat Group owns some of the largest shopping malls in Thailand, such as Siam Paragon, Iconsiam, and Siam Premium Outlet Bangkok, Thailand’s only luxury outlet mall. The group’s president of sales and business relations, Caroline Murphy, said in her interview with BOF that ultra-luxury consumers are looking for more sophisticated and quiet luxury brands like Loro Piana.

Understanding Southeast Asia’s luxury market

- Southeast Asia’s luxury market value reached USD 14.38 billion in 2022. It is expected to grow by 4.16% annually from 2023-2028.

- High quality of products, product longevity, and product uniqueness are the main reasons Southeast Asian consumers buy luxury goods.

- Millennials and Gen Zs are becoming strong drivers of luxury in the region and they are dependent on e-commerce.

- Luxury brands are entering the metaverse and blockchain to target luxury consumers in Southeast Asia.

- Thai celebrities are becoming more influential in the region. Ultra-luxury consumers in Thailand are starting to shift toward quiet luxury brands.