Korea’s luxury goods market is the seventh largest in the world. In 2021, the market was worth USD 5.8 billion, and by 2024, it is projected to grow beyond USD 7 billion. Some of the reasons Korean consumers are showing greater interest in luxury include retaliatory consumption and travel restrictions. Another driver is “flex” consumption, where people consume to show off what they have. While there is growing demand, there is also intensifying competition among the “old” and the “new” luxury brands. Here’s what brands should know about Korea’s luxury goods market.

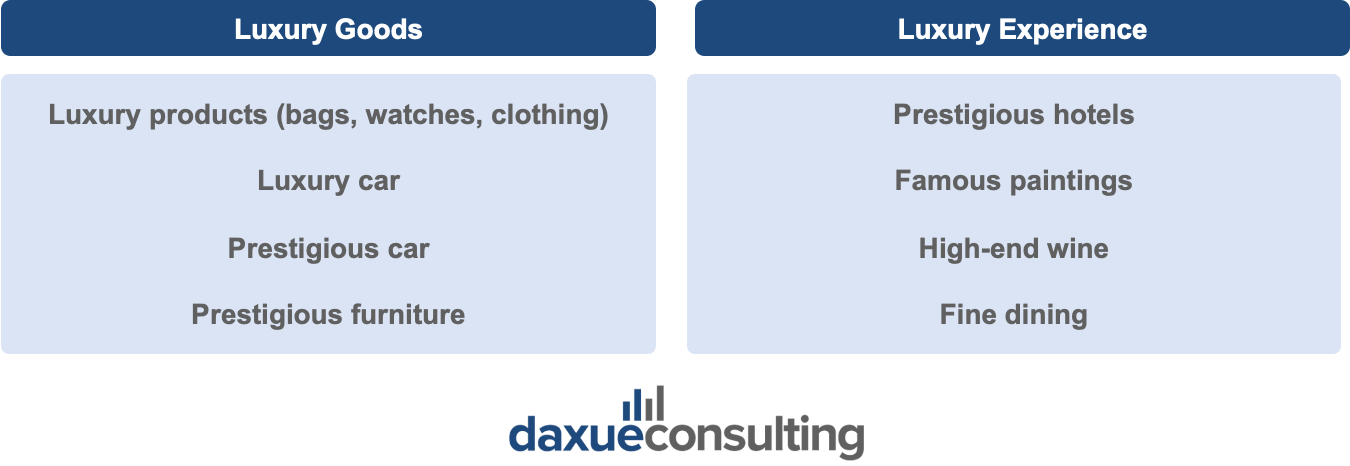

Luxury is not only about the products but about the experiences

Source: Deloitte, re-designed by daxue consulting, Korea’s luxury goods and experience categorization

Korea’s luxury goods market, whether in the K-beauty or the fashion industry, is changing. It is no longer defined only by the products but also the experiences provided by the brands. Consumers are demanding a luxurious experience. Therefore, top luxury brands like Dior have opened pop-up stores to provide and share their “narratives” with their consumers. Dior’s huge pop-up store, inspired by the company’s historic headquarters at avenue Montagne in Paris, has an experiential café. Consumers can have coffee while enjoying the atmosphere recreated from that of the mansion in Granville where Christian Dior spent his childhood.

Source: Fashion Network, Dior large pop-up store in Seongsu-dong (left) and Dior Café where consumers can enjoy a drink and the atmosphere of Christian Dior’s childhood home (right)

The new rising luxury consumers: the MZ Generation

The MZ Generation (MZ 세대 in Korean) is the collective term of Millennials (born in early 1980s to early 1990s) and Generation Z (born in the mid-1990s to early 2000s). They are becoming the major group of consumers in the luxury industry. They are usually referred collectively because they share many characteristics like being digital natives, preferring a You-Only-Live-Once (YOLO) life, and doing “FLEX” consumption.

Intensifying competition by the rising contemporary brands

As the MZ Generation brings opportunities for luxury brands, there is rising competition between the “new”, contemporary brands and the “old”, classical brands. The representative brands of the contemporary brands are AMI Paris (아미), Maison Kitsuné (메종키츠네), and Le Mer (라 메르), who have a relatively short history. They have been popular among the MZ Generation for their simplicity and trendiness, attractive logos, and high-economic accessibility. They have also appealed to them through their light fashion that aligns with the “One mile wear” (원마일 웨어) trend, where clothes can be worn casually and without any special care for decorations when going out to nearby areas. The “old”, classical brands are mainly represented by brands like “Herusha” (Hermès (에르메스), Louis Vuitton (루이비통), and Chanel (샤넬)), who have a longer history, are less affordable, and are relatively less appropriate for casual-wear.

Luxury brands in Korea are diversifying into the pets, kids, and living markets

As the MZ Generation is becoming the new major luxury consumers, luxury brands are diversifying their products. To cater to the needs especially of that of the MZ Generation, luxury brands are expanding to other lifestyle areas like kids, pets, and living. They are making pet products like opening restaurants and cafés. For example, Gucci released its Gucci Pet Collection. MARDI MERCREDI (마르디 메크르디), an increasingly popular S. Korean luxury brand, signed an intellectual property with B&BN (비엔비엔), a premium online pet select shop. MARDI MERCREDI gave them permission to use create a collection using their iconic logo.

Source: Gucci, Portrait of dog unveiling one of the items of the new Gucci Pet Collection (left) and portrait of dog in pile of clothes of the MARDI MERCREDI pet collection (right)

The luxury resell market is booming in Korea

The resell market is booming in the S. Korea’s luxury goods market. Since consumers are demanding the luxury experience than only the products themselves, they are buying luxury markets and then selling them on second-hand markets. They no longer perceive secondhand products as “used” but rather as more valuable “vintage” products they can wear to express their unique charm.

Just like many businesses have gone online, secondhand stores have done as well. The MZ Generation prefer to buy and sell their used luxury products, where they have greater access to a wide range of products and are not largely limited by the Covid-19 restrictions. Foreign luxury brands like Burberry (버버리) and Gucci (구찌) have partnered with online second-hand platforms like The Real Real (더리얼리얼) to supply their products. Burberry sells stock and out-of-season products that are not available in department stores or outlets.

There are many popular, existing platforms to meet the online luxury goods market

Data source: Statista, designed by Daxue Consulting, Size of S. Korea’s online luxury goods market from 2015 to 2020

S. Korea’s luxury goods market is largely going online, worth 1.1 billion USD (or 1.6 trillion South Korean won) in 2021. The online platforms in S. Korea can be viewed in three major groups: the vertical platforms, e-commerce, and luxury D2C.

Vertical platforms refer to those that meet the needs of a niche market. The top players include Mustit (머스트잇) and Balaan (발란). Balaan has signed contracts with over 600 foreign luxury boutiques and offers over 1 million products. From October to November 2020, Balaan had experienced a 200% increase in Monthly Active Users (MAUs). Their customers are mainly characterized by the following: is aged 25-44 years old, lives in Seoul Gangnam-gu, Seocho-gu, or Gyeonggi-do Bundang, and is searching for new luxury brands.

The second group is e-commerce, where Naver Shopping (네이버쇼핑), 쓱닷컴 (SSG.com), and Kakao Commerce (카카오커머스) are a some of the large players. Naver Shopping holds Naver Shopping Live (네이버 쇼핑 라이브), where consumers can interact with the host before making any purchases by asking and receiving questions real-time and receiving special discounts.

Lastly is D2C, where luxury brands themselves directly sell their products. Louis Vuitton, Chanel, and Gucci are a few major luxury brands with official online Korean stores.

Key takeaways in South Korea’s luxury goods market

- Korea’s luxury goods market is growing, bringing opportunities for not only the classical brands like Louis Vuitton but the contemporary ones like AMI Paris.

- Luxury is no longer defined by the product itself but by the experiences. The rising new consumer group, popularly known as the MZ Generation, desire these experiences. Foreign luxury brands like Dior have already started to bring these experiences through their pop-up stores.

- There is intensifying competition between the “old” and “new” brands. While the former finds ways to maintain and even adjust to the changing needs, the latter looks for ways to satisfy the growing needs.

- Luxury brands are diversifying into other categories like pets, kids, and living. For example, Gucci has released Gucci Pet Collection and MARDI MERCREDI has sold its intellectual property to B&BN.

- As consumers prefer experience over the product itself, the resell market is booming. Luxury brands have also joined by partnering with existing secondhand platforms like Burberry did with The Real Real.

- South Korea’s online luxury goods market is rising. Luxury brands have already started to build their online presence and sales channels to meet their consumer needs.