As South Korea’s beauty market is a global trendsetter, understanding the Kbeauty market is not only useful in understanding Korean consumers, but also the global beauty consumer base. Our public research team deep dived into Korea’s beauty and skincare market and compiled our findings in this downloadable report.

Download the Korean beauty consumer trends report

What’s in the report?

Korea’s beauty scene has global impact, that’s why it’s worth studying for both beauty brands in the Korean market and all beauty brands globally

Download to learn:

- Whether Koreans are leaning more towards the 10-step routine or minimalism

- What ‘clean beauty’ means to Korean consumers

- How Korean beauty consumers view European and Japanese beauty brands

- How to tap into South Korea’s digital ecosystem: What platforms to know and what tactics work

Key Stats:

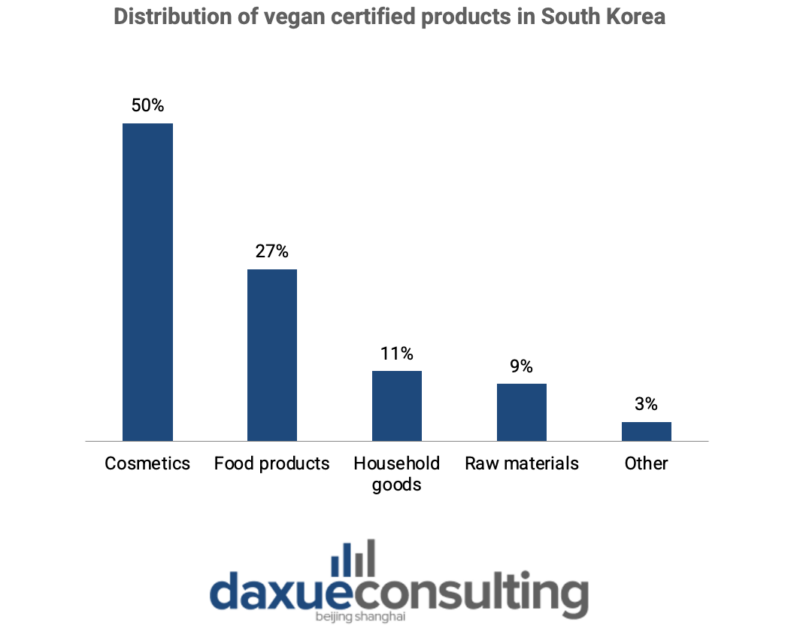

- 50% of vegan certified products in Korea are in the Cosmetics category

- The most ‘recognizable’ cosmetics brand in Korea is Sulwhasoo at 92.8% recognizability, followed by Hera and SKII (91.0% and 89.7%)

- 61% of 20–50-year-old Korean consumers consume health supplements

- Online shopping penetration is very high, at 95% for those in their 20s, and 60% for those in their 50s

The mature South Korean beauty market remains strong. Although market size decreased in the early periods of the pandemic, early figures for 2021 sales released by the Ministry of Food and Drug Safety indicates forecasts for the year in the 10 trillion KRW range. Beauty brands were largely impacted by the fall in the sales, especially with the obstruction of offline shopping; however, brands, particularly the domestic ones like Olive Young and Tony Moly, have adapted quickly.

How foreign brands adapt to Korea’s evolving beauty standards

Although Korean beauty standards generally remain the same as the pre-pandemic period, makeup trends are shifting. Most beauty consumers in South Korea still prefer a natural look and pale skin, although there are more who are desiring the darker and more elaborated “Western” look. For example, many celebrities like Jennie (제니) from K-pop group BLACKPINK and solo-singer IU (아이유) appear wearing light and natural-looking makeup in social media. There is also rapper, singer, and entertainer Jessi (제시) and Hwasa (화사) from K-pop group Mamamoo who wear a heavier and more “fierce” makeup.

In addition, K-beauty consumers aim to get a makeup look that appears like they are wearing little to no makeup. For instance, when they search for lipsticks, they are searching for those of more natural looking colors such as earth red, nude pink, and earth orange. South Korean beauty giant Amorepacific Corporation’s HERA (헤라) introduced “Hera Sensual Fitting Glow”, a natural-colored and thin-textured tint that give users a long-lasting natural look. They are also demanding more beauty products that do not only contribute to a more “pleasing” appearance but a healthier one.

Korea’s famous 10-step skincare routine is challenged by minimalism

The 10-step skincare routine is going out of trend as consumers in South Korea demand a more minimalistic approach. The 10-step skincare routine had been popularized by K-beauty influencer and aesthetician Charlotte Cho. Many consumers practiced it as it allowed them to personalize every step and experiment with different brands. However, they are desiring a simpler yet effective skincare routine that saves them time and keeps their skin healthier.

What differentiates South Korea’s clean beauty scene

In the Korean beauty industry, clean beauty is becoming more popular. However, the definition of clean beauty in Korea may differ from other countries like China. Among the vegan certified products in South Korea, half of them belong to the cosmetics section. Domestic brands like Amorepacific Corporation’s Innisfree (이니스프리) and Primera (프리메라) have introduced products that are made of environment-friendly ingredients.

Domestic brands have a steady hand over buyers in Korea’s beauty industry

Domestic K-beauty brands are widely known among consumers. They can generally be categorized into three main tiers: the top tier (with >1 trillion KRW 2020 Q1 revenue), tier 2 (with >200 billion KRW revenue), and tier 3 (with >130 billion KRW). Amorepacific Corporation (아모레퍼시픽), owner of Sulwhasoo (설화수), Laneige (라네즈), and Innisfree (이니스프리), among many, operates about 4,000 counters.

Foreign brands are also widely recognized in Korea’s beauty industry

Foreign beauty brands, especially those from Japan and Europe, are widely recognized. Japanese beauty brands like Shiseido (시세이도) and SK-II have established footholds in the market and remain resilient. European brands like Jo Malone are largely perceived as being reliable and prestigious.

Foreign brands can tap into the K-beauty market through the Hallyu, or the Korean wave. They can reach their consumers through product placement in K-dramas like how the multi-balm KAHI became the biggest trend with frequent exposure on TV or product reviews in on YouTube by top beauty influencers like PONY Syndrome.

Social media and Naver are the main communication channels

Foreign brands should communicate with their beauty consumers in South Korea through social media (SNS) and Naver (네이버). Popular social media platforms include Instagram (인스타그램), YouTube (유튜브), and TikTok (틱톡). Not only do brands upload videos and posts but celebrity ambassadors post them themselves with direct mention of the brands. Naver (네이버), the Google of Korea, is also another common channel. Consumers can find articles, product recommendations, and live events on the Naver Live Shopping (네이버 라이브 쇼핑).

Experience is a key success factor in the K-beauty industry

Consumers in South Korea are focusing more on the experiences than on the products themselves. Now that living with Covid-19 has become normalized, brands have started to re-open pop-up stores. But rather than focusing heavily on the products themselves, they are paying more attention into the “special experiences” and the “fresh fun”. For instance, in Chanel opened a pop-up store N°1 DE CHANEL GARDEN in August 2022. They allowed visitors to learn about the brand story and engage with the products through immersive and customized experiences. Brands have also unleashed limited-edition products to strengthen the consumer’s “Gotcha Power” (득템력). This “power” refers to the ability to obtain products that are hard to acquire due constraints in limited time, quantity, raffle draws, and not necessarily due to financial constraints.

In addition to the pop-up stores, brands in the low-to-mid-priced brands have launched non-conventional products to reach “Funsumers” (펀슈머), a compound word of “fun” and “consumer”. “Funsumers” refer to the consumers who buy products for the fun experience rather than the cost-to-benefit ratio. Gompyo (곰표), a flour brand, successfully launched non-food related products like cushion compacts.

Consumers are looking for “narrative” in the brands they buy

Narratives (내러티브), stores containing a point of view or values and also incorporating emotion, are becoming more important for South Korean consumers. Although they are common in Western countries, they are being built by smaller and larger brands. French luxury fashion and beauty brand Dior (디올) opened a massive pop-up store in May 2022 as a narrative strategy. The store was inspired by their iconic headquarters at 30 Montaigne. They displayed multiple settings, a Café Dior, and even original pieces by Korean designers so visitors can learn and experience Dior’s culture and story.

Key takeaways of Korean beauty market trends

- Despite the market decline impacted by the Covid-19, the K-beauty market is expected to grow in the next few years. Domestic brands like Olive Young have been adjusting to the shifting trends. Foreign brands are also suggested to do so to capture a piece of the market.

- Foreign brands, particularly from Japan and Europe, are largely recognized among beauty consumers in South Korea. Jo Malone, for instance, is perceived as a reliable and prestigious luxury fragrance brand.

- The popular 10-step skin care routine is being outdated as consumers are demanding minimalism. This has brought opportunities for brands to develop more simple yet effective products.

- Clean beauty products are also on the rise as consumers. Clean foreign beauty brands are suggested to join the fairly small yet promising trend.

- To communicate with consumers, social media like YouTube and Instagram, and Naver are preferred channels. More brands are using them to communicate and interact with their consumers who have grown more “digital”.

- Although the digital aspect is important, brands should also build their offline presence through interactive and memorable pop-up stores, non-conventional and fun products, and limited-edition launches.

- Instead of focusing only on the product and its features, brands have been building a “narrative”, where they can share their stories and culture to their consumers.