While fashion powerhouses struggle to adapt to shifting trends and global trade tensions, Shein is thriving, selling USD 5 dresses at lightning speed to millions around the world. Founded in 2008, Shein has become the world’s largest fast fashion e-commerce platform, with operations in over 150 countries, but none in its home market of China. Its biggest audiences are Gen Z women in the United States and Europe, where Shein’s marketing strategy it working. It has built an empire on ultra-cheap, trend-sensitive clothing. Today, its catalog extends far beyond fashion, into electronics, home furnishings, and lifestyle accessories.

Download our report on the future of sustainable fashion in China

But behind the viral hauls and promo codes lies a growing chorus of criticism. Allegations of labor exploitation, unsustainable practices, and intellectual property theft are mounting. Meanwhile, global governments are taking aim at the company’s tax avoidance, consumer manipulation, and carbon emissions. Despite rising U.S. tariffs and European regulatory crackdowns, the Chinese e-commerce platform continues to thrive and expand—thanks to its strategic adaptation and aggressive marketing. As it prepares to shift production to India and pursue a major IPO, the question is: can Shein’s disruptive marketing strategy outpace the backlash closing in?

The pioneer of ultra-fast fashion

The key principles of real-time fashion

The main component of Shein’s marketing strategy is “real-time fashion”, which takes the “fast-fashion” model to its extreme by identifying fashion trends quickly and minimizing manufacturing cycles. The Chinese e-commerce offers similar clothes to other fast fashion brands often at lower prices. Shein prioritizes quantity over quality, offering a vast selection of items that rotate quickly based on customer behavior and social media trend shifts.

To shorten the time it takes to identify trends, design, manufacture, and ship, Shein uses an in-house design team and comprehensive analysis of fashion trend data. In 2020, it introduced 150,000 new items, averaging over 10,000 per month, surpassing Zara’s annual volume in just one to two months. With its trend following strategy, Shein is regularly accused of stealing designs, as it mainly replicates successful existing ones.

Shein’s algorithm also drives production decisions by tracking shopper behavior. If users frequently click on a specific T-shirt or spend extra time viewing a dress, the system quickly signals factories to ramp up production of those items.

A successful strategy

By 2020, Shein’s sales had skyrocketed to USD 10 billion, more than triple the previous year’s revenue. In June of that year, the company captured 28% of the United States’ fast fashion market, nearly matching the combined share of both H&M and Zara. Around the same time, reports estimated Shein’s valuation at over USD 47 billion, placing it among the most highly valued private tech startups globally.

Social media focused marketing

Micro influencers

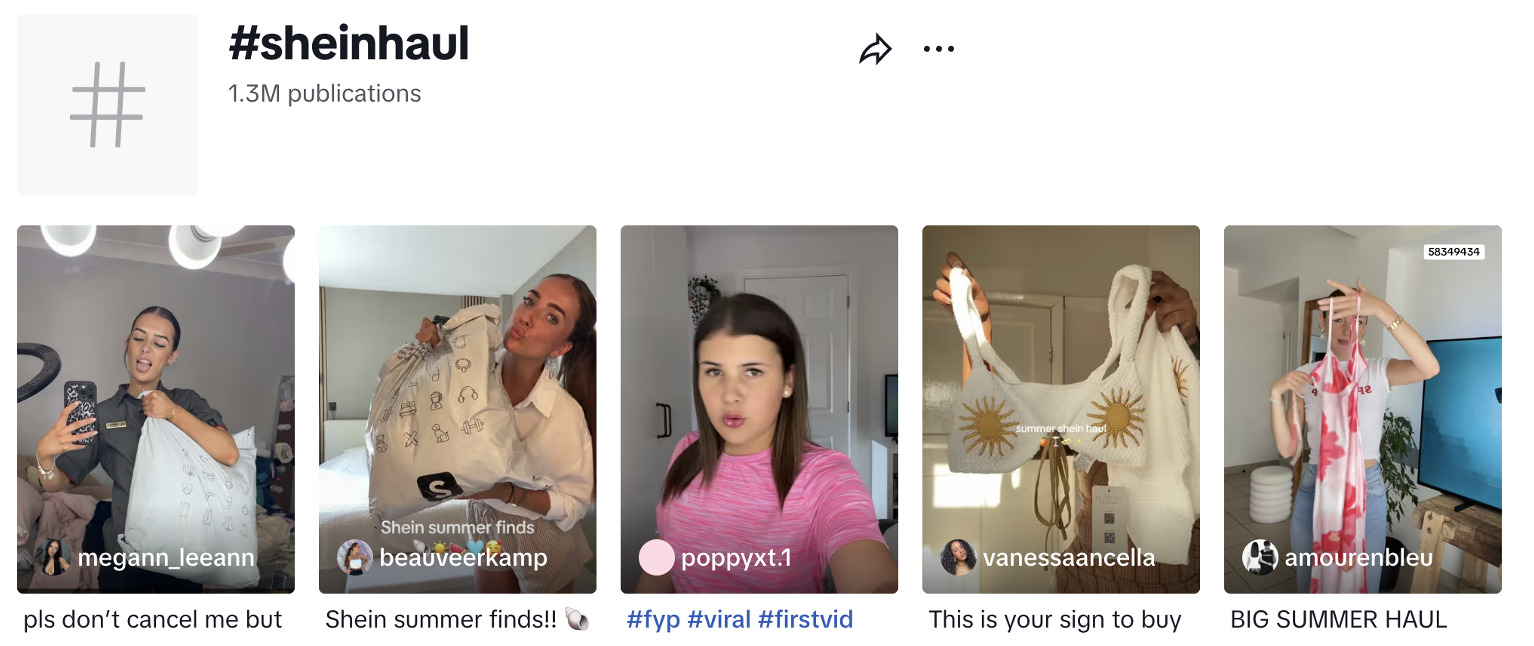

The fashion retailer mainly partners with micro-influencers, often individuals with a modest following on Instagram, YouTube or TikTok. In exchange for their posts, these influencers receive complimentary product deliveries every month. Some of them can also get up to 10 to 20% commission from the app’s referral sales, well above the average affiliate rates. This referral strategy helps to spread awareness about the brand in a genuine way.

Hunger marketing

The e-tailing platform’s mastery of hunger marketing tactics is evident through its frequent catalog updates, flash sales, and exclusive discount codes. The brand’s IP collaborations and pop-up stores further fuel consumer anticipation, emphasizing the effectiveness of scarcity and exclusivity in driving sales.

Pop-up stores instead of real stores

Even though it has no permanent brick-and-mortar stores, Shein has opened pop-up stores in many cities since 2018, such as Las Vegas, Milan, and Seoul. It has also opened a permanent showroom in Japan, where people can scan the QR codes on the tags and get their products to delivered.

In 2023, Maxine Silva, senior director of brand PR, told Chain Store Age that Shein doesn’t intend to open permanent stores for the moment. However, as a global online retailer, they aim to target cities with a high concentration of online shoppers, offering customers a unique shopping experience and spots to capture Instagram-worthy photos.

Digital army of fake commentators and bots

Shein has been suspected to utilize a network of fake accounts, many featuring identical or AI-generated content, to boost its online presence. These accounts often post repetitive promotional messages across platforms, such as “I’m shocked the Shein promo code in your bio really worked!” as part of a broader advertising strategy.

In addition to promotions, these fake profiles regularly share positive product reviews and defend the brand against criticism. They frequently echo Shein’s slogan “Fashion is a right, not a privilege.” with emotionally charged comments like “Shein gave lower social classes the ability to dress how they want” or “I’m poor, thank you for not stealing my clothing dignity.”

Critics of Shein’s marketing strategy and model

Human rights: Rising concern as the company expands to India

As Shein partners with Reliance Retail to scale its operations in India, partly to counter U.S tariffs on China, concerns over the company’s labor practices are growing. The plan to increase Indian suppliers from 150 to 1,000 within a year raises red flags among human rights advocates, especially in light of Shein’s existing supply chain conditions in China. Investigations, including one by the BBC and Swiss NGO Public Eye, reveal that many workers in Shein-contracted factories endure grueling shifts, often 10 to 12 hours a day, with minimal rest, and are paid per piece, earning less than a dollar per garment. The base wages fall far below the recommended living wage. Cases of child labour have also been found in its supply chain in 2023. Such practices reflect a pattern of labor exploitation that could be replicated in India unless stronger protections and transparency are enforced.

An unsustainable business model

Shein’s 2024 sustainability report shows a sharp rise in its carbon footprint. Supply chain emissions reached 11.2 million metric tons of CO₂ equivalent, a 9.7% increase from 2023. These come from clothing production, material sourcing, dyeing, and digital operations. Transport emissions rose by 13.7% to 8.5 million metric tons, due in part to Shein’s heavy use of air freight over sea shipping. With the fashion industry already producing 10% of global CO₂ emissions, Shein’s model highlights the environmental cost of ultra-fast fashion, raising concerns about the future of sustainable fashion in China and globally.

Geopolitical and regulatory pressures

U.S. tariffs and trade tensions

Rising trade tensions between the U.S. and China pose significant challenges for Shein. In early 2025, the Trump administration raised tariffs on Chinese imports to 30% and announced the revocation of the de minimis exemption, which had allowed shipments under USD 800 to enter the U.S. duty-free with limited inspections. This policy had been crucial to Shein’s business model, enabling the company to ship low-cost products directly from China to American consumers. The abrupt announcement on February 1st, 2025 caught customs officials and businesses off guard, leading the administration to soon pause the changes on February 7th to allow time for better implementation planning. If the exemption is fully removed, Shein could face higher costs, potential price increases, and shipping delays, threatening its position as a low-cost, fast-fashion leader in the U.S. market.

Tax and policy backlash in Australia and EU

At the same time, regulatory pressure is also increasing in Europe. On March 14th, 2024, the French National Assembly passed a bill targeting the environmental impact of ultra-fast fashion. Starting in 2025, brands like Shein and Temu will face a tax of up to EUR 5 per item sold in France, which will rise to EUR 10 by 2030.

In 2024, consumer watchdogs from 21 countries filed a formal complaint to the European Commission, accusing Shein of using “dark patterns” such as fake countdowns, low-stock alerts, and “confirm shaming” to pressure consumers into buying. The European Consumer Organisation warned these tactics promote overconsumption and may mislead shoppers, especially regarding product safety and sustainability. If Shein fails to address these concerns, it could face fines and be required to remove misleading features from its platforms.

Global sourcing strategy

To avoid intense regulatory and political pressure in Western markets while tapping into capital from Asia and emerging economies, Shein is expanding production to India and is now pursuing a public listing in Hong Kong after failed attempts in New York and London. The listing could help Shein attract investors less focused on supply chain controversies.

How Shein’s disruptive marketing strategy outpaces global critics and regulations

- Shein has become the world’s largest fast fashion platform by mastering real-time production, low prices, and influencer-driven marketing, appealing especially to Gen Z.

- Its success relies on ultra-fast supply chains, algorithm-driven design choices, and aggressive digital strategies like “hunger marketing” and the use of micro-influencers.

- However, Shein faces mounting criticism for labor exploitation, environmental harm, and manipulative tactics, including fake scarcity and misleading ads.

- Regulatory pressure is growing globally, with tariffs in the U.S., environmental taxes in France, and EU investigations into unfair commercial practices.

- Despite this, Shein continues expanding, shifting production to India and seeking a Hong Kong IPO to access capital while dodging Western scrutiny.