South Korea’s chocolate market is considered mid-sized, influenced by the country’s declining birth rate and the growing trend toward healthier eating habits. Despite these challenges, the market has shown steady growth in recent years, driven by the launch of new products that align with evolving consumer needs and a shift away from mass-produced, sugar-heavy chocolates toward premium, healthier, and imported options. According to Mordor Intelligence, the South Korean chocolate market was valued at USD 714.82 million in 2025 and is expected to expand at a compound annual growth rate (CAGR) of 2.56%, reaching approximately USD 811.12 million by 2030.

Read our Korea F&B industry report

Chocolate entered Korea as a premium product

Chocolate was first introduced to Korea during the late Joseon Dynasty in the 19th century by Western visitors, such as diplomats and missionaries, who brought it as a luxury gift for the elite. However, it was not until the Korean War that chocolate became more widely accessible. American soldiers distributed chocolate and candy to children and local communities.

The market received another boost during the 1988 Seoul Olympics, when the arrival of many foreign visitors increased interest in Western sweets. As Koreans’ disposable income grew, purchasing chocolate became more common for occasions like Valentine’s Day and birthdays. Around the same time, local manufacturers also began creating chocolate products that matched Korean preferences, helping the industry expand further. This early history, marked by chocolate’s introduction as a premium item, helped shape its identity in South Korea as a popular gift and a treat reserved for special occasions.

Local leader Lotte dominates, but global brands are also gaining ground in Korea’s chocolate market

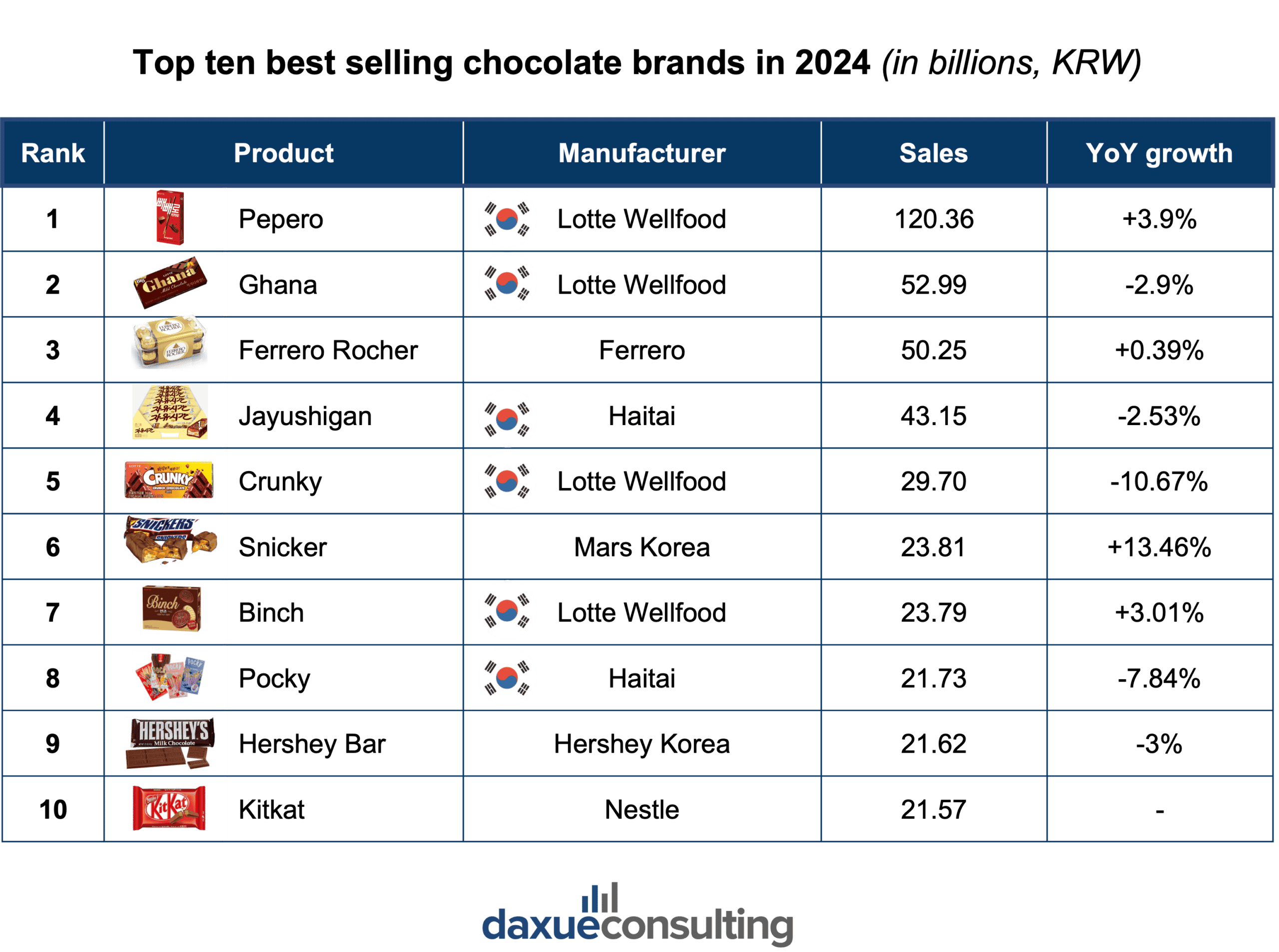

Lotte has long dominated Korea’s chocolate market since its early establishment with 37.2% of domestic market share in 2025, continually adapting its products to meet consumer demand. However, foreign companies have been steadily catching up. According to the Korea Agro-Fisheries & Food Trade Corporation, Lotte Wellfood’s Pepero was the best-selling chocolate and confectionery product of 2024.

Among the top ten best-selling brands, six were domestic, and four were international. Lotte Wellfood accounted for four products and Haitai for two. Pepero led the market by a wide margin with strong growth, followed by Ghana and Roshen, though Ghana experienced a slight decline.

Meanwhile, several local products such as Crunky and Zero Sugar saw noticeable drops, whereas Mars’ Snickers recorded the strongest growth, indicating rising consumer interest in imported brands. Overall, while Lotte continues to dominate in total sales, international competitors are gaining momentum and reshaping the competitive landscape of the South Korean chocolate market.

Korean chocolate consumption habits are increasingly shifting toward premium, health-focused choices

Koreans are increasingly drawn to chocolates made with better ingredients, higher cacao content, and minimal artificial additives. This shift toward healthier lifestyles is fueling the rise of sugar-free, dark, organic, vegan, and gluten-free chocolate products. As awareness of cacao’s health benefits, such as the polyphenols that may support heart health, continues to grow, demand for high-cacao chocolates is rising despite their higher prices, further expanding the premium segment.

The market is also boosted by the rapid expansion of global premium brands like Godiva, La Maison du Chocolat, Pierre Marcolini, and M&M’s, which have opened dedicated stores in major Seoul locations. Additionally, the tradition of gifting chocolate during holidays such as Christmas, Valentine’s Day, and White Day continues to strengthen consumer demand for premium boxed chocolates. Altogether, these trends show how Korean consumers are shifting toward more premium, health-oriented, and internationally diverse chocolate choices.

Ferrero Rocher’s manufacturing move triggered consumer concerns

Ferrero Rocher is an Italian premium chocolate brand long favored by Korean consumers. The brand’s products are among the most commonly given premium gifts during Valentine’s Day, national exams, and special official occasions. However, it recently faced backlash due to changes in its production site. The brand is widely available both online and offline, including in convenience stores and large supermarkets. As global cocoa prices continue to rise, the company announced in 2025 that Ferrero Group would begin supplying Ferrero Rocher products manufactured at its Hangzhou, China-based facility to the South Korean market, with online retailers switching entirely to China-produced products. According to the company, the shift to Chinese manufacturing aims to maintain a stable supply chain and meet increasing consumer demand, and it has assured customers that product quality will remain unchanged.

However, the “Made in China” label has caused many Korean consumers to feel that the brand’s identity as an “authentic Italian premium chocolate” is being diluted. Negative reactions quickly spread across online communities, with consumers expressing concerns such as: “The premium value disappears if it’s no longer made in Italy,” “I’m hesitant to pay the same price for a China-produced version,” and “If production has moved, the pricing should reflect that change.”

While country of origin is not as significant as occasion, packaging and visual appeal, and accessibility when it comes to buying chocolate in Korea, it still matters. This is especially the case for Ferrero, as Korean consumers generally perceive products made in China as cheaper, while the brand is positioned as premium.

Korea’s chocolate market is small yet holds significant potential

- Korea’s chocolate market was worth USD 714.82 million in 2025, smaller than that of the United States, Germany, and many other Western countries, but it is steadily growing, supported by rising demand for premium and healthier products.

- Chocolate has historically carried a premium image in Korea, shaping its role as a popular gift item.

- Lotte leads the market, but international brands are increasingly gaining share.

- Korean consumers prefer high-quality chocolates with higher cacao content and health-focused options.

- Global premium brands expanding in Seoul reflect growing interest in luxury chocolate.

- Country of origin can significantly affects consumer trust, as seen in the backlash over Ferrero Rocher shifting production site.