South Korea’s dairy consumption has been increasing gradually for the past ten years. With rising demand for dairy products, the nation’s dairy import has increased from USD 211.66 million in 2017 to USD 369.63 million in 2022. Followed by the increasing popularity of Western dining and awareness of the health benefits associated with dairy products, South Korea’s dairy market is poised for even further elevation in the future.

Read our Korea’s consumer trends report

Imported dairy products are gaining more popularity in South Korea

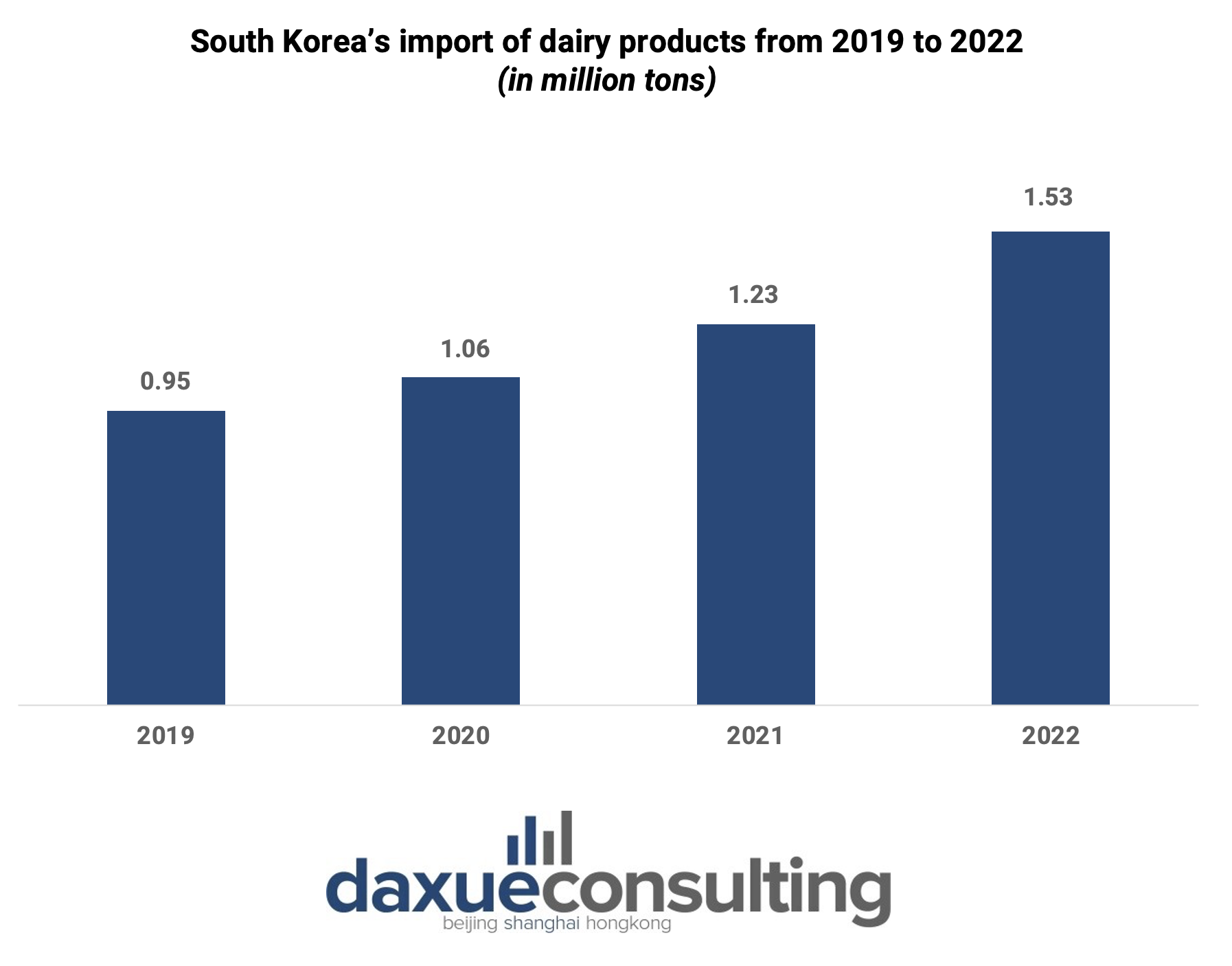

Due to the rising prices of domestic dairy products, consumers are turning their attention to imported alternatives. The amount of import for dairy products has increased from 0.95 million tons in 2019 to 1.53 million tons in 2022.

With the high price of domestic milk, consumers are showing a greater preference for imported milk. South Korea’s self-sufficiency rate of milk decreased from 62.8% in 2012 to 45.7% in 2021. The main reason for such a decrease is attributed to the expensive price of domestic milk. The price of domestic milk is set by the “raw milk price sliding system” (원유가격원동제) implemented in 2013. Under this system, the price of milk is determined by the production costs of raw milk and not by demand and supply. This means that there is no need for farmers to make efforts to curb overproduction or foster innovation.

As of 2023, tariff rates applied to milk from the United States and the European Union stand at 7.2% and 9%, respectively. However, according to the FTA (Free Trade Agreement) South Korea, the tariff rate is set to gradually decrease and is slated to be completely eliminated by 2026. This transition is expected to further tip the scales in favor of imported dairy products, including milk, over domestic counterparts among South Korean consumers.

In addition to milk, other imported dairy products, such as cheese and butter, have increased by 13.3% and 105%, respectively in 2022, compared to the previous year.

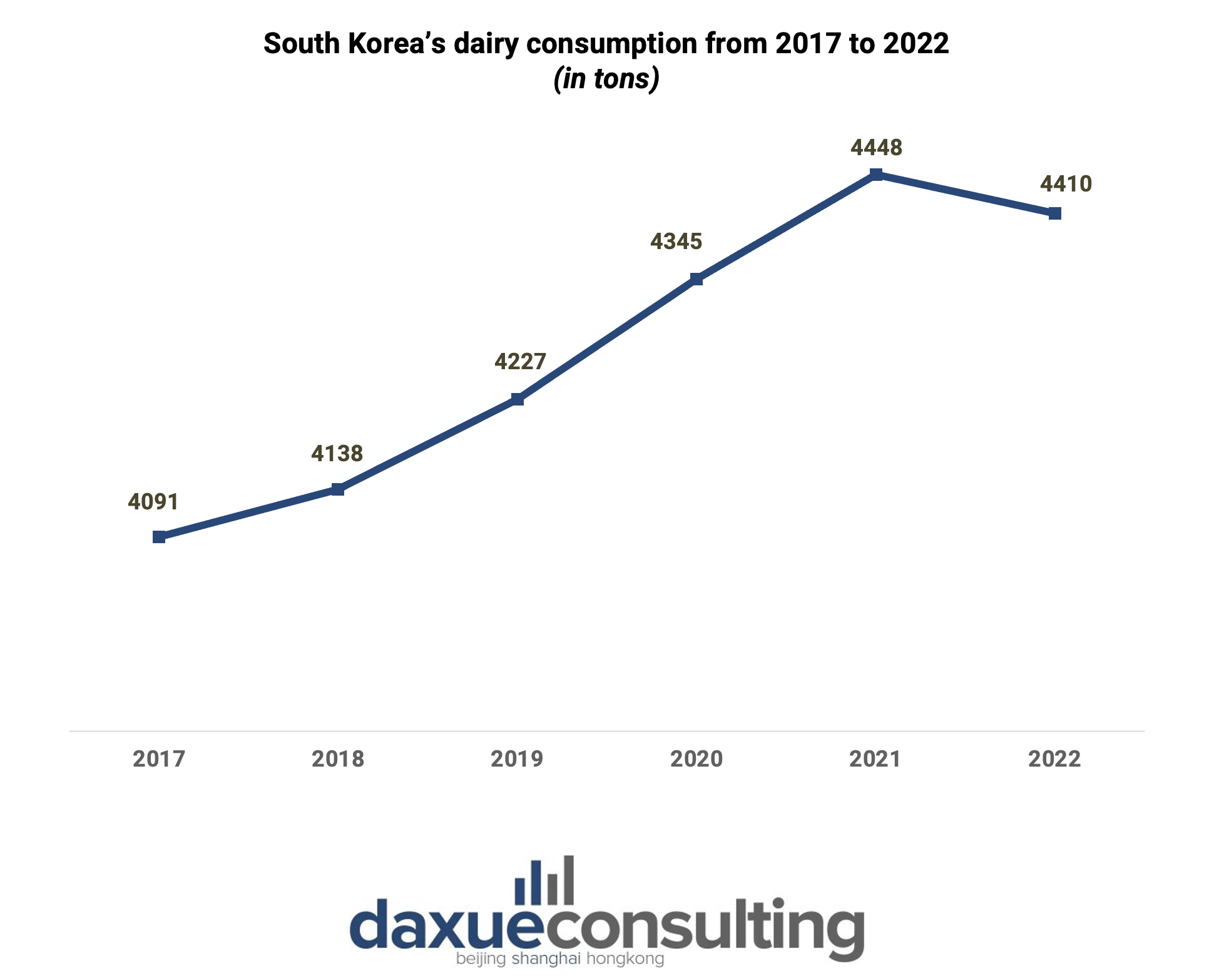

Total consumption for dairy products continues to rise despite decrease in milk consumption

Although people are consuming less milk, they are consuming more other kinds of dairy products. Milk consumption per capita decreased from 33.7 kilograms per capita in 2012 to 31.6 kilograms per capita in 2022. However, consumption of dairy products per capita increased from 67.2 kilograms per capita in 2012 to 85.7 kilograms per capita in 2022. Businesses and consumers are demanding dairy products, including cheese, butter, and cream, especially with the growing popularity of Western dining.

The main reason for the decline is largely because South Korea’s fertility rate is decreasing. The population of children, who are the main consumers of milk, is decreasing.

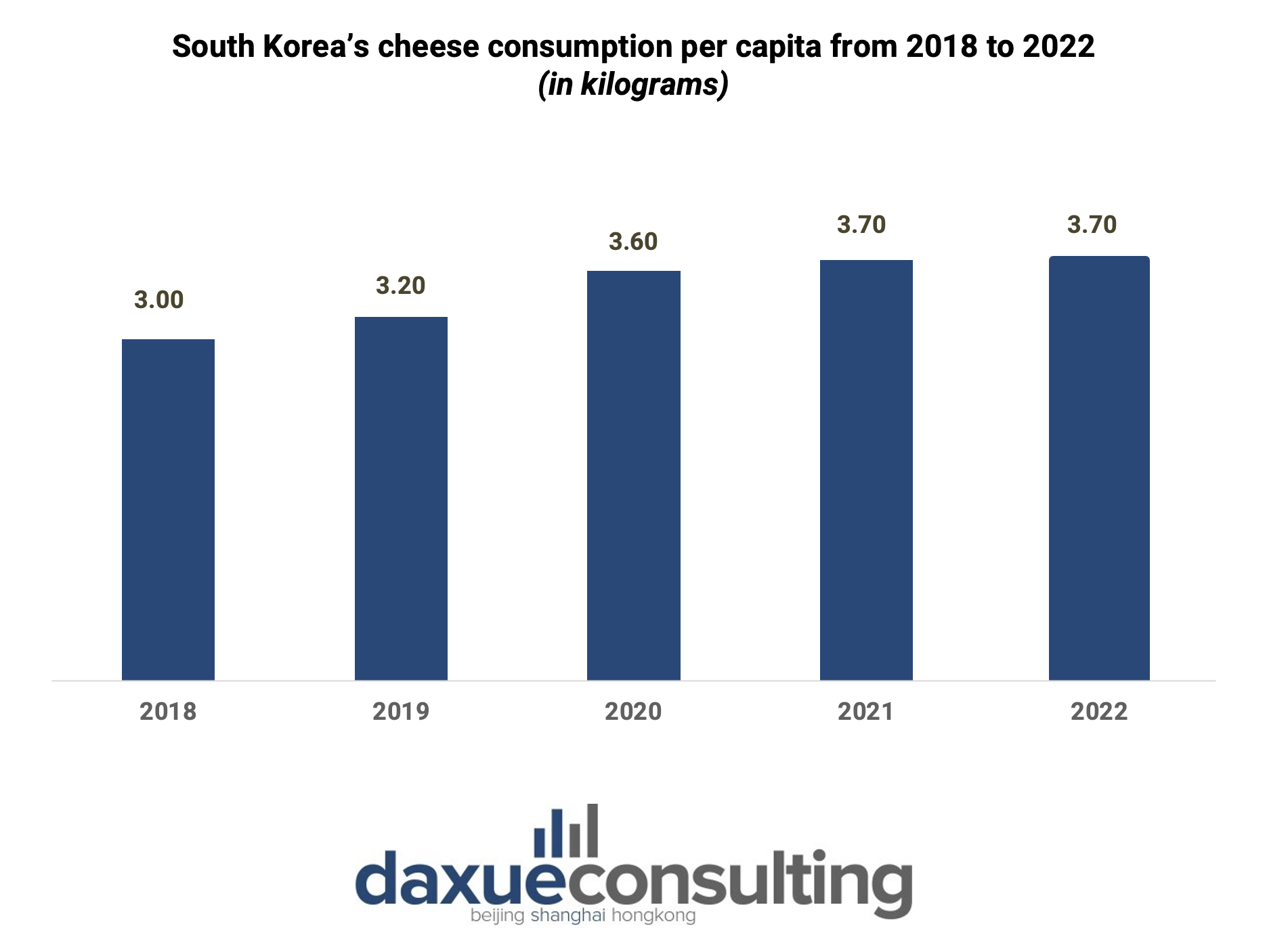

Cheese gains popularity with the rise of home drinking

As home drinking gained popularity during Covid-19, people started exploring a variety of drinks and snacks. South Korean consumers are directing their spending toward relatively expensive alcohol like wine and whiskey. With the growth of the wine industry, there was subsequent surge in the popularity of cheese. In South Korean drinking culture, “anju (안주)”, or drinking snacks, accompany drinks. Cheese, once an uncommon snack, saw a surge in popularity, becoming an easily prepared home treat.

The consumption of processed cheese in South Korea increased from 43,040 tons in 2018 to 51,130 tons in 2022, and its market is expected to grow further in the future.

Rise of Western-style dining and fusion cuisines are driving South Korea’s dairy market

As Western cuisine and fast food become increasingly popular in South Korea, the consumption of dairy products is also following the trend. In South Korea’s foodservice market, the burger market continues to grow as more foreign fast food brands open stores in South Korea. Western cuisines like burgers, pasta, and pizza have become ingrained in Korean consumers’ dietary preferences, resulting in greater demand for dairy products.

Moreover, consumers are creating more fusion cuisines by combining Korean food with other foreign cuisines with dairy ingredients. For example, the MZ Generation have shown interest in rose sauce, a sauce made by mixing tomato sauce with milk and cream. While it is typically used with pasta, Koreans have incorporated it into Korean dishes like the spicy “rice cake (떡볶이)” and “Jjimdak (찜닭)”. Many Korean cuisines are spicy and rose sauce reduces the spiciness, balancing the taste of the cuisine.

Health-conscious choices: South Korean consumers’ demand for nutritious dairy

South Korean consumers are seeking health and wellness in dairy products. As more individuals prioritize their well-being, consumers are gravitating toward healthy dairy products. Fermented milk products, known for their health benefits, are increasing in popularity. The market size for fermented milk has shown an average annual growth rate of 1.5% from 2016 to 2021. This upward trend is anticipated to continue and reach market size of USD 1.17 billion by 2026.

“Functional fermented milk” (기능성 발효유) and Greek yogurt are capturing consumers’ attention for their health benefits. In the fermented milk market, “Will (윌)” and “Bulgaris (불가리스)” rank first and third, respectively, in terms of market share. The market size for Greek yogurt also increased by 35% in 2022, reaching USD 222 million, compared to 2021.

Premium milk is also gaining South Korean consumers’ attention. In response to increasing interest from consumers, companies are stepping up their efforts to promote these premium milk products, capitalizing on their rich composition of vitamins and minerals. This growing trend reflects an expanding market for health-conscious consumers seeking both quality and health benefits in their dairy choices.

South Korea’s dairy market: embracing the dairy demand uptrend

- South Korea is importing more dairy products, with the country’s self-sufficiency rate for milk dropped to 45.7% in 2021. .

- Followed by increasing growth in South Korea’s wine industry, consumption and demand for cheese increased during the pandemic.

- With South Korea’s decreasing fertility rate, the country’s milk consumption decreased. However, the nation’s total dairy consumption continues to increase.

- Popularization of Western-style dining is one of the primary reasons for growth of South Korea’s dairy market.

- Consumers are caring about their health more. Healthy dairy products like functional fermented milk and premium milk are gaining more popularity.