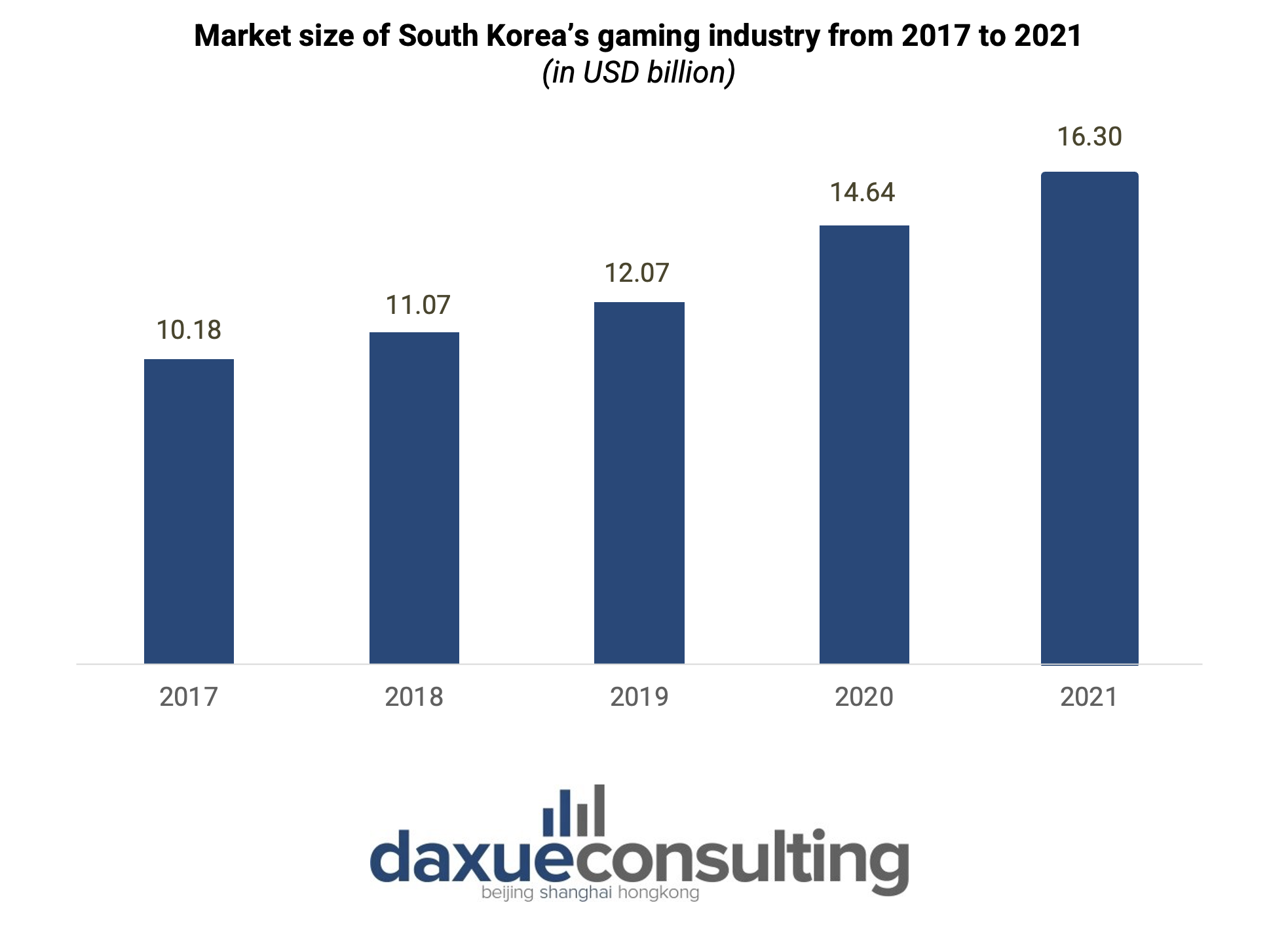

South Korea ranks as the fourth largest gaming market in the world. With a market size of USD 16.3 billion in 2021, it is behind the United States, China, and Japan. Games have become an important export sector for the country. They made up almost 70% of the total contents exported, including K-pop music, movies, TV shows, and commercials in 2020. With the increasing number of gaming users and surge in exports to foreign countries, the market size of South Korea’s gaming industry is expected to reach USD 20 billion in 2024.

Read our Korea’s consumer trends report

Mobile games dominance in South Korea

Mobile games are the most popular channel through which people play games in Korea. Their accessibility and convenience make them appealing to users of all ages. According to the survey by Korea Creative Content Agency, more than 70% of the 6,000 respondents play games. Out of the group, 84.2% play games on their mobile phones. Furthermore, the mobile gaming industry accounts for 57.9% share of South Korea’s gaming market size.

However, mobile games are not solely popular for their accessibility. They also serve as a source of entertainment and social connectivity. Games like BattleGrounds mobile and Among US particularly resonate with the MZ Generation. They require teamwork and communication, which aligns with the preferences of young consumers to make friends online and engage in virtual interactions.

Mobile games have grown even further with the release of mobile versions of famous Personal Computer (PC) games like the Lineage series, attracting PC users to mobile games. PC MMORPGs (Massively Multiplayer Online Role-Playing Games) create the most revenue in South Korea’s mobile gaming industry. They are not only enjoyed by young consumers but also by those in their 30s and 40s, who generally have higher disposable incomes. Older consumers continue to play them due to the genre’s old history and simple game play. They have played MMORPG since childhood, and they don’t need excessive skills or intense concentration to play them. Moreover, the “pay to win” strategy in MMORPG tends to be more pronounced than in other genres. This prompts older and wealthier consumers to willing spend more in enhancing their in-game characters.

South Korean government’s support for the game industry

Beginning with StarCraft, professional players and game leagues in South Korea started to grow in popularity and reached their height with the rise of League of Legends. This has elevated games from mere leisure activities to sports events officially recognized by the South Korean government.

To support e-sports, the Ministry of Culture, Sports, and Tourism approved the creation of Korean e-sports Association. This, along with the support of the government, facilitated the launch of global tournaments in South Korea, resulting in economic profits. For instance, the 2023 League of Legends World Championship in Seoul contributed an estimated profit of USD 153 million to the economy.

Moreover, the Korean government’s active involvement extends beyond tournaments. They annually organize G-STAR (Game Show & Trade, All Round) in Busan. This event allows foreign and domestic companies to share gaming information and promote their products to the consumers.

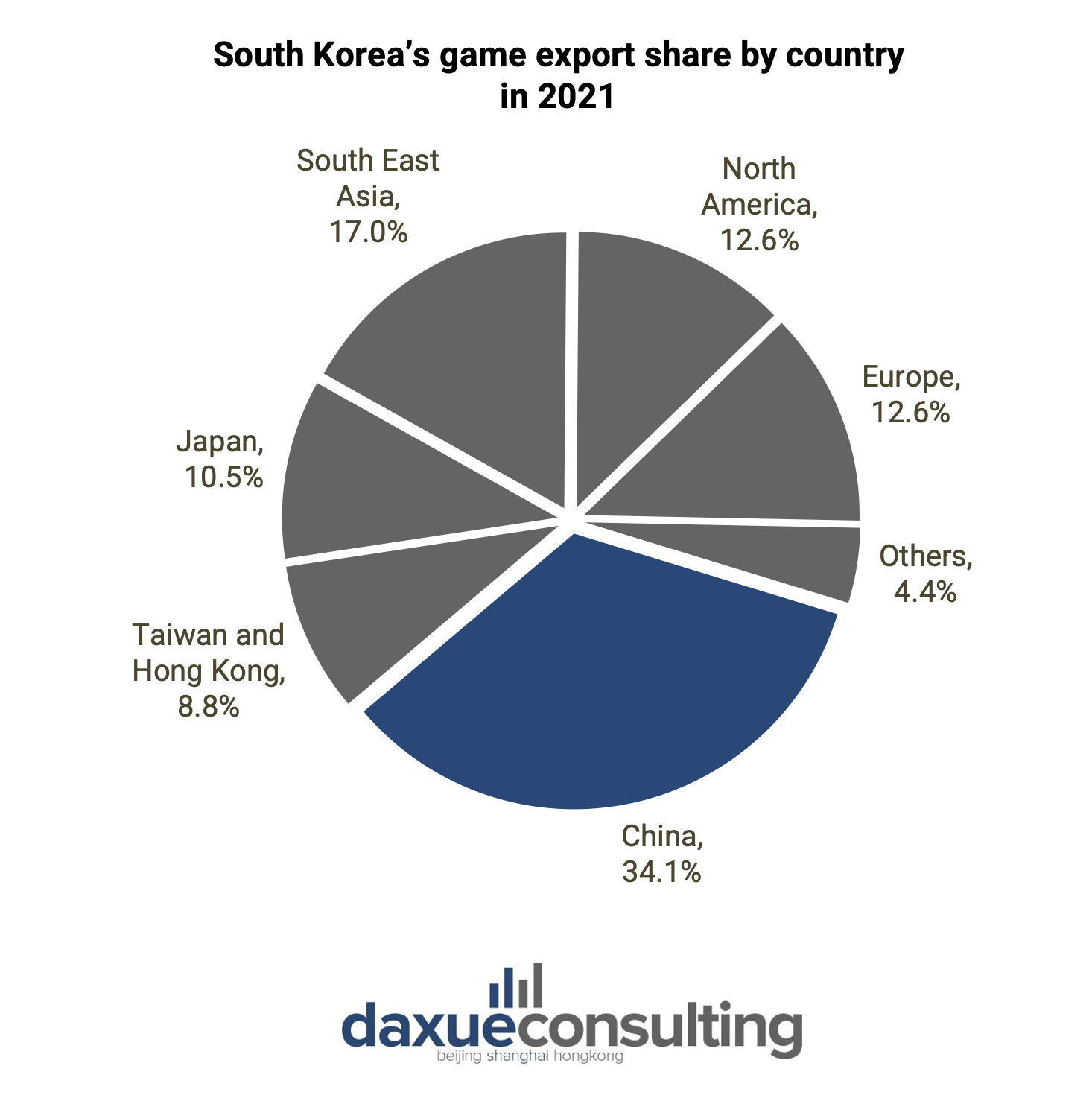

China is the biggest consumer of South Korean games

China and Southeast Asian countries are the biggest importers of South Korean games. They make up 34.1% and 17% of South Korea’s total game exports, respectively. China in particular accounts for 44% of South Korea’s PC game exports and 29.2% of mobile game exports. While China’s mobile games cater to the domestic market, games from other countries, including Korea, continue to be imported.

Although China remains the biggest consumer of South Korean games, export to China has been limited due to political reasons like South Korea’s decision to deploy “THAAD (The Terminal High Altitude Area Defense)” in 2016. Since 2017, China has restricted the import of South Korean content, limiting the entry of newly released games from South Korea. However, in 2022, seven South Korean games in China received licenses for release in China, and an additional five were approved in 2023. If this trend continues, South Korea’s exports to the Chinese market are expected to grow even further.

European market: next opportunity for South Korea’s gaming companies

Major importers or consumers of South Korean games are from Asian countries. However, South Korean companies are also starting to focus on European markets. The share of game export to Europe has increased from 8.3% in 2020 to 12.6% in 2021. In response to the European market’s growing interest in South Korean games, the country’s game industry is targeting Europe.

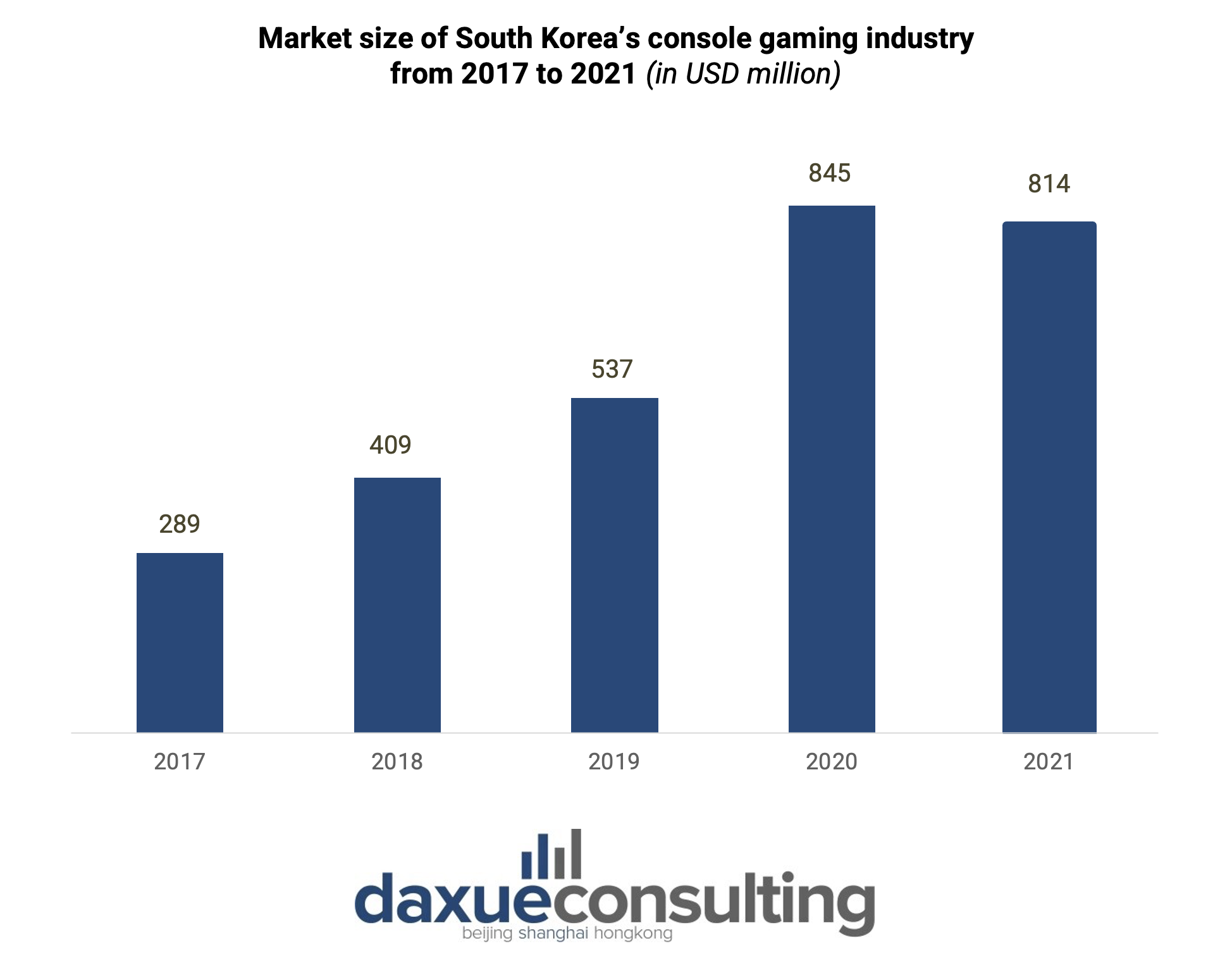

While PC and mobile games reign as the primary gaming choices in South Korea, European consumers lean more toward console games. In 2023, South Korean companies visited Gamescom, one of the world’s largest game shows, in Germany. They promoted their newly released console games. Despite South Korea accounting only 1.7% of the global console gaming market in 2021, the number is expected to grow as companies release and develop more console games.

South Korea’s game industry: Embracing the global gaming landscape

- South Korea is the fourth largest gaming market in the world. It reached a market size of USD 16.3 billion in 2021.

- Mobile games, enjoyed by consumers of all ages, are the most popular type of game in South Korea.

- Recognizing e-sports as an official sports event, the South Korean government is supporting the Korean gaming industry by organizing professional leagues and gaming events.

- China is still the biggest consumers of South Korean games. It made up 34.1% of total games South Korea export in 2021.

- Viewing European market as their next significant consumer base, South Korean companies are developing and releasing more console games.