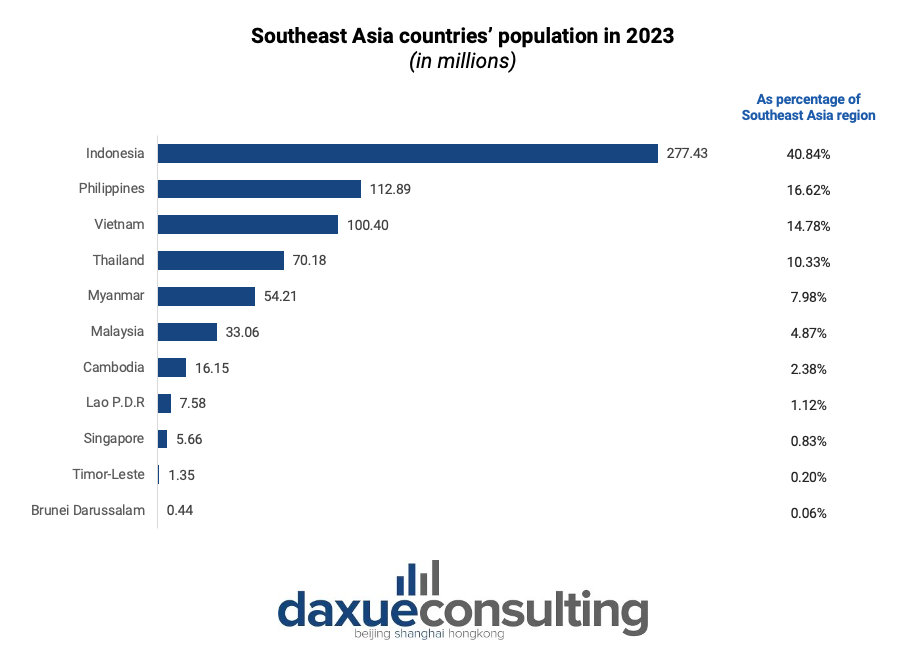

Southeast Asia is a diverse market situated between the Indian Ocean and the Pacific Ocean. The region comprises 11 countries: Brunei, Cambodia, East Timor (Timor-Leste), Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. With a population of 679.35 million in 2023, Southeast Asia represents around 8.67% of the total population. Added to the increase in internet penetration and mobile-savvy population, Southeast Asia’s e-commerce sector is an attractive market to explore.

Download our report on Gen Z consumers

Introducing ASEAN: The home of 3.8% of the world’s GDP

Southeast Asia hosts the Association of Southeast Asian Nations (ASEAN), a regional organization that fosters economic collaboration, political stability, and cultural interchange among its members. Comprising ten nations located in the region, excluding Timor-Leste, ASEAN serves as a platform for addressing common challenges and promoting regional unity.

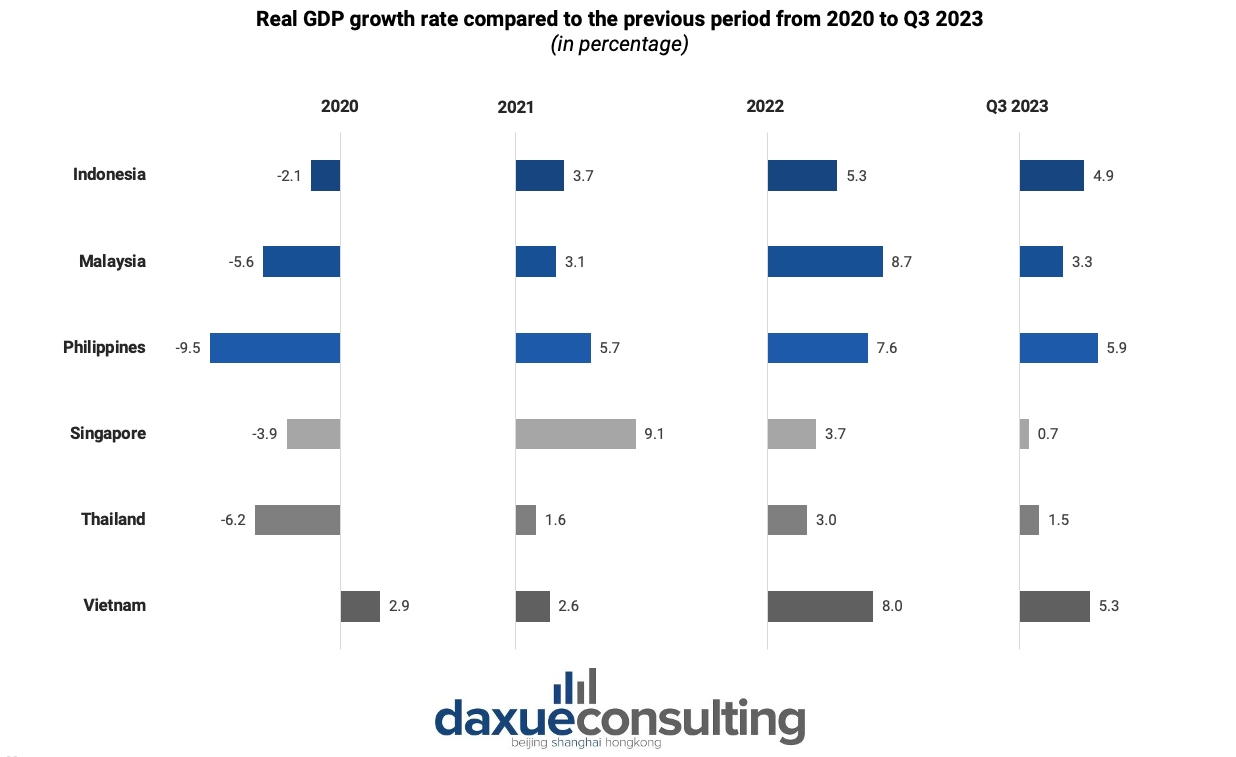

In terms of nominal GDP measured in US dollars, the ten ASEAN nations collectively reached USD 3.6 trillion in 2022, which is around 3.8% of the global GDP that year (USD 95 trillion). While the global economy faced a downturn, the Southeast Asian region stood out positively in the third quarter of 2023. Four of the six countries (Malaysia, the Philippines, Singapore, and Vietnam) experienced accelerated GDP growth, with Indonesia and Thailand seeing a slight slowdown.

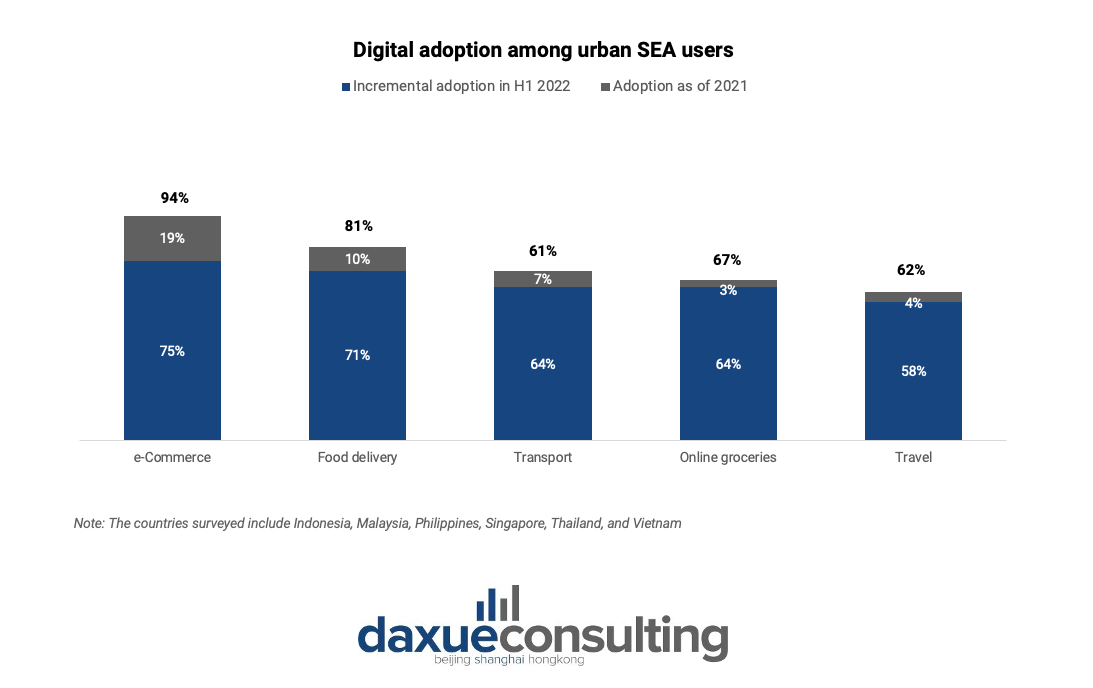

Digital domination: E-commerce dominates with a 94% digital adoption among urban SEA users

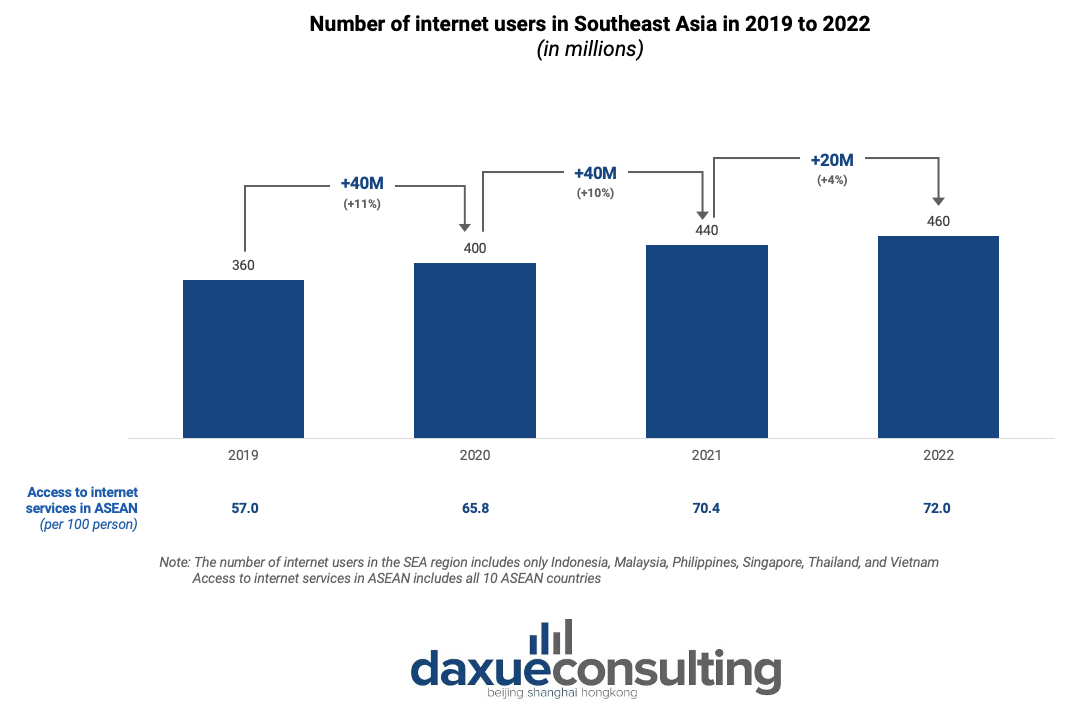

The number of internet users in the Southeast Asia (SEA) region has consistently risen. From 2019 to 2022, there was a growth of 100 million internet users. According to the ASEAN statistical yearbook, in 2022, 72 per 100 individuals in the region have internet access. Moreover with 99.6 mobile phones per 100 people in 2022, the accessibility further amplifies the potential for a robust expansion of e-commerce in the region.

Data source: Google, Temasek, Bain & Company, and ASEAN Secretariat, designed by Daxue Consulting, Number of internet users in Southeast Asia in 2019 to 2022

The prevalent use of smartphones, coupled with advancing internet infrastructure, has spearheaded widespread digital adoption across various sectors in urban Southeast Asia. E-commerce emerges as the frontrunner, boasting an impressive 94% adoption rate among users, closely followed by sectors such as food delivery, transport, online groceries, and travel.

Data source: Google, Temasek, and Bain & Company, designed by Daxue Consulting, Digital adoption among urban SEA users

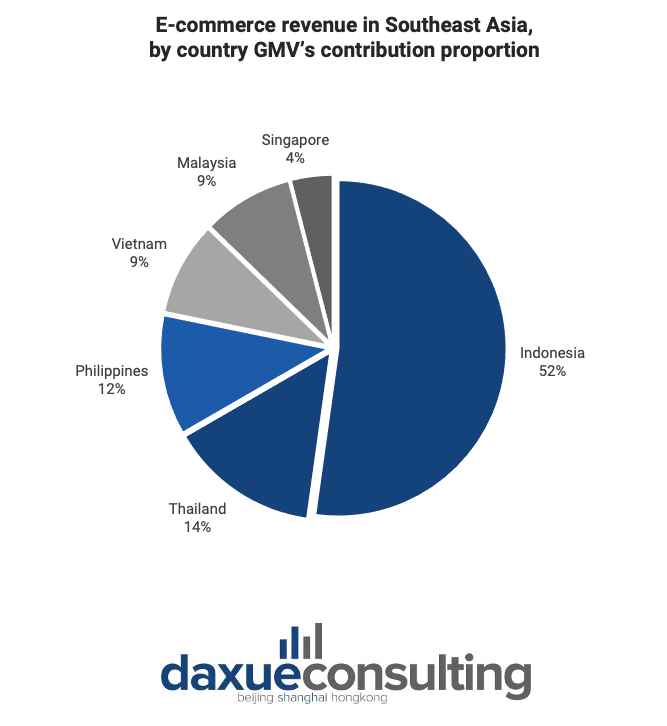

Southeast Asia’s e-commerce GMV: Indonesia takes the lead with a 52% contribution

In 2022, the e-commerce market in Southeast Asia (including Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam) achieved a total revenue of USD 99.5 billion. This figure indicates a growth of 1.8 times compared to 2020 when the revenue was USD 54.8 billion. Indonesia played a significant role, contributing 52% of the total, amounting to USD 51.9 billion. The distribution of total Gross Merchandise Value (GMV) across countries closely aligns with population rankings, except for Thailand. Singapore and Malaysia, on the other hand, lead in GMV per capita, mirroring their positions in GDP per capita.

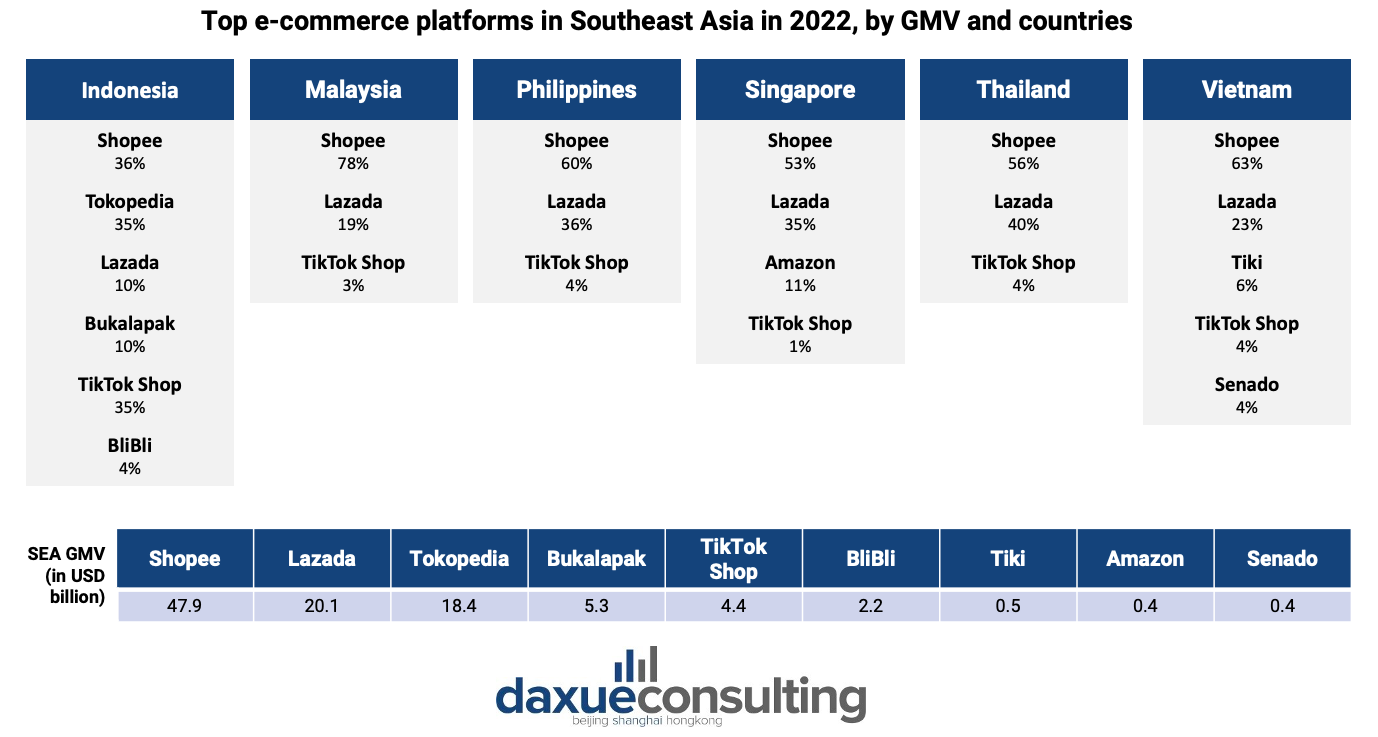

Southeast Asia’s e-commerce giants: Shopee, Lazada, and Tokopedia

Observing the popular e-commerce platforms in the region, Shopee emerges as the top performer in GMV across all mentioned countries. In each country, Lazada follows suit, except for Indonesia where Tokopedia, a local e-commerce platform, secures a larger share of the GMV market, claiming the second position. Meanwhile, regarding product categories, Food & Beverage and Beauty, Health, and Personal Care stand out as the top two most popular segments in Southeast Asia’s e-commerce landscape.

Data source: Momentum Asia, designed by Daxue Consulting, Top e-commerce platforms in Southeast Asia in 2022, by GMV and countries

Shopee

Established in 2015 by Sea Group, a Singapore-based technology company with backing from Tencent, Shopee has swiftly grown into one of the SEA region’s largest and most favored online marketplaces. Notable for its distinctive features like “Shopee Guarantee,” providing secure payments for both sellers and buyers. Furthermore, Shopee’s triumph is rooted in its mobile-first strategy, aligning with the rising preference for mobile shopping. As of August 2023, the platform boasts 270 million monthly visitors, solidifying its position as a major player in the e-commerce landscape.

Lazada

Lazada is a prominent e-commerce platform launched in 2012 and operating across Southeast Asia, including Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. With a vast marketplace hosting over 155,000 sellers and 3,000 brands, it caters to 560 million consumers. Following Alibaba’s significant investment in 2016, Lazada aligns its platform structure with Alibaba’s ecosystem, reflecting the growing importance of cross-border e-commerce in Southeast Asia. The platform has around 96 million monthly visitors as of August 2023.

Tokopedia

Founded in 2011 by Indonesian entrepreneurs with the mission of addressing disparities in Indonesia, Tokopedia has emerged as a dominant force in the country’s e-commerce market. Tokopedia has garnered significant investments from global VCs, including Alibaba and SoftBank. Known for its lively marketing campaigns featuring international and local pop stars such as BTS and SM*SH, Tokopedia competes fiercely with Shopee as one of the main players in the Indonesian eCommerce landscape. In August 2023, Tokopedia had 68 million monthly visitors.

Pain points and opportunities: Logistics and payment methods

Logistics

With the ongoing surge in online shopping across Southeast Asia, customers are increasingly demanding reliable logistics services. A December 2022 McKinsey report underscores prevalent issues, including delivery delays, slow speed, poor customer service, damaged packages, and inadequate tracking.

Widespread dissatisfaction is evident, with only 22% satisfied, and 78% willing to pay more for enhanced reliability. Notably, 83% would increase online purchases by 30% with a seamless return process. Another instance, despite the booming homeware sector valued at over USD 27 billion by 2025, logistics challenges, especially for bulky items, hinder its full potential. Over 40% cite product damage during delivery as a major concern, offering a prime opportunity for logistics firms. Nearly 70% of furniture buyers are willing to pay for professional handling, signaling a demand for secure and reliable delivery services.

Addressing the gap between customer expectations and reality presents a strategic opportunity for logistics companies, with specialized handling capabilities holding the potential for a first-mover advantage.

Payment methods

The SEA region exhibits diverse payment preferences. This resulted to the adoption of various payment methods, including digital wallets, credit/debit cards, and bank transfers. Digital wallets like GrabPay and GoPay have become popular due to their convenience. However, low banking system usage poses a challenge for online transactions in some countries. Additionally, there are obstacles such as non-tariff barriers and logistics gaps that require innovative solutions for efficient cross-border operations. As e-commerce grows, new rules may impact taxes and online sales procedures. Although regional agreements aim to streamline cross-border transactions, a persistent challenge remains the prevalence of cash usage for online purchases, particularly notable in countries like Indonesia and Vietnam.

From internet growth to e-commerce boom: A comprehensive overview of Southeast Asia’s e-commerce

- Internet users in the Southeast Asia region grew by 100 million from 2019 to 2022. 72 per 100 individuals in the region have internet access in 2022, with 99.6 mobile phones per 100 people.

- The E-commerce market in Southeast Asia reached USD 99.5 billion in 2022, with Indonesia contributing 52%, of the revenue.

- Shopee leads in GMV across all listed countries, followed by Lazada in most countries except Indonesia. Instead, Tokopedia secures a larger GMV market share in Indonesia, ranking second.

- According to McKinsey’s report, customer dissatisfaction due to delivery delays, slow speed, poor service, and damaged packages is common. 78% of customers are willing to pay more for enhanced reliability.

- Low banking system usage hampers online transactions while addressing non-tariff barriers and logistics gaps is crucial for efficient cross-border operations. Overcoming challenges related to the persistent use of cash in online transactions, particularly in countries like Indonesia and Vietnam, requires targeted solutions.