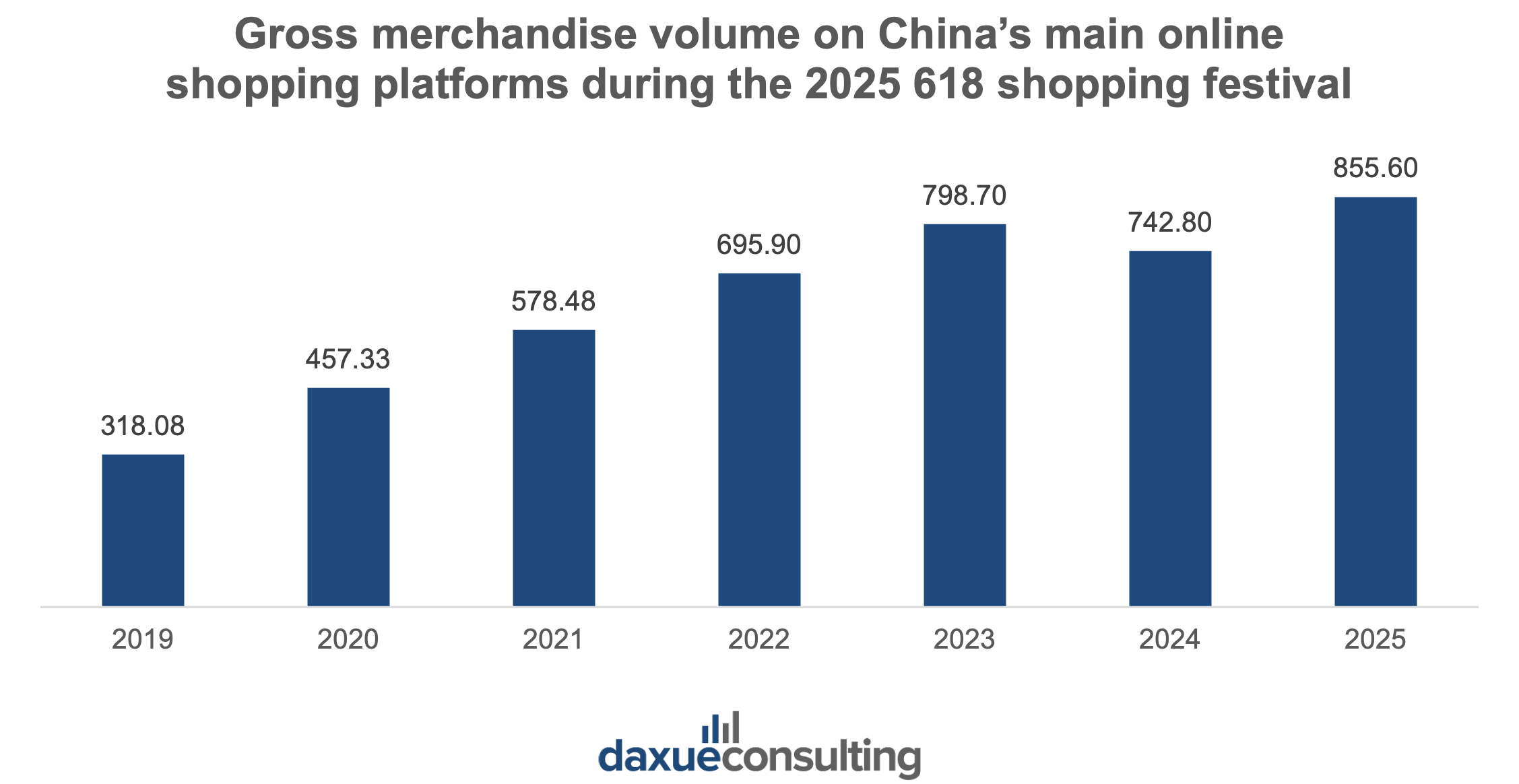

In 2025, China’s 618 shopping festival set new records with RMB 855.6 billion in gross merchandise value (GMV) across major e-commerce platforms, a 15.2% increase from the previous year. Alibaba’s Tmall maintained its top platform position in 2025. This was followed by JD.com, while ByteDance’s Douyin and Pinduoduo were also major platforms. As one of the areas where consumption growth is outpacing other categories, the strong performance of sportswear brands in China’s 618 shopping festival in 2025 indicates a shift in consumer priorities.

Download our report on China’s summer sports market

The festival coincided with peak summer demand for sporting goods, and Tmall saw sports and outdoor apparel sales grow over 50% year-on-year. Notably, within Tmall’s sports and outdoor segment, 36 sportswear brands surpassed RMB 100 million in sales during 618. Some notable brands included foreign brands Nike, Adidas, and Fila.

Several premium and niche athletic brands such as Salomon and HOKA also achieved triple- to quadruple-digit sales increases. Moreover, the rise of racket sports, known as “small-ball sports” (小球运动) in China, was a notable trend. The sales of tennis gear jumped 75%, badminton 50%, and even pickleball equipment surged over 1,100%, reflecting Chinese consumers’ diversifying sports interests.

High-performing sportswear brands in China’s 618 shopping festival in 2025

Foreign sportswear brands like Nike and Adidas, which are facing strong pressure from local competitors, showed strong performance in China’s 618 shopping festival in 2025.

Nike hits RMB 100 million sales in just 8 minutes

In 2025’s 618 shopping festival, Nike was the number one sportswear brand on Tmall, with its GMV exceeding RMB 1 billion. It hit the RMB 100 million sales mark in only 8 minutes after the sale opened, reflecting its popularity among Chinese consumers. Nike offered many discounts such as selected sale items up to 50% off and extra RMB 30 off when shoppers spend RMB 500.

Nike also featured an “under-RMB 199” add-on section, which allowed shoppers with, say, RMB 400 in their cart to select another low-priced item to reach the RMB 500 threshold for the extra discount.

FILA outruns Nike in pre-sales

FILA, whose China operations are owned by Anta, was the top two sports brand on Tmall 618. It reached RMB 100 million within the first minute of 618. It also recorded over RMB 1 billion in sales, just as Nike and Adidas did, with over 50% YoY growth.

Surprisingly, FILA briefly surpassed Nike in the early phase of 618 to rank number one during pre-sales. This is partly due to how FILA leveraged Tmall’s pre-sale features: buyers can secure a product without the need to pay a deposit and can obtain many cashback opportunities. These features largely increased its sales during pre-sale. Moreover, FILA also released new products such as limited-edition “Rouyun 3” sneakers during 618.

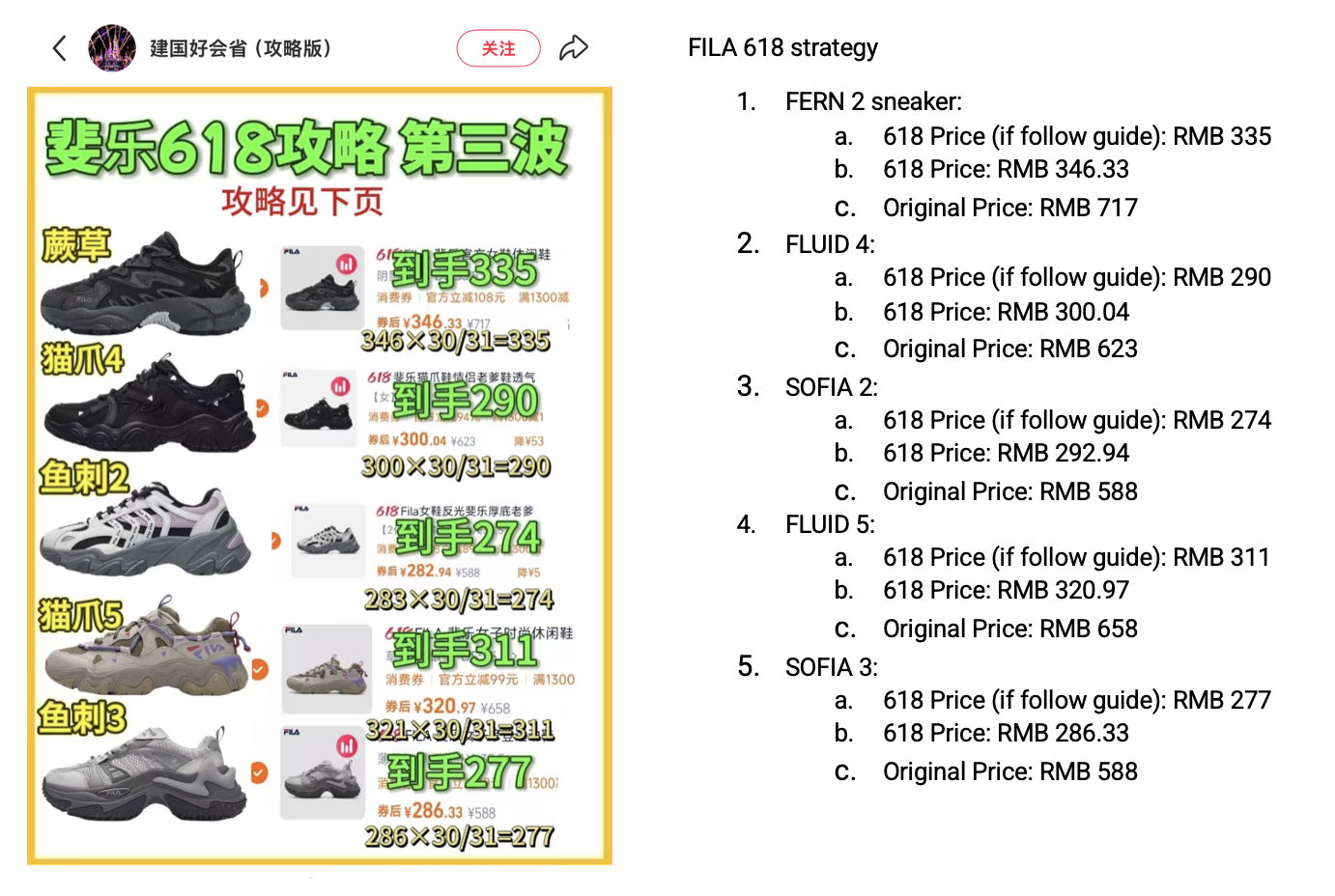

Some shoppers even shared detailed 618 guides to help others maximize discounts on FILA sneakers on RedNote (known as Little Red Book in China). The post breaks down specific models, shows how to stack platform coupons and store promotions, and calculates the final “到手价” (price after all discounts). This altogether helped buyers secure popular styles for as little as RMB 274 to RMB 335.

Adidas’ dad shoes bring retro back to China

Adidas also exceeded RMB 1 billion in GMV, and it ranked number three in Tmall’s sports category in 2025. It saw retro footwear hits drive its sales. Notably, its Temper Run 2 “dad shoes” (chunky retro sneakers) grossed over RMB 50 million and an “Ice Cream” colorway sneaker topped RMB 40 million in sales within the first hour of 618.

How did sportswear brands in China’s 618 shopping festival perform in 2025?

- The 618 festival reached RMB 855.6 billion in GMV in 2025. This was a 15.2% YoY increase across major e-commerce platforms in China. The event has become a vital mid-year sales driver, with platforms like Tmall, JD.com, Douyin, and Pinduoduo all competing through discounting, livestreaming, and more.

- Sportswear was a breakout category, with Tmall sports and outdoor sales rising over 50%. 36 brands surpassed RMB 100 million in sales, driven by China’s summer sports market demand and growing health-conscious consumer base.

- Nike topped Tmall’s sportswear rankings, surpassing RMB 1 billion in sales. Its smart use of layered discounts and a “below RMB 199” add-on section encouraged higher order values, hitting RMB 100 million within 8 minutes of launch.

- Adidas followed closely, propelled by retro sneaker trends.

- FILA recorded over 50% YoY growth and briefly surpassed Nike in China during pre-sales. It leveraged Tmall’s deposit-free pre-sale features and cashback incentives to gain early momentum. User-generated discount guides on Xiaohongshu helped shoppers stack coupons and buy sneakers at very low prices.