Founded in 1985, in The United States, Tommy Hilfiger is a highly recognizable designer brand dedicated to producing unique, classic and highly fashionable clothing and accessories for the global market. The product range includes men and women’s wear, children’s wear and a jeans collection. Other affiliated products include as watches and perfumes. Tommy Hilfiger in China has had double-digit growth since 2015, so we looked at the marketing strategy behind the brand.

Tommy Hilfiger’s performance in the Chinese luxury market

In China, from 2012 to 2016, the sales performance of Tommy Hilfiger was remarkable and has become one of the most influential brand of its parent company, PVH Corp. PVH Corp is a comprehensive company that includes the brands such as Calvin Klein, Van Heusen and IZOD. Since 2012, its parent company has taken over Tommy Hilfiger’s business sector in China. Such a decision has enabled Tommy Hilfiger to expand and develop its markets directly and rapidly. Meanwhile, the company is able to utilize its sophisticated regional leaderships and infrastructure in Asia. Taking over the business of subsidiary in China is able to facilitate the global decision making and standardization the global strategy.

China’s market has been appeal to Tommy Hilfiger’s business. Since 2012, the year of takeover, the revenue of Tommy Hilfiger in China’s market has surged from 70 million USD to 0.14 billion USD.

By the end of 2016, Tommy Hilfiger had more than 357 retail stores in China. Among these stores, 65 of them are direct stores, 292 of them are authorized resellers. Before 2011, they had merely 100 retail stores. On average, the store area is 1,500 square foot.

Tommy Hilfiger’s China market strategy

Products embody both standardization and localization

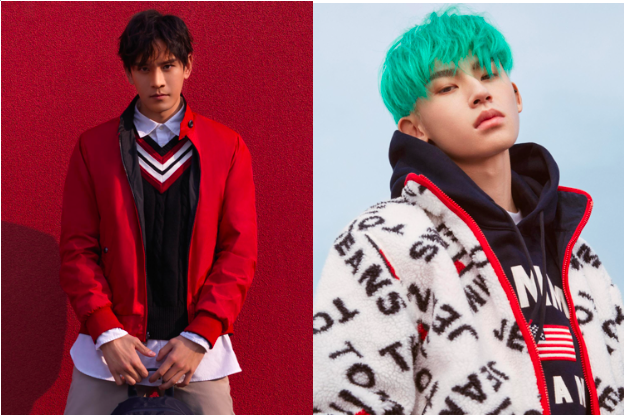

Tommy Hilfiger has standardized its product segments all over the world. Nevertheless, Tommy Hilfiger has launched its special series in China that tailors to China’s market. According to the official Chinese website of Tommy Hilfiger, most of the products in China such as jeans, hoodies, shirts, etc. can be found in other markets. On the other hand, in order to tailor to China’s market, Tommy Hilfiger has launched the Chinese New Year series and joined-design series that feature popular Chinese celebrities. Celebrity endorsements have had a positive impact on Tommy Hilfiger consumption in China.

[Photo source: Tommy Hilfiger, ‘Chinese New Year series and joined-design series’]

Distribution channels of Tommy Hilfiger in China

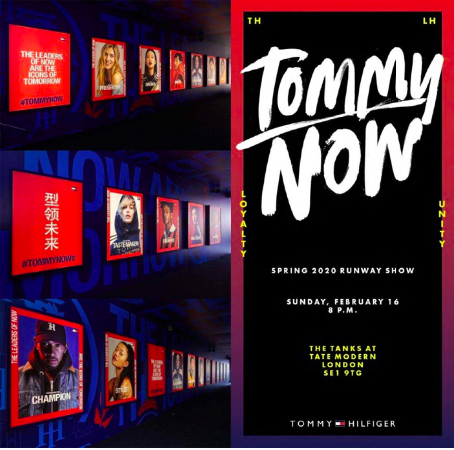

TOMMYNOW: an innovated sales channel that boosts transactions and orders

Since 2016, Tommy Hilfiger has launched TOMMYNOW Snap, where Tommy Hilfiger customers are able to shop and order novel style of clothes in real time via the image provided by TOMMYNOW the fashion show. This turned out to be successful as the order had increased by 60% and many designed clothes were sold out. Afterwards, Tommy Hilfiger has implemented such a distribution channel in other cities such as Los Angeles, Milan, London and Paris.

Even though these fashion shows are normally held in Europe and North America, in 2018, the company selected Shanghai as their location for the first TOMMYNOW in Asia. Tommy Hilfiger consumers in China are able to purchase the new arrival while watching TOMMYNOW in real time.

[Photo source: Weibo, ‘TOMMYNOW’]

Digital concept stores implemented in early adopted countries

As digital technology is a growing trend all over the world, Tommy Hilfiger realizes that and keeps pace with the trend. In 2019, the company has shut down some flagship stores in United States. “Large scale of flagships stores should exist in the history instead of now as no one wants to enter such a grand store. Just like you would no longer be interest in the food if the table is filled with it,” says Daniel Grieder, the CEO of Tommy Hilfiger Global.

China has been a suitable business location for Tommy Hilfiger to exercise this idea. In 2019, Tommy Hilfiger had scheduled the launch of the digital concept store in Beijing and this is the first digital store in Asia. As Chinese consumers are early adopters in regard with digital branding, satisfying Chinese customer’s need will drive key success to the business.

[Photo source: Beijing Business Today, ‘Digital concept store of Tommy Hilfiger in China’]

[Photo source: Beijing Business Today, ‘TommyXYou campaign for Tommy Hilfiger in China’]

Tommy Hilfiger aims to follow the original style of store décor. Nonetheless, in order to feature the characteristic of digital technology, Tommy Hilfiger has established the digital shopping wall and intelligent fitting rooms. Moreover, TommyXYou is an intelligent platform that installs the function of intelligent clothes matching. Tommy Hilfiger consumers in China are able to select different types of clothes on the screen and try virtual fitting.

Online stores are highly localized to the Chinese market

As E-commerce is a current trend in China, Tommy Hilfiger has kept pace with this trend and set up a couple of online stores in the mainstream platforms.

Tommy Hilfiger owns its Chinese official online store. This is a common platform for Tommy Hilfiger consumers in China to shop due to its authenticity and trustworthiness.

[Photo source: Tommy Hilfiger, ‘Website of Tommy Hilfiger’]

Additionally, Tommy Hilfiger has also owned its online stores on Tmall and JD. Since these are the platforms that have earned lots of consumers in China, establishing online stores on such platforms are able to maximize its brand exposure and expand its customer base.

[Photo source: Tmall, ‘Online store of Tommy Hilfiger on Tmall’]

[Photo source: JD, ‘Online store of Tommy Hilfiger on JD’]

Tommy Hilfiger is more expensive in China than in the United States

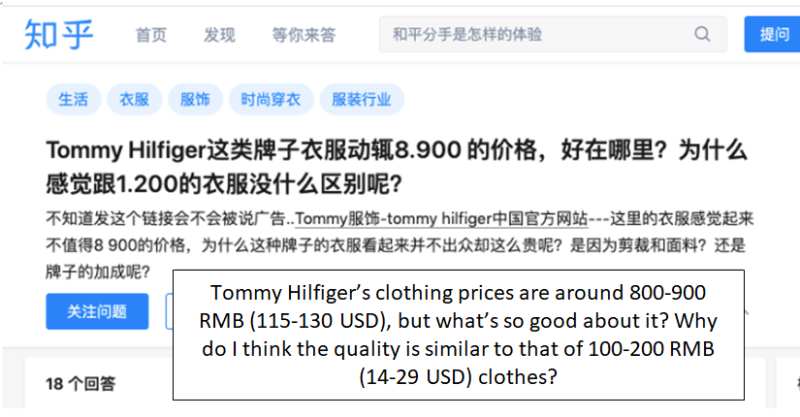

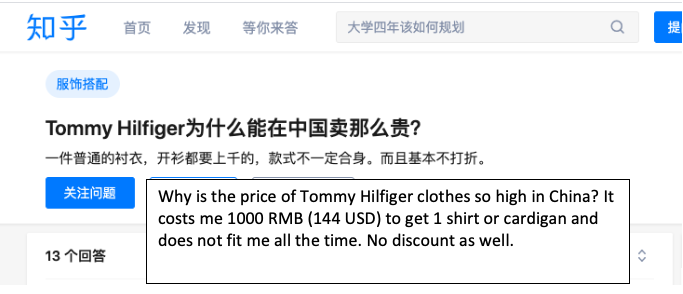

On average, in China, the price of Tommy Hilfiger is more expensive that of the United States. According to both official websites in China and United States, take Men’s TOMMYMYXMERCEDES-BENZ series as an example, the average price is 154 USD in United States while that is hi RMB (199.8 USD).

This has been proven by Chinese people’s perception towards Tommy Hilfiger. According to Zhihu, there are topics regarding the price of Tommy Hilfiger being relatively high. Some users argue that Tommy Hilfiger has different positioning in different countries. In Japan and China, Tommy Hilfiger products that are sold in direct stores are mid-to-high end products. For those sold in United States are positioned as mid end products. Another argument is that the products sold in direct stores in China are European manufacturing with better quality.

Chinese consumer profile of Tommy Hilfiger: polarized customer groups

Even though Tommy Hilfiger products seem to be classic, the consumer profile of Tommy Hilfiger in China is polarized. According to Zhihu, some people agreed that this brand is most popular with middle-aged men as they perceive that the design is rustic, except for the jeans series which suit young men in China.

Tommy Hilfiger marketing campaign in China: celebrity endorsement

Leveraging celebrity endorsements in China

Tommy Hilfiger collaborates with popular Chinese celebrities.

The first Chinese brand ambassador of Tommy Hilfiger is Shawn Yue Man-Lok, a former Hong Kong actor and singer. He is also the global brand ambassador of Tommy Hilfiger. As Yue is in his 40s, some Chinese netizens argue that selecting Yue as the global brand ambassador reveals the major target market in China are consumers aged 30-40.

[Photo source: Weibo, ‘Shawn Yue Man-Lok, the global brand ambassador of Tommy Hilfiger’]

Moreover, Tommy Hilfiger China has also collaborated with Junkai Wang and Zhengting Zhu, the stars in China that are popular with people aged 15-25. As celebrities in China are able to influence Chinese consumer’s behavior, Tommy Hilfiger’s collaboration with these stars is able to drive income stream from Chinese young people.

[Photo source: Weibo, ‘Zhengting Zhu, the brand ambassador of Tommy Hilfiger in China’]

[Photo source: Weibo, ‘Junkai Wang, the brand ambassador of Tommy Hilfiger in China’]

Promotion channels of Tommy Hilfiger in China, on mainstream social media

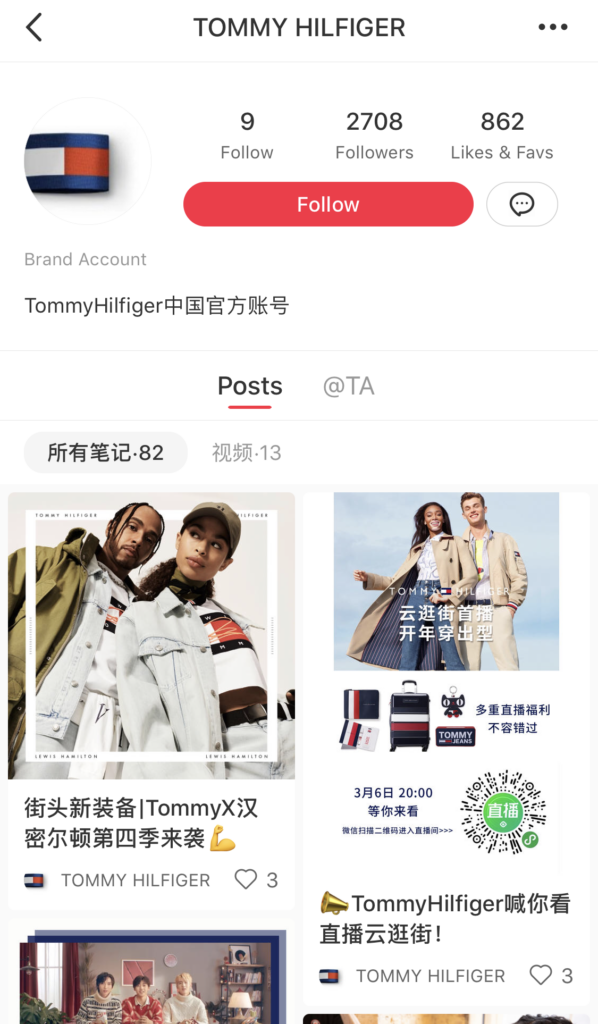

Tommy Hilfiger has set up its social media accounts on the mainstream social media platforms, Weibo and Xiaohongshu as means of promoting their brands to Tommy Hilfiger consumers in China. On Weibo, Tommy Hilfiger has 318,005 followers while the figure of Xiaohongshu is 2,708. As a global brand, Tommy Hilfiger’s popularity in China can be improved significantly since the number of followers is comparatively low.

Tommy Hilfiger China shares photos of models or brand ambassadors in their clothing on Weibo. It is an effective way to promote different products and instruct Tommy Hilfiger consumers in China what to where in different social occasions.

[Photo source: Weibo, ‘Home page of Tommy Hilfiger on Weibo’]

[Photo source: Xiaohongshu, ‘Home page of Tommy Hilfiger on Xiaohongshu’]

How the Coronavirus outbreak has affected Tommy Hilfiger’s business in China

The Coronavirus outbreak in China has affected many industries in China, especially retail. In February 2020, PVH Corp announced that Tommy Hilfiger China shut down some of the retail stores temporarily due to the decreasing customer flow at shopping centers and concern for employees and business partners’ health. Even though such an action has affected the business performance of Tommy Hilfiger in China or even Asian-Pacific region, it seems to be a feasible solution under such a serious circumstance.

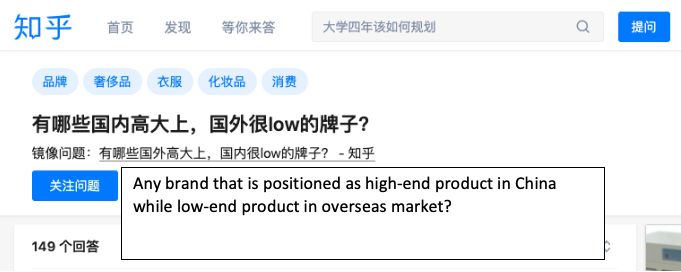

Chinese people’s perception towards Tommy Hilfiger: Overpricing the number one issue mentioned

Although Tommy Hilfiger is a famous brand all over the world, some Chinese people have negative perceptions towards the brand. According to Zhihu, some users commented that products of Tommy Hilfiger are expensive and overpriced in China. Furthermore, some of them labeled Tommy Hilfiger as a high-end brand in China while being a low-end brand overseas.

[Photo source: Zhihu, ‘Chinese people’s perception towards Tommy Hilfiger’]

Tommy Hilfiger has localized their marketing strategy but not all their products

The American luxury brand has proven their success in China leveraging celebrity influence to market to middle-aged people. However, their positioning as an aspirational brand is muddled by the perceived price-quality gap of Chinese consumers.

Author: Amelia Han

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes