Although coffee got off to a late start in China, coffee shops are now scattered through tier-1 and tier-4 cities alike, and consumption is on the rise. One chain that captures the premium side of China’s coffee market is Costa Coffee. This case study of Costa Coffee in China shows how the British coffee shop is capturing a large market share by expanding into the instant coffee market.

Overview of China’s coffee market

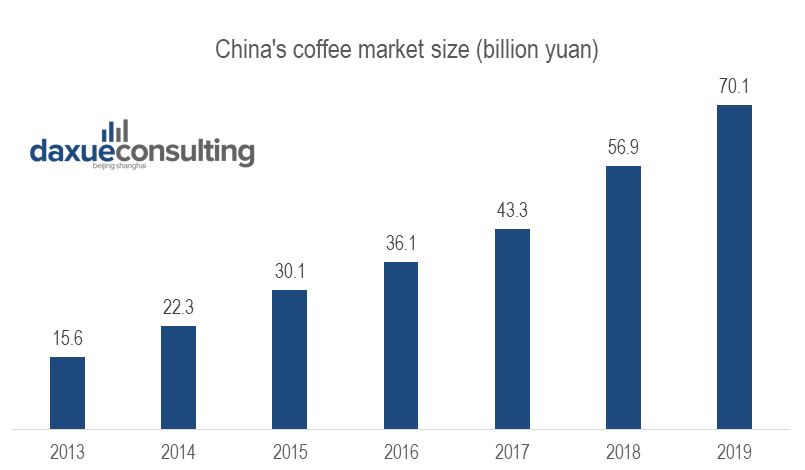

The Coffee market in China has been steadily climbing for years. In 2019, the market scale of coffee in China reached US $10 billion, which only US $7 per person. Chinese coffee consumers are mostly in tier-1 and tier-2 cities, as lower tier-city consumers become familiar with coffee, the market has potential to explode. If China’s per-capita coffee consumption matched that of Japan (at US $237 per person annually) China’s coffee market would reach $330 billion US, which is a lot of room to grow. Hence, the coffee market in China is promising to explore.

[Data Source: chyxx “The Market Scale of Coffee in China”]

Since 2006, Costa Coffee, the British coffee shop chain has entered the Chinese market and expanded dramatically. Based on the Starbucks model, with the implementation of Coffee shop just nearby Starbucks stores, its ambition is to make China become its ‘second home’, having one-third of the market share of coffee shop market. Costa Coffee has the particularity to have his own roastery with their proper blend in every store. The giant has since more than 3,800 stores globally.

However, Costa only has 293 China stores as of mid-2020. The possible reason may be the aggressive competition among those famous chain coffee brands. Starbucks leads the coffee market in China.

See also our piece on the Coffee shop market in China

In 2017, Costa China’s parters of Southern China withdrew its shares. Thus, Costa China and Costa’s parent company were able to totally control China’s southern market, preparing for Costa’s expansion plan. However, in 2018, Costa was adopted by Coca Cola with 3.9 billion pounds (around 5.1US dollars). James Quincey, the CEO of Coca Cola, contended that the company desired to create a drink portfolio catering to customers. Costa can bring Coca Cola to explore the hot drink market and build a robust coffee sale platform, while Coca Cola can create more opportunities for Costa to develop new service. After Coca Cola acquired Costa, Costa started to make some innovations to improve its position in the coffee market in China.

Strategic Approach for Costa Coffee to Enter China’s Market

In order to differentiate Costa Coffee from its strong competitors such as Starbucks, Costa Coffee relies largely on local Chinese retailers. One of the recent moves included an agreement signed with the Beijing Hualian Group, a nationwide retailer. Costa Coffee also gives many authorities to its partners; as more it gives authorities, more the operations are efficient.

Costa Coffee conducts a strong analysis of the local market and is open to change its offer according to its region and the taste of the people in that region. This strategy leads many Chinese consumers to give feedback saying, even in Shanghai and Beijing, Costa coffee tastes slightly different. Ye Xiaobo, the store manager of Costa Coffee 1912, said: “Starbucks are more casual like the way Americans do while as for Costa Coffee, is more traditional, rigorous with more focus on the utensils”.

Costa Coffee also noticed that Chinese customers tend to be more comfortable sitting in a more private space while drinking coffee. Costa Coffee has been focusing on a smart way of arranging tables and chairs so that every customer will feel more at ease.

Like its competitors, Costa also embraced the localization strategy by adding iced green tea to stores in southern China and a hot beverage in northern China.

Overview of its Long-Term Business Plan in China

Compared to Starbucks’ 16-year-presence in China, Costa used only 8 years to reach 25% of the total market share. The only problem is that having too many partners to share its profits can be risky in the future. Thus, how to build an efficient platform where each party has a fixed say and how to create a system to prevent future conflicts remains to be considered.

Costa Coffee Club

Costa coffee in China is directly competing with the American coffee maker “Starbucks” who have seen a lot of success in China with a strong local strategy, with an emphasis on the consumer experience factor. Such as his main competitor the British Coffee brand is proposing a loyalty card for app or android phones, the member can gain points every time-consuming at the shop in order to get free coffee or other goods.

How to launch a new product in China’s coffee market

In September 2019, Costa initially launched its portable instant coffee in the U.K, gaining 6 percent market share in a short time. Later, on March 25th, 2020, Costa’s instant coffee appeared in China’s coffee market, marking its formal layout in China’s instant coffee market and the beginning of its ‘omi-present’strategy, making products for the home in addition to coffee shops. This coffee is available in online platforms, supermarkets, and other distribution channels, mainly in tier 1 and 2 cities. Costa’s overseas market CEO said China was an essential market for Costa, and considering modern consumers’ fast pace of life, Costa targeted the instant coffee market to adapt to customers’ requirements and develop new growth points for Costa under the competitive coffee market in China.

Image source: sohu.com, Costa Coffee launches instant coffee in China

Cooperation with Onecup to kick-start China’s at-home coffee market

Recently, it is reported that Costa united Onecup to produce customized coffee capsules with Costa’s formulation. Meanwhile, similar coffee will also be accessible in Costa’s stores. Although Costa has many stores in China, it aims to make its products available everywhere. Particularly, NCA’s global data unveiled that the average person consumed 2.06 cups of coffee a day. That comprised 1.37 cups at home, 0.24 cups at workplaces, 0.25 cups at restaurants and cafes, and 0.2 cups at other sites. Most coffee around the world is consumed at home. Their cooperation can allow more people to enjoy Costa’s high-quality coffee, triggering more consumption of its coffee.

Daxue Consulting expertise

With many years of experience in the coffee shop industry, Daxue Consulting can help you enter the Chinese market and develop your brands to reach millions of consumers. From online surveys to mystery shopping, our consultants in China can give you a full tour of the Chinese market and determine what is the best strategy for your brand. To know more about the Chinese coffee market, do not hesitate to contact our dedicated project managers by email at dx@daxueconsulting.com.